Clear Tips from Cloudy Earnings

Sentiment often provides timely clues to a stock's direction.

If there were ever a contest for “most useless stock market indicator,” my vote would be Wall Street analysts’ 12-month price targets.

These are regularly dispatched with great solemnity and fanfare by major Wall Street firms. And paying customers will receive a detailed analysis explaining why Dominion Energy (NYSE: D), for example, should rise to $67 over the next 12 months, rather than the previous projection of $63 per share.

The general public through popular media usually gets just a number. But either way, changes in targets basically amount to acknowledging something after the fact. And all too often, that’s simply that a stock has already risen or fallen by that amount or more.

Bottom line: Analyst targets aren’t very useful forecasters of future stock prices. They do, however, give a pretty fair indication of analyst sentiment, especially since popular firms tend to act like a herd—all raising or lowering targets at the same time.

And when enough research houses move in one direction or the other, the stock will move that way at least temporarily—almost regardless of where prices are set.

Global chemicals firm LyondellBasell Industries (NYSE: LYB) operates in a highly cyclical business that’s simultaneously facing headwinds from rising prices for raw materials, uncertain demand and over supply—particularly from China. And since rival Dow Chemical (NYSE: DOW) cut its dividend this summer, many have assumed the company will ultimately be forced to do the same.

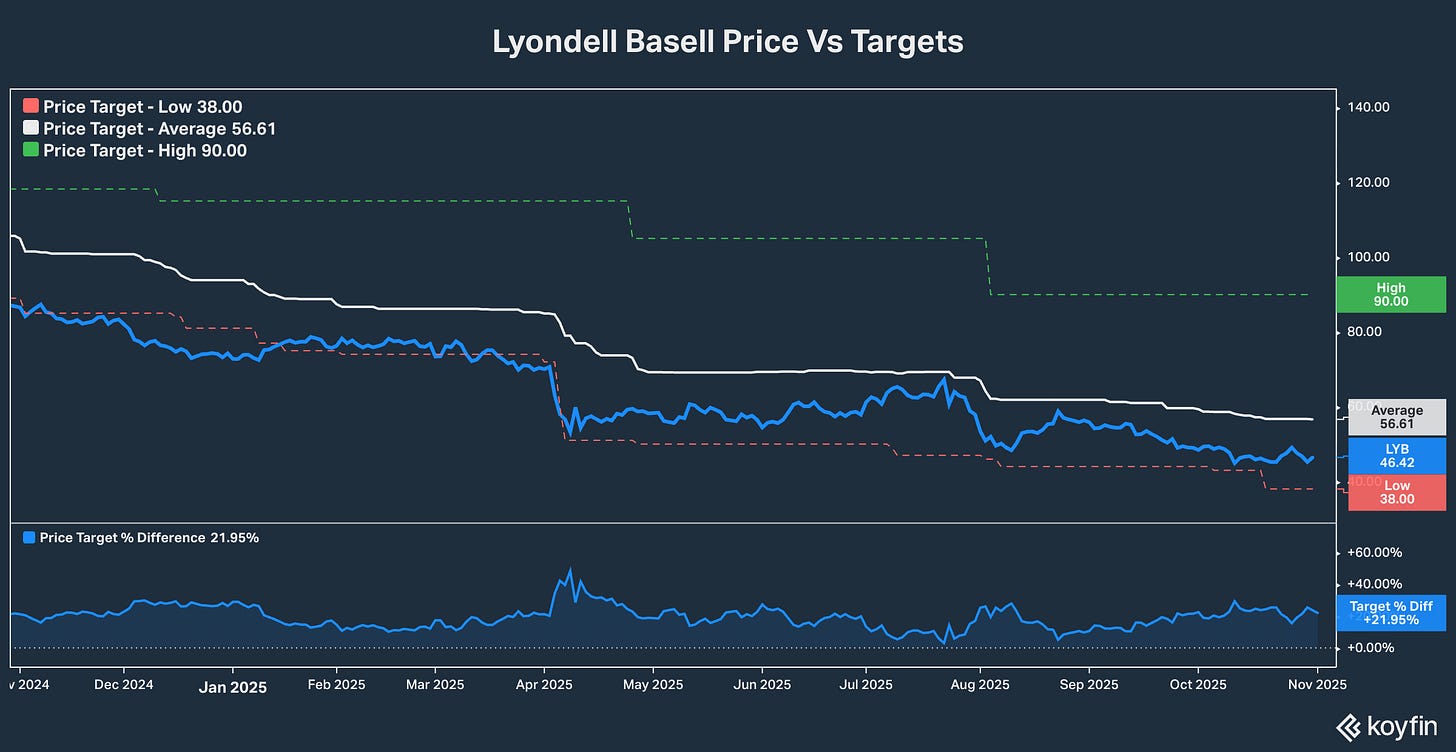

The stock has as a result been under pressure, sliding from the mid-60s in late July to the mid-40s currently. As recently as mid-September, as many as half of the 20 Street analysts covering the stock had 12 month price targets in the 70s or higher. Then starting in early October, half of the research firms cut their target for LYB, some dramatically.

As a result, the average 12-month price target for LyondellBasell Industries stock has dropped from roughly $94 to start the year to $56 now. In fact, as the graph shows, price targets have pretty much been cut in tandem with the shares’ actual drop.

So much for predicting anything. But what this graphic does tell you is sentiment among the people paid richly to follow this stock has steadily dropped along with the share price, just as no doubt the mood of Lyondell’s actual shareholders has soured.

First an admission: I’ve pretty much ridden Lyondell down all the way this year. It’s by far my worst year-to-date performer (-33.3% year to date) in the Dividends Premium portfolio—and in a year when the holdings on average are running 10 percentage points ahead of the Tech-heavy S&P 500.

I haven’t given up on it mainly because Dividends Premium is a balanced and diversifiedportfolio designed to hold best in class dividend paying companies across multiple sectors. And Lyondell fits the bill in its industry with ultra-conservative financial management, broad market reach and its strategy of moving toward growing markets such as advanced polymers and chemicals recycling, where margins are higher and the long-term regulatory environment brighter.

It’s clear the core business is facing tough cyclical pressures. Management cautioned investors to expect further weakness in several areas well into 2026. And it outlined plans to temporarily idle production capacity in Q4 for maintenance as well as anticipation of a supply glut, especially in China.

There is clearly risk to the dividend for these reasons. But on the other hand, it’s hard to argue Lyondell shares aren’t already pricing in a reduction of as much as 50%.

Management also laid out a pretty strong 4-part case during its Q3 earnings call why it didn’t have current plans to cut the payout:

(1) It was very conservative managing cash during the recent cyclical upturn in anticipation of a downturn and as a result has $3.4 billion in cash—or roughly twice what it’s considered “normal” in the past.

(2) The company’s self described “cash improvement plan” is on track to generate $600 million in incremental cash flow this year and another $500 million in 2026. And there’s an opportunity to cut CAPEX from $1.4 to $1.2 billion next year, if tough cyclical conditions persist.

(3) The company’s balance sheet is firmly investment grade and it’s further improved flexibility by negotiating an increase in net debt-to-EBITDA covenants from 3.5 to 4.5 times.

(4) Maintenance CAPEX remains robust and the portfolio shift including the sale of some European operations will improve efficiency.

In other words, there is dividend cut risk at LyondellBasell. And it’s well priced into the share price. But neither is a payout reduction inevitable. And in any case, this company is well positioned to weather its current cyclical downturn in solid shape to ride the next upturn.

External conditions are tough. But this company’s not going anywhere. And that means it will be around to ride the next cyclical upturn, which should take it back to at least the mid-90s, where after all the stock traded as recently as early 2024.

Analysts were bullish on the stock back then when it was flying high. They could scarcely be more bearish now when it’s selling for half the price. So much for buying low and selling high. And it may be a while before sentiment improves enough to push the stock higher.

Most observers, for example, seemed very skeptical of both management’s comments and what were generally Q3 solid results—including 16.8% higher EBITDA from Q2. And many investors will be considering selling LYB for a tax loss, particularly if they have sizable gains to offset. But LYB is nonetheless increasingly shaping up as a bargain hunter’s dream—a high quality company with a stock experiencing a sentiment low as its business navigates cyclical pressures.

Lyondell shares got a small bounce on the earnings news last week. Several stocks, however, were sold off even after companies increased earnings guidance.

That was the case for big pharmaceutical company Abbvie inc (NYSE: ABBV), which I took profits on in Dividends Premium last month after a big run up. The company raised the mid-point of guidance for 2025 adjusted earnings per share from $10.48 to $10.63 per share. But the stock nonetheless sold off hard on the news.

The reason is a shift in momentum that had been relentlessly upward all year.

In contrast to Lyondell, Abbvie stock has for most of this year seen a steady progression of price target increases from Wall Street analysts—and those boosts have basically followed Abbvie’s stock price higher, after the fact. They clearly chart the upward momentum. But if that’s run out, count on target decreases to follow.

One other thought: AI could not have written this perspective on analyst's price swings, unless the LLM scoped in and summarize the wisdom offered in this article -- i.e., experience wins over AI datamining for now.

Appreciated the detail on LYB and how you used it to explain WS analysts' perception swings. FYI, I hope to add to a position initiated earlier this year when tax-loss selling nears its close.