EPA Fires up Energy Inflation

New regulations, even well intentioned ones, have consequences.

Natural gas prices are less than $2 per million BTI. Oil’s well under $100 a barrel despite ongoing wars in the Middle East and Russia. And prices of solar panels and batteries are falling so fast that US government officials have traveled to China to plead for output reductions.

That’s welcome deflationary news for energy at a time when the US Federal Reserve is keeping interest rates at “higher for longer” levels—and the other central banks in America’s orbit are forced to follow suit from the European Union to Japan.

Only a handful of US utilities so far have released Q1 earnings and updated guidance. But we’re already seeing meaningful reductions in fuel costs and operating and maintenance expense.

This week, NextEra Energy’s (NYSE: NEE) Florida Power & Light utility reported a -14.8% decline in fuel costs for the first three months of 2024. It also cut operating and maintenance expense 5%. And it installed 1.64 gigawatts of new solar—as it moves to increase solar from 6% of total generation to 38% by 2033.

The sun doesn’t shine as much on CMS Energy’s (NYSE: CMS) Michigan service territory. But the company cut fuel and related costs by -1.8% and slashed its cost of gas by -35.8%. “Maintenance and other” expenses were reduced -6.7 percent, providing an earnings benefit seven times the negative impact of higher debt interest expense.

Falling costs are why US electric utilities have been able to continue record levels of investment, with a sizeable portion going to reducing CO2 emissions. CMS, for example, is on track to generate 60% of its electricity from renewable energy by 2035, and 100% by 2040. And NextEra—the leading US producer of wind and solar—expects American renewable energy to triple to a range of 375 to 450 GW within seven years.

Other utilities have similarly ambitious plans, as electricity demand surges from artificial intelligence-enabled data centers. And that’s in addition to grid hardening to combat storms and wildfires, which I highlighted in my substack article last week “Hey WSJ: Where’s Your Utility Wildfire Armageddon Story?”

All that spending is a big ask for utilities, particularly with borrowing costs three times what they were just a few years ago. But one half of the Biden Administration has been extremely supportive of the effort.

The Inflation Reduction Act at its best has leaned into what were already robust investment trends in solar and energy storage. Other agencies have dismantled duplicative regulatory barriers to speed permitting for transmission, offshore wind and even natural gas infrastructure—for when the sun doesn’t shine, the wind doesn’t blow and batteries run out of juice.

But there’s another side to the Biden Administration that makes this more of a Dr. Jekyl and Mr. Hyde story. At its root is an apparently irresistible urge to micromanage. It’s spurred by belief only direct government action will bring about desired policy outcomes. And the blunt instrument is regulation, generally well intended but that always raises costs and ultimately discourages investment.

A case in point: The four “final” rules for the electric utility industry issued last week by the US Environmental Protection Agency. The Legacy CCR Rule addresses past “contamination” from coal-fired power plants. A revamped National Emission Standards for Hazardous Air Pollutants (NESHAP) adds new requirements for discharges of “toxic metals and other pollutants” also from coal plants.

There’s a new “Greenhouse Gas Reporting Program” targeted at both coal and natural gas power plants. And there’s a new requirement to reduce GHG emissions by at least 90 percent from all coal and gas plants by 2039. Plants will have to install carbon capture and storage (CCS) at all power plants or face mandatory closure. And Bloomberg New Energy Finance estimates a 50 percent boost in these facilities’ operating costs.

The EPA calls its actions “providing regulatory certainty as the power sector makes long-term investments in the transition to a clean energy economy.” They’re by far the most stringent regulations ever imposed, and obviously a major incentive for companies to shutter coal and older natural gas plants.

It is, however, fair to ask whether these new regulations will actually result in meaningful reductions of GHGs over the next 15 years—or if they’ll just raise the cost of electricity and ultimately discourage investment.

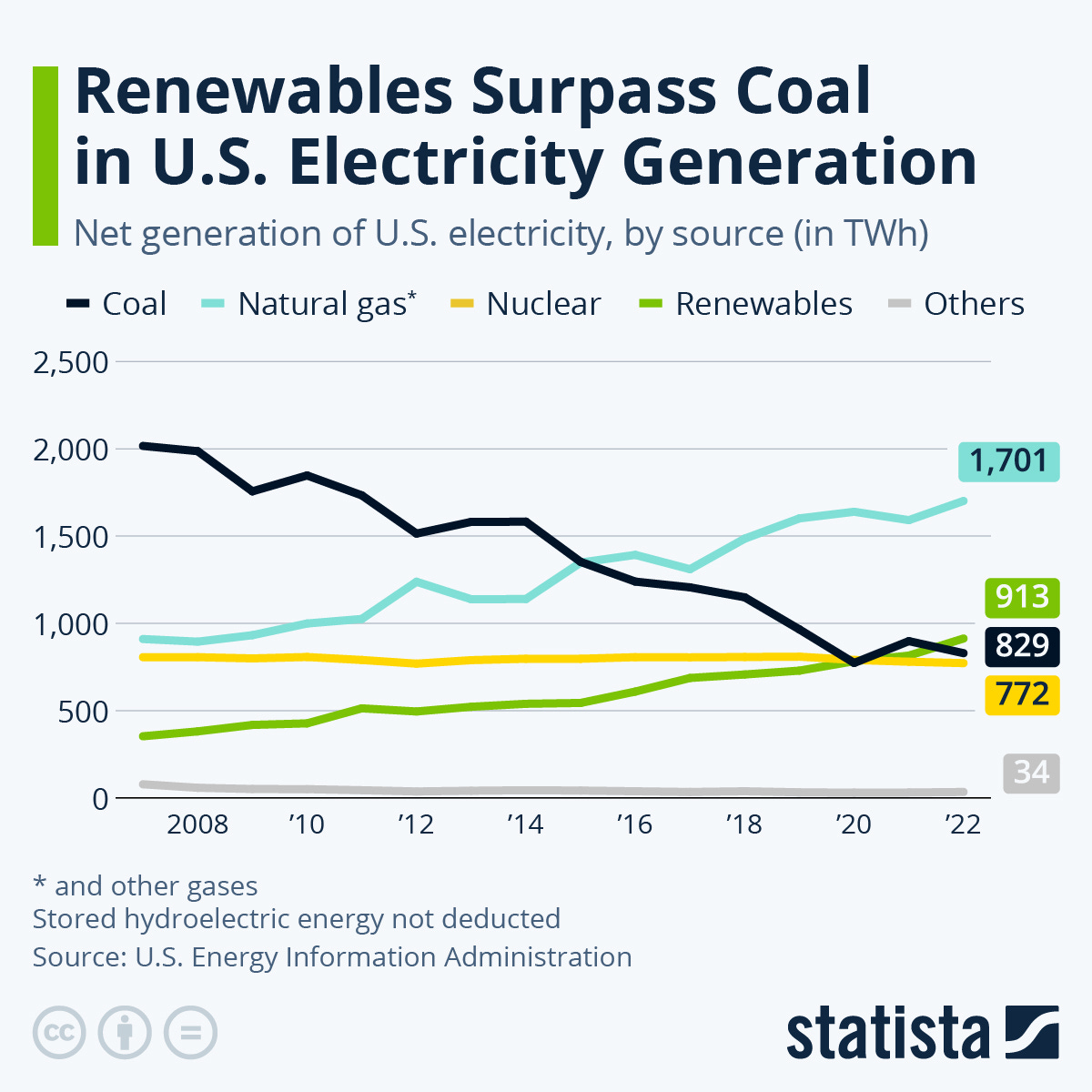

For one thing, coal use in the US was already well on the way out before these rules. Some facilities are being kept in operation a few more years to ensure grid reliability. But aging plants are no longer economic to run without subsidy. And utilities are shutting them down.

At most, the new EPA rules will accelerate what companies are already planning to do by 3 to 5 years. But doing so may destabilize the grid and spike electricity costs. Some project as much as 120 GW of coal generation will be shut by 2030, taking the black mineral’s share to just 3 percent. That’s at the same time data centers’ share of total US electricity consumption is expected to rise to 20% from 2.5% in 2022.

It’s also impossible to imagine bridging the supply gap left by coal without a quantum leap in natural gas usage the next few years. And that’s even if NextEra’s expectations pan out for a tripling of renewable energy capacity by 2030.

New gas plants emit less than half the CO2 of coal and old gas--and none of the particulate matter, toxic metals like mercury or acid rain gasses.

In fact, utilities’ big switch to them in recent years is responsible for almost all US reductions in CO2 emissions the last two decades.

EPA’s new regulations, however, put new gas squarely in the same category as coal. It’s hard to imagine that won’t cause at least some companies and regulators to second guess new build. And that will both slow CO2 emissions reductions and push costs higher: States like California are now paying premium prices to keep older gas power plants open.

Obviously, a lot can happen with technology between now and 2039. I think we’ll see development of CCS that’s economic to deploy. Batteries are becoming ever more efficient and longer lasting sources of stored energy even as prices decline, allowing the grid to absorb more renewable energy. And the cost of nuclear could drop.

But however you slice it, EPA’s new rules add another hurdle to what’s already a tough task for industry. Such is the law of unintended consequences when regulators get aggressive, rather than leave it to the private sector to get the job done.

Thanks for the explanation...just wish the rule-setters would check with you re unintended consequences prior to imposing their regulations. Wondering if these EPA rules are set in stone, regardless of which political party is in place? I understand this isn't a Q&A forum, but, trying to get an idea of how much bureaucracy, regardless of the elected political powers, will make the cited regulations untouchable for revision...Your in-depth work is appreciated.