Focus on Costs to Pick Winning Stocks

Controlling expenses may now be more important than growing revenue.

Thank you for reading Dividends with Roger Conrad!

My Dividends Premium service highlights my actively managed income and growth portfolio, featuring a low risk 5% plus yield. Dividends Premium REITs features investment advice and analysis for 83 real estate investment trusts. And you’ll have access to my Dividends Roundtable investment discussion forum, which I host 24-7 on Discord.

To find out more, follow the link attached to this email, or on the Substack application. Hope everyone is having a fun and profitable summer!—RC

Last week, Canadian energy midstream giant TC Energy (TSX: TRP, NYSE: TRP) began collecting tolls on its Southeast Gateway natural gas pipeline.

The roughly 440-mile line system is now pumping Texas gas to feed 8.5 gigawatts of Mexican power plants, either already operating or in advanced development. And TC is receiving reliable cash flow under a 30-year contract with the Mexican government-backed Commission Federal de Electricidad.

But the project’s most impressive achievement isn’t the added revenue. It’s the reduced cost:

TC completed Southeast Gateway for $3.9 billion, 13% less than its initial cost estimate. That’s at a time of elevated interest rates and inflation, made worse by uncertainty about tariffs and other trade barriers.

The Southeast Gateway project is a welcome contrast for TC from its experience building the Coastal GasLink pipeline, which came on line last year in British Columbia.

That 400-mile plus project is vital infrastructure, feeding Canada’s Pacific coast LNG export sector with extremely cheap natural gas from eastern British Columbia. But a shortage of skilled labor, challenging construction conditions amid a regional drought and regulatory delays eventually pushed up the cost north of $10 billion.

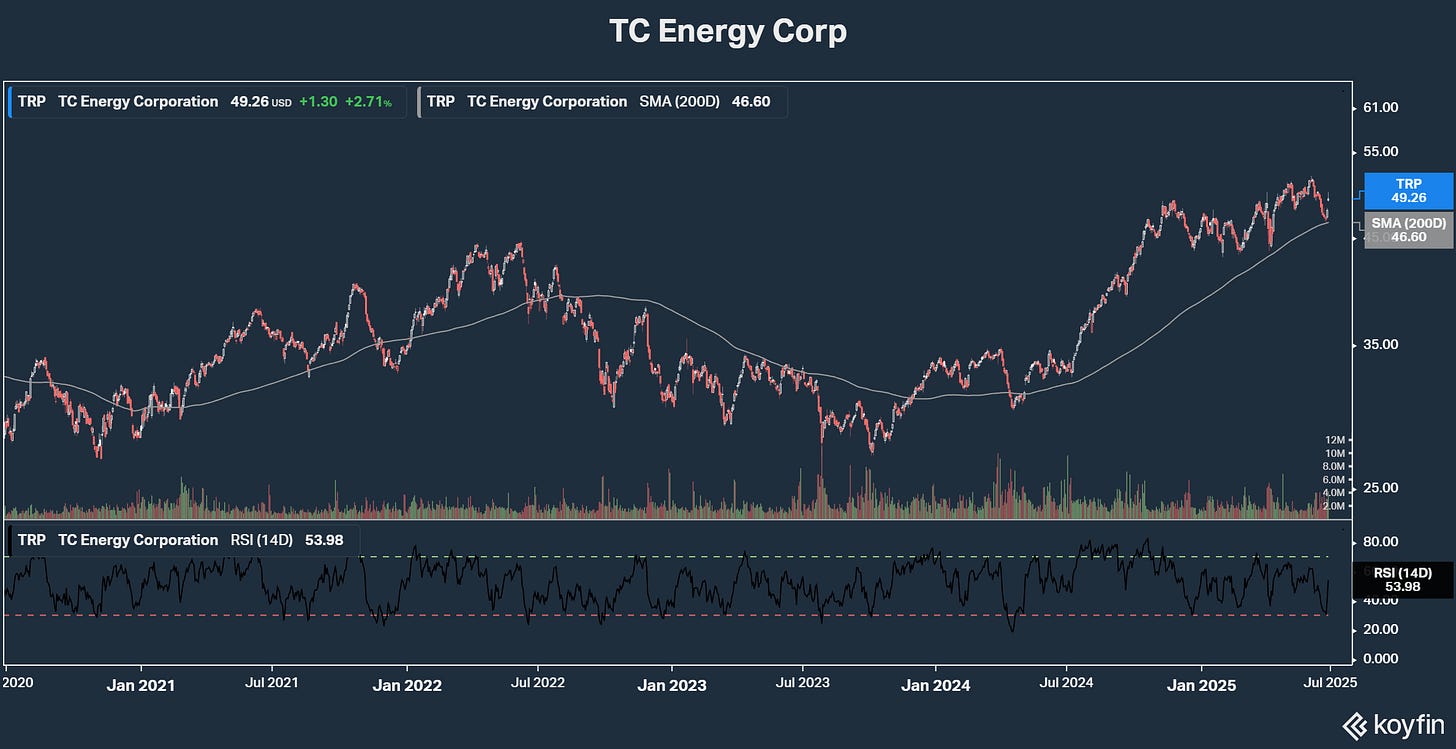

The Coastal GasLink experience is well captured in this 5-year price chart of TC stock. To its credit, the company reliably raised dividends every year. But the decline from July 2022 to January 2024 reflects how badly the project’s cost overruns temporarily undermined its reputation for operating competence.

Conversely, the key catalyst for the recovery since is management has restored that confidence. And that’s in no small part by coming in sharply under budget with Southeast Gateway.

The larger point here is companies’ ability to control costs is just as important to earnings—and thereby investor returns—as growing revenue. In fact, there are some good reasons to expect it will become far more important the next few years:

· Corporate borrowing costs are staying higher for longer.

· Inflation is still well above the Federal Reserve’s 2% target.

· Investment remains subdued in key sectors, reducing future supply relative to underlying demand.

· Labor costs are rising, especially for key functions.

· Stock buybacks are rewarded, equity issuance to fund investment is generally punished.

· Tariffs are already driving up costs and future levies are uncertain.

· Tax changes in the federal budget bill will reward some and punish others.

Balance sheet strength and pricing power are two essential strengths for companies to overcome these challenges.

In my post last week “Are Credit Ratings Over-Rated?” I highlighted investment grade credit ratings as critical to accessing affordable capital, especially should the economy weaken in coming months. But essentially, balance sheet strength means a company is able to fall back on its own resources at least temporarily, should capital markets freeze up for any reason.

A company has pricing power if it can pass on rising costs to its customers, without taking a significant hit to sales. But in practice, there are limits even for the most insulated businesses.

For example, regulated electric and gas utilities automatically pass on changes in the cost of fuel. But when Winter Storm Uri caused natural gas costs to skyrocket, the most affected companies agreed to recover the extraordinary expense only gradually. Many “securitized” the expense by issuing bonds paid off over time with a surcharge on customers’ monthly bills.

Bottom line: Even utilities operating regulated monopolies aren’t excused from keeping a sharp eye on costs. And for less protected businesses, controlling expenses is still more mission critical, even as effectively doing so becomes increasingly problematic.

The first Q2 earnings results and guidance calls will post in mid-July. By early August, we should have heard from most Dividends Premium actively managed portfolio stocks, as well as the majority of Dividends Premium REITs on my First Rate REITs list.

With just a couple days left in the quarter, there’s every indication the trends we saw in Q1 numbers and guidance have carried over. And that should be good news for our recommended stocks.

Cost trends, however, are increasingly likely to weigh on guidance for the rest of the year.

Interest expense, for example, is still rising for many companies. And the longer rates remain elevated, the more maturing debt will be refinanced at a higher cost. Companies that have been heavy users of floating rate debt will likely see the biggest increases. And that will cut right into earnings and in some cases the ability to pay dividends.

The stock market seemed to take last week’s economic news as a sign the Federal Reserve is close to cutting benchmark rates. But to date there have been few signs of that from the central bank itself.

In fact, the 12-month core Personal Consumption Expenditures Index—the Fed’s preferred inflation gauge—actually rose to 2.7% in May. And that was at the same time US Personal Income actually fell -0.4% and in advance of the impact of President Trump’s tariffs.

Neither should investors count on a threatened early replacement of Fed Chairman Powell to drive down borrowing costs. In fact, it could do precisely the opposite by triggering a big decline in the US Dollar.

The US Dollar Index is already about -12% lower against a basket of foreign currencies this year. And it’s down-15% and falling against the Euro, as Americans traveling to Europe this summer have already or will discover.

Where taxes and tariffs will wind up later this year is anybody’s guess. And even if you manage to bet correctly on policy outcomes, investment returns won’t necessarily follow.

Remember that oil and gas was the top-performing sector during the Biden administration, while green energy was among the worst. And during Trump 1, green was king while oil and gas languished.

The 50% tax on steel imports is already posing a cost challenge to any US company planning to build or upgrade infrastructure. That includes oil wells and pipelines, power plants, buildings and even new factories to manufacture steel.

So much is still unknown. So I don’t expect most of the companies I track to radically roll back investment plans at this time.

But management will be pressed to tell us how they’ll control expenses and guard against risk from further cost increases. And how they answer will be key to whether I stick with their stocks in second half 2025—or move onto something else.