Four Takeaways from Energy Earnings

Shut out the hype and focus on what industry is actually doing.

Welcome to Dividends with Roger Conrad!

One of my top goals this year is to start using artificial intelligence to leverage what I do. I’m on vacation this week. So rather than sitting at a computer, I figured, why not sit out here this evening looking out at this beautiful river in southeastern Virginia and give the Fireflies application a try? I hope you like the article.

Click this link to listen to the full audio and/or read the transcript. If you prefer to just read, this article is adapted from the recording:

This week's topic is energy. I’ve just finished working on an advisory that I’ve been part of for 12 years called Energy and Income Advisor.

The task was to look at Q2 earnings—operating results for all these companies—as well as the guidance that management sets out regarding where they think the company is going to wind up by the end of the year. And I've come away with four top takeaways. I'm sharing them with you now in the same format more or less that I recorded them, with a little help from AI to edit.

As always, to find out more about Dividends Premium, see the link in this email and on the Substack application.—RC

The Problem: Energy Politics

Energy has become extremely political. It’s been heading that way for at least the last five, six, eight years. Up until the latter Obama administration, when you looked at something the Energy Department said or wrote up, it was God awful boring, which means that it was very fact dense and opinion light. I miss those days. I miss the days when people talked about energy more dispassionately.

Right now, you look at a forum like X and it’s just all advocacy. Everyone has their own axe to grind. Even the Energy Department now has got its own opinion out there, focusing on facts that back up its case and ignoring everything else.

Unfortunately that’s not the way it works in energy. The energy world is governed by things like physics, economics in a very big way. It’s just very distressing to see how so much of this so called debate really does not even involve people that are actually in the industry, the people whose job it is to decide what is the most economic way to produce energy.

America needs abundant energy. We have tremendous needs that continue to grow, particularly electricity. If you look back the last hundred years since electricity became ubiquitous, human longevity has expanded two and threefold in many parts of the world. So it’s unequivocally a good thing that we have energy abundance. But we need not just abundant and cheap energy. We need effective energy. Energy that is sustainable, that requires as few inputs as possible for maximum output, that doesn’t pollute the water and the air.

Partisan politics isn't the way to achieve it. And you won't have investment success in energy unless you look at the facts on the ground, and ignore the hype that's unfortunately all around us.

Why Company Data Matters More Than Government Statistics

Let's get one thing straight. You won't get a clear picture of what's going on if you listen to somebody BS about their favorite energy source. The only important question is what are the best energy projects and how can we invest in them? That’s what it’s all about. There’s no bad source of energy. There are bad projects though. And there are no absolutely infallible perfect sources of energy either. But there are some sources of energy that work better with certain projects and in certain parts of the country or parts of the world.

For investors, it's really about figuring out where the best projects are and who owns them. Those are the companies you want to invest in.

You look at all this survey data, a lot of people like to look at industries and sectors from 30,000 feet up. The big stats. Got news for you folks. These are compiled by survey data. What you’re going to get is just a lot of information that is frequently revised.

Even in eras where energy was a less partisan issue, US Energy Department Energy Information Administration numbers are wildly revised. The projections rarely if ever were truly useful. Remember all those offshore wind facilities that were going to be built by 2030? Just five of them actually made it to the development stage. Those 110 mega coal-fired power plants everyone talked about in the 2000s? Just two of them are running now. I

But you can hang your hat on the information that companies are going to provide you as what's actually happening. Information is not perfect and we do have to sometimes use a smell test when we ferret through it. But that is where the rubber meets the road.

So what are the takeaways from Q2 results and guidance updates for energy companies?

Takeaway #1: Investors Basically Ignored What Companies Actually Reported

This time around, investors, to a large extent, ignored what companies actually reported.

A number of companies increased their guidance, which is a very positive thing. It indicates that business is going better than management thought it would initially at the beginning of the year. So that happened quite a bit throughout the industry. Energy prices have been weak all year, but companies were actually doing the kinds of things that they said they were going to do. So that’s a very positive thing for us as investors.

But investors kind of ignored all that. That’s not uncommon in the energy sector, commodity prices are very important. That’s what a lot of people just pay exclusive attention to.

And people were paying a lot more attention to the fact that oil and gas prices have been coming down, that oil’s below $70 a barrel, that natural gas has actually come down below $3 per thousand cubic feet. Those have been kind of benchmark figures. Coming below that has created a lot of investor bearishness.

Why is that important? Prices have been weak. So that’s been a huge headwind for the business performance of energy companies. But despite that, management teams have been increasing their guidance. So there’s a little bit of cognitive dissonance there between how investors have been treating these stocks and what the companies have been reporting in the context of those same conditions. When that happens, you often see a pretty powerful recovery in the stocks. Eventually, investor sentiment is going to shift positive in the face of strong company reporting and guidance increases. And these stocks are going a lot higher.

To put this another way, companies facing these headwinds, they’ve been overcoming them. They’ve been reporting good numbers, increasing their guidance, and investors really haven’t caught on to that yet. So that’s a very big takeaway. It’s a very big reason why I think selected oil and gas stocks are a pretty good place to look right now.

Takeaway #2: Investment Is Increasing in the Energy Patch

Investment is increasing in the energy patch. Not the kind of investment maybe that the Energy Department would like to boast about or the administration would like to have. We don’t have a national oil company. So just because the federal government says produce more oil and gas doesn’t mean it’s going to happen.

Private land is where the action is and the federal government can’t just wave a wand and say, hey, we’re going to have more oil and gas production. The way that it works is that the companies that are producing oil and gas have to see price signals that make it worth their while. Otherwise we’re going to see continuation of free cash flow strategies. That’s pretty much where the oil and gas industry is right now, passing along additional cash flow to shareholders as dividends and stock buybacks—as well as continuing to cut debt.

But there is now considerable investment going into what I would call production and development. Those are investments that actually lower cost per barrel of production and particularly cash costs. So that’s been really the thrust of investment in the sector, not producing for its own sake. Energy companies are investing more so they can bring their costs down so they can be more competitive, generate higher free cash flow at lower energy prices. No one’s betting on higher energy prices at this time. We think energy prices are likely to rise for that reason alone.

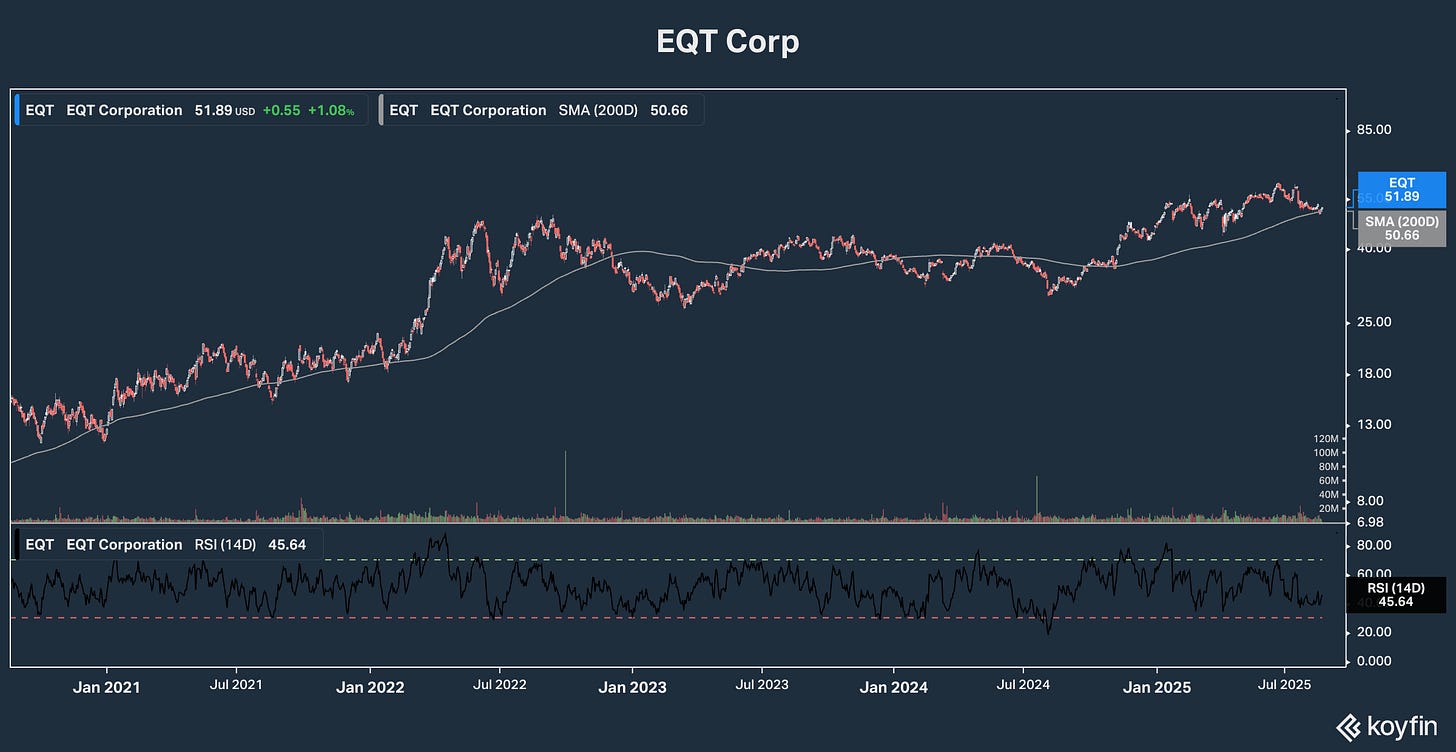

A number of the companies that we track in Energy and Income Advisor, companies like EOG Resources (NYSE: EOG), companies like EQT Corporation (NYSE: EQT) big producers, they’ve managed the feat of increasing their guidance for production and simultaneously decreasing their cost, including their capital spending on more development. That’s really the hat trick for oil and gas producers.

Take Permian Resources, for example—5 of the 10 wells it drilled in the second quarter were the cheapest wells it’s drilled in its entire time in business. That’s what you want to see in these companies. By the way, that's what’s called shale discipline. North American producers are bringing down their costs and they’re really proofing themselves against even lower energy prices going forward. They’re increasing balance sheet strength. They’re just becoming more powerful companies and better investments.

Takeaway #3: Debt Reduction Remains a Major Priority

Debt reduction remains a major priority and particularly in the North American shale area. That to me is very positive. It means that companies are financing what they do with less risk.

Another key point here is there were a lot more US energy companies 10 years ago than there are today. We’ve seen a tremendous consolidation. A lot of that was forced consolidation by the fact of debt. It’s a different case today. There are far fewer companies that matter in North American shale that really have significant operations. As a result it’s just a lot more rational of a market and there’s shale discipline in place and that means debt reduction.

In an environment where interest rates have been higher for longer, borrowing costs have been higher for longer. That impetus over the past decade to use free cash flow to cut debt is still there and you’re still seeing some tremendous reductions taking place.

We think we have a long way to run with this thing. Every time we see companies investing to cut costs and reduce debt, investors not really paying much attention to either. These are unmistakable signs that we’re still fairly early in the cycle and that it’s a good time to buy.

Takeaway #4: Companies Aren’t Taking Risks That Would Get Them in Trouble

Despite the dramatic reduction in regulation on oil and gas, despite basically the Energy Department becoming a cheerleader for coal and oil and gas, companies aren’t taking the kinds of risks that would get them in trouble when inevitably there will be a shift in the political winds.

Energy is such a big politicized subject right now. I think there’s a very good chance that the next government that comes in is going to be very anti fossil fuels. And the Trump administration is basically writing them a playbook to do it with its war on wind and solar.

The good thing here for investors is that these companies, good best in class oil and gas companies up and down the value chain, aren’t taking the bait. They’re not jumping in to try to ram a pipeline through states where the citizens don’t want it. They are focusing on projects in energy friendly states where there’s a very high likelihood of getting assets built fast so the payoff starts quickly. Places like Texas, Louisiana, where there’s all this LNG infrastructure being built, that’s a no brainer.

Oil and gas companies, if they want to remain relevant, they have got to think in terms of decades like ExxonMobil, like Chevron does. Those companies didn’t get where they are by just thinking from quarter to quarter. What I saw in guidance and the reports is that’s exactly what companies are doing.

They are not sticking their necks out there to get chopped off the next time there’s a political change. That’s extremely positive in my view.

The Bottom Line

The general thrust is that things are very positive for the oil and gas group. The only thing that’s not really is investor sentiment, which is being driven by where oil and gas prices are right now.

I think it makes a great opportunity right now to buy. Not just any energy company,—there are many out there that still carry a lot of debt. And that's still really not a good place to be. So you want to be selective. But this is a great time to buy the best in class.

I’ve named a few for you in the substack today. If you’re interested in more, check out Energy and Income Advisor.com. Thanks for reading.