End Year Stock Sales: Yes or No?

When it does and doesn't make sense.

I sincerely hope all your stocks made money this year. I make no such claim for Dividends Premium.

Yes, 2025 has been extremely good for our stocks: An average year-to-date total return of over 32 percent that’s still climbing this month. But I don’t bat 1.000.

Some years, the strongest companies lag, even whole sectors. My Dividends Premium REITs recommendations are dead even for 2025, as are the largest sector ETFs. And I have a notable loser from that group, the best-in-class life sciences landlord Alexandria REIT (NYSE: ARE).

More on that one in a minute. But first, a little on Dividends Premium.

It’s a portfolio of 15 to 20 stocks I run as a taxable account and manage with three main objectives:

· Harvest a high and rising stream of income from dividends.

· Grow principal long term by building positions in companies with strong balance sheets and growing businesses, when they sell at low prices.

· Minimize volatility as much as possible, so investors can use the portfolio as a source of funds without sacrificing growth or income.

Because this has been such a good year, I’ve made sales to lock in gains. And the result is I have capital gains on which taxes will be due.

Should I sell my losers from taxable accounts by the end of December?

Yes, provided holding periods of the stocks you sell for losses match up with the stocks you sold for gains. That is winning stocks held more than one year need to be matched up with losers held a year or more.

I may want to re-enter the stock I’m selling for a loss after 30 days, to avoid the “wash rule.” And by selling I will be running the risk of having to buy back in at a higher price. But every dollar you don’t pay in capital gains taxes is one you can invest. And if a stock you sell does get away, there’s always going to be another company to buy.

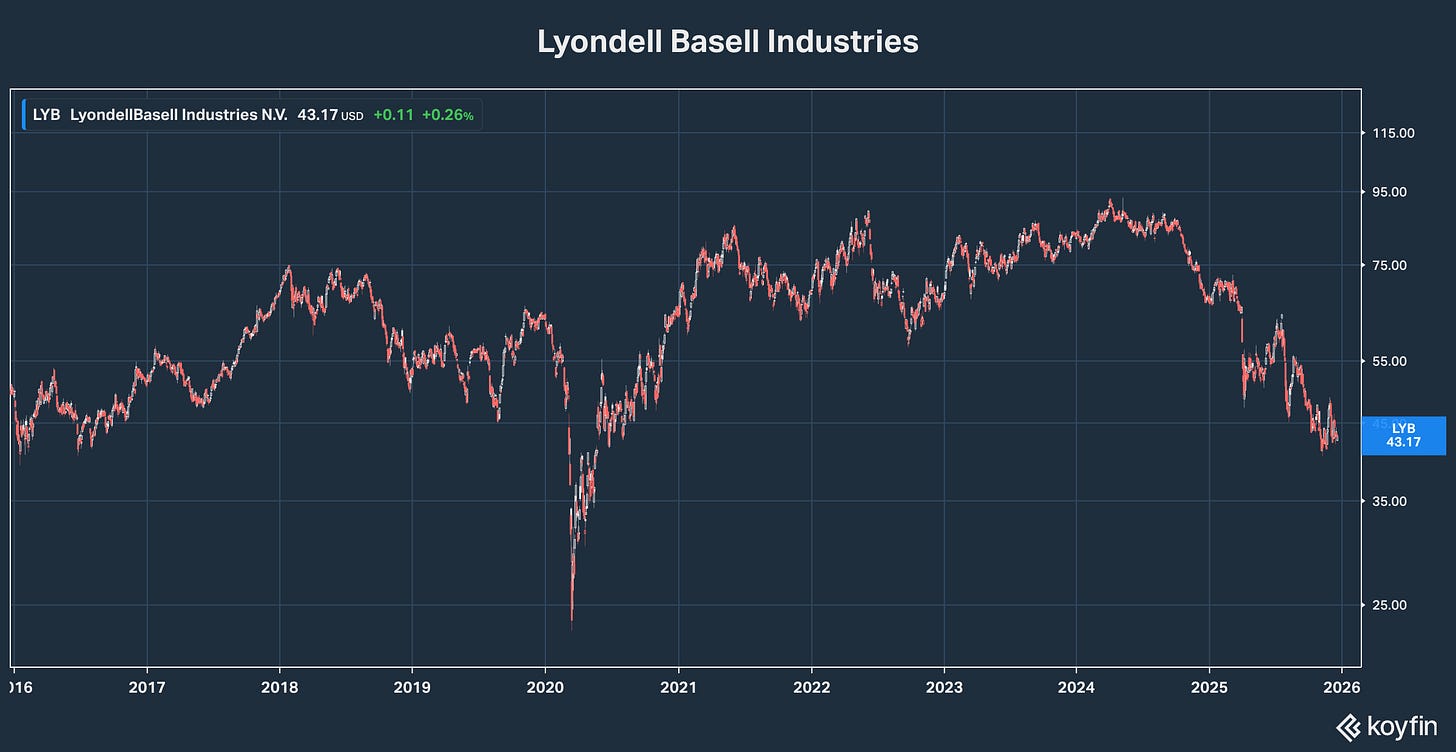

This year, I’ve covered a good chunk of the realized gains from the Dividends Premium portfolio with the sale of LyondellBasell (NYSE: LYB). The chemicals company has been dragged down this year by headwinds affecting its industry and investor concerns it will cut its dividend in 2026.

At this point, I intend to re-enter Lyondell. The stock is already priced for a dividend cut with a yield over 13%, which should limit downside if it does cut. The chemicals business cycle is at a trough due to multiple factors, including overbuilding in China. But there are signs it’s bottomed.

The company has survived the downturn with investment plans and balance sheet intact. And it’s arguably as efficient as it’s ever been after asset sales and cost cutting efforts.

Yes, there is dividend risk. But this looks like the bottom with a big recovery ahead. And the surety of shielding gains is worth the risk of not being able to re-enter at a price in the 40s next month.

Should you sell Lyondell and other underwater stocks if you hold them in an IRA or other tax deferred account?

Here the answer is a bit more complicated. Mainly, there’s no “bird in the hand” of immediate tax savings—no capital gains to shelter no matter how much trading you’ve been doing.

Rather, the decision to sell or hold on depends entirely on an honest assessment of what the stock will do next year and beyond.

Generally speaking, the end of the year is a poor time to sell stocks if you’re not doing it for tax reasons. For one thing, losing stocks tend to see a last burst of selling. And this year has been no exception.

Some of that is from tax selling, as investors book losses to offset gains. Some is “window dressing,” fund managers tossing out losing stocks to give investors a better impression of their product. Sponsors of indexes and related ETFs do it for the same reasons. And individual investors will sell losing stocks in December as part of placing bets for the New Year, or just for the emotional satisfaction.

That’s one reason so-called “Dogs of the Dow” strategies have often worked so well in January. Even following the best years, there’s always a handful of underperformers that emerge so cheap from December selling that at a bounce is inevitable. And if positive catalysts appear, gains will pick up steam the rest of the year—as they have this year for 2024 laggard CVS Inc (NYSE: CVS).

The best reason to sell losing stocks end-year—including from tax deferred accounts—is if there’s meaningful uncertainty about the health of the underlying business of the company in question. In fact, if you don’t sell, you need to be sure you’re OK with taking the risk of a deeper loss, at least temporarily.

For example, my only real loser of 41 stocks Conrad’s Utility Investor portfolios stocks this year is XPLR Infrastructure (NYSE: XIFR). I could have avoided the loss by selling and waiting until parent NextEra Energy (NYSE: NEE) announced details of a promised recovery plan in January.

I was willing to take the risk. I got burned. At this point, I believe XPLR—formerly known as NextEra Energy Partners—has set a good plan and made solid progress dealing with impending debt maturities, which at one time were a serious risk to call away assets. But if you have a stock in a similar position and aren’t willing to take the risk of a similar outcome, this is a good time to sell, whether the investment is in a taxable or tax-deferred account.

What about Alexandria REIT? Selling and taking the loss to offset capital gains is a no brainer for taxable accounts. But if there’s no tax benefit to selling—and you’re both aggressive and patient—you may want to consider hanging in.

The stock is down this year mainly because management surprised the market by cutting dividends, despite strong cash flow coverage and firmly investment grade ratings. But the REIT now has cash to cut debt and accelerate development, even at a trough for its industry. We’re almost surely closer to a bottom than a top—and a year ago this stock was more than twice its current price.