Dividends Premium REITs: August 2025

A dozen guidance boosts portend a second half comeback.

Editor’s Note: Welcome to the August Dividends Premium REITs. Thanks for reading.

For REIT investors, the year so far has been mostly a case of taking a step back for every one forward. That’s even true of the best in class companies.

A majority of First Rate REITs raised 2025 earnings guidance in the past few weeks, versus no reductions. And several of my picks accelerated dividend growth. But on average, these stocks are actually down fractionally, by -0.14 percent year to date.

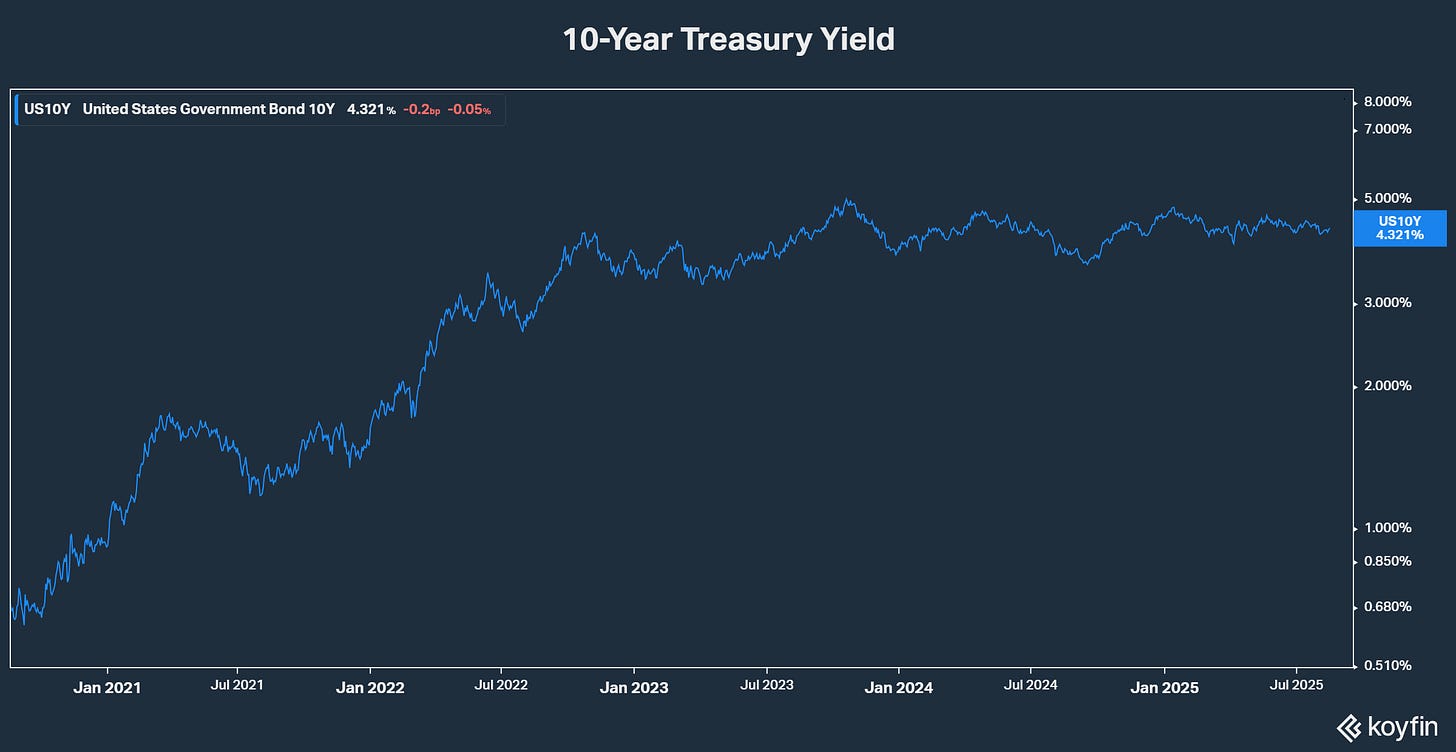

Higher for longer interest rates are one major factor keeping REITs generally under-owned at around 1 percent of S&P 500 ETFs. But crucially, we’re seeing stronger operating performance of individual REITs despite the obvious headwinds.

That means sooner or later we’re going to see a powerful rally for REITs that continue to perform well as businesses. If you’re still light on REITs, now’s the time to build positions.

Have a question? Check out my Dividends Roundtable forum on the Discord application. I host it 24-7. Hope everyone is having a fun and profitable summer!—RC

Guidance Boosts Portend A Second Half Comeback

Will the Federal Reserve resume cutting the Fed Funds rate next month?

Depending on what forecasting gauge you consult, US investors appear to be assigning a 90 percent chance for the Fed to cut its benchmark rate by a quarter point when it next meets.

That seems reasonable. For one thing, the central bank has never changed its guidance for two quarter point cuts this year, which it initially issued last December. And the July employment report—leaving aside the fact it’s compiled from frequently revised survey data—gives the inflation doves cover to push harder for cuts.

On the other hand, strip out volatile food and energy prices and July inflation was meaningfully higher, backing up the direction of “restraint for longer,” in the words of current Fed Chairman Jerome Powell. In fact, inflation hawks are likely to argue for higher rates if the impact of trade tariffs continues to show up in the data going forward

In my view, the larger impact of tariffs—like any tax—will be contractionary. And in fact, there’s already evidence some industries have pulled in their horns on new investment and employment, at least until it becomes clear what’s going to eventually be taxed and to what extent.

The money Treasury is boasting about collecting from tariffs has to come from somewhere. If businesses eat the cost, they’re going to have less money to invest and employ. That’s contractionary.

If businesses have the pricing power to push costs off to consumers, the result will be higher inflation. But it’s also contractionary. That’s because consumers will have less to spend without taking on massive new debt. And that means more cyclical businesses will suffer, with retail an especially good candidate.

It's easy to see how high the stakes are for the property sector in this game. A cut in Fed Funds rate that does not inspire a corresponding rise in long term bond yields would be bullish.

Not only would investors be more attracted to dividend stocks like REITs. But lower borrowing costs would further unfreeze investment to spur growth. On the other hand, a rise in inflation and/or softening economy will do the opposite by pushing up costs while depressing rents and occupancy.

REIT Strategy for Second Half 2025

So how to play it with so much unknown? Here’s my take.

First off, REITs are not a high-priced sector of the stock market. They’re dramatically under-owned in the S&P 500 at somewhere around 1 percent for the entire sector, depending on what you count.

That compares to a nearly 16 percent weighting for just two stocks, Microsoft (NSDQ: MSFT) and NVIDIA (NSDQ: NVDA). And aside from a handful of non-traditional REITs like data centers, measures of standard valuation like price to book, price to FFO and yield are quite reasonable.

In a full scale selloff, everything is going to take at least some hit. That was the case in 2008, the last true bear market on Wall Street. And if there is a second Tech Wreck in the cards, it’s likely REITs will drop some as well, particularly data center operations and others perceived to be tied to the fallen leaders and/or operating more cyclical businesses.

Best in class REITs, however, would also be coming down from a much lower place. Their high yields have historically provided a floor in downturns. And they’d be among the first stocks to recover when the macro storms inevitably blow over.

Second and more important, the best in class First Rate REITs are in a position of strength just now. That’s clear from Q2 results and guidance updates.