Is Cash Trash Again in 2026?

Not if you manage it well.

Editor’s note: Thanks for reading my weekly Dividends Roundtable post! I hope everyone is enjoying the President’s Day weekend.—RC

Is cash once again trash for investors?

Just 18 months ago, the Vanguard Federal Money Market Fund (VMFXX) offered a robust current yield of 5.3%. Now my favorite cash investment is paying out just 3.64%. Rates on bank CDs and savings accounts have dropped a like amount. And the next time the Federal Reserve cuts the Fed Funds rate, cash yields will fall closer toward 3%.

At the same time, FOMO—fear of missing out—is justifiably on the rise in the stock market. The S&P 500 and related ETFs haven’t been much of a dividend staple for years yielding barely 1 percent. And the blue-chip benchmark index is having a volatile and directionless 2026 so far—finishing Friday trading slightly underwater.

High quality dividend paying stocks, however, are off to a great start after finishing 2025 strong. The the iShares Select Dividend ETF (DVY) is ahead by nearly 12 percent. And the average year-to-date gain for the 17 Dividends Premium stocks is up another percentage point since yesterday’s post (15 percent), with the portfolio at a new high-water mark.

Utility stocks have been heating up since early February. The Select Utilities Sector SPDR ETF (XLU) has a year-to-date gain of nearly 9%. And that’s in advance of its first quarterly dividend next month. Even long-suffering—and very cheap—real estate investment trusts are getting in on the act.

The 21 “First Rate REITs” I currently feature in Dividends Premium REITs are up nearly 8% in advance of their first dividends. That’s slightly better than the REIT ETF (XLRE), an extremely top-heavy ETF that yields about two percentage points less than the First Rate REITs’ 5%.

Readers can expect the next issue of Dividends Premium REITs to post Thursday. And despite their gains so far this year, now is still a good time to buy almost all of the First Rate REITs.

Stocks paying 4% or better are currently only a very small piece of the S&P 500. Even after sliding this month, the 7 Big Tech stocks are more than 35% of the blue-chip index and related ETFs. Dividends are a mere afterthought in most Americans’ portfolios and retirement accounts.

The stock market has been due some time for re-balancing. And though Big Tech finished last year at new highs, we may finally be seeing a “Great Rotation” that will catapult dividend stocks higher over the next few years.

There are also signs that company borrowing costs may finally be ready to follow short-term benchmark rates lower.

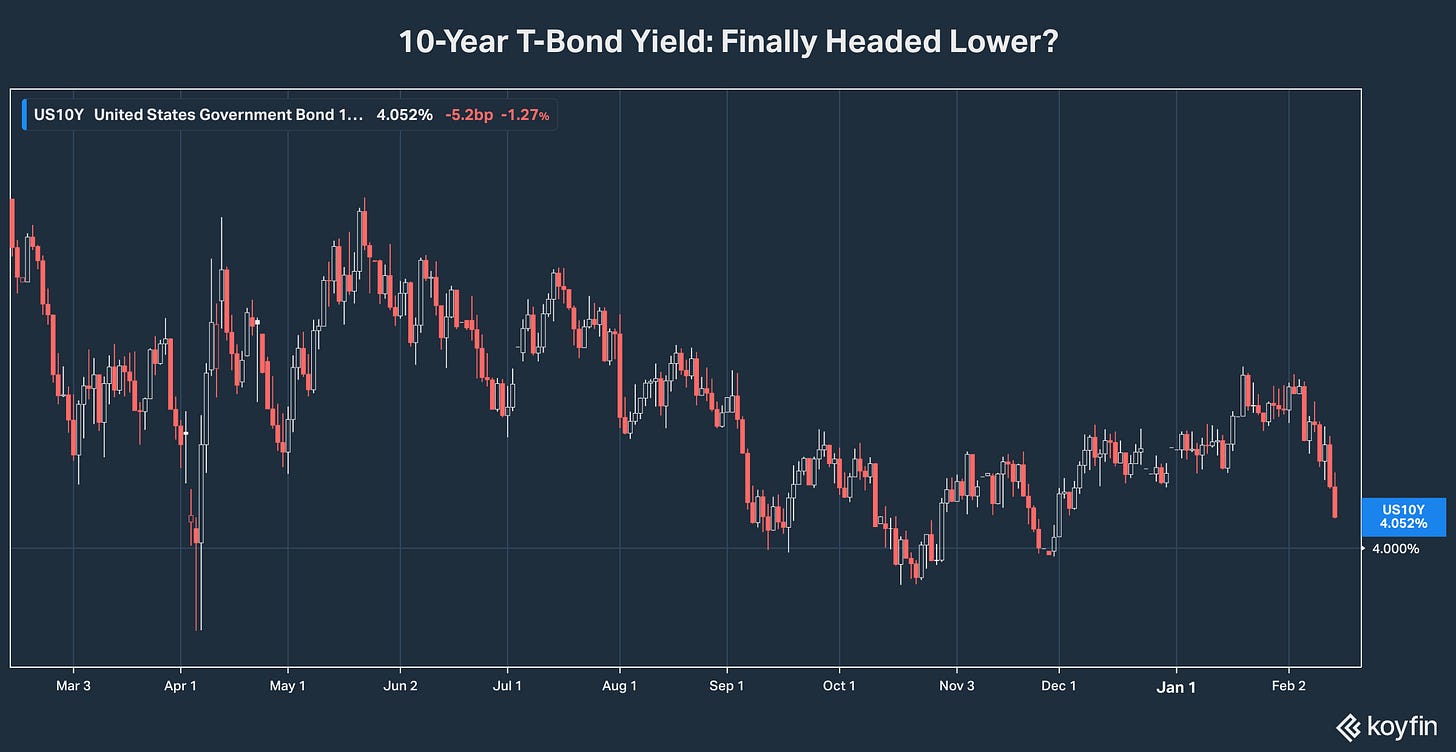

Gold’s push back over $5,000 an ounce last week is a pretty clear sign investors haven’t forgotten about inflation. But January Consumer Price inflation numbers released last week were more benign than many expected. And in response, the yield on 10-year Treasury bonds dipped to its lowest level in 2026 at just 4.05%.

If rates keep falling, dividend stocks benefit two ways. First, yields will be more attractive relative to bonds and cash. Second, debt-related pressure on earnings and dividends will decline sharply.

The surest way to make money with dividend stocks is picking companies that are healthy and growing. Reliable dividend increases will boost your income. Their underlying businesses will become more valuable, generating capital gains. And high-quality companies hold their value in bad markets, so your portfolio’s overall value will never take an unrecoverable hit.

Many stocks that were ripe for purchase last year are now what I’d call “fully priced.” Most are still worth holding. But they’re too expensive to make new purchases worthwhile. And some stocks have risen far and fast enough to merit selling a part of your position. But there are still many high-quality companies worthy of purchase, especially in sectors like REITs that have been unpopular.

Is now the time to take your low yielding cash and load up on high paying, top quality stocks? After all this discussion of stock bargains, my answer may surprise you:

Absolutely not, unless you’re dead certain you won’t need to withdraw funds for at least 2 to 3 years.

Don’t get me wrong. Anyone planning to live off their investments for any length of time should be stock-centric. But your money’s not going to grow in a straight line. There’s going to be volatility.

There are reasons to be bullish on the market this year. But there’s also good cause for caution.

That starts with investor inflation expectations that are still elevated and have kept interest rates higher for longer. Q4 earnings and guidance are still coming in. But we’ve already seen dividend increases frozen to hold in more cash.

Even companies not planning big debt-funded investments are seeing their interest costs creep up every time they refinance a maturing bond. And in more cyclical businesses where revenue is also under pressure, management teams are eying dividend cuts so they can control debt.

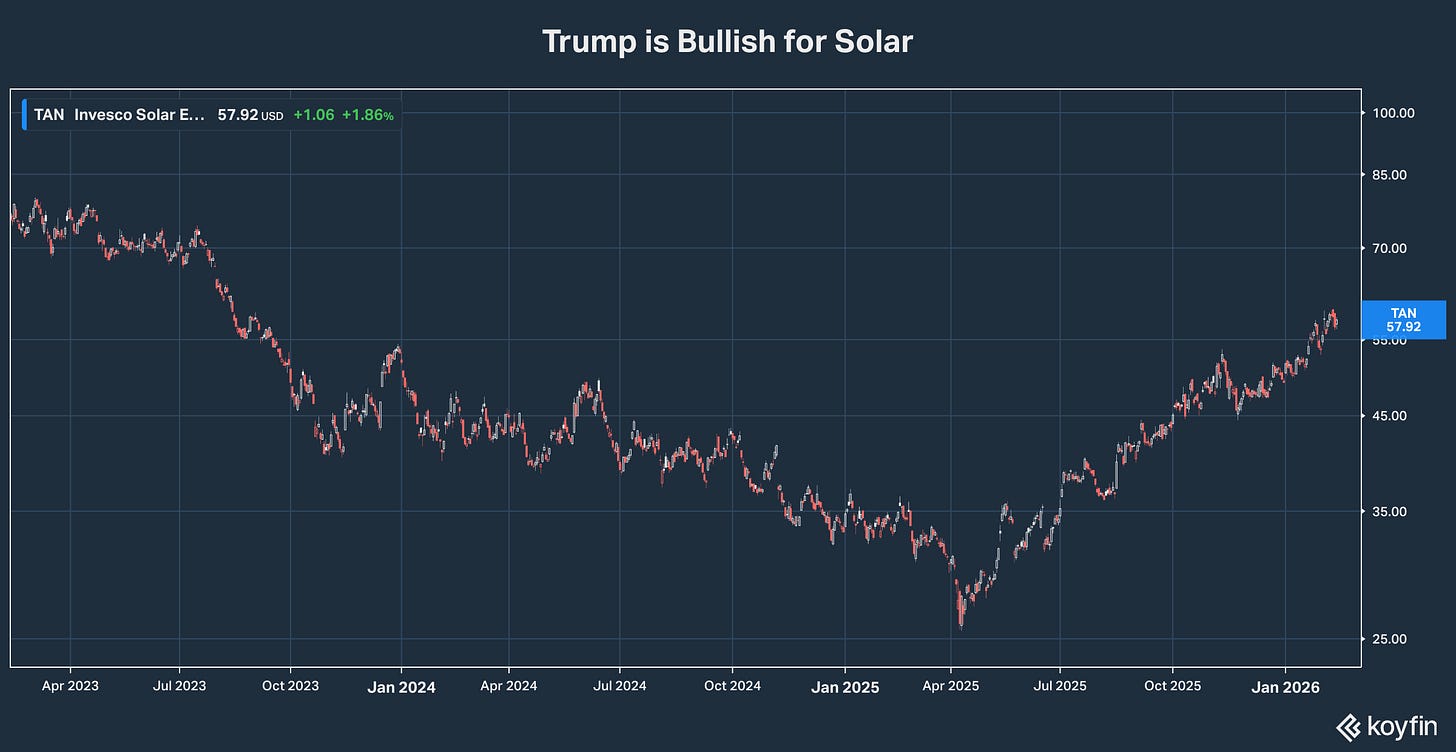

To say ongoing developments in national politics and geopolitics are posing more risk than usual may be the understatement of the year. Politics-based investment strategies are notorious for getting it wrong—the 18% year-to-date gain in the Invesco Solar ETF (TAN) on top of a double last year in the face of a deeply hostile Trump Administration being a great example. But government actions such as last April’s “Liberation Day” tariffs have caused several major market rifts in the past year.

It also seems unlikely the stock market will be able to rotate from Big Tech overweight without at least some carnage. And market history is full of examples where almost everything took on some water when the leaders suffered a big hit.

So how to cope with lower cash yields?

First, make sure you’re getting the best yield you can, without tying up your money or risking principal. I strongly advice keeping your money in reliable organizations, rather than chasing offers of higher payouts that are likely too good to be true.

I’m comfortable Vanguard with $11.6 trillion of assets under management will be able to make good on its Federal Money Market Fund—which focuses on government agency debt maturing in 90 days or less. But probably more important, the published yield of 3.64% is in line with the securities it purports to own.

Any fund or cash investment offering substantially more than that is carrying more risk. That may be because getting the yield is conditional on not being able to get at the money for a specified time, as is the case with CDs. And even a 1-year CD should not be considered a cash alternative.

Second, don’t think of your portfolio cash as static. If there’s a stock you want to own, don’t be afraid to dip into your stash. Portfolio cash is also a great source of funds if there’s an unexpected bill or need to otherwise reduce debt—which I guarantee is costing you more in interest than you’re getting in yield.

The Dividends Premium portfolio about 15% in cash now—mainly the Vanguard Federal Money Market Fund. That’s an amount I’m generally comfortable with, though I do intend to put more cash to work in stocks this year.