Bet on Utility Stocks in 2026

The best are powering up for another big year.

Editor’s note: Thanks for reading Dividend Roundtable! Stay warm and enjoy the snow this weekend.--RC

So far, Winter Storm Fern has triggered a state of emergency in 18 states. And electric utilities are on the spot: A projected 170 to 200 million Americans are at risk of losing power to record snowfall, wintry mix and sub-zero temperatures.

The most damaging storm in recent memory was Winter Storm Uri in February 2021. That storm struck hardest in Texas, claiming over 200 lives and wreaking $200 billion plus in damages. And a breakdown in natural gas production supplies triggered shortages and price spikes, which utilities have recovered only after several years keeping customer rates elevated.

Utilities’ Fern performance will be measured three ways:

· The number of people who lose power at some point during the storm.

· How long it takes to get at least 90% of outages resolved.

· The cost of system damages above what’s covered by insurance.

The stakes couldn’t be higher. Companies perceived favorably by the public will benefit this year from a grateful state government. But any that falter—even if it’s no real fault of management—could find themselves a campaign issue in a year where 36 states will elect governors and 46 a new legislature.

But despite this risk, best in class utility stocks are set for another strong performance in 2026.

The Big 7 Tech stocks again dominated the US market in 2025. But utilities were right there with them, adding to robust returns from 2024. And the key driver for both sectors was artificial intelligence, as investors “discovered” there will be no AI revolution without a great deal more electricity.

We’re going to hear much more about the AI business opportunity for US electric utilities in guidance calls the next few weeks. And I expect the same from water, natural gas and telecommunications infrastructure providers.

AI excitement’s ability to drive stock returns in 2026, however, may be waning. Shares of America’s leading nuclear power company Constellation Energy (NYSE: CEG), for example, are down nearly 30% since mid-October.

AI-related investment will support electric utilities’ longer-term guidance investment and earnings growth. But as drivers of 2026 stock returns, I see three other factors having a greater impact:

· Investors’ growing desire for safety.

· Improving perceptions of renewable energy exposure.

· Long-term borrowing costs at last follow short interest rates lower.

As of Friday’s close, the Big 7 Tech stocks were 36.4% of the SPDR S&P 500 ETF (SPY). Electric utilities were just 1.45%, Multi-utilities 0.58%, Wireless telecoms 0.15%, Independent power 0.1%, Gas utilities 0.04% and Water utilities 0.04%.

You get the point. Utility stocks even after two solid years of performance are historically under-owned by US investors. And relative valuations aren’t even close. The biggest Big Tech NVIDIA (NSDQ: NVDA), for example, trades at 47 times earnings. The largest utility NextEra Energy (NYSE: NEE) sells for less than half of that.

Just a trickle of outflow from historically high-priced Big Tech to still reasonably valued utilities would have a major positive impact on sector stocks. And utilities are considerably less vulnerable to an overall market decline as well.

Utilities’ most compelling safety appeal in early 2026 is versus other dividend stocks.

The same factors behind dividend cuts in many sectors last year—particularly real estate investment trusts—are still with us in 2026. That’s supply chain disruption, stubbornly high inflation, soft investment, weakening employment and above all higher for longer borrowing costs. And we’re likely to see more companies freeze or reduce payouts to hold in cash.

Utilities will remain the notable exception, with earnings locked in by multi-year, regulator-approved investment plans. And the more dividend cuts elsewhere, the more their appeal will grow.

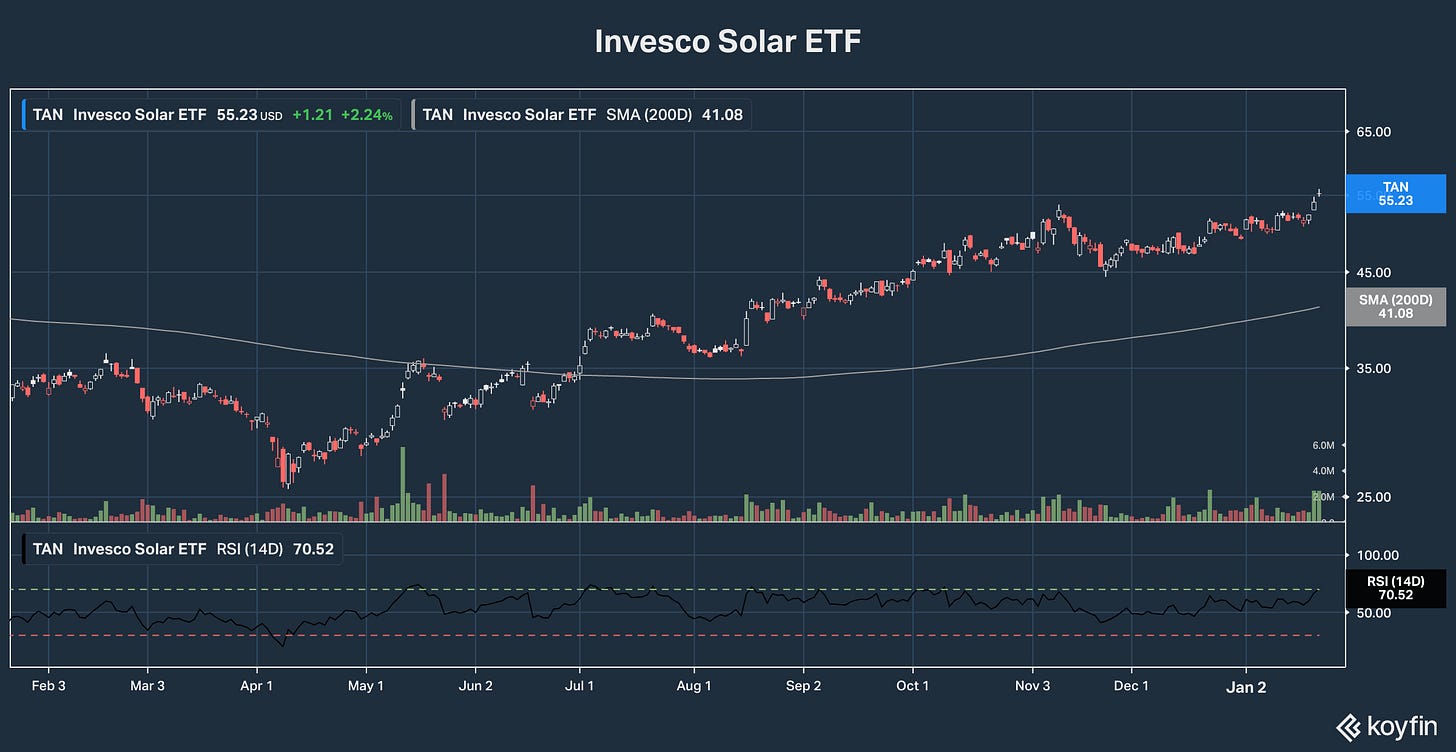

The Trump Administration is hostile as ever to wind and solar energy. But the Invesco Solar ETF (TAN) has tacked on a double-digit gain so far in calendar 2026. Returns since inauguration day are north of 75%.

Returns have followed proof of resilience—as companies up and down the value chain have shown they can grow rapidly regardless of the political environment. I expect more evidence of that this year, with NextEra’s Q4 earnings this week the opening salvo.

But renewable energy stocks may get a much bigger lift later in the year, ironically from politics. Incoming governors of New Jersey and Virginia have already doubled down on wind and solar development in their states. That’s a strong indication Democrats will revive tax credits and other development incentives if the party wins control of Congress in November.

And any hint of a building Blue Wave will likely trigger a sharp rally for stocks like Clearway Energy (NYSE: CWEN) well in advance of the vote.

But there’s an even bigger potential upside catalyst for utility stocks in 2026: That’s longer-term interest rates and borrowing costs at last following short-term rates lower.

A meaningful drop in borrowing costs would cut utilities’ debt interest expense. That means savings for customers. It would also slash the cost of funding new regulator-approved system investment. And utility dividends would be more attractive relative to falling bond yields.

How likely is this to happen? Cutting interest rates has obviously been a top priority of the Trump Administration for over a year. But arguably what it’s done so far has actually kept them higher for longer. That includes tariffs that have up-ended supply chains, playing hardball with the Federal Reserve, and trying to get mortgage rates lower by having Fannie Mae and Freddie Mac expend reserves to buy mortgage-backed securities.

Long rates have stayed high because of elevated inflation expectations, demonstrated most plainly by gold prices now close to $5,000 an ounce. Borrowing costs won’t go lower until they do.

My view: Appointing a new Fed Chairman with Wall Street bona fides as an inflation fighter would puncture inflation expectations. That would set the stage for meaningfully lower borrowing costs later this year.

That would be a huge plus for utility stocks. But the real surprise may be that companies are now well prepared however things go.

Bottom line: Handle Winter Storm Fern competently and 2026 will be another very good year for utility stock investors.