Dividends and Gold Stocks

The best is likely still to come for both.

Editor’s note: Thanks for reading Dividends Roundtable! Hope everyone is enjoying Super Bowl Sunday.—RC

The good times have kept rolling for income investors in 2026—with dividend and value stocks piling onto gains from 2025.

Dividends Premium Portfolio positions are up an average of more than 11% year to date—with just two dividends paid so far. That’s on top of 36% average gains last year. And it’s happening in a year when the S&P 500 SPDR ETF (SPY) is ahead only 1.28%.

Many income investors focus mainly on current yield. That’s understandable: Fixed income investments like bonds and CDs quote you a yield. And that’s what your return will be holding on until you get your money back.

But stocks are different. A big current yield is a powerful lure. But only a well-run company will increase its dividend over time. A less adept business will always be at risk to cutting its payout, especially this year with borrowing costs likely to stay higher for longer.

A strong company’s share price will also move higher, as its underlying business becomes progressively more valuable. So, your principal grows over time. That doesn’t happen with a CD. And unless you manage your bond investments—as my friend Elliott Gue does in his Smart Bonds and Free Market Speculator on Substack—you won’t see much capital growth from them either.

My dividends strategy is stock-centric. And nothing is more important in my selection process than companies’ underlying business strength, which I regularly monitor and assess using the following five criteria:

· Dividend policy sustainability—The level of dividend and growth rate can a company’s business reasonably sustain in different environments.

· Revenue reliability—All businesses are cyclical. But can a company manage its ups and downs to become a more valuable business?

· Regulatory/Legal—Government regulation and lawsuits are the cost of doing business. But is management navigating the challenges successfully?

· Financial strength—With borrowing costs higher for longer and segments of the economy weakening, over-leverage is the single biggest risk to dividends now.

· Operating efficiency—The best dividend paying companies are always those constantly looking for ways to do more with less.

You can reasonably forecast when you’ll receive dividends. And if you’re willing to do a little research, you can also estimate with accuracy what a company will pay, for some even as far as 3 to 5 years in the future.

I provide that service for Dividends Premium portfolio stocks.

What’s more difficult is timing capital gains—when a top-quality stock’s price will reflect the value of its healthy, growing business. And a position will often languish unloved for a while, and then suddenly shoot higher.

The two biggest winners in the Dividends Premium portfolio for 2025 were CVS Inc (NYSE: CVS) and Newmont Mining (NYSE: NEM). And it’s fair to say both were hated by investors the year before.

More money is passively invested in the stock market than actively managed. That means share price momentum now runs longer in one direction than ever before. High-quality value stocks stay cheap, while hot companies become ever-more unmoored from business worth.

Best-in-class dividends and value stocks have a lot further to run the next few years.

It’s too soon to declare a great rotation from the 7 Big Tech stocks. They were still 35.9% of the S&P 500 SPDR ETF as of Friday’s close. 2025 underperformance last year was erased by a furious Q4 rally. And though Microsoft (NSDQ: MSFT) at 5% of the S&P 500 has dropped -17% since the start of the year, three of the Big 7 are still in the black this year. The largest—still Nvidia (NSDQ: NVDA) at 7.19%--is flat.

But just a little money coming out of those seven stocks will turbocharge buying power for the rest of the market. And dividend and value stocks are already catching it—just as they did a quarter century ago during the great Tech Wreck.

The question is which dividend stocks have the most upside in early 2026—and which may be already reaching their limit.

High-quality real estate investment trusts I feature monthly in Dividends Premium REITs are also off to solid start in 2026. But they’re also starting from a low point after underperforming the last three years. And pessimism is still heavy around certain property types like apartments and office.

There are still headwinds facing the sector. But the best in class have adapted. And that sets the stage for powerful capital gains the next few years, in addition to generous yields.

What about gold? Four months ago, I posted “Does Gold Still Glitter?” making the case for sticking with gold stocks but focusing fresh money on midstream energy stocks—which had been treading water since late 2024.

That was the bottom for midstream energy. The Alerian MLP Index has returned better than 20% since. And there’s still considerable value, with the energy upcycle ramping up again.

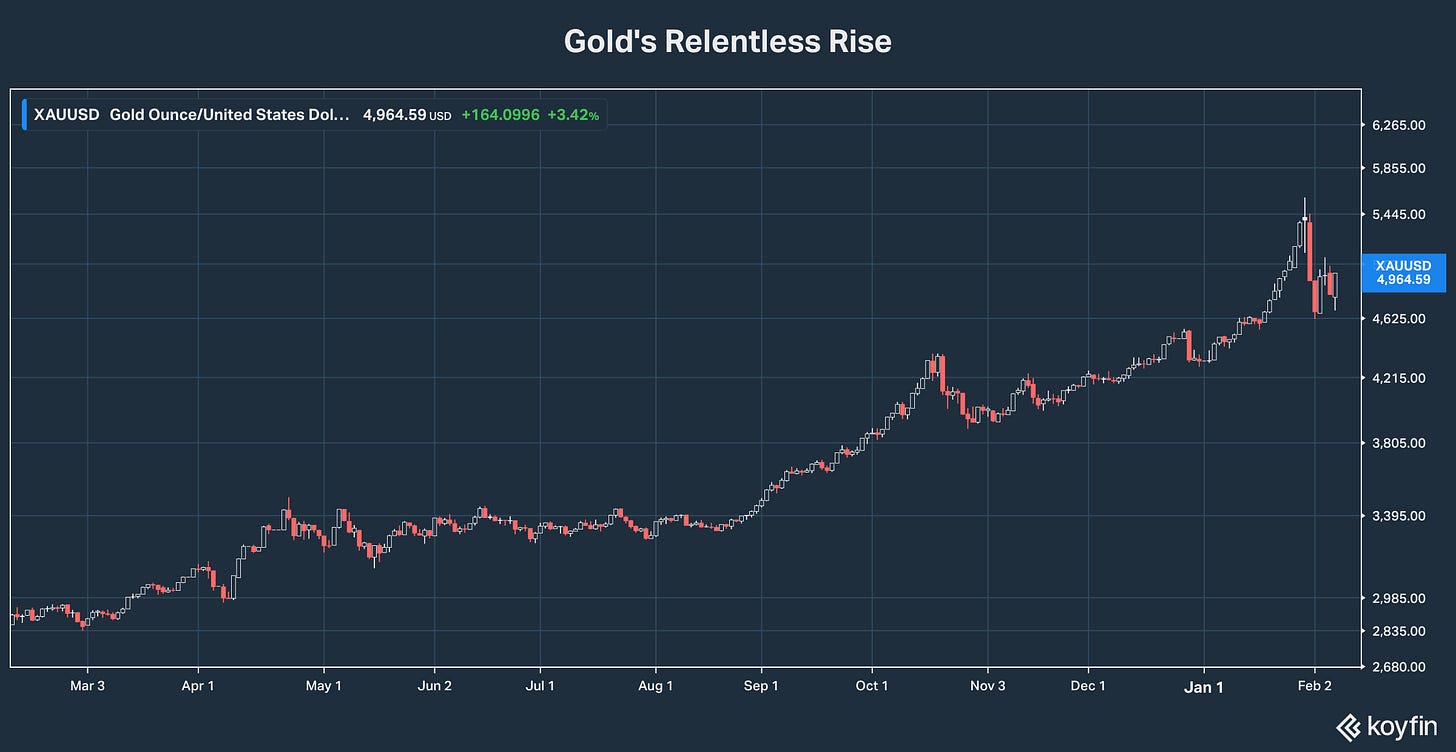

But gold has done even better. Starting from a mid-October all time high of around $3,900 an ounce, the yellow metal almost hit $5,600 in late January, before settling just under $5,000 at Friday’s close. And gold stocks have largely followed it up.

Gold’s peak and subsequent plunge back under $5,000 coincided with the release of consumer and producer price inflation data for December showing a sharp acceleration. But the same day, President Trump announced he would nominate Kevin Warsh to be Federal Reserve Chairman when Jerome Powell’s term end.

For those who aren’t Fed watchers, Warsh is Wall Street. And he has a history of being an inflation hawk and fierce critic of quantitative easing—central bank bond purchases to drive down interest rates.

It’s reasonable to blame gold’s plunge on the nomination news—Warsh still must be confirmed by the US Senate—as a sign the Fed will continue to be serious about fighting inflation. But that may also be premature, as the White House still appears to be expecting rate cuts. And key commodities are showing signs of entering a new super-upcycle.

The unknowns will keep gold prices volatile. But despite big 2025 gains extending into 2026, gold stocks are arguably only just beginning to see the benefits of $3,000 gold, let alone $4,000 or $5,000!

So, I’m staying with my mining stocks, just as I did four months ago. No guarantees. But the best just might still be ahead.