ChatGPT Runs on Dividend Stocks

Double-digit demand growth has arrived for utilities thanks to AI data centers

As an investor, my love affair with utility stocks began in the mid-1980s. I found their asset-focused, regionally rooted and tradition bound sector instantly fascinating—starting with the fact that so many people take these companies for granted, at least until there’s a problem.

That much is still true, both for customers and these companies’ investors. No one pays much attention so long as the power’s on and the dividends are flowing in. But interrupt one or the other and everyone notices.

We’ve all experienced power outages. And unless you live in an area especially prone to natural disasters, I’ll bet you can remember quite clearly the times when the electricity was out for several or more.

As an investor—and as an advisor who has helped investors pick utility stocks for the past 40 years—I remember graphically every time a company I’ve recommended surprised us with a dividend cut. But the fact I can is also a pretty strong endorsement of this industry’s resilience.

To put this another way, those types of setbacks don’t happen often. And when they do, companies have always come back strong. That includes the one utility that suffered a real nuclear disaster—Metropolitan Edison, now a piece of immensely profitable First Energy (NYSE: FE).

What’s new for utilities, however, is they’re now rapidly growing. As of this post, roughly 75% of the companies I track—which include every regulated US electric and natural gas distribution company—have released their Q3 earnings and updated guidance. And if you’re willing to look beyond the usual Wall Street BS about who “beat” or “missed” projections, the numbers are truly eye opening.

For the past couple decades, US demand growth has barely registered above a percentage point a year. Given the size of the system, that still adds up to a great deal of needed new power generation on America’s power system, which for all its alleged faults is still the envy of the world.

But now even companies in the sleepiest corners of the country are seeing electricity demand growth several times that. And along the Gulf Coast—where an energy export and manufacturing reshoring boom is taking shape—demand growth is running at a double-digit percentage.

There are multiple drivers of rising US electricity demand. Electric vehicles won’t displace ICE’s (internal combustion engines) as the drive train of choice here anytime soon. And we’re likely to see a negative impact on sales from the end of tax credits under President Trump’s OB3.

But EV usage is slowly but steadily growing, as consumers gravitate toward the sleek designs and electronics offered by Tesla Inc (NSDQ: TSLA) and others. And if current oil and gas underinvestment translates into higher oil and gas prices as we expect at Energy Bulletin, the ability to drive around on electricity will become more attractive—even as EVs around the world continue to gain range and charging times decline.

ExxonMobil’s (NYSE: XOM) 2050 Energy Outlook includes fairly aggressive EV projections for those reasons. And it’s hardly making heroic assumptions—It still projects rising oil demand over that period.

Bottom line, EVs and electrified transport for large vehicles will be a large and growing draw on power for years to come. So will reshoring of industry, which began long before the president began applying tariffs.

Rather the primary motivation has been to diversify and strengthen supply chains, after the wakeup call of China’s manufacturing shutdown during the pandemic year (2020). And the Middle Kingdom’s recent geopolitical flexing on rare earth supplies will only intensify that effort.

Population growth has been a steady driver of electricity demand growth in many states, particularly the South and Rocky Mountain states. And that also looks set to continue.

Those factors alone add up to a great deal of electricity demand growth. But the biggest emerging driver for the next 3 to 5 years by far is from data centers adopting artificial intelligence. And if Q3 results showed us anything, order growth is accelerating—both for regulated utilities and non-utility power producers that sell energy under lucrative long-term contracts.

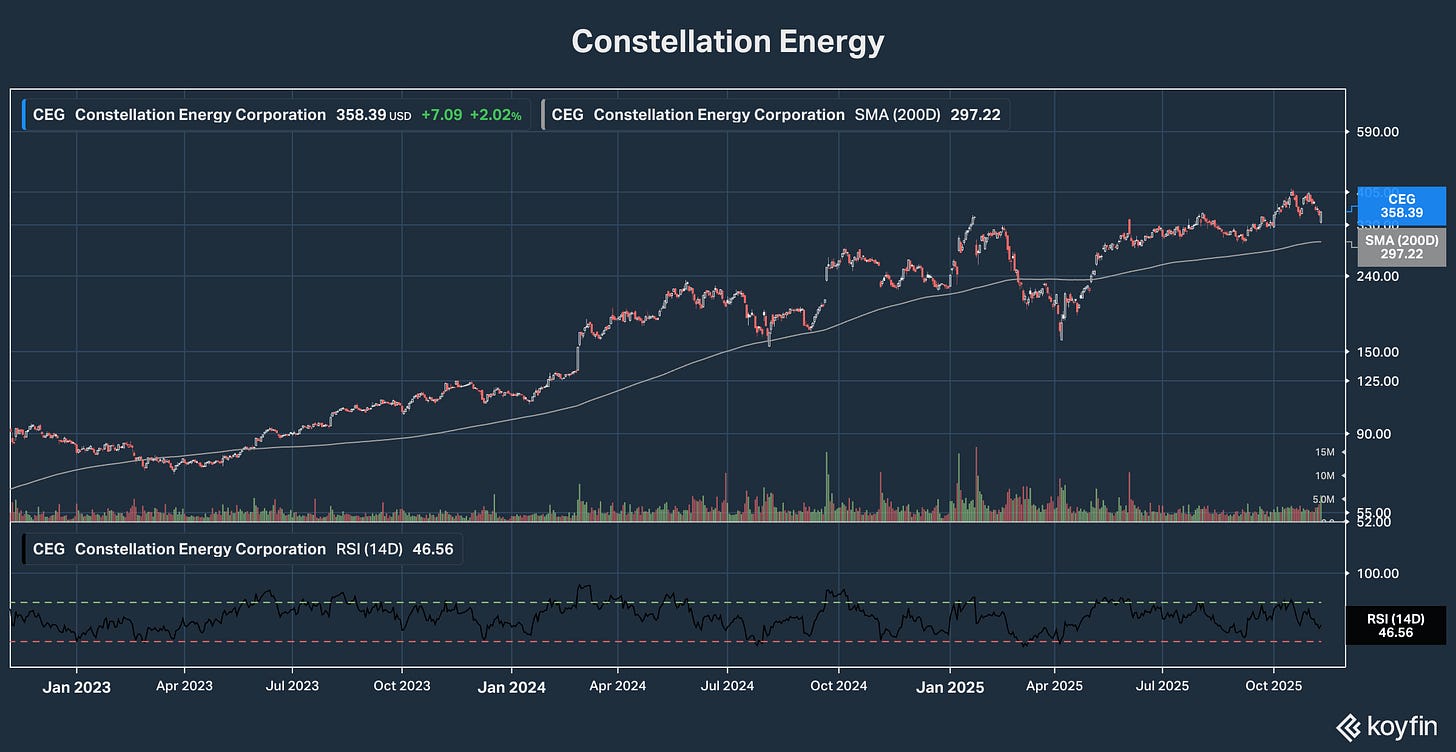

Regulated utility investment plus regulatory support equals earnings growth. Meanwhile, companies like Constellation Energy (NYSE: CEG) and Brookfield Renewable (TSX: BEP-U/BEPC, NYSE: BEP/BEPC) have a similar model—signing long-term contracts with Big Tech companies that lock in big returns for years to come.

More conservative investors will be attracted to the utility model, which is far less affected by cyclical factors. Though now heavily subsidized by several states and now the US government with tax credits, profit from Constellation Energy’s 20 plus operating nuclear reactors is affected by market prices, particularly in the PJM (Pennsylvania, Jersey, Maryland) region.

With demand rising rapidly, the company is riding high now. But I remember the previous decade when Constellation was still a unit of Exelon Corp (NYSE: EXC). And had it not been attached to the steady cash flows of that giant utility, it’s likely we would have seen more of those nuclear power plants close—as unable to compete with power from abundant, low-cost shale gas.

Nuclear is arguably even less competitive now against gas, as turbines become ever more efficient. And it also now has to go up against far cheaper solar facilities, which can be built at scale in less than one tenth the time—and which can now be paired with ever-cheaper and more efficient battery storage to limit intermittency concerns.

If you owned Exelon at the time of Constellation’s spinoff in 2022, the shares you received then have been worth as much as 20X the cost basis at times in 2025. And with AI demand surging, it’s likely profit margins will remain strong the next few years. But on the other hand, momentum can swing the other way in commodity markets when investors least expect it—which is why I’ve been consistently advising taking profits this year when the stock surges.

Regulated utilities on the other hand make their money as a return on investment—whether oil is at $40 or $400. And buying stocks like Exelon and Dominion Energy (NYSE: D) into the AI boom—which is also improving these companies’ operating efficiency and resiliency—is the slow and steady way to build real wealth.

The data center power demand story is massive for the entire energy supply chain. Natural gas midstream like Antero Midstream (AM) is perfectly positioned since gas fired plants provide reliable baseload and peaking power for these facilites. Their infrastructure assets should see sustained demand growth as more data centers come online.