Dividends Premium: June 2025

Prospering in 2025 increasingly means looking past daily political news.

Editor’s Note: Welcome to the June Dividends Premium!

This month I’m making a couple of moves to the portfolio to take advantage of emerging bargains and over-reaction by investors to political news. But mostly, I’m just staying the course. And despite some uncharacteristic volatility, it’s been a very profitable year for our positions so far, with an average total return of 12.08 percent.

If you have any questions about what you read here, please join me at my Dividends Roundtable, which I host 24-7 on the Discord application. It’s easy to sign up. And I promise to answer anything you throw my way!

Thanks for reading and here’s to your wealth.--RC

To Prosper in 2025, Look Beyond Politics

It’s hard to remember a time when investors were so focused on politics. And given the almost daily bombardment of news, that’s certainly understandable.

I wouldn’t argue actual and even threatened tariffs aren’t having a real impact on multiple sectors of the economy.

The newly enacted 50 percent tax on imported steel, for example, is already increasing the cost of building everything from factories that would manufacture more steel to apartments, oil wells, energy pipelines and power plants. And there’s no doubt more than a few would-be developers are throttling back plans unless the economics are extremely compelling.

Word is the US Senate is doing quite a bit of marking up of the federal budget bill sent over by the House of Representatives, which passed by a single vote and reportedly wasn’t read by many who voted for it. And the stakes are quite high regarding what ultimately does pass, starting with the US Treasury being able to avoid default as annual deficits threaten to reach trillions of dollars.

Rising trade and perhaps military tensions between the US and China are a global flashpoint. I continue to believe a deal of some kind is too important for both sides not to reach an agreement. And as you’ll see in this report, I’ve now essentially doubled our bet on one.

But it’s critical for all of us to remember at this time that politics is only one driver of investment returns. In fact, they rarely if ever have been the most important factor. And they aren’t now.

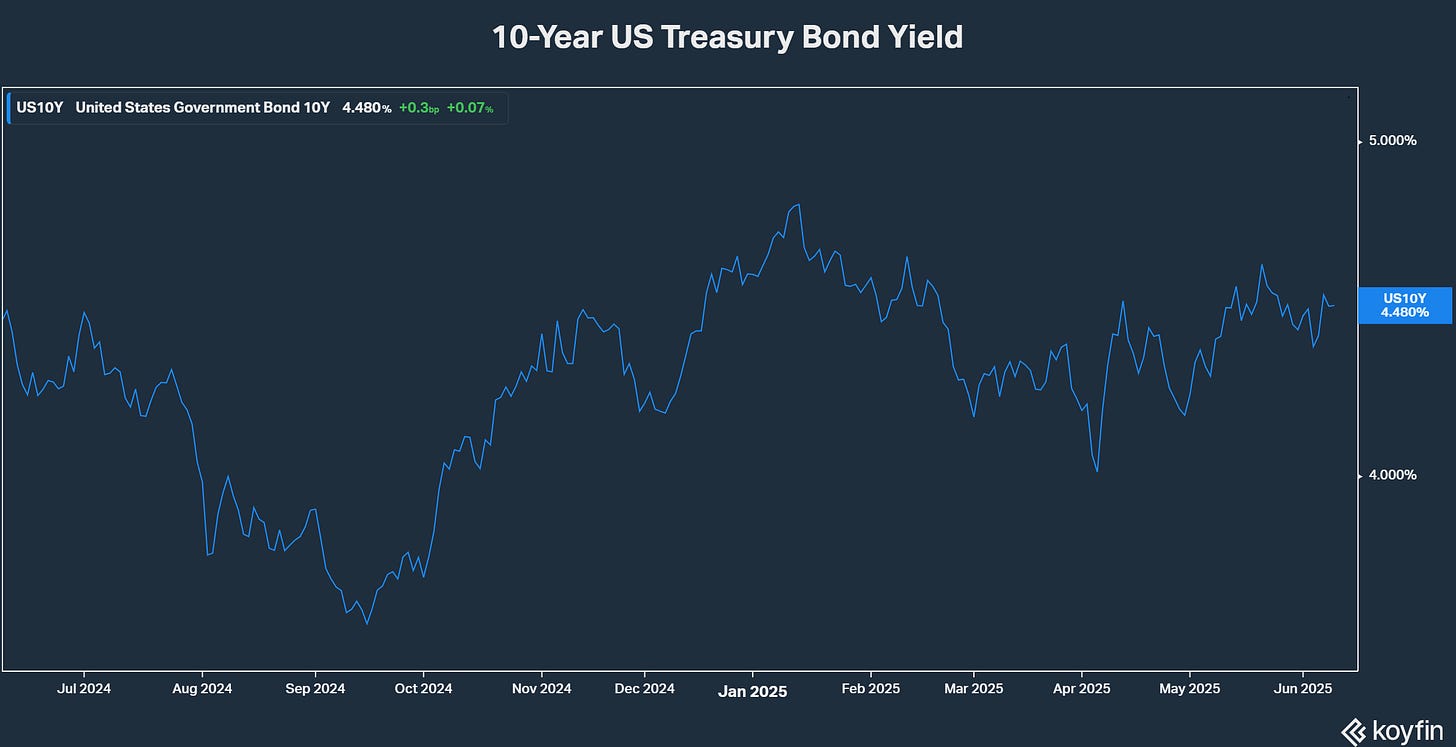

Sure, the Federal Reserve would almost certainly have cut the Fed Funds rate further by now. But America’s central bank is still concerned tariffs on imports will reverse the progress its “restraint for longer” has made to date on inflation. And elevated benchmark rates have kept borrowing costs high, restraining investment everywhere the added cost can’t be passed onto someone else or offset somehow.

I still expect the Fed to deliver on its December 2024 guidance for two quarter point rate cuts by the end of 2025. But equally, the central bank won’t do anything until it can get a better read on where tariffs will wind up and what their impact on inflation and economic growth will be. And that’s not going to happen until there’s clarity on what the Trump Administration’s end game is.

I suspect the ultimate objective here is to achieve some combination of “better” trade deals, collecting additional taxes to offset enormous federal deficits and re-shoring of manufacturing to the US. That list of objectives reflects the competing voices in the Administration, though it certainly opens the door to acting at cross purposes: The 50 percent steel tariff, for example, may actually slow reshoring by making it more costly to build here.

Making investment decisions based on what tariffs may or may not be enacted, however, has so far been a formula for whiplash. And so is trying to figure out what will be in the federal budget that ultimately passes Congress.

Smart Investment Decisions

So what can we do? The best course is to just stick to the tried and true. And in this portfolio, that means continuing to build position in stocks of companies with strong balance sheets and underlying businesses that enjoy pricing power.