Don’t Get Flustered by Federal Budget Busters

There are real investment opportunities in addition to the obvious dangers if you look beyond today’s headlines.

Happy Memorial Day weekend! And thank you for reading Dividends with Roger Conrad!

Last week, I sent a new buy recommendation for Dividends Premium members. Tomorrow, I’ll be posting the May Dividends Premium REITs with the best fresh money buys from that battered but unbowed high yielding sector.

If you’re not a Dividends Premium member, check it out by following the link attached to this email, or on the Substack application. Here’s to continuing finding ways to prosper in this uniquely uncertain market!—RC

Elections most certainly do have consequences. And whether you voted for or against the current government, it should be crystal clear that this regime sees its role as shaking things up, and letting the chips fall where they may.

For investors, the federal budget bill emerging from the US House of Representatives last week is a pretty clear case in point. So was the announcement of a new 40% tariff on imports from the European Union a day later, and the 25% tax on Apple Inc (NSDQ: AAPL) iPhones made outside the US. And it’s a safe bet investment markets are going to get rocked by a lot more of the same in the coming months.

What may surprise you is this is not necessarily a bad thing when it comes to building wealth. In fact, it’s no exaggeration to say that current volatility presents compelling opportunities for buying low and selling high—and almost on a daily basis.

Think about it this way. The US government is effectively this country’s largest and most powerful corporation. So when it takes action—or even states an intention—big money is going to move around as the players anticipate consequences.

Certain impacts of changing policy are unmistakable. I have my doubts taxing imported iPhones will make that much difference to Apple’s bottom line. And the US Big 3 communications companies—AT&T Inc (NYSE: T), T-Mobile US (NSDQ: TMUS) and Verizon Communications (NYSE: VZ)—have all said they would pass on any additional cost of wireless equipment to customers.

But let’s take the massive cuts to the Medicaid program in the budget bill the House passed last week by a single vote.

As I’ve pointed out to Dividends Premium REITs readers, landlords for hospitals and medical buildings have been battered in recent years by their tenants’ inability to keep up with rents. Medical Properties Trust (NYSE: MPW) has cut its dividend by -72 percent the past two years.

Sharply lower cash flow as it’s been forced to renegotiate leases with hospital operators filing bankruptcy like Steward and Prospect Medical Group. And a big cut in Medicaid will force more hospitals to close with those staying open forcing rents lower.

I don’t think the US Senate will just rubber stamp what the House sent over. And Medicaid may emerge better in the final budget. But this new threat to hospitals should make avoiding this group easier—though some will still be tempted by the 13.6% yield paid by Global Medical REIT (NYSE: GMRE).

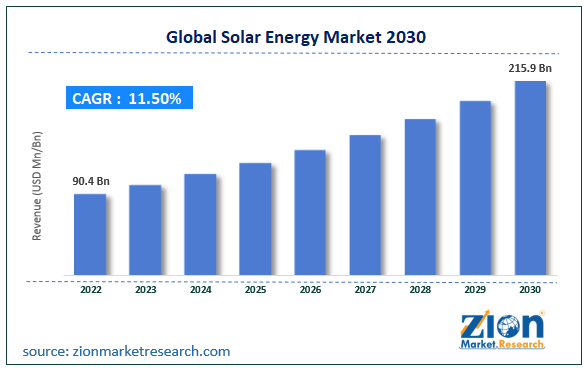

The other place the House bill cut deeply is energy. The original proposal that came out of committee phased out most tax credits starting in 2028 and fully by 2032. The final bill, however, basically ends anything to do with electric vehicles, energy efficiency and rooftop solar at the end of 2025.

Tax credits for utility scale wind, solar and energy storage would end in 2028. And projects in development would only be safe harbored by entering service by then. Advanced manufacturing facilities for solar and batteries will get full tax credits if they start selling products by the end of 2029.

Wind manufacturers, however, would get tax credits only if they’re up and running in 2027. Geothermal tax credits will now start to phase out in 2030 for projects but only if construction has begun. Nuclear will be eligible for full tax credits, but only if construction begins in 2031.

Sounds pretty severe. And on the face of it, it looks like the 21 Republican House members who signed that letter advocating keeping tax credits lacked the courage of their convictions—including members from districts that will clearly suffer greatly.

The Solar Energy Industries Association (SEIA) cites 300 US factories being built or already in operation as at risk to closing if the House bill passes in current form. That’s $200 billion of prospective investment pulled from mostly Republican voting states.

On the other hand, the committee did vote to preserve at least most of that investment. And it seems highly likely at least some Republicans went along with the changes just to move the bill to the Senate, where reconciliation would produce something more favorable.

As I’ve pointed out here, tax credits are not the same thing as direct subsidy and cash payments. They only come out of the government’s pocket after an investment has been made, the solar facility is up and running and the awarded company is already paying taxes on the profit.

The credit cuts the tax. But the government is still collecting taxes where it wasn’t before. So if SEIA is right and $200 billion of investment gets pulled, Uncle Sam’s deficits will be bigger than if Congress leaves the credits in place.

Obviously, there are people advising Congress and the Administration who can do basic math. So we can logically infer tax credit opponents have other motivations that have nothing to do with saving the public money. But they’re no less aggressive trying to tilt the energy investment playing field as the Biden Administration was.

Sound bleak for renewable energy?—Not at all.

The reason is scarcity. When government takes action that discourages investment, less new supply gets built. That means consumers and businesses pay more. And energy companies’ profits, dividends and stock prices all rise.

Eliminating tax credits so suddenly would be the last straw for stretched small providers already hanging on by a thread. But let’s dispense right now with the idea that big US renewable energy companies will be forced to retrench.

Companies with scale like Brookfield Renewable (TSX: BEP-U/BEPC, NYSE: BEP/BEPC) and NextEra Energy (NYSE: NEE) were loud and clear during Q1 earnings calls that their growth doesn’t depend on tax credits.

The reason is demand for electricity is growing in real time at the fastest pace since at least the 1960s. And as if on cue, AES Corp (NYSE: AES) last week announced power sales contracts with total capacity of 650 megawatts to Meta Platforms (NSDQ: META).

AES’ shares were still lower last week. But the company now has 10.1 gigawatts of contracts with data center hyperscalers. Microsoft (NSDQ: MSFT) and Brookfield now consider the initial 10.5 GW under their Renewable Energy Framework Agreement as a “minimum.” And NextEra Energy is coming off its “largest solar…and battery storage origination quarter ever.”

Why so much solar? Because facilities backed with battery storage on private land can be planned, contracted, sited, permitted, procured for, built and connected in 12 to 18 months. That’s five times faster than major new natural gas generation, which has become increasingly expensive due to a shortage of turbines and skilled labor in the US. And even if the administration takes the risk of gutting current permitting, solar will still be at least 10 times faster to build than new nuclear.

And here’s another reason solar will stay popular with Big Tech and other key customers at time of growing uncertainty about inflation:

The Institute for Global Sustainability at Boston University recently analyzed data from 662 projects across 83 countries totaling roughly $1.4 trillion of investment since 1936. On average, nuclear projects experienced cost overruns of 102.5%. Solar projects were -2.2% under budget.

The tax credits passed in 2022 boosted US investment in solar and storage projects, in large part because they offset the negative impact of higher for longer interest rates. And losing the credits raises the bar on new projects.

But with rivals leaving the field, the leaders will have an easier time pushing the added costs along into contracts. And that means higher earnings, dividends and (eventually) stock prices the next four years.