Dividend Stock Hidden Treasure

Overlooked assets can produce windfall gains in the safest stocks.

Have you owned AT&T Inc (NYSE: T), MDU Resources (NYSE: MDU) or WP Carey (NYSE: WPC) the past few years? I hope so.

All three dividend-paying stocks are solidly in the black this year, adding to gains from 2024. Their average yield is north of 4%. And while we won’t see a dividend increase from AT&T in 2025, electric and gas utility MDU nearly doubled its yearly payout growth rate to 7.7%. So did industrial REIT WP Carey, which raised dividends sequentially four times during the year for a total of 4%.

A sustainably growing dividend is an unmistakable outward sign of a company’s inner grace. And these three companies are delivering the kind of solid, reliable growth that builds real wealth for investors over time.

But the biggest payday this trio has delivered to their investors so far this decade is from spinoffs: That’s by forming independent companies from certain operations considered “non-core to management’s long-term plans, and distributing ownership to investors.

In 2023, Carey spun out its office properties as Net Lease Office Properties (NYSE: NLOP). Many considered the move an asset dump at the time. But though much of the US office market has yet to bottom, NLOP shares have risen by roughly 50%. And management has dished out $7.54 per share in total dividends, including a monster payout of $4.10 to shareholders of record December 4.

AT&T’s spinout of its Warner Media operation in 2022 was similarly scorned by many investors as a long overdue admission by management of a colossal error. And after subsequently merging with Discovery Inc to form Warner Brothers Discovery (NYSE: WBD), the stock sank into the mid-single digits for most of 2024.

Late in 2022, WBD shares briefly bounced higher. And my advice then for income-focused customers receiving shares was to move on to a stock that actually paid a dividend—including buying more AT&T.

That turned out to be a pretty good move. But now Warner Brothers Discovery is the target of a bidding war.

Management has accepted an offer from Netflix (NSDQ: NFLX) for $23.25 per share in cash plus $4.50 in NFLX stock. The value of the stock portion is protected by a “collar mechanism.”

WBD shareholders will receive a minimum of 0.0376 Netflix shares—if Netflix trades at $119.67 or higher on a 15-day average basis at the close. WBD will get a maximum of 0.046 shares, if Netflix stock sells for $97.91 or less. And if Netflix’ price is somewhere in between, the share count will adjust to ensure a value of $4.50 per WBD share.

At one time, Comcast Corp (NSDQ: CMCSA) expressed interest in merging Warner with its NBCUniversal unit. But Netflix’ primary rival now is a hostile bid from Paramount, a unit of Skydance Corp (NSDQ: PSKY). That’s an all-cash offer of $30 per share, which is rumored to be heading as high as $35.

The Netflix offer for Warner has already provoked a flurry of opposition from consumer groups and Democrats in Congress. Ultimately, however, it’s up to Trump Administration regulators to approve a takeover. And seems highly likely, once the bidding war is over.

Investors who didn’t sell their WBD will want to hang on to see where this goes. But the bids will have to go quite a bit higher to match the windfall MDU Resources’ shareholders received from not one but two spinoffs: The company’s construction materials unit as Knife River (NYSE: KNF) in 2023 and in 2024 its construction services business as Everus Construction (NYSE: ECG)–both on a 1 share per 4 MDU basis.

Neither stock had paid a dividend to date. And they might not ever. But even with the materials sector slumping this year, both stocks have doubled since their debut. And both businesses are growing rapidly. Last month, Everus posted 35.4% higher Q3 earnings on a 6% boost in backlog and raised its 2025 guidance. Knife grew Q3 revenue and EBITDA 9% and 11% respectively and is also on track to report record full-year results.

It’s been 25 years since my book “Power Hungry” hit the bookstores. It was no best seller. But it did do well enough for the publisher to propose a sequel.

I confess that project is still on the drawing board. And I admit to cringing now at some of things I said back then. But at the risk of being promotional, much of it has proven to be spot on since.

A chapter I named “Hidden Treasure” traced the history of utility sector diversification. At one time, sector companies owned everything from thrift stores to insurance companies and banks. And while some of those ventures were verifiable disasters, much of it was either sold or spun out profitably.

By the late 1990s and early ‘00s, most diversification efforts had morphed closer to core businesses. For example, 15 states and the District of Columbia had adopted deregulation laws that required regulated utilities to sell their power plants to third parties.

Some like Southern Company (NYSE: SO) bought those plants and spun them out as separate companies. Others like Exelon Corp (NYSE: EXC) and NextEra Energy (NYSE: NEE), however, built separate companies they continued to fully own and grow.

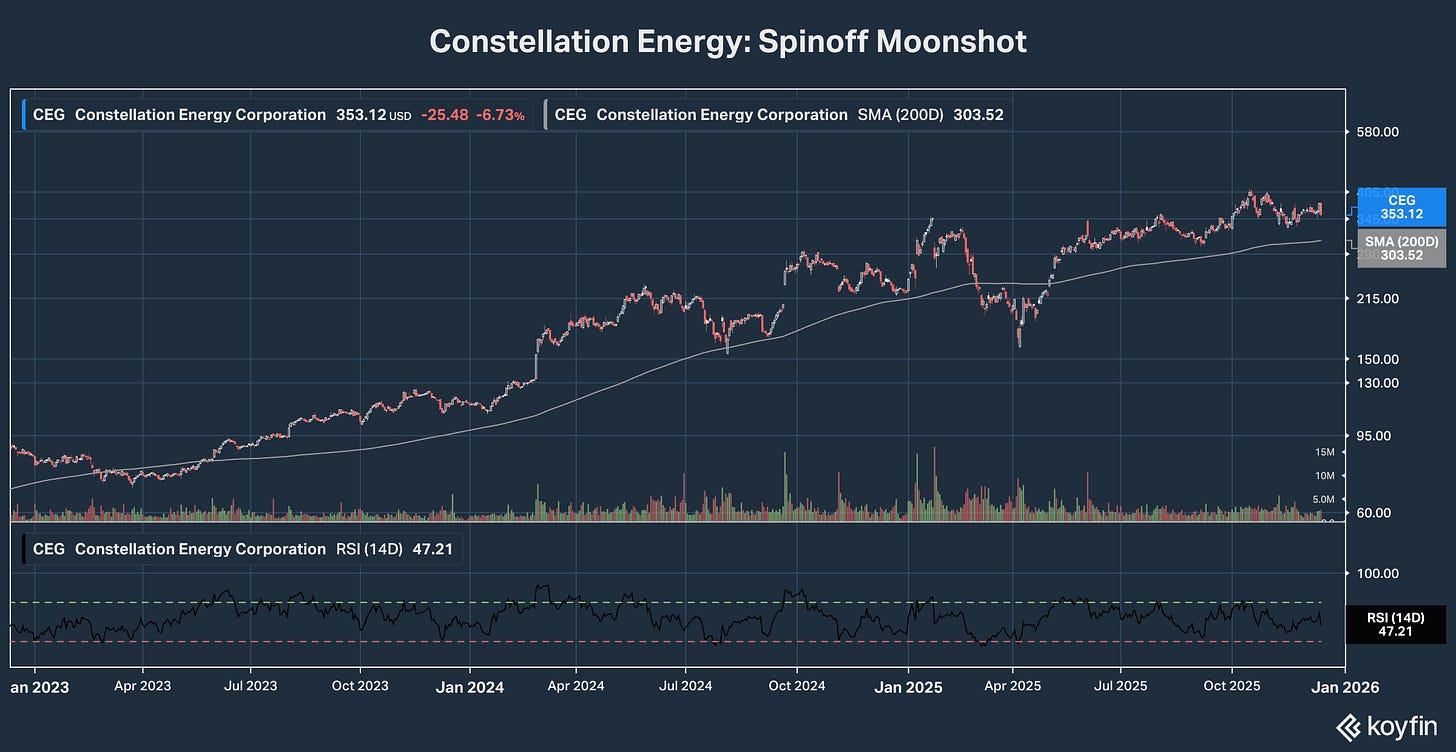

In early 2022, Exelon spun out those operations as Constellation Energy (NYSE: CEG). And the result is easily the most successful utility spinoff in history, an almost 20-to-1 moonshot at one point this year.

Constellation’s nationally leading fleet of nuclear power plants was a business success story that Wall Street had fully ignored. It was true hidden treasure. And all income investors had to do to cash in was just shares in an exceptionally conservative utility dividend stock—Exelon.

Will NextEra Energy be next? I have my doubts. But the good news is there are multiple candidates to be the next Constellation in the income investing universe. And they’re not all utilities—far from it.

Last year, for example, the Dividends Premium portfolio banked a 50% plus gain in just seven months by buying 3M (NYSE: MMM) several months before it spun off Solventum (NYSE: SOLV).

My rule with betting on potential spinoffs is the same as it is for buying takeover targets: I want to be happy owning the stock to perpetuity, even if no spin ever happens.

Targets must have a solid operating business at the core, backed by a strong balance sheet and supporting a competitive dividend. That way, we build real wealth long-term. And if there is a spinoff (or takeover) we’ll get our windfall sooner.