Big Moves for a Year of Danger and Opportunity

Your February Dividends Premium REITs

Editor’s Note: Thank you for reading Dividends Premium REITs.

54 companies in the REIT Rater coverage universe have released Q4 results and issued 2026 guidance. That includes 15 of the 21 on the First-Rate REIT list. I highlight the results in the “Commentary” column in the REIT Rater table.

The rest will report in the next few weeks. But I’ve already seen enough to make a few moves, which I highlight in this report.

My number one objective here is to get us through the REITs’ muddled near-term to the wealth building boom beyond. We’re building positions in top quality REITs selling on the cheap, like this month’s top fresh money buys. And I’m making a couple of sales as well.

Though the S&P 500 so far has been directionless and volatile, we are off to a good start this year with a 7.5 percent average year-to-date gain with the First Rate REITs. I highlight our strategy and my property sector outlook below.

Got a question? Join the discussion at my Dividends Roundtable, which I currently host 24-7 on the Discord application—and is soon coming to Substack. All Dividends Premium members welcome! To your wealth!--RC

REITs: Making Moves in a Year of Danger and Opportunity

Why own REITs in 2026? For one thing, they’re running well ahead of what’s been a flat-lined S&P 500.

The REIT SPDR ETF is ahead 7.4 percent this year. The average for the First Rate REITs is slightly ahead of that at 7.5 percent, with twice the dividend yield.

Will the good times keep rolling? I see several reasons the answer will be yes.

First, REITs are the rare low-priced stock sector in a market that’s unmoored from business value.

Higher for longer interest rates have restrained REITs’ growth the past few years. And they’ve made dividend stocks generally less attractive, particularly relative to the Big Tech-led S&P 500.

The silver lining is REITs are very cheap on a relative basis to the rest of the stock market. The average dividend yield for the 81 companies tracked in the REIT Rater is well over 6 percent. That’s roughly six times what S&P 500 ETFs currently pay. It’s almost twice the yield for the iShares Dividend ETF (DVY), a commonly used benchmark for income equity portfolios.

REITs are also cheap on an absolute basis: With the exceptions of the Pandemic (2020) and the Financial Crisis (2007-09) market bottom, dividend yields are the highest we’ve seen in a quarter century. And many REITs are selling for less than the worth of their properties, inducing management to use spare cash to buy back stock rather than invest.

National REIT Association (NaREIT) data reveal a “valuation gap” between public (REITs) and privately owned real estate since the Federal Reserve started raising interest rates in early 2022.

Capitalization or “cap” rates are a shorthand measure of the rate of return on commercial investment property. The simple calculation is to divide net operating income—basically rents and other revenue collected less operating costs—by the current market value of the property.

According to NaREIT, the spread between cap rates for REITs and private equity is currently hovering around 130 basis points in favor of the private market. That’s the result of the underperformance of REIT shares the past few years. And historically, when the spread has been this elevated, REITs have outperformed in subsequent years.

Continuing sector rotation would also fuel further gains. All REITs together are less than 2 percent of S&P 500 ETFs. That compares to 34 percent for just seven Big Tech stocks, all supported by the single theme of artificial intelligence investment.

So far this year, Big Tech’s share of the S&P 500 has already declined from 38 percent. But there’s a long way to go before the index that dominates Americans’ portfolios has any semblance of sector balance.

That means a lot of potential money yet to come into REITs. And it’s worth noting that the property sector was also a reliable, high yielding wealth builder during the ‘00s, following the Great Tech Wreck of 2000-02—the last time a handful of giant, extremely high-priced technology stocks dominated the S&P 500 for this long.

A third reason for REITs to continue this year’s rally is the potential for a big decline in borrowing costs. That would increase the relative appeal of REITs and other dividend stocks versus cash alternatives and bonds. And more important, it would provide a powerful spur to REIT earnings and investment, which was tepid in 2025.

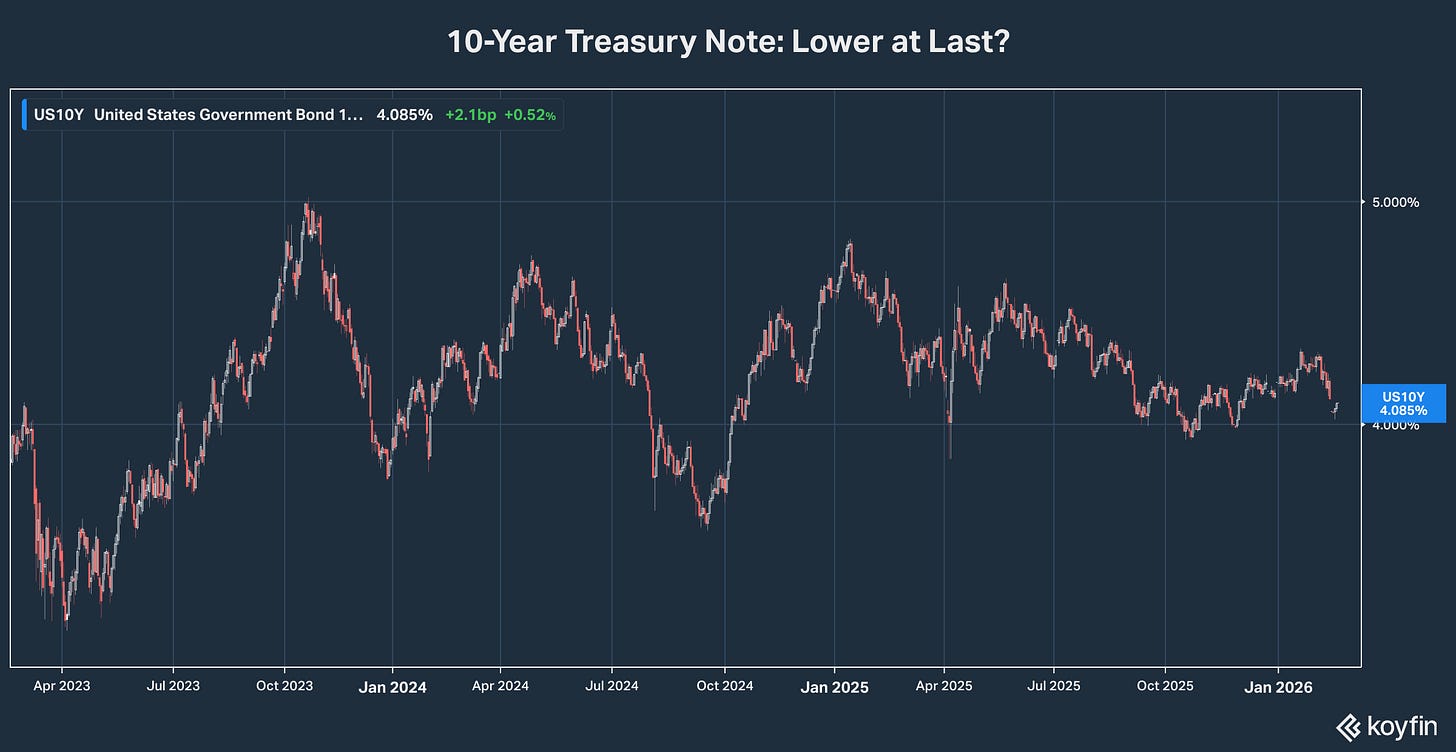

Admittedly, I’ve been looking for this to happen for some time. And it won’t, so long as inflation expectations are elevated, as rising gold prices, a falling dollar and stubbornly high 10-year Treasury bond yields have indicated over the past year. But that may be changing now.

It’s no coincidence that gold prices’ runaway rally suddenly stalled and then reversed in late January, when President Trump announced he would appoint Kevin Warsh as Federal Reserve Chairman. Fed Watchers had been speculating for months that the candidate would not be someone considered an inflation hawk.

December numbers announced the same day indicated inflation was accelerating. But the fear level nonetheless dropped. And since then, we’ve seen January numbers indicating moderating inflation, with the benchmark 10-year Treasury yield sliding again towards 4 percent.

Bullish But Headwinds Persist

The two big questions now are (1) Will rates continue to fall and (2) Will they drop enough to spur REITs to invest more to spur earnings and dividend growth, as well as to increase REITs’ relative attraction as investments versus cash alternatives, bonds and other stocks.

Until rates do fall, higher for longer borrowing costs will remain a major headwind for REITs, just as was the case last year. And judging from what we’ve heard from REITs in Q4 results and earnings calls, management isn’t laying plans based on any expectation of relief.

As of this post, almost 75 percent of the 81 REIT Rater companies have released Q4 results and updated their 2026 guidance. Several reported robust levels of investment with opportunities accelerating in second half 2025. And a handful—including seniors home REIT Ventas Inc (NYSE: VTS) and industrial/single purpose property landlord WP Carey (NYSE: WPC)—confirmed substantial volumes already this year.

Even those REITs, however, were cautious about what they projected for the rest of the year. Ventas, for example, expects 2026 investment to come in flat with 2025. W.P. Carey’s official target for this year is almost one-third less than what it did last year.

A meaningful drop in borrowing costs would likely convince both of these REITs to accelerate their expansion. And the same is likely true for the rest of the coverage universe. But at this point, REIT investment if anything is widely expected by the industry to be less this year than last. And that in turn is restraining guidance for FFO growth and plans to dividend increases.

As of my January post, only Prologis Inc (NYSE: PLD) had reported Q4 results and updated 2026 guidance. And I highlighted three key takeaways from the news and numbers:

· Management was able to beat guidance it issued earlier this year for both profits (FFO) and investment.

· The REIT made solid progress minimizing risk from higher for longer interest rates to its balance sheet and long-term investment plans.

· Despite exiting 2025 with clear business momentum, the world’s leading industrial and logistics REIT issued decidedly conservative guidance for 2026.

Those have also been my key takeaways from the news and numbers of the 58 REITs reporting since, including 14 more companies on my First Rate REITs list.

You can read my analysis of what’s important in the “Commentary” column in the “REIT Rater” table, which is attached to this report.

The rest of the coverage universe will be reporting its results over the next three weeks. And I’ll have full analysis of that in the March post, or sooner if action is needed for any of the First Rate REITs.

But it’s already clear that most REITs are expecting another challenging year operationally and financially in 2026. Management teams’ guidance is conservative.

If 2025 is any guide, many companies will beat it. And many will increase their projections at least once this year. But there are also risks that could derail some REITs. And I fully expect to see more dividend cuts and losses.

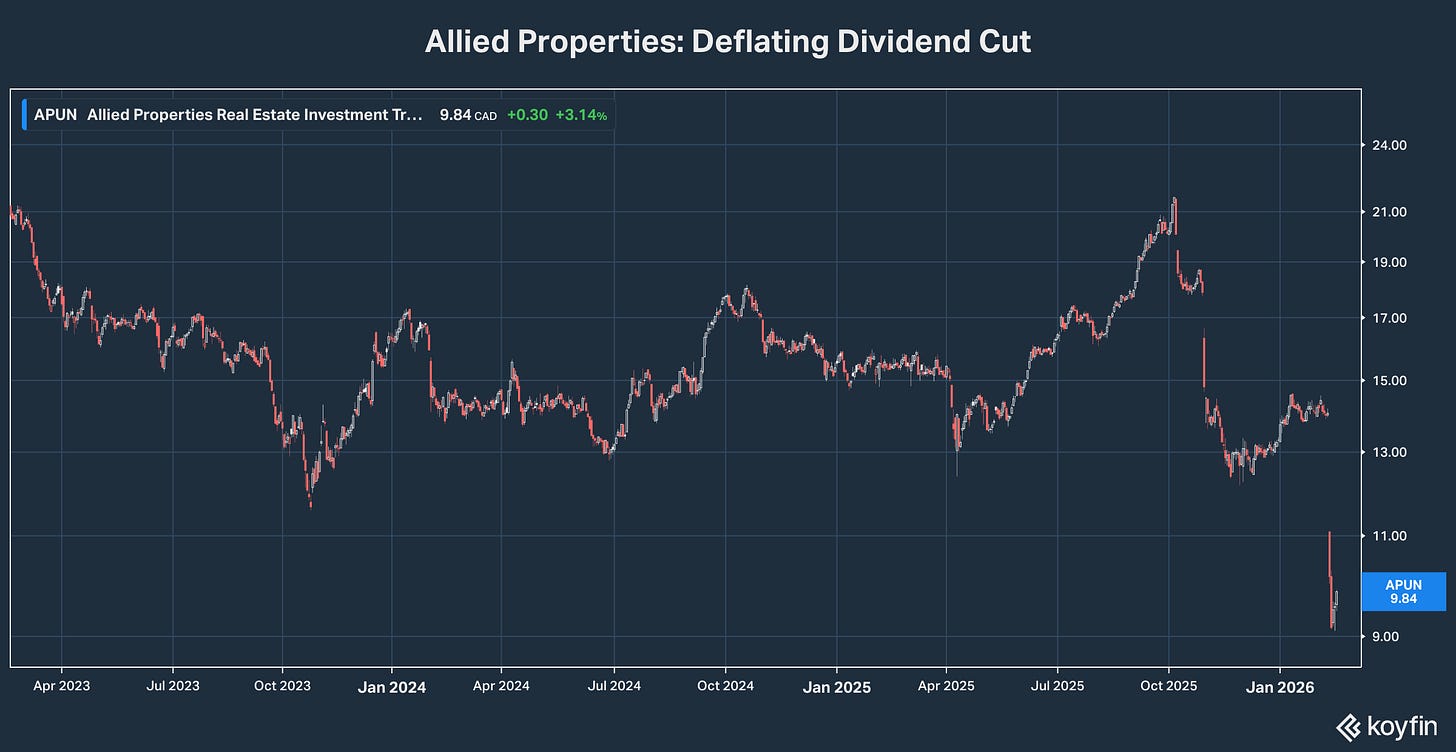

For example, despite most REIT stocks in the coverage universe being in the black year-to-date, five are already sitting at double-digit percentage losses.

The biggest loser so far is Canada’s Allied Properties (TSX: AP-U, OTC: APYRF), which started the year cutting its dividend by -60 percent and has dropped by almost -30 percent. The others are financial/mortgage REITs Franklin BSP Realty (NYSE: FBRT) and KKR Real Estate (NYSE: KREF), and New York office property owners SL Green (NYSE: SLG) and Vornado Realty (NYSE: VNO).

I’ve been wary of most financial REITs for some time, mainly because their customers are often on the lower end of the credit spectrum. The yields are attractive. And several reported solid Q4 results with increased book value, increased returns on investment and generous net interest income spreads. But should the economy weaken, default rates could rise quickly. And a drop in long-term borrowing costs could flatten net interest spreads.

Weakness in office properties has been part of the real estate landscape since the pandemic. A year of pressure to return to the office in some industries has kept the market reasonably solid for “premium” properties, leveling off occupancy declines for BXP Inc (NYSE: BXP) and a handful of others. But net operating income is dropping sector-wide, as expiring leases are still proving difficult to impossible to renew at comparable rates. And debt is more toxic than ever, tempting management to slash dividends to speed up deleveraging plans.

Where there’s been new development in office this decade, it’s upgrading properties in key locations to “premium” or “Class A.” That’s still left many markets at chronic levels of oversupply for non-Class A properties. And the bankruptcy of Office Properties Income Trust may not be the last in the sector.

But we are starting to see some markets tighten for Class A. And with little or no construction below that in the US, there’s reason to believe the office market is headed for a real bottom in the next couple years, possibly sooner in places like New York City.

Overbuilding, however, remains a drag on several property sectors. One of those is life science, hit by the perfect storm of a five-year downturn in the Biotech business and 180-degree changes in federal regulation and research funding.

At the epicenter is leading life science landlord Alexandria REIT (NYSE: ARE), which issued 2026 guidance including a big first half drop in occupancy. And as a result, management’s guidance range for FFO is well below 2025 levels, still covering the reduced dividend comfortably but a clear indication the bottom for this business is still not in.

Residential REITs have traditionally been safe havens for investors even during more severe recessions. But a building boom earlier this decade, particularly in the SunBelt, will keep rent growth negative on new leases this year. And means low single digit percentage growth at best for NOI and FFO, and negative growth for most SunBelt-focused property owners.

On the plus side, residential REITs are still raising dividends. That includes all three on my First-Rate REIT list, which announced boosts in the past couple weeks along with guidance-meeting Q4 results.

These increases are an unmistakable vote of confidence by management that the sector is working through current oversupply. And it’s gearing up for a boom later this decade, as and new development starts remain at multi-year lows.

I’m very bullish on residential REITs long-term. But it’s fair to say these stocks aren’t going to jump until there’s flattening of the decline in rents on new leases. And that’s only going to happen as oversupply is absorbed.

Residential REITs are going to require some patience this year. And the same is likely to be true of self-storage REITs, a sector that’s also demonstrated ability to weather economic downturns but is also absorbing oversupply.

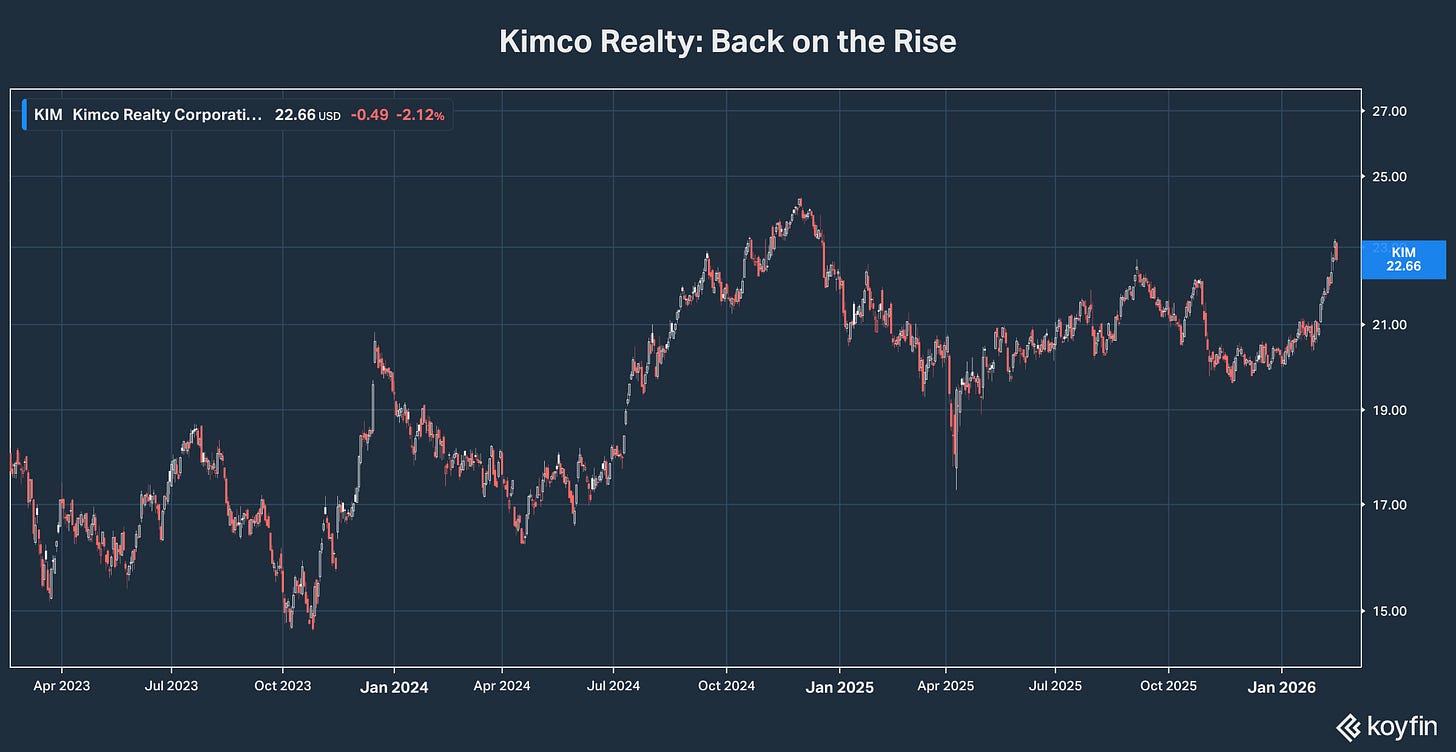

Retail REITs have started out 2026 better than they finished 2025. Shares of grocery anchored shopping mall owner Kimco Realty (NYSE: KIM), for example, are already up by a double-digit percentage this year, after losing almost -10 percent in 2025. NNN (NYSE: NNN) is also up double-digits after being underwater before dividends last year.

Retail REITs are up because they keep posting strong operating numbers. If the economy does slip this year, there will be pressure on retailers. But after five years of sector consolidation, cutting debt and reducing risk, the best in class will weather it far more easily than they did in 2020. And barring a real calamity, it’s unlikely retail landlords will be forced to close spaces as they did that year.

Bottom line: These are not the retail REITs of five years ago. And there’s far less risk in this group than meets the eye. But their shares will likely take on water just the same.

Three property sectors not seeing overbuilding concerns at the moment are senior housing, industrial/logistics and data centers. They’re getting all the business they can handle. FFO is rising and investment is robust.

But there is a concern here as well for investors—mainly, high valuations that may or may not be sustainable. Seniors home leader Welltower Inc (NYSE: WELL), for example, has a dividend yield of just 1.4 percent. And it’s up another 12 percent year to date, 40 percent in the last 12 months.

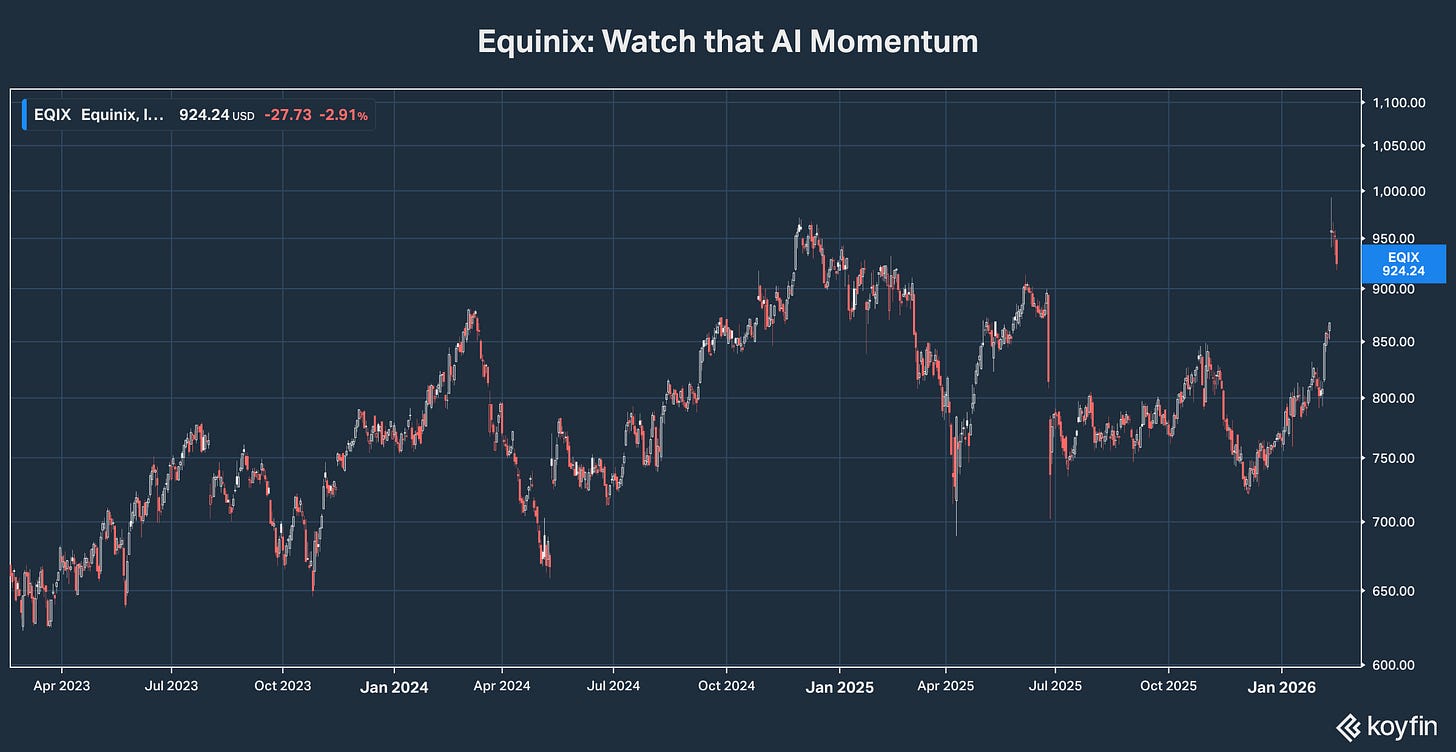

Welltower is a great company. But there’s a lot of great news baked into that price. And the same is true for data center leader Equinix Inc (NSDQ: EQIX) at its current price, as well as most industrial REITs.

I still think the best in class of these sectors have a lot more left in the tank over the long-term. But a look at the recent price history of Equinix highlights some major declines in relatively short periods of time. And the $200 per share gain since early December may not last long.

Eyes on the Prize and Sticking to Strategy

So what am I advising to take advantage of REITs’ low valuations and long-term potential now, without taking on too much risk from the cloudier near-term picture I’ve highlighted here?

First, keep your eyes on the prize. Our primary goal here is to build positions in high quality REITs when they trade at low prices. And we certainly have a great opportunity to do that now, after nearly four years of sector-wide underperformance.

Second, control risk by sticking to this four-part REIT investment strategy: