Dividend Stocks and Mr. Trump’s Tariffs

Here’s what income investors need to know now.

Thank you for reading Dividends with Roger Conrad! If you like what you’re reading, please consider a trial subscription to Dividends Premium.

My portfolio stocks are what every income investor should own now. And membership includes Dividends Premium REITs, as well as 24-7 access to the Dividends Roundtable forum I host on Discord. See this email and the Substack app for more information. To your wealth!—RC

“Liberation” from decades of unfair trade practices—or one of the most devastating economic policy “own goals” in history?

If you’re looking over your portfolio this weekend, the answer probably seems obvious. Barely two weeks after peaking February 19, the S&P 500 has lost nearly 20 percent of its value.

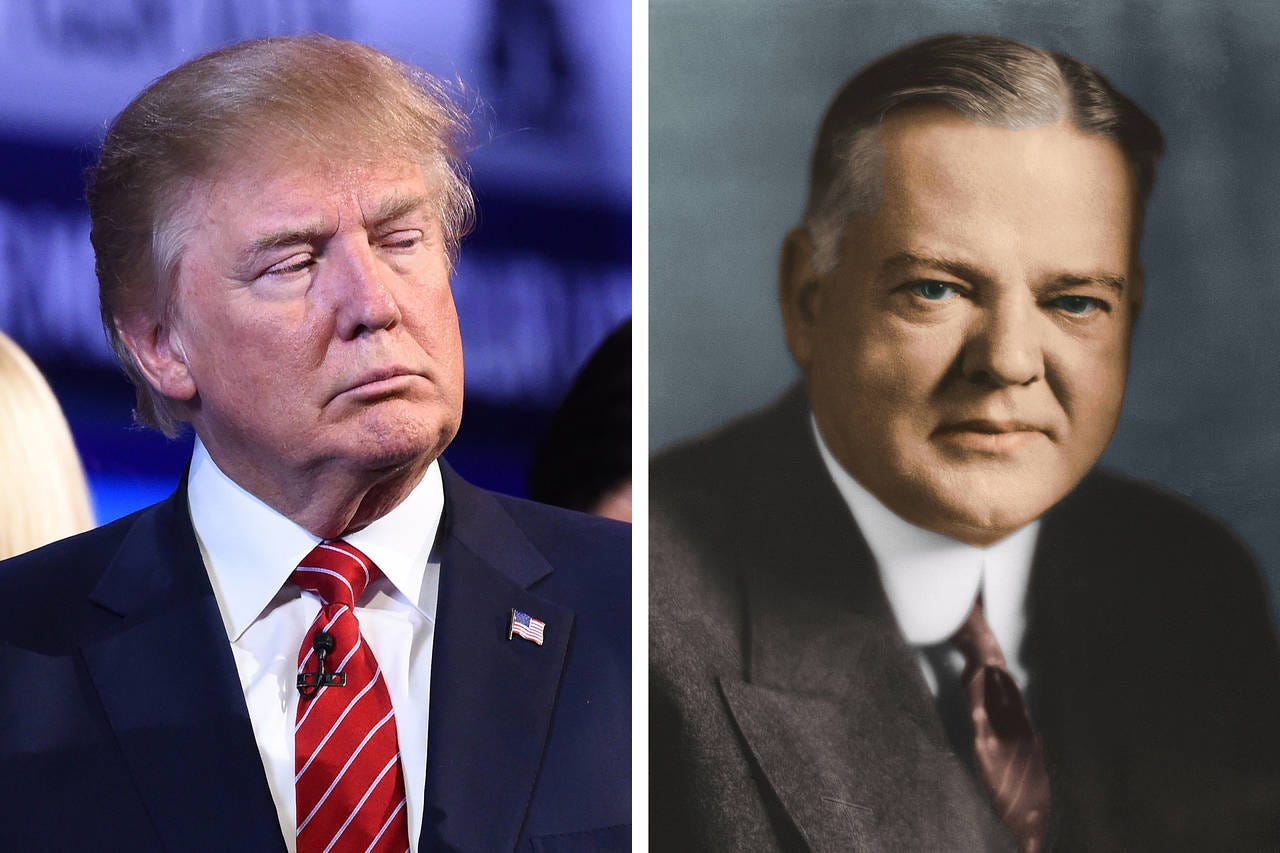

Most of that drop has come since President Trump announced 1930s-magnitude tariffs on imports from basically every country on earth. And America’s most important trading partners have responded with their own tariffs on US exports including China, matching the president percentage point for percentage point.

Before you read further, let me be clear about one thing: I don’t like tariffs. Politicians’ ongoing bluster to the contrary, no country in history has ever become wealthier by taxing its citizens when they buy imported products. In fact, there are plenty of examples where trade protectionism turned vibrant economies into multi-decade basketcases—including several in our hemisphere like Argentina.

Simply put, so long as they’re in force, Mr. Trump’s tariffs will be mostly paid by American businesses when they import products, either in finished form or as parts needed for manufacture. If their industry has pricing power, companies will pass the added cost onto their customers—who will then have less money to spend elsewhere.

If the industry doesn’t have pricing power, companies will have to eat the additional cost of importing—or else find a domestic source that will inevitably be more expensive. That will compress margins and shrink earnings. And the affected companies will have less money to invest and employ workers.

At this point, we really don’t know what the impact of Mr. Trump’s tariffs will be. It’s even still possible they’ll be rolled back, at least for countries that negotiate lower tariffs on US exports. A handful of Republicans in the US Senate have already joined with Democrats to pass legislation that would limit presidential power to unilaterally impose tariffs. And chief buddy Elon Musk was quoted last week promoting the idea of a Europe-US “free trade zone.”

That is to say, stocks could recover—or we could be looking at a lot more downside in the coming weeks. Worst case for the economy, we could be looking at stagflation: Tariffs boosting prices and simultaneously depressing growth and employment, with the Federal Reserve limiting rate cuts for fear of sparking even higher inflation.

Not a pretty picture. But neither is this the first time the stock market has taken a significant hit, or economic growth threatened. And it’s hardly the first time a massive government policy shift has been a catalyst for a selloff—President Kennedy going toe-to-toe with steel manufacturers in the 1960s being a good example.

What’s important is the aftermath of every big decline in stock market history has ultimately been bullish for investors. The excesses of the uptrend preceding it are wrung out. And the stage is set for a new run to higher highs.

There are two caveats, however. First, only stocks backed by still solid underlying businesses are assured recovery. Companies caught with too much leverage not backed by reliable revenue often never made it back.

Second, for the first time at least since the Great Depression of the 1930s, we’ve entered a stock market correction with more money passively invested than actively managed.

All of those people sold on the idea that the way to buy stocks was to “find a good index ETF” aren’t diversified in a high quality basket of companies. Rather, they’re tied the S&P 500’s performance. And even after last week’s meltdown, the index is still one-third invested in just 8 historically expensive and out of gas Big Tech stocks.

The entire oil and gas sector—the top performing stock sector for five years—is less than 3 percent. Electric utilities in contrast to the S&P 500 are largely in the black year-to-date. But they’re barely 1.5 percent.

Even before Mr. Trump’s tariffs, a great rotation from Big Tech to high quality stocks in other sectors had been underway for roughly 10 months. And the past week’s action notwithstanding, the trend remains in progress—which means we can look forward to those “good index funds” underperforming for some time to come.

So step one for investors in being ready for what’s to come is to dump the idea that a “good” index fund is going to get the job done.

Step two is to make sure you own individual stocks with pricing power. They’re in great shape to pass on the cost of tariffs without meaningfully sacrificing sales.

Odds are companies that have been able to pass on the cost of higher inflation the past few years will be able to pass on tariffs. They were the stocks to stay with when inflation rose out of the pandemic. And they’re the kind of stocks you want to stay with amid current uncertainty, particularly if they pay a generous and regularly increased dividend.

Here are three dividend stock sectors that stack up very well.

Regulated electric, natural gas distribution and water utilities top the list, which explains their outperformance this year.

Some sector companies are stronger than others. And more than a few sell at higher prices now than I want to pay. But Americans can’t get by without them so revenue is exceptionally steady in every environment. And regulation sets the price with most costs passed through in rates, so inflation exposure is limited as well.

Utilities even have an opportunity to profit from Mr. Trump’s tariffs—to the extent manufacturing “re-shores” inside US tariff walls, driving up demand. That’s been the trend for several years in fact. And more utility investment means faster earnings and dividend growth.

Energy midstream—companies that own and operate gathering and processing infrastructure, storage systems and pipelines for oil and gas—are another industry with pricing power. That’s thanks in part to growing scarcity, as North American shale producers continue to make price discipline-based decisions. And it’s because of a decade of very conservative financial management that’s slashed debt and swelled free cash flow.

Energy stocks including midstream companies took a big hit in Friday’s market-wide selloff. The silver lining is top quality companies are bargains again, like Dividends Premium recommendation South Bow (NYSE: SOBO) yielding over 8 percent.

High quality real estate investment trusts are also looking increasingly inviting. Not every property class has a record of recession resilience. But residential and self-storage REITs surely do. And after several years of market slack, they’re early stages of a secular upturn to higher occupancy and rents, and a return to robust cash flow and dividend growth.

Invest patiently. I recommend buying in three stages, making a third of your investment now with the remaining thirds in subsequent months.