Empowering Investors in Orlando

Top takeaways from this year's MoneyShow in sunny Florida.

Editor’s note: Thank you for reading Dividends Roundtable! Last week, I hosted and co-hosted three live investment presentations at the Orlando MoneyShow. In this post, I’m sharing some of the highlights, as well as slides. I hope you enjoy them and will consider coming to a future gathering!—RC

There’s a time to reap and a time to sow. And it’s rarely been more important for investors to actively do both than in October 2025.

Powerful momentum swings regularly take stock investors from rags to riches and back again. Portfolios today are massively and historically over and under weighted in stocks and sectors: Just 8 Big Tech stocks are 37.2% of the S&P 500. And each of them is a higher percentage than the entire oil and gas sector all added up. Most striking: The number of investors who’ve abdicated control over their money by “going passive” is at a record, and from all reports still rising.

Bottom line: When I presented at the 2025 Orlando MoneyShow last week, it was a far different market environment than when I made my first MoneyShow appearance, back in 1989 at the Fairmont Hotel in San Francisco—when even managed mutual funds were a relatively new phenomenon.

MoneyShows have always been about empowering investors to build real, lasting wealth. The literally tens of thousands of attendees I’ve met at the hundreds of shows where I’ve presented since 1989 have come primarily for fresh ideas. Most want advice about specific stocks they own or are thinking of buying. Others just want to put a face to a name of someone whose recommendations they’ve been following.

For those of us on the other side of the podium, live MoneyShows are a unique opportunity to connect directly with those interested in our areas of expertise. And of course, we’re there to sell—in my case investment advisories like Dividends Premium, where I share my thinking, investment strategy and top recommendations for investors who value income, safety and inflation-beating capital growth.

This year, I chose to feature two top income generating stock sectors—midstream energy and utilities. Both are represented in my Dividends Premium model portfolio and are uniquely great places to invest now.

I presented twice on midstream energy with my long-time friend and colleague Elliott Gue, the last a three hour plus extensive seminar. And I highlighted utilities in an intensive workshop titled “Electric Gold.” In between, I fielded dozens of questions from interested investors on a wide range of themes and stocks.

I’ve attached the slides from my Electric Gold presentation to this post. They include information on three power stock recommendations for fresh money investment, as well as background information on sector risks and primary drivers of growth.

Utilities are also historically underweighted as a sector in the S&P 500, collectively at less than 3%. That number will rise in coming years as the premier US index reverts to the mean, fueling buying of sector stocks.

This year, the utility sector has been rocked by massive momentum-fueled divergences in performance.

Nuclear power stocks have clearly captured the public’s imagination. Shares of America’s largest nuclear producer Constellation Energy (NYSE: CEG) now sell for more than 10 times their price in early 2022, when the company was spun out of Exelon (NYSE: EXC). SMR (small modular reactor) developer Oklo Inc (NSDQ: OKLO), which sold for barely $5 a year ago is now over $160.

It’s harvest time for these stocks. In fact, today’s hyped up nuclear stocks today bear a close resemblance to “Green” energy stocks in 2021, just before they entered a four-year bear market.

There has been massive adoption of wind, solar and now energy storage since early 2021. But within a couple weeks of President Biden taking office, all that good news and more was priced in for leading green stocks. And as a result, even the most successful green companies sell for less than they did four years ago. Some of the leaders no longer exist.

Maybe things will turn out better for nuclear power stocks. But companies like Oklo are far more dependent on government contracts and subsidy to survive than, for example, is Brookfield Renewable (NYSE: BEP/BEPC), which has actual, growing earnings. And Brookfield shares today are still selling for one-quarter less than they did in early 2021.

Ironically, electricity stocks with the most renewable energy exposure offer the richest field of sector bargains now. Not surprisingly, they’ve lagged this year’s utility rally due to investor concerns about politics. And that’s despite having far more immediate earnings upside than nuclear leaders from rising power demand for artificial intelligence, industrial reshoring and electrification.

Some renewable energy stocks have moved higher this fall. They’re showing hostile Trump Administration politics are a challenge they can handle, rather than an existential threat.

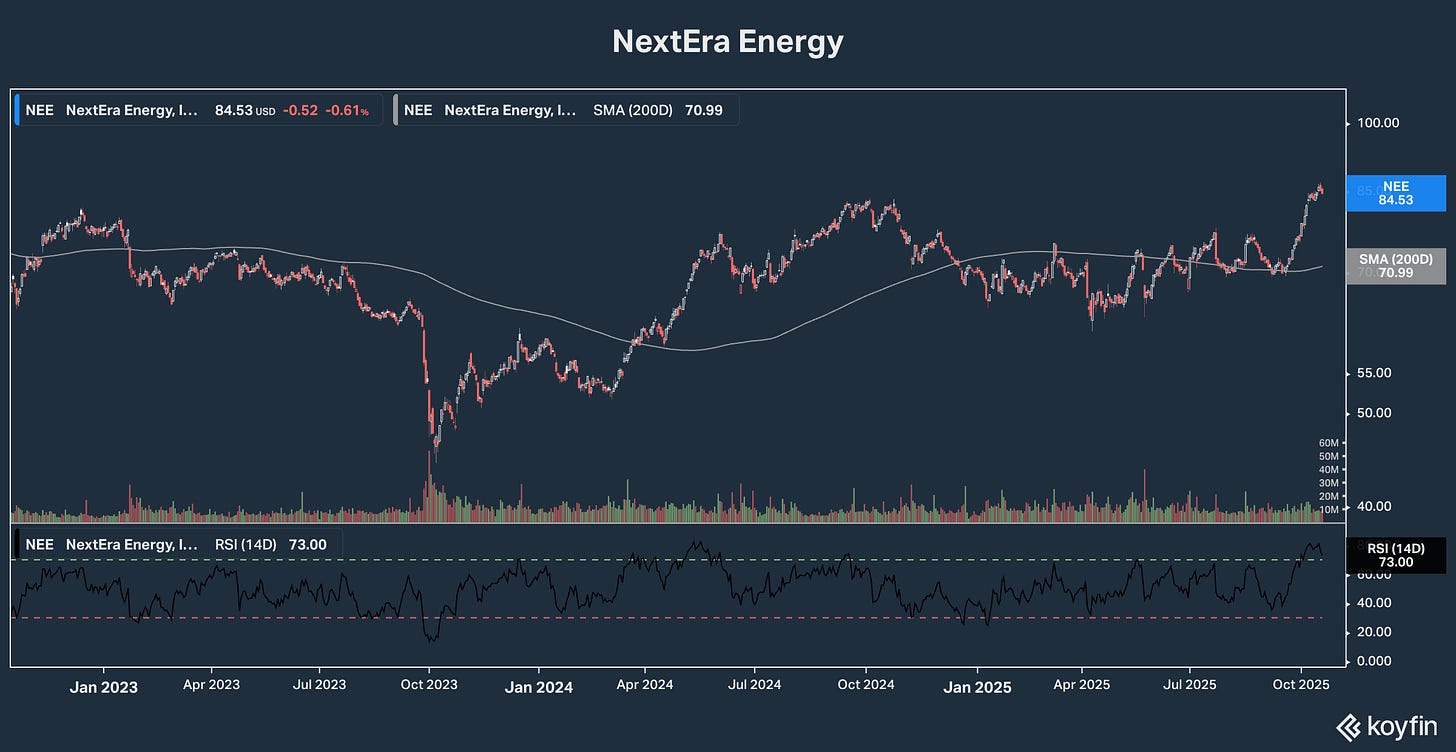

A few weeks ago, for example, I had intended to feature NextEra Energy (NYSE: NEE) at the MoneyShow. The Florida utility had lagged in 2025 mainly because it’s the leading US producer of electricity from wind, solar and storage. But in recent weeks, management indicated in a series of investor meetings that there will be no “earnings cliff” in coming years, and that it’s already putting in place the next wave of system investment.

As a result, the stock has rebounded above what I consider to be a good buy price. Instead, I featured other stocks are still strong bargains.

I still like NextEra as a long-term investment. The company is also the largest US electricity producer from natural gas. It’s the seventh largest producer of nuclear energy in the world, with an opportunity to reopen and long-term contract at least one currently shuttered reactor—the Duane Arnold facility in Iowa. And I expect the stock to get more credit for these assets as investor worries about its wind, solar and storage portfolio fade. But at this point, the stock is only a buy again on a dip.

In contrast Dominion Energy (NYSE: D), which I did feature at MoneyShow, is still cheap. And the stock is likely to get a big lift once it begins generating electricity at its 2.6 gigawatt Coastal Virginia Offshore Wind (CVOW) facility, which is now expected in March 2026.

Investor worries that the Trump Administration will challenge CVOW before it opens have prevented Dominion stock from getting credit that it’s also a leading US nuclear power company. Same with the fact it’s far and away the utility with the most upside from rising electricity demand to run artificial intelligence-enabled data centers.

I look for that to change with a vengeance as perceived CVOW risk fades. And Dominion valued for its AI leverage and nuclear generation should trade at a low to mid-70s price by early next year.

Out of favor energy midstream stocks were my other featured sector at MoneyShow. Two big reasons:

Investors can lock in safe, tax advantaged and growing annual income yields in leading companies of 9% and higher

All too many investors are treating the sector as though 2025 is 2015 all over again.

I can’t entirely blame the fear. 2015 was an ugly year for midstream stocks. And at least one Wall Street firm with a venerated name is predicting a drop in oil prices to $40 a barrel or lower.

But the industry today is a far different place than it was a decade ago. From 100 plus pipeline companies then, less than a dozen now dominate the space in North America with scale. Debt has been slashed. Contract quality has greatly improved. And leading companies only build after transportation capacity is locked up and future cash flows are assured.

Leading midstream companies would weather even an unlikely drop to $40 oil. And as investors realize there’s little risk to the 9% plus yields, stock prices are going to rise, very likely too quickly for those without positions to react.

On a closing note to this post, not everyone I talked to at the MoneyShow fully agreed with my views and recommendations. And several attendees gave me some very real food for thought, including additional companies to focus on.

But that’s what makes a genuine forum of ideas so valuable for taking charge of your wealth. And I for one am looking forward to the next event!