Dividends Premium: July 2025

To add to first half 2025 gains keep an eye on debt.

Welcome to the July CUI Plus/CT Income!

Each of our 20 current holdings sells for about it did a month ago. But it’s still prime time to make a handful of portfolio moves.

One big reason: Performance is likely to change dramatically for some stocks over the next four to six weeks. That’s as companies release Q2 earnings and update guidance.

This month, I examine each of our holdings’ strengths and vulnerabilities in a potential second half 2025 environment where borrowing costs don’t come down—and may actually start rising again. And I highlight what I expect in results and guidance over the next several weeks.

I’ll be paying special attention to potential earnings impacts from the recently passed federal budget bill and import taxes. But it looks increasingly like the greatest threat to companies’ investment plans, growth, balance sheet strength and dividends in second half 2025 will be debt.

If you’re not a Dividends Premium subscriber yet and want a look behind the paywall, I encourage you to check out the service through the link in this email or through the Substack application. Next week, you’ll receive Dividends Premium REITs, featuring extensive coverage of real estate investment trusts. And you’ll have access to my Dividends Roundtable discussion forum on the Discord application, 24-7.

Thanks for reading and here’s to a very happy and prosperous second half to the year!--RC

For Big Second Half 2025 Returns Watch the Debt

Since inception, our model income and growth portfolio is ahead by 68.17 percent. That return is the change in principal plus accumulated dividends, which is added up distributions from both current and now closed positions. And it’s based on the assumption investors have harvested cash from distributions, rather than reinvested to produce a significantly higher return.

We’re meeting our dividend growth objective: 15 of the 19 positions raising their payouts at least once over the last 12 months. And the average weighted yield is a superior 5.1 percent, which compares to 3.8 percent for the iShares Select Dividend ETF (DVY) and 1.2 percent for the SPDR S&P 500 ETF (SPY).

Year to date, the portfolio recommendations are ahead by an average of 14.18 percent. That compares to 5.36 percent for the DVY and 6.48 percent for the Big Tech-heavy SPY.

The DVY is a commonly used benchmark for equity-focused income portfolios like this one. But the ETF is unsuitable for anyone relying on a steady stream of dividends, as quarterly payments can vary widely.

The critical factor for our companies to add first half 2025 gains: Their underlying businesses must remain healthy and growing.

That’s what I expect all of them to confirm when they release Q2 numbers and update guidance in the coming weeks. And that includes hold-rated Kraft Heinz (NYSE: KHC), though I may still unload the position depending on what management has to say.

One reason Kraft is on effective “probation” now is debt. The food company has made great strides streamlining product lines to cut costs and maximize free cash flow the past several years. And that plus some sales of non-core assets has enabled substantial debt reduction.

But now forces beyond Kraft’s control—including inflation—are depressing revenue. Management has slashed 2025 earnings guidance in response. And long-term debt is up 8.9 percent since December 31, with interest expense are on the rise again.

Bottom line: What happens to interest rates going forward could have a pretty big impact on Kraft’s earnings and even its ability to pay dividends. And that’s despite mid-BBB credit ratings from Fitch, Moody’s and S&P.

Borrowing Costs: Higher, Lower or Sideways?

The big question now is if borrowing costs will finish 2025 higher or lower than where they started. And a little more than halfway through the year, the jury is very much out on that question.

The Federal Reserve is still maintaining its projection of two quarter-point cuts in the benchmark Federal Funds rate by the end of December. But so far, the official mantra from the central bank—despite immense pressure from the White House—is “restraint for longer,” or at least until there’s clarity on the inflation impact of President Trump’s tariffs/import taxes.

The Fed only influences corporate borrowing costs and other market-interest rates. It does not set them.

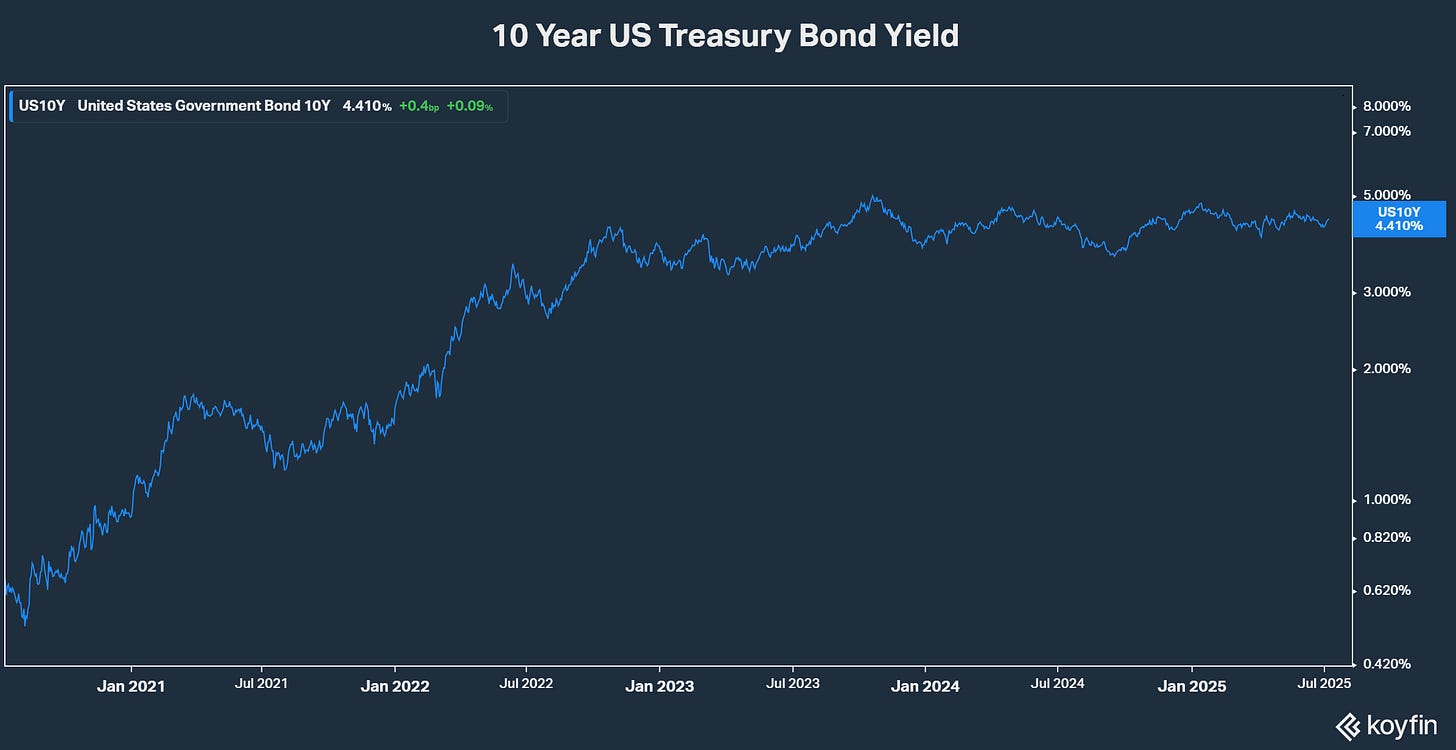

But market rates too are little changed this year so far. The 10-year Treasury note yield—the benchmark rate for intermediate-term corporate bonds—closed this year’s first trading day (January 2) at 4.568 percent. And as of yesterday’s close, it was at 4.41 percent. Five year Treasury bond yields have dropped a little more: From 4.375 percent to 3.976 percent.

That’s not much of a discount for waiting six months for borrowing costs to drop. But a growing number of companies I track are apparently losing patience (or faith) and have come to market to sell bonds over the past month.