Does Gold Still Glitter?

Yes, but midstream energy stocks are now the better bet for inflation proof income.

Editor’s note: Thank you for reading Dividends Roundtable with Roger Conrad.

This week, I look at two sectors that have gone in very different directions this year, gold and midstream energy stocks. That’s despite both being powerful beneficiaries of an environment of persistent inflation.

Both sectors are well represented in the Dividends Premium Portfolio. But at this point, I’m more excited about the midstream energy sector for fresh money.—RC

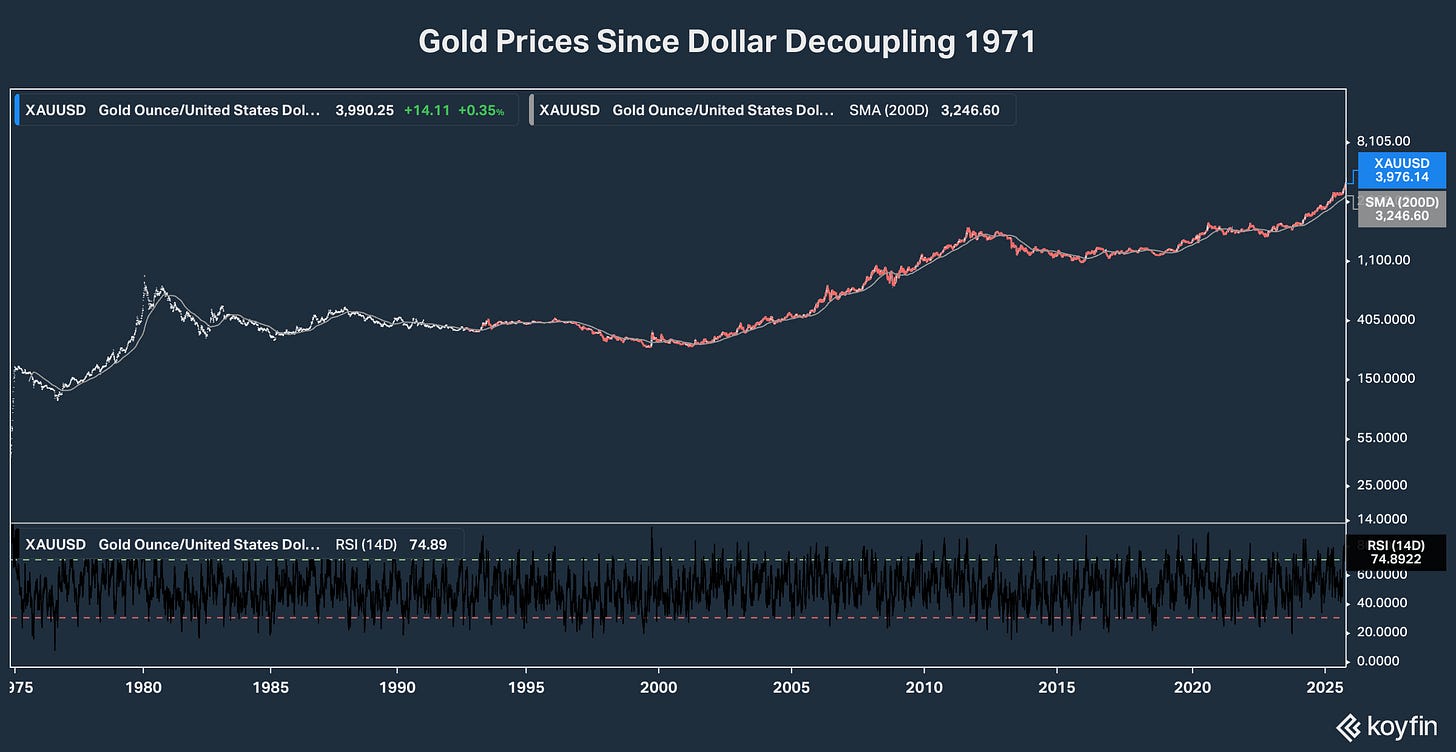

Can gold prices keep rising? That may seem an odd question with the yellow metal hitting new all-time highs almost daily, and last week pushing over $4,000 an ounce for the first time ever. And for the first time in at least a decade, gold mining stocks are joining in the party.

Dividends Premium recommendation Newmont Corp (NYSE: NEM) was a big time laggard in 2024, and in fact the two years before that as well. But year to date in 2025, the stock has risen roughly 130%. Close rival Barrick Mining Corp (NYSE: B) is up 115% after badly trailing the market for four years. And smaller mining stocks have lately started to catch fire as well.

Cut your losers and let your winners run has been a winning strategy this year in the stock market. Buying and selling momentum is arguably running further in one direction or another than at any time in history. And that’s made it very difficult to stick with losing stocks, or to even take a partial profit in the top performers.

But equally, no one has ever gone broke from harvesting gains in a surging stock from time to time. And buying a top quality stock that’s out of favor has routinely rewarded patient buyers with massive gains—Newmont’s windfall performance this year being a great example.

To be sure, the underlying drivers of gold and gold stocks’ returns this year are strong as ever. The Federal Reserve is under growing political pressure to cut its benchmark Federal Funds rate aggressively into an environment where its primary gauge of inflation is not only well above its long-term target of 2%. But it’s also been rising the past several months. And Chairman Jerome Powell and other voting members of the Federal Open Market Committee (FOMC) continue to note tariff-triggered supply chain disruption as just starting to boost inflation.

Since the late 1970s, the Fed has generally responded to similar conditions by raising rather than lowering rates. But back in the early 70s, then Fed Chairman C. Arthur Burns was pressured by then President Nixon to cut rates in inflationary times. And the result was an undermining of confidence in the central bank’s will to fight inflation, which was undoubtedly a significant contributor to the double-digit inflation we saw before President Carter appointed Paul Volcker as chairman.

Will the Fed’s authority be similarly undermined this time around? The result would be certainly be glorious for gold, which could easily make a serious run on even $10,000 an ounce. And those of us who remember the 1970s and 80s—up until “Black Tuesday” in 1987 ended the yellow metal’s run—are well aware that gold stocks like Newmont would do even better.

But I would say this probably will not happen.

Jawboning Fed officials to cut rates is one thing. But appointing anyone to the FOMC other than professionals who have Wall Street’s confidence—especially obvious toadies picked to do the president’s bidding—is another thing entirely. The Trump Administration is if nothing else hyper-aggressive on every front. And it may wind up pushing things too far. But more likely, we’ll see continuity that preserves at least the Fed’s perceived independence.

It’s also quite possible the primary impact of tariffs and disrupted supply chains will be contractionary to economic growth, rather than inflationary—as companies pull back on investment and hiring.

That’s taken place in wide swaths of the property sector over the past year. There are a handful of companies I track in Dividends Premium REITs that have actually increased investment targets and therefore earnings guidance for 2025. But for the most part, management has responded to the combination of higher for longer borrowing costs, concerns about the economy and previous years’ overbuilding to pull in their horns on new development.

Curtailed investment is actually extremely bullish for property stocks longer-term. Sectors like self storage are reporting occupancy and rental “rate gaps” are narrowing as new supply slows to levels well below historical averages, tightening the supply/demand balance.

Apartments have been tightening for most of this year, even in the SunBelt where a glut of new supply came on in many areas earlier in the decade. Seniors housing has made a massive comeback since the pandemic, in large part due to massive consolidation. And even office is tightening up, particularly for premium properties.

Tightened supply means higher property values and REIT earnings and dividends in coming years. And the same is true for the North American energy sector, which for the last decade plus has stuck to conservative “shale discipline.”

The sector’s most important investments now are in efficiency and cost-cutting, rather than ramping up output. And that’s now been re-enforced by benchmark WTI Cushing crude oil prices slipping to around $60 a barrel and Henry Hub natural gas trading under $3.50 per million BTU for most the year.

The prevailing narrative in investment media now is over production of oil and gas running into a slowing US economy. And that’s stalled the upward momentum in energy stocks in 2025, though the Select Energy Sector SPDR (XLE) is still in the black for the year.

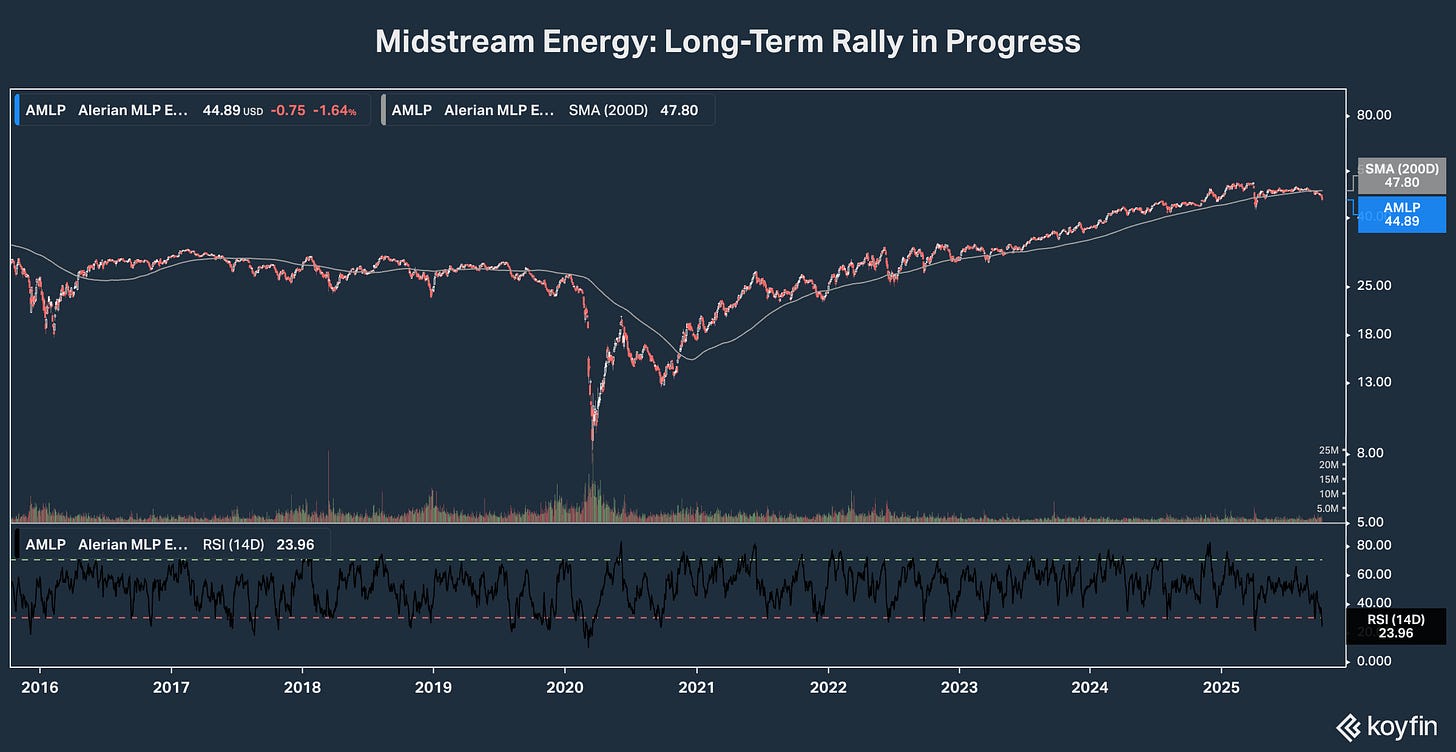

But the happy result is investors now have an opportunity to buy top quality energy stocks at the best prices we’re likely to see for some time. And for those seeking a high yield, energy midstream stocks are particular bargains.

Midstream companies don’t produce oil and gas. They own the pipelines and other facilities that gather, process, store, compress and transport it from the wellhead to the burner tip. E,

Midstream company earnings are backed by long-term contracts with minimal direct exposure to commodity price volatility. And they’re now seeing unprecedented opportunity for expansion—supplying LNG for global export and for generating electricity to power artificial intelligence as well as re-shoring of industry in the US.

That investment means midstream companies have not just the highest yields you’ll find anywhere on Wall Street. But their dividends will be increased faster than the rate of inflation for years to come.

And midstream dividends are safe: Oil and gas are more essential to a functioning modern world than ever. And after a decade of conservative financial management, midstream companies are stronger than ever. It’s time to buy.