Electric Gold: Tariffs Winner

Here are 4 reasons more important than high yield to buy utility stocks in 2025.

Happy Easter and thank you for reading Dividends with Roger Conrad!

To find out more about Dividends Premium, check out the information in this email and on the Substack application. You’ll receive the Dividends Premium Model Portfolio of top quality dividend stocks, Dividends Premium REITs featuring coverage of 83 individual real estate investment trusts and 24-7 access to the Dividends Roundtable forum, which I host on Discord. To your wealth!—RC

Bring up “utility stocks” in cocktail conversation, and odds are you’ll find yourself alone in short order.

You can trust me on that: For the past 40 years, I’ve built a steadily growing portfolio around high yielding top quality utility stocks. And I’ve literally helped thousands of individual investors do the same through my advisories.

But other than the “converted,” the vast majority of investors will always choose to talk about NVIDIA (NSDQ: NVDA) instead of NextEra Energy (NYSE: NEE).

For the past 12 years, I’ve been the chief analyst and publisher of an advisory with the word “utilities” in the title: Conrad’s Utility Investor. Before that, for 27 years, I was founding editor of my former publisher’s advisory on the sector.

I can tell you now with absolute authority that as far as marketing is concerned, the word “utilities” is a total buzz kill. In fact, my former publisher once tried to change the name of its utility advisory, backing down only after an angry response from subscribers.

The enraged were, of course, the already converted. And many of them joined me when I co-founded Capitalist Times and Conrad’s Utility Investor.

But you get the point. Utility stocks aren’t high on most investors’ priority buy lists. And that’s especially true in 2025, with so many still convinced buying Big Tech is the only way to make money in the stock market.

There’s more money right now passively invested in stocks than actively managed. And that money is mainly in S&P 500 linked ETFs, which own hardly any utilities at all: Electric utilities are barely 1.5 percent of the SPDR S&P 500 ETF (SPY). Add in “multi-utilities,” non-utility power generation, natural gas distribution and water companies and you’re still at barely 2 percent—roughly one-third the weighting of NVIDIA.

Over weighting energy stocks the past four years would have made S&P 500 ETF investors wealthier faster. Big Tech did keep the S&P 500 moving higher—at least until this year.

But quoting the prolific Bob Dylan, “the times they are a changin.” And for investors, it’s time to “admit that the waters around you have grown…(and)…you better start swimmin’ or you’ll sink like a stone.”

So far in 2025, NVIDIA has lost over one-fifth of its value. That’s roughly 25 percentage points worse performance than the S&P 500 Utilities. And 75% of the 167 utility stocks I track are actually well in the black year to date, nearly half by a double-digit percentage.

Utilities in fact have been outperforming the market’s erstwhile leaders for about 10 months, along with the energy sector and a wide range of high quality dividend paying stocks.

As always in the stock market, it took longer for the inevitable turn. And Big Tech stayed in the lead far longer than expected, even with prices completely unmoored from business value at 30, 50 even 100 times earnings.

But the Great Rotation is in progress. And it’s reason number one why investors need to build up their utility stock holdings now, especially taking advantage of those days when tariff talk or some other reason sows temporary panic.

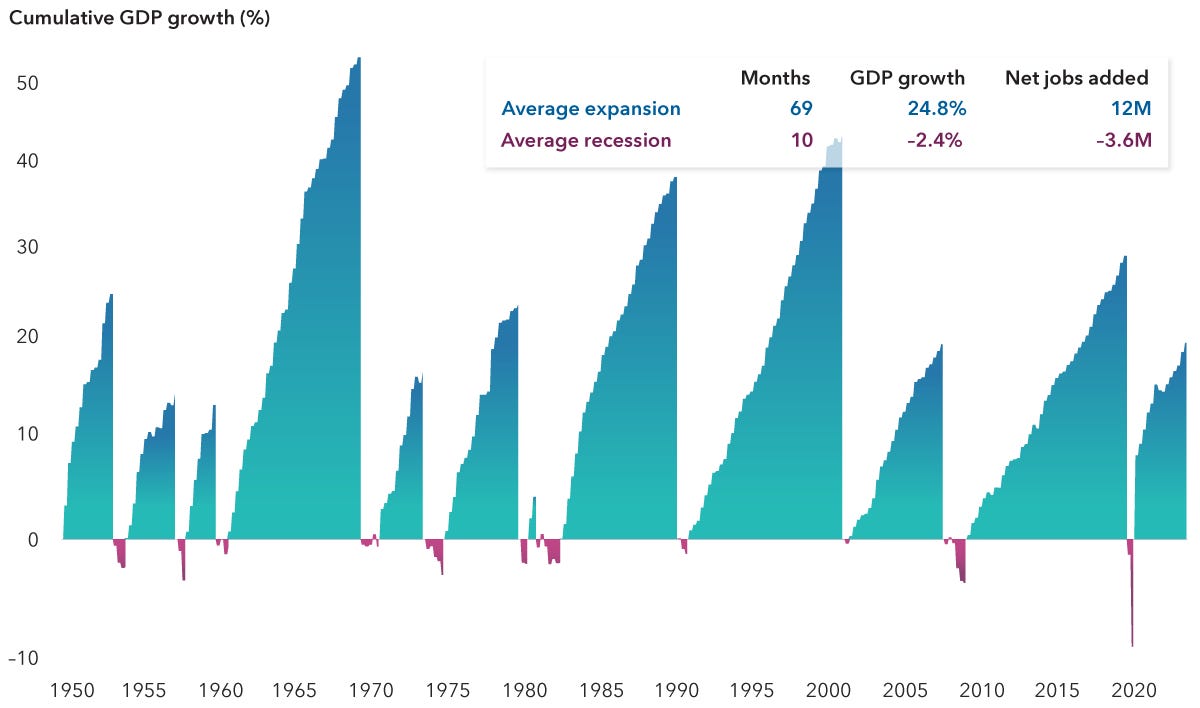

Reason two is recession resilience. No regulated US utility has gone out of business in the industry’s 125 year-plus history. That includes during the 1979 aftermath of the Three Mile Island accident, fallout from the Enron implosion of 2001 and the catastrophic wildfires sweeping Hawaii and this winter southern California. And it includes every major economic debacle as well, from the Great Depression of the 1930s, to the deep recessions of the 1970s and 80s, the 2007-09 Great Financial Crisis and the 2020 Pandemic.

Utilities hold up in hard times simply because what they sell is essential. A recession will increase unpaid bills. But electricity, gas heat and water will be among the last items distressed consumers and business will cut. And state regulators always allow utilities the flexibility to stay financially whole.

That’s why utilities’ revenue, earnings and dividends have historically been very steady during downturns. That includes 2020, when demand from commercial and industrial users dropped sharply and consumers were suddenly stretched.

If anything, utilities’ financial and operating policies now are even more conservative than they were then—following three years of higher for longer interest rates. That should keep performance steady this year come what may. And utility stocks will benefit as havens from the turmoil, as they arguably are now.

Reason three to buy utilities is interest rates are still likely to drop later this year. True, uncertainty surrounding Mr. Trump’s tariffs has forced the Federal Reserve to go slower than it would have otherwise cutting the Fed Funds rate. But inflation did drop in March. And it’s looking more and more like the primary impact of tariffs will be to slow the economy.

Utility stocks will benefit from lower interest rates as alternatives for yield to bonds and money market funds. But the bigger boost will come from stronger earnings and eventually dividend growth, as borrowing costs drop for funding record CAPEX budgets and refinancing debt.

Almost every US utility boosted its five-year investment plan earlier this year. But only a handful increased earnings growth guidance. And several actually throttled back on dividend growth.

That conservatism is prudent so long as interest rates stay higher for longer. But it won’t be needed when rates drop. And the result should be a solid boost to utility stock prices.

Reason four to buy utilities: They’re among the tiny handful of sectors that stand to actually benefit from without being really hurt by Mr. Trump’s tariffs.

Is the true purpose of tariffs to raise tax revenue? Attract manufacturing investment to the US? Pressure other countries to reduce barriers to trade? Advantage favored industries? All of the above? Something completely different?

Like all investors, I’m hoping the Trump Administration will eventually provide some clarity. But in the meantime, utilities are financially strong companies with pricing power to pass on higher costs in customer rates, including tariffs on imports. And the re-shoring of industry we’ve already seen the last eight years is pushing up sales growth—in concert with artificial intelligence related demand.

That’s four good reasons to take a hard look at utility stocks now. And oh yeah, 70 of the companies I track yield 4% or better. That’s competitive with bonds and money market funds. And there’s a kicker—almost all of them will increase their dividend at least once this year.

If I were going to buy just one utility stock right now it would be NextEra Energy—America’s largest generator of electricity from both renewable energy and natural gas, as well as the seventh largest nuclear power producer in the world.

Energy politics are perhaps even more scrambled in Washington D.C. now than trade policy. But however things shake out, NextEra’s $120 billion capital plan will continue to fuel superior earnings growth, along with dividend increases of 10% this year and next.

Even Congress scaling back wind and solar tax credits would likely boost business: Squeezing out weaker non-utility competitors unable to absorb the temporarily higher costs, even as demand continues to accelerate for the world’s cheapest sources of electricity.