Dividends Premium REITs: July 2025

Uncertain interest rates pose a challenge to REIT returns, but many are succeeding.

Editor’s Note: Welcome to your July Dividends Premium REITs. Thanks for reading.

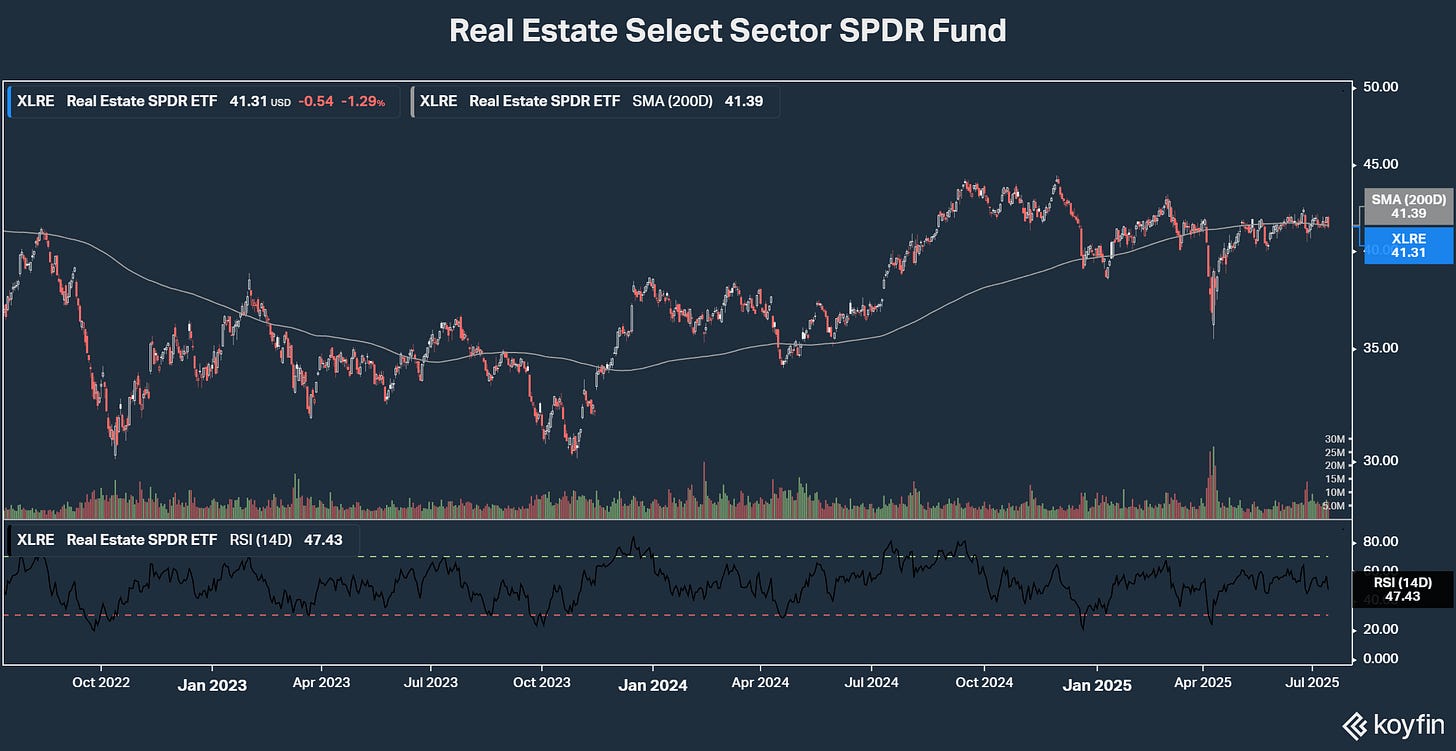

Leading REIT ETFs have been mostly flat since my June post. But our First Rate REIT List has gained some momentum, particularly higher yielding fare.

Big picture, the property sector’s position is basically the same it’s been all year. That’s in the stock market where investors are understandably watching interest rates. And it applies to business fundamentals too, as REITs prepare to report Q2 earnings results and update guidance.

With very few exceptions, our now 84-REIT coverage universe either held or raised summer dividends. And based on that, this doesn’t look like the quarter for big surprises. But if any First Rate REITs come in with something suggesting real weakness, I will cut and run.

This month’s top two fresh money buys are a pair of higher yielding REITs I’m very comfortable with ahead of their earnings. Both have delivered solid dividend growth already this year. And they’re better protected than most from interest rate volatility, which increasingly looks like it could be with us for a while.

Got a question. Join my Dividends Roundtable discussion, which I host for Dividends Premium members 24-7 on the Discord channel. Want to become a member? Check out the link in this email or in the Substack application. Hope everyone is having a fun and profitable summer!—RC

REITs: Interest Rate Resilience is the Key to Superior Second Half 2025 Returns

Tariff talk is still dominating investment headlines. And as far as most real estate investment trusts are concerned, there’s good reason for that.

True, most real estate investment trusts are only tangentially affected by import taxes. Tariffs on imported steel—along with recent steel price increases announced by domestic producers—will increase the cost of construction. And tariff uncertainty has made warehouse tenants wary of committing to additional space, which has slowed the pace of investment even for sector leader Prologis Inc (NYSE: PLD).

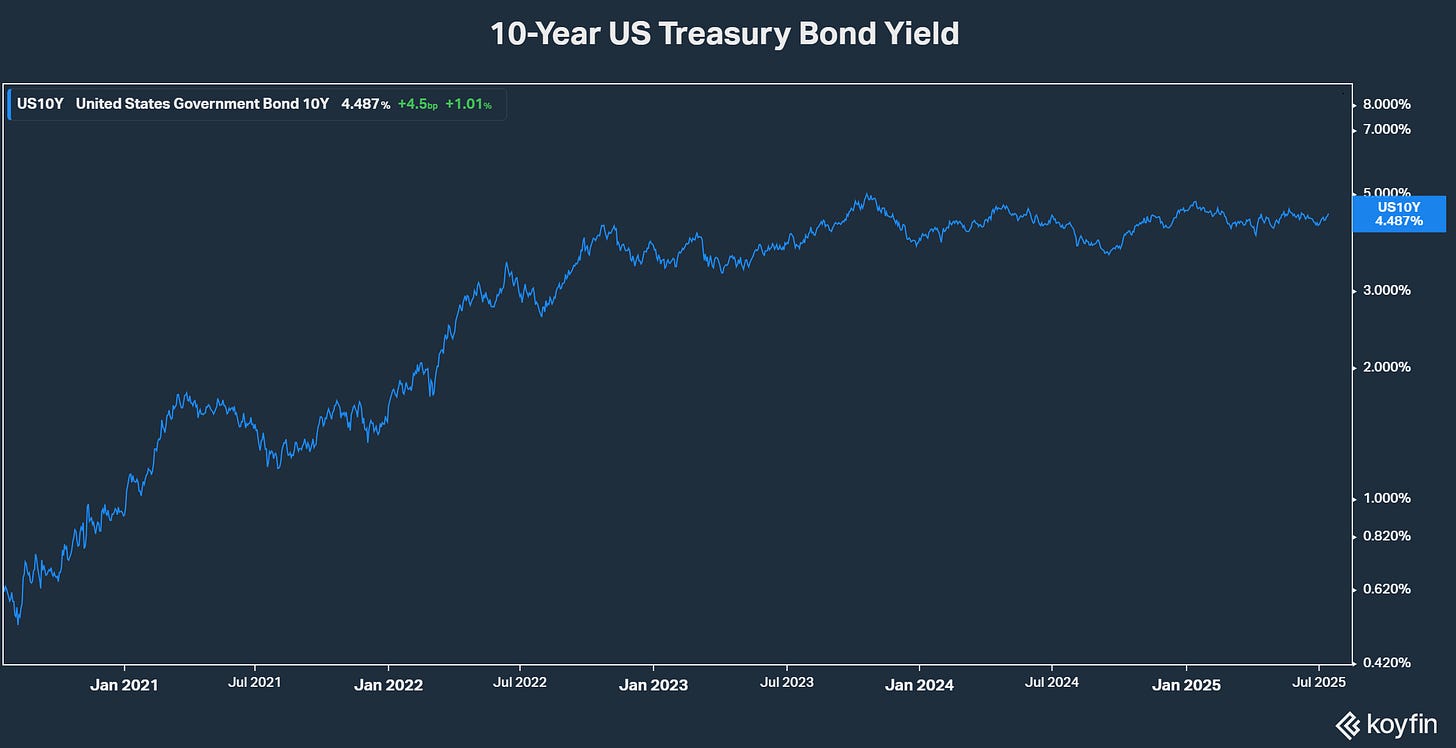

But even the strongest REITs have been facing a headwind from tariffs when it comes to borrowing costs. Debt is an essential piece of funding property expansion and REIT acquisitions. And key interest rates have remained higher for longer in large part because of worries about inflation. So most companies’ response has been to rein in investment, by extension slowing growth in cash flow and dividends.

The White House has blamed elevated interest rates squarely on Federal Reserve Chairman Jerome Powell. That’s because Powell has stuck to a policy of “restraint for longer” until more is known about the inflation impact of the president’s tariff policy. And with tariffs’ impact now showing up as higher inflation, it’s highly unlikely he’ll back down. That’s despite the almost daily barrage of threats from the president and his surrogates to replace him, possibly before his term as chairman expires next year.

In another twist to this saga, JPMorgan Chase CEO Jamie Dimon weighed into interest rate dispute this week on Powell’s side. So far, Trump administration policies for the financial sector have been practically a big banks’ wish list. So risking the ire of the president is obviously something sector leaders would prefer to avoid.

But the June Consumer Price Index announced this week was up 0.3 percent sequentially from May and by 2.7 percent from a year ago. And so-called “core” inflation that excludes energy and food prices came in up 2.9 percent.

According to the talking heads, that was still “in line” with expectations. But it’s also well above the Fed’s 2 percent target, which the bond market has gotten used to as a sign of central bank discipline. And there were clear signs that the president’s on again/off again taxes on imports are starting to show up in the real economy, with possibly a lot more to come.

Like the head of every major bank, Mr. Dimon knows how important it is for the Fed to maintain bond market confidence. And he’s seen up close and personal what can happen if that faith is shaken, for example by abandoning long-standing targets for reducing inflation in the face of pressure from politicians.

The Market Sets Rates, Not the Fed

The big investment media rarely if ever points this out. And given how vociferous the president and his surrogates have become about how Powell must either cut rates now or go, investors could be forgiven believing the Fed has the power to set the exact level of interest rates with the stroke of a pen or press of a button.

If only life were that simple. But at the end of the day, it’s always market forces that determine the interest rates that count. Simply: Who’s willing to lend what to who and at what rate. And that’s why corporate America’s cost of debt capital is based on two factors:

· Individual companies’ perceived credit risk.

· Investor perceptions of where inflation is headed.

That’s not to say Federal Reserve policies like setting the Fed Funds rate and managing its massive balance sheet buying and selling Treasury bonds don’t wield outsized influence. But maintaining influence depends on investors trusting the central bank to act solely based on economic considerations.

You don’t have to look that far back to see disastrous results when investors perceived the Fed as bending to the will of an American president. The double-digit inflation of the 1970s is the most egregious example. That’s when Chairman Burns undermined confidence by infamously acceding to President Nixon’s desire to cut rates.

Real property has historically outperformed during times of high inflation. So if that’s what’s in our future, I’m still comfortable holding the 21 First Rate REITs. In fact, Farmland Partners (NYSE: FPI) is especially levered to the kind of boost in commodity prices we’d see if inflation should get out of control again as in the 1970s.