Closing the Year of the Dividend Stock

Your December 2025 Dividends Premium.

Editor’s Note: Happy Holidays! And thank you for reading Dividends Premium.

It’s been a very good year for the stocks in our income and growth portfolio. With less than three weeks left in 2025, the current roster of stocks has an average year-to-date total return of 30.5 percent, including closed positions.

If the stock market overall performs up to its usual seasonal strength, we should finish 2025 at or near a new high-water mark for the portfolio since inception. That’s now 81.7 percent with an average weighted yield of 4.7 percent.

December’s top fresh money buys are both energy related, That reflects the fact both stocks are relatively cheap and high yielding, and my expectation the energy upcycle will resume in 2026 after what was mostly an off-year for the sector.

I’m also topping up the position in last month’s new addition. And I’m selling the portfolio’s lone big loser for a tax loss to offset the gains we’ve harvested this year. I currently intend to buy back the position after 30 days to avoid the wash rule tax.

Have a question? Then join the discussion at my Dividends Roundtable investment forum I host on the Discord application 24-7. Details of how to join are on the Dividends Roundtable webpage.

To your wealth this holiday season!--RC

Income Portfolio: Final Moves for a Very Good Year

High, reliable and growing income, long-term capital growth and below market volatility: Those are the three main objectives I have every year for this portfolio.

To reach them, I employ four basic principles of portfolio management. They are:

· Stick with companies so long as their underlying businesses are positioned for long-term growth and balance sheets are healthy. Sell when that’s no longer true, even if it means taking a big loss.

· Maintain a cash reserve against the possibility of a broad correction. My favorite parking place for cash is still the Vanguard Federal Money Market (VMFXX), which currently has a 7-day SEC yield of about 3.84 percent.

· Build a watch list of high quality companies to buy when they hit designated entry points, or preferably our “Dream Buy” prices listed in the attached table.

· Make fresh investments increments of at least two, rather than all at once. Be willing to pare back positions when upside targets are reached, or when it makes sense from a tax perspective.

At any time, I’ll hold between 15 and 20 stocks—there are currently 18 plus the Vanguard fund. They’re drawn from a wide range of industries. But I have no set formula that requires me to own stocks from each of the various official regulator-designated “sectors.”

I do look for catalysts that can drive investment returns. But what I’m most interested in are companies that can reliably build wealth as growing businesses over a period of years, and that share the wealth in dividends while they do it.

By any measure, it’s been a very good year to be following this strategy. Not every stock we own has been a winner year-to-date. But provided Wall Street maintains just a shadow of traditional seasonal strength this time of year, we’re going to end the year with our biggest gains since the portfolio’s inception in late 2018.

That’s an average 2025 total return of 30.5 percent for the stocks, including what we made on the various closed positions: Kraft Heinz (NYSE: KHC) sold in July, the last piece of Abbvie (NYSE: ABBV) sold in October and the partial position in Newmont Corp (NYSE: NEM) also sold in August.

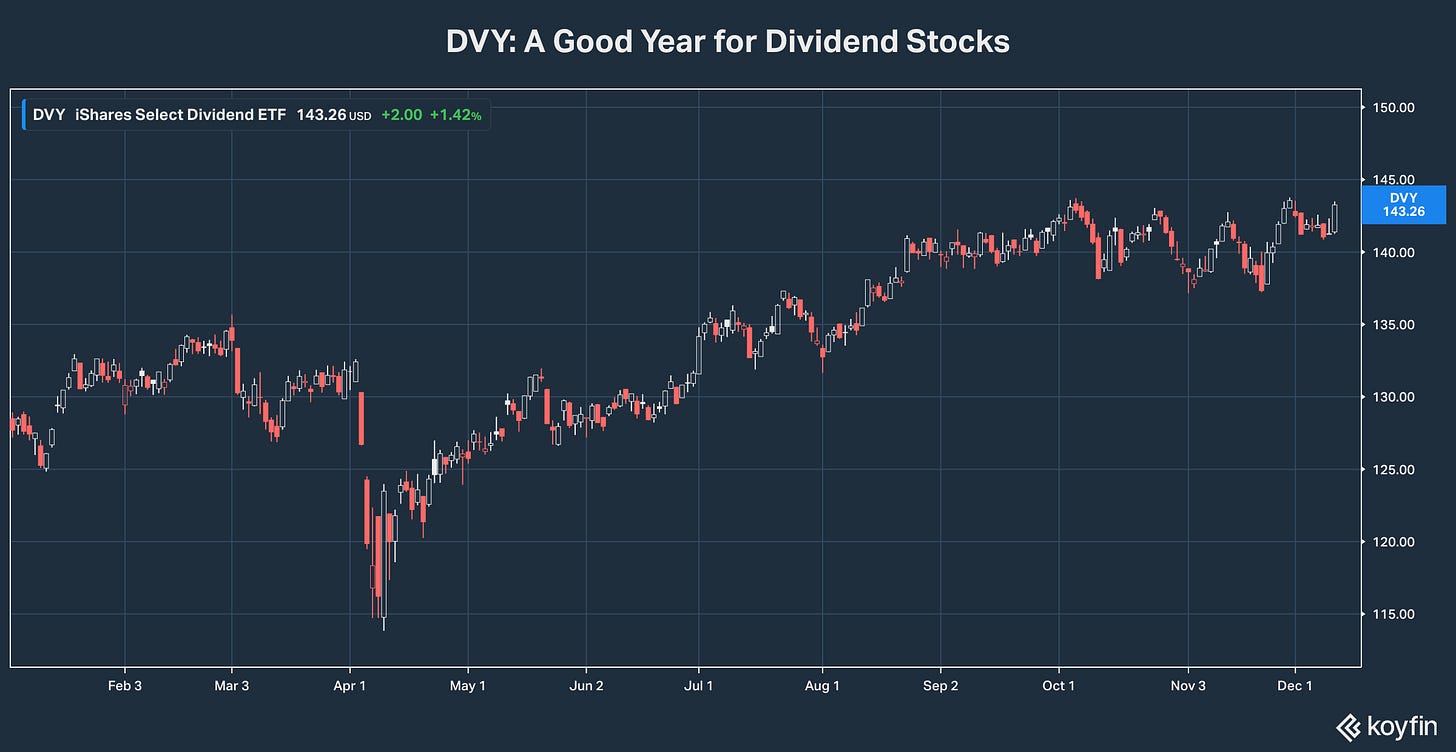

Our total return since inception is also at a high-water mark of 81.7 percent. And the weighted current yield of 4.7 percent is almost five times what you’d get from an S&P 500 ETF and a percentage point and a half more than the iShares Select Dividend ETF (DVY) paid the last 12 months.

The average 2025 year to date return on our stocks was 2.5 times gains for the DVY, which is a commonly used benchmark for equity dividend portfolios. I credit that outperformance mainly to the fact that large ETFs and funds must abide by a rule we individual investors do not:

Mainly, we can invest as much as we want in virtually any stock we want without fear of moving the market by ourselves. When you’re running an ETF of roughly $21 billion in assets like the DVY, you can only buy the handful of companies with enough market capitalization to absorb your magnitude of investment--unless you’re going to own so little that the impact on portfolio returns is negligible. And then it’s just not worth the trouble.

Each of the 18 stocks currently in the portfolio is a substantial company with real earnings. And some are quite large like BHP Group (ASX: BHP, NYSE: BHP) at $150 billion and TotalEnergies SE (Paris: TTE, NYSE: TTE). But the point is we can make our choices throughout the investment universe. And that’s paid off this year.

For Success in 2026 Buy Your Own Stocks

From all indications, stock selection is likely to be even more important in 2026.

For one thing, the big market averages are historically vulnerable on two major counts: (1) Their historically high weighting in one group of stocks, mainly High Tech and (2) The extreme valuations of that group of stocks, which have been launched into the stratosphere on a single theme—artificial intelligence.

Will there be a day of reckoning? Yes. There always has been when the market had reached similar conditions, most notably the Tech Wreck of 2000-02.

Can we time it with any degree of certainty? Not likely.

For one thing, this has been the condition of the stock market for at least the last year and a half. There’s nothing magic about 7 AI-hyped up stocks being 38 percent plus of the leading S&P 500 ETFs that dominate active and especially passive investors portfolios. And NVIDIA Corp (NSDQ: NVDA) can trade at 50, 60 even 100 times earnings if enough money comes into the stock.

But market history is full of examples of prevailing trends ending abruptly that many investors assumed would go on forever. And while the eventual result of extreme over-weighting in very expensive stocks has been a great rotation to other less frothy sectors, it’s often been quite painful for those who didn’t at least harvest some gains in advance.

Right now, your harvesting should also include high flying stocks that have nothing to do with Big Tech and AI. That’s because when the big trees come down, they’re going to take everything else with them, at least for a while and to some extent.

Energy is a sector that should escape most damage, as the long-term upcycle picks up steam next year. And not coincidentally, both of my top fresh money buys this month hail from that sector,: