Don't Play Wall Street's Game

4 Ways Q4 earnings point you to 2026 investing success.

Editor’s note: Strong companies build wealth. Financial results assess strength. Here are my four takeaways from Q4 results and guidance updates so far. Thanks for reading Dividends Roundtable!--RC

Every three months, Wall Street and investment media play a game of “expectations.”

Those “in the know” make a projection, usually for earnings per share. Stocks of companies that beat their numbers attract buyers. Those that disappoint get sold off.

If you’re serious about building wealth, you’ll do best ignoring this action. But earnings reports and guidance updates are critical information in one huge respect.

Viewed in perspective, they assess our companies’ underlying health and ability to grow. And so doing, they answer the question of whether we want to continue owning them, or to move onto something else.

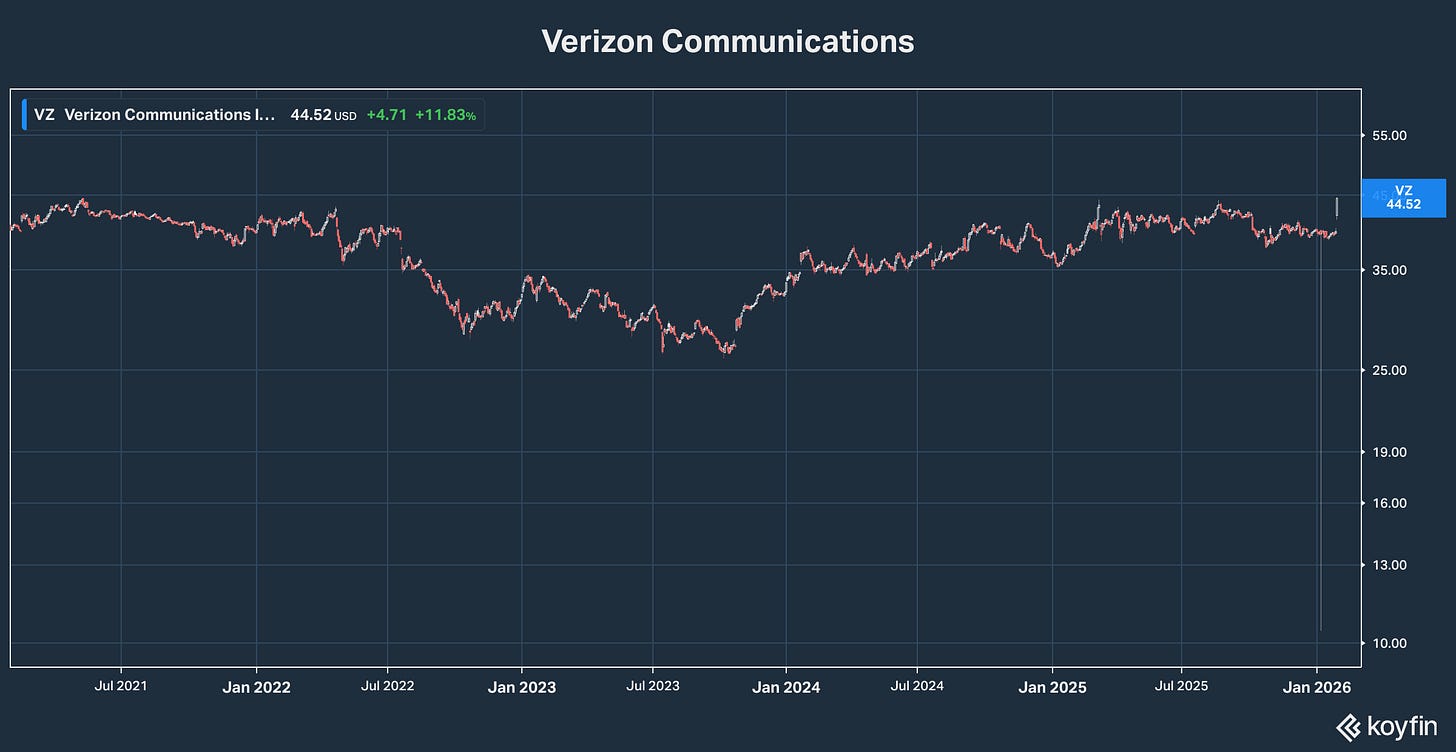

Sometimes, though not often, a “beat” of expectations illuminates strengths investors had largely overlooked. That was the case for Verizon Communications (NYSE: VZ) last week.

The self-proclaimed “turnaround story” posted 2025 earnings at the high end of expectations, on the strength of the most customer additions since 2019. And management guided to free cash flow growth of 7% and 4-5% earnings growth for 2026, versus an average rate of -1% the past five years.

Verizon had been trading for around 8 times earnings—the burden of extremely low expectations. And it’s headed for bigger gains so long as management executes. The stock at 11X earnings is still deeply discounted to rival T-Mobile US (NSDQ: TMUS) at 19X, and the S&P 500 at 29X.

Verizon is also just 0.28% of S&P 500 ETFs. That’s an historically low weighting, comparing to a combined 37% for the seven largest Big Tech stocks. And the company pays a dividend of over 6%, with a 2.5% increase on tap for March.

It won’t take much of a shift in S&P 500 weightings to provide a big lift to Verizon shares. But it’s important to realize that immediate post earnings announcement gains often erode near-term. And that could well be the case for this stock, as media narratives move onto something else.

Verizon’s market share gains are also zero sum to some extent. Many of the fiber broadband and 5G wireless customers it’s winning now came from smaller players in the communications sector, including big cable companies like Comcast Corp (NYSE: CMCSA). AT&T Inc’s (NYSE: T) customer additions reported earlier in the week came the same way. And T-Mobile will report the same with its earnings February 11.

Bottom line: The Big 3 US telecoms are consolidating market share and growing earnings while everyone else in their sector is literally shrinking. And the Q4 results we saw last week are just the latest evidence of this trend.

The gains from AT&T and Verizon last week demonstrate how quickly stocks trading at low valuations—i.e. discounts to their peers and the S&P 500—can move higher. That’s even when Big Tech leaders weaken, as they did late last week.

I expect value and dividend stocks to outperform again in 2026, as they did in 2025. In fact, they’re already off to a great start. Dividends Premium portfolio stocks returned 8% in January, virtually all capital gains. That’s against 1.5% for the S&P 500. The iShares Dividend ETF (DVY) is up 6.6%.

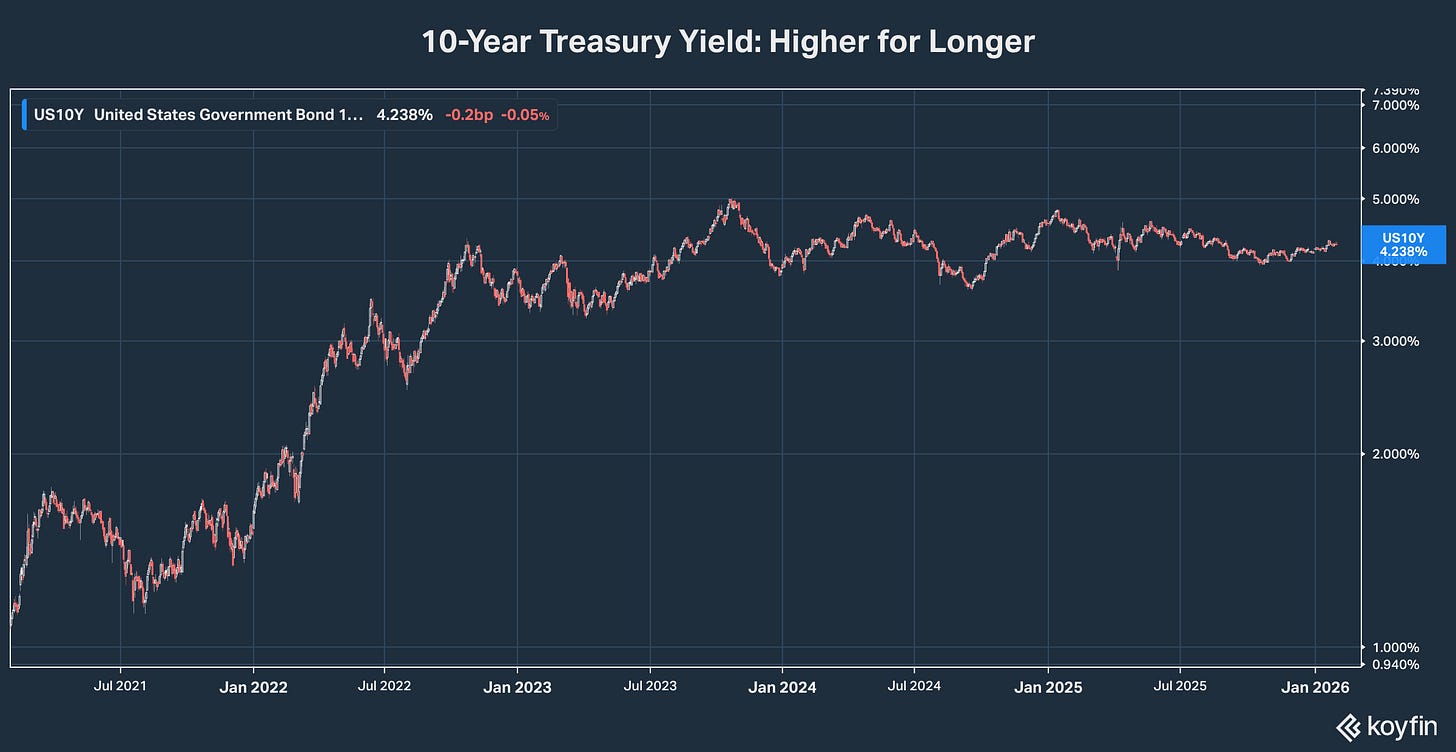

Takeaway two is Q4 results clearly show multiple sectors of the economy are facing headwinds. And that means elevated risk to dividends, particularly with borrowing costs remaining higher for longer and companies reporting increased debt interest expense.

Last week, Comcast became the latest company to announce it will not increase its dividend in 2026, as it deploys more cash to cut debt. It won’t be the last.

Other companies appear to be on track for cuts. The CEO of global chemicals producer Lyondell Bassell (NYSE: LYB) strongly hinted during the Q4 guidance call that his board will consider a dividend cut later this month, as it weathers a cyclical downturn.

Strong earnings from Prologis Inc (NYSE: PLD) testify to the REIT’s business strengths. But they also point to better times ahead for industrial and logistics real estate, as tenants adapt to supply chain disruption.

Seniors housing looks set for another solid year, with rising occupancy and rents. But results from biotech landlord Alexandria REIT (NYSE: ARE) and high-end New York City office owner SL Green (NYSE: SLG) highlight pressures still facing office REITs six years after the pandemic. And residential REITs are weighed down by temporary oversupply, despite plunging new development.

I’ll have a complete recap of how REITs fared later this month in my Dividends Premium REIT Rater. And I expect a positive year overall for the First Rate REITs, which gained 4.3% in January. The iShares REIT ETF (IYR) is up 2.5%.

But there will also be dividend casualties in this sector. Wise selection is critical. And that means exercising a little discretion whenever you spot a yield that looks too attractive to be true.

My third major takeaway from Q4 results is adapting to higher for longer interest rates is critical to stock performance—just as it was in 2025.

Banks that control credit risk, for example, will continue to profit from the gap between short-term and longer-term interest rates. But lenders with less credit worthy borrowers will see gains vanish if there are significant defaults.

Last week’s big news on the macro front was President Trump’s nomination of Kevin Warsh to be the next chairman of the Federal Reserve, when Jerome Powell’s term expires this year.

Last week, gold prices briefly shot up to nearly $5,600 an ounce—a clear sign of inflation expectations surging out of control. Then came the announcement of Warsh, historically an inflation hawk and advocate of a smaller Fed balance sheet. And the result was a sharp one-day plunge in gold to around $4,900 with the US dollar having its best day in a while.

Will inflation expectations continue to deflate? Ironically, the US Bureau of Labor Statistics reported Friday that producer prices rose 0.5% in December, a 6% annualized rate and well above Wall Street projections for a 0.2% rise. That follows a 0.3% boost in the All Urban Consumer Price Index for the month (3.6% annualized).

Excluding food and energy the CPI boost was 0.2%. But that’s still too fast to reach the Fed’s 2% target rate. And at this point, food and energy are arguably driving other prices higher, backing the central bank’s recent decision not to cut Fed Funds again, despite pressure from the Trump White House.

The single most bullish potential event for dividend paying stocks in 2026 would be a meaningful drop in corporate borrowing costs. But that’s only going to happen if inflation expectations decline sharply from here. And even assuming Warsh still acts like an inflation hawk, it could be months before that happens.

So, my final takeaway from last week’s Q4 earnings releases and guidance updates is we need to invest based on the assumption corporate borrowing costs will stay higher for longer. That means seeking out the best of the best and generally ignoring the rest.