Gold’s Picking Up Good Vibrations

Chaos and the commodity cycle means big profits ahead for the yellow metal and selected mining stocks.

Rest in peace musical genius Brian Wilson. And thanks so much to everyone for subscribing to Dividends with Roger Conrad!

Last week, I sent everyone a preview of my Dividends Premium service for June. If you’re interested in checking out the whole thing—including 19 top quality income building stocks and ETFs—please follow the link attached to this email, or on the Substack application.

Dividends Premium members can look for the June Dividends Premium REITs in about 10 days. In the meantime, please join me at my Dividends Roundtable investment discussion forum, which I host 24-7 on Discord. Here’s to a profitable summer!—RC

The S&P 500 is roughly flat since last November’s election. But the price of an ounce of gold is up by more than $650 (24%) since my October 20, 2024 Substack post “The Ecstasy of Gold.”

You can read it now on the “Dividends with Roger Conrad” main page on the Substack app. But to briefly summarize, I reviewed gold’s now almost 54-year history in the post-US dollar peg era, which began with the “Nixon Shocks” of August 1971.

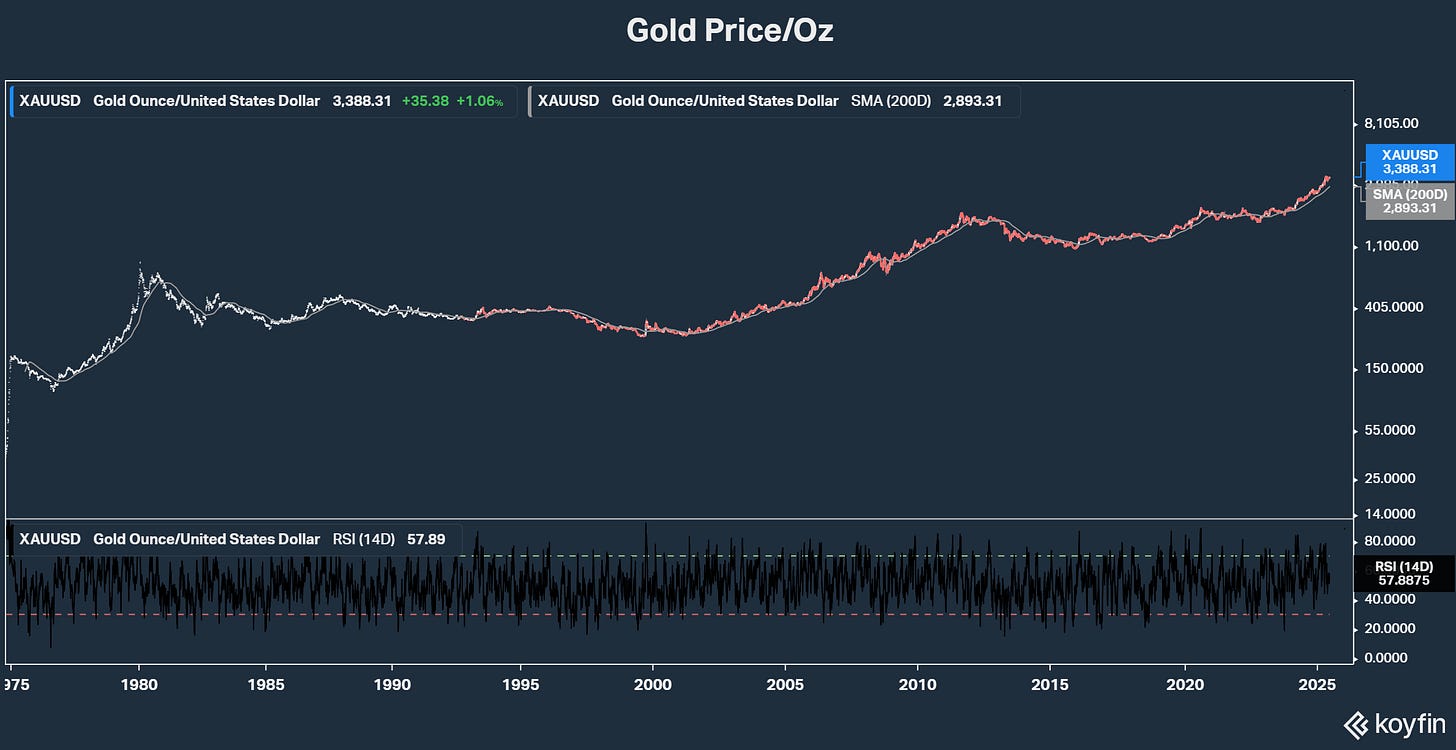

Suffice to say from the attached graph that even a small investment in gold back then would be immensely profitable by now. That’s despite considerable volatility along the way.

I also highlighted what I called “two major confidence-shaking factors” pushing gold higher in 2024. And I forecast both would drive the price up considerably more in 2025.

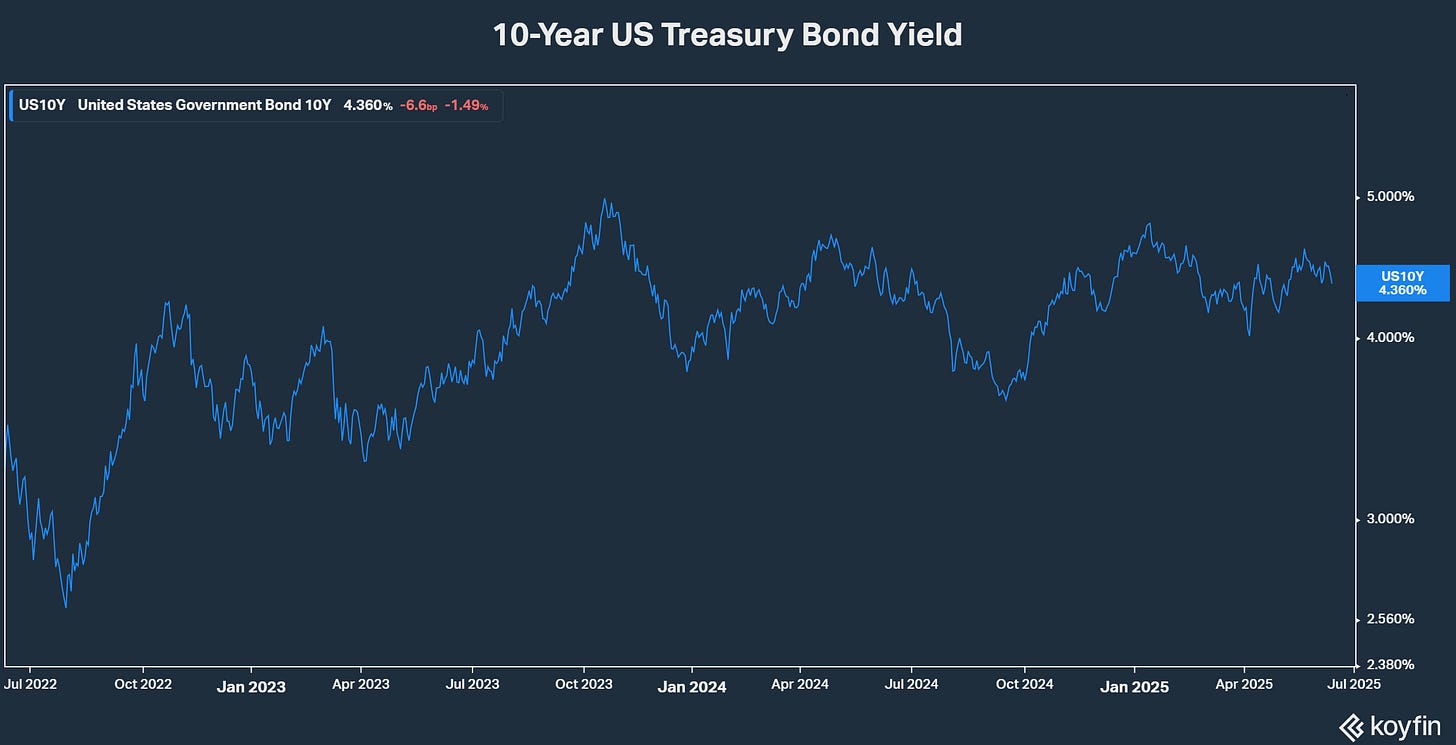

First, the Federal Reserve had pivoted from what had been two-and-a-half years of “higher for longer interest rates.” That was despite the fact that inflation is still running well above the central bank’s target rate of 2 percent.

Second, no matter who won the presidential election, tax and spend proposals would raise the federal budget deficit meaningfully from an already elevated level.

The good news since then is inflation has continued to moderate. May core Producer Price Inflation announced last week, for example, rose just 10 basis points sequentially from April.

Year over year, the core rate was up 3%, still well above the Fed’s target but actually down from April’s 3.2%. And May Consumer Price Inflation announced earlier in the week tracked similarly.

The Federal Reserve is still standing on a Fed Funds rate target range of 4.25% to 4.5%. And it still forecasts two-quarter point cuts by the end of 2025.

That’s pretty much what I expect the policymaking Federal Open Market Committee to affirm when it meets later this month. And the primary reason is still a lack of clarity on the Trump Administration’s on-again, off-again tariff policy—and especially whether it will boost inflation and/or slow the economy.

In last week’s Dividends Premium, I noted the government’s trade policy appeared to be simultaneously pursuing three objectives, reflecting the voices competing for the president’s ear.

The Wall Street contingent, including Treasury Secretary Bessent, wants tariff threats to lead to “ better” trade deals. Deficit hawks want tariff revenue to offset the projected $2.6 trillion in additional debt from the budget bill now being debated in the US Senate. And America Firsters want to speed re-shoring of manufacturing to the US.

Not surprisingly, the three objectives can work at cross-purposes. For example, the 50 percent tariff on steel imports may actually slow re-shoring by making it more costly to build here. Steel is also needed to drill for and transport new oil and gas. So absent higher energy prices, tariffs will discourage investing in new supply.

The Fed won’t act until it can answer whether tariffs do more to boost inflation or slow economic growth. But now another upside driver has emerged for gold prices: Despite the Fed not cutting rates more aggressively, the US dollar has dropped like a stone this year.

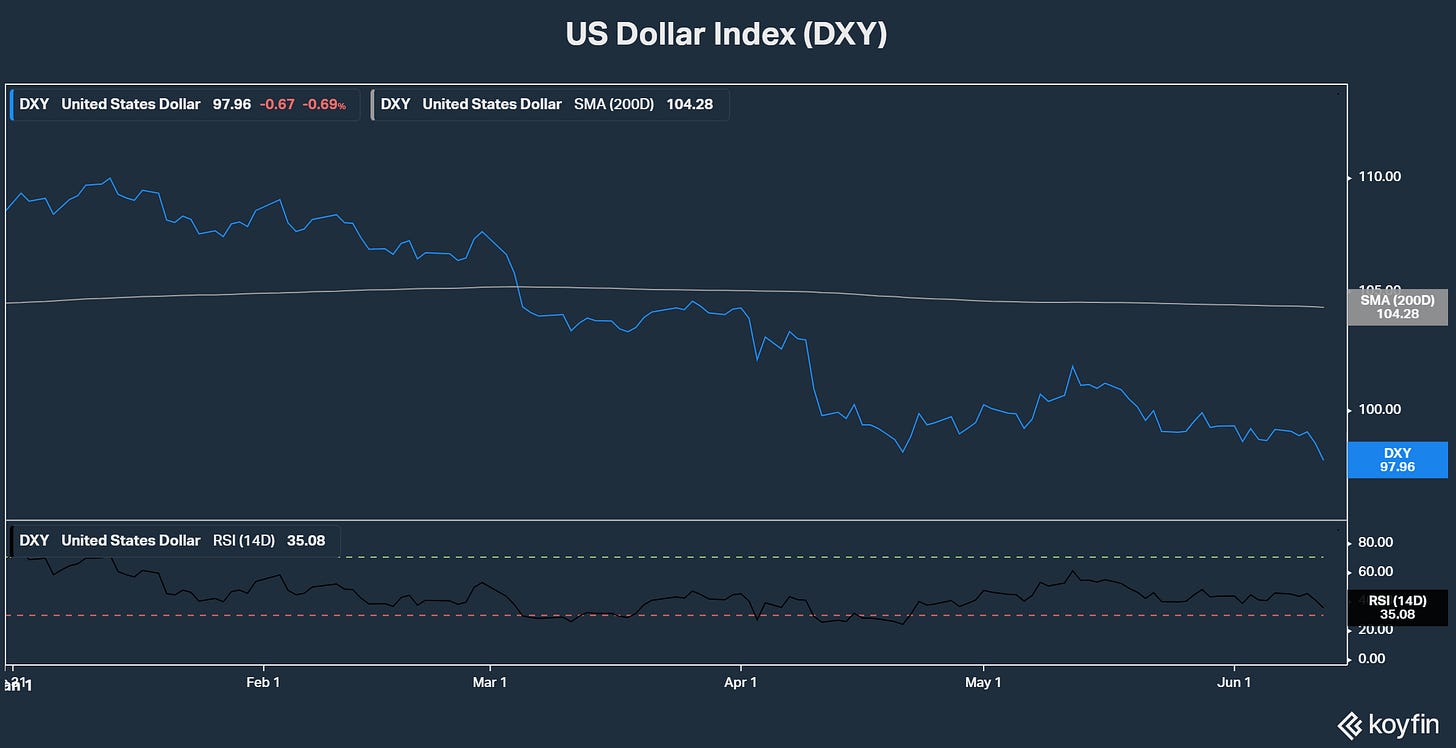

The US Dollar Index—representing the dollar’s value against a basket of currencies and shown in the graph—is down about -11% since mid-January. That includes a -12% slide against both the Euro and Mexican Peso, as well as an -18% swoon against the Brazilian Real.

Crashing currencies at a time of elevated interest rates are nothing new for emerging markets, which historically have been prone to collapses of global investor confidence. But it’s highly unusual for the U.S. And there’s little sign political uncertainty feeding the chaos will subside anytime soon—good vibrations for gold prices.

Ultimately, the most fuel for a gold rally will come from the long-term commodity up cycle. For the last decade plus, real assets have been underinvested, while stock market leaders have reached ever-more extreme valuations. Both trends are now reversing and should stay in motion for years to come.

How high can gold go? Despite roughly doubling in the last three years, the price of an ounce is still below its 1980 high of $800 adjusted for inflation—which is around $3,500. I think we’ll wind up close to $5,000 before the metal takes a serious breather—with the SPDR Gold Trust (GLD) enjoying equal gains.

And it looks like we’ve already reached the point where gains in gold mining stocks are starting to outpace the metal itself.

GLD, for example, is up roughly 29% year to date. But shares of Newmont Mining (NYSE: NEM)—the world’s leading gold miner and the company I mentioned back in October—are up more than 50%!

Newmont’s dividend policy makes it uniquely attractive for income-oriented investors. The “base” dividend is currently 25 cents a share. But the company earned record free cash flow of $1.2 billion in Q1—4.3 times the cost of that payout. That left nearly $1 billion for debt reduction and $755 million of accelerated Q1 stock buybacks.

Newmont’s current free cash flow guidance is based on a $2,500 per ounce gold price, almost $900 below current gold prices. That means higher selling prices, increased production and reduced costs will drive free cash flow to new records the rest of the year.

I won’t complain if Newmont also uses that growing windfall for more share buybacks. But there’s already plenty of cash to resume variable rate dividends. And I expect to see the stock at the century mark or better in the next 12 to 18 months.