It's Time to Harvest Some Gains

Riding momentum indefinitely is never a winning investment strategy.

Thank you for reading Dividends with Roger Conrad. To receive these posts weekly in your mailbox, please click on the link in this email.

I hope everyone is celebrating a great Labor Day weekend with friends and family!—RC

For most investors, portfolio management is about selling losing stocks. And in a mostly uptrending market like this one, many also keep underperformers on a tight leash—stocks in the black that have lagged market and/or industry sector averages.

Moving on from companies that aren't measuring up as businesses is absolutely essential for successful long-term wealth building. In fact, it's the cornerstone of my four-part investment strategy for the Dividends Premium portfolio.

But not every underperforming stock is a sell.

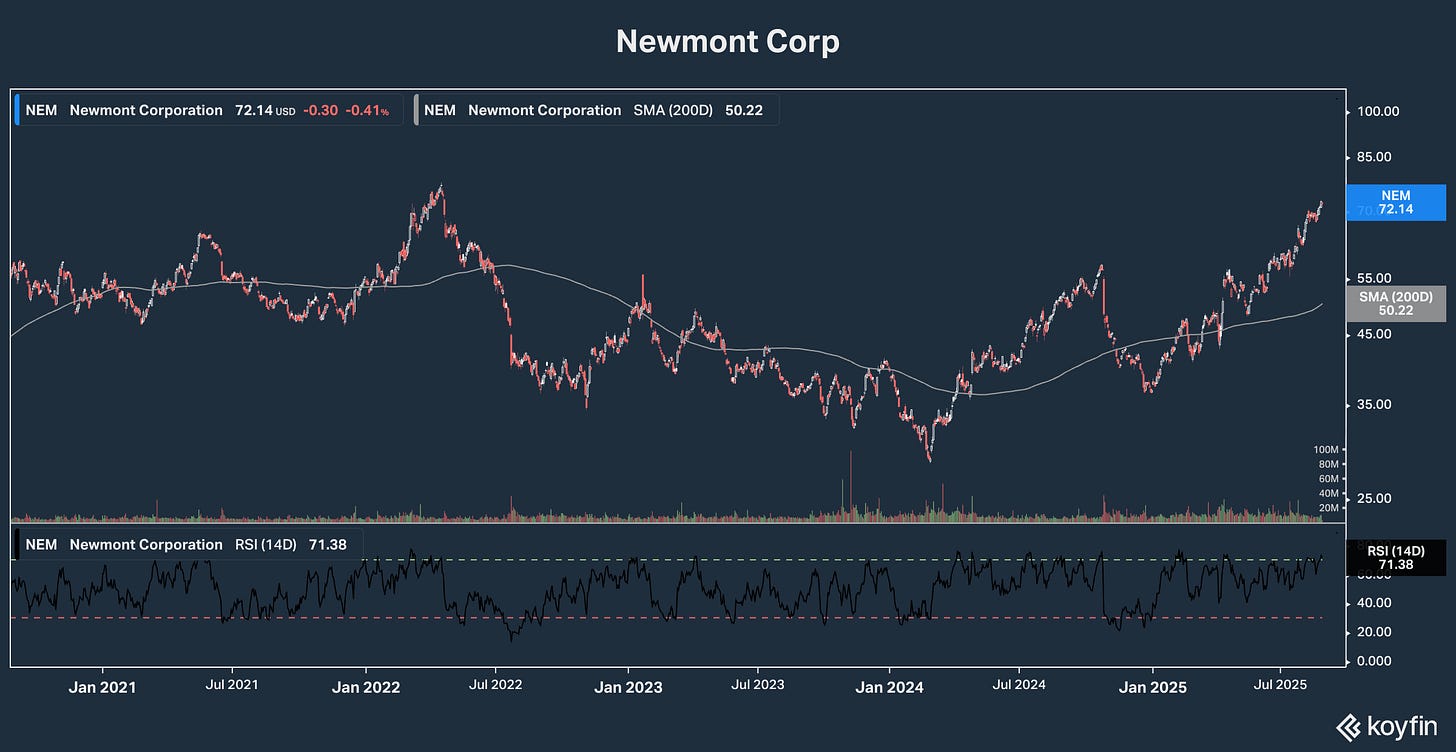

In 2024, for example, shares of leading global gold and copper miner Newmont Corp (NYSE: NEM) barely broke even. Earnings were solid but investors had little interest in gold mining stocks.

This year has been a far different story, as inflation has remained stubbornly high and worries about tariffs and concerns about Federal Reserve independence have grown. Investors who stuck with Newmont through the underperformance have doubled their money.

When a stock underperforms, I always want to know why—and the sooner the better. But it's critical to separate stock price performance from underlying business strength. When investors are negative on a company that's getting stronger, big gains will follow for patient buyers.

Conversely, just because a stock has been rising for a while doesn't mean it will continue to score gains. And unfortunately, most of us tend to pay a lot less attention to our winners than our losers. So all too often, windfall gains on temporarily over-extended stocks are never harvested. And they ultimately vanish.

I would argue portfolio risk is actually higher from your winners than your losers. That's because over time they tend to become an ever-larger piece of your overall portfolio, while losers' share shrinks.

To put this another way, when a former winner falls from grace, it takes a far bigger bite out of your brokerage account than when a loser drops by the same percentage. And in a momentum-driven stock market like this one, sentiment can literally turn on a dime. Just ask anyone who bought Tesla Inc (NSDQ: TSLA) at nearly $500 on the crest of the post-election wave in late 2024.

There are always reasons why a stock's price is rising. And sometimes they make a good case for even bigger gains.

Newmont Mining, for example, has only lately regained its first half 2022 high. Back then, it was a much smaller company, having not yet acquired the former Newcrest. Production costs were higher and output lower. And the price of its main product—gold—was barely half its current level.

In my view, Newmont is still well underpriced relative to the price of gold. The company is systematically driving costs and debt lower. And with the Fed seemingly getting ready to cut interest rates with inflation still elevated, there's a good case for the yellow metal moving even higher—which I think could eventually take the stock north of $100.

Newmont, in other words, does not appear to be a good candidate for harvesting gains at this time. Satellite television firm EchoStar (NSDQ: SATS), however, looks like a great one.

The company received a good not great price for its 5G wireless spectrum licenses in the deal announced last week with AT&T Inc (NYSE: T) for $23 billion. And management is rumored to be in talks to sell other assets, as well as revisiting a merger with privately held DirecTV.

All that good news and more, however, looks priced in with the stock trading near $60 a share. And there's reason to question whether that level will hold.

For one thing, $23 billion won't erase EchoStar debt. That's even if the company managed to zero out taxes—the price was $5 billion higher than the appraised value used to securitize the assets. The remaining satellite pay television business is shrinking fast. And while the Trump Administration has been very merger friendly so far, there's always a chance this deal comes apart.

For its part, AT&T is locking up increasingly scarce 5G spectrum that will only be more in demand in coming years. And the deal effectively closes the book on the Biden Administration's ambition to support a fourth major US wireless network. That's also a boost to the other two US Big Three—T-Mobile US (NSDQ: TMUS) and Verizon Communications (NYSE: VZ).

In my August 17 Dividends Post "It's August 2025: Do You Know Where Your Money Is?", I highlighted the Big 8 Technology stocks as candidates for partial harvesting. And because upside momentum has carried them to an unprecedented 36.3% weighting in the S&P 500, S&P ETFs are good candidates for taking money off the table as well.

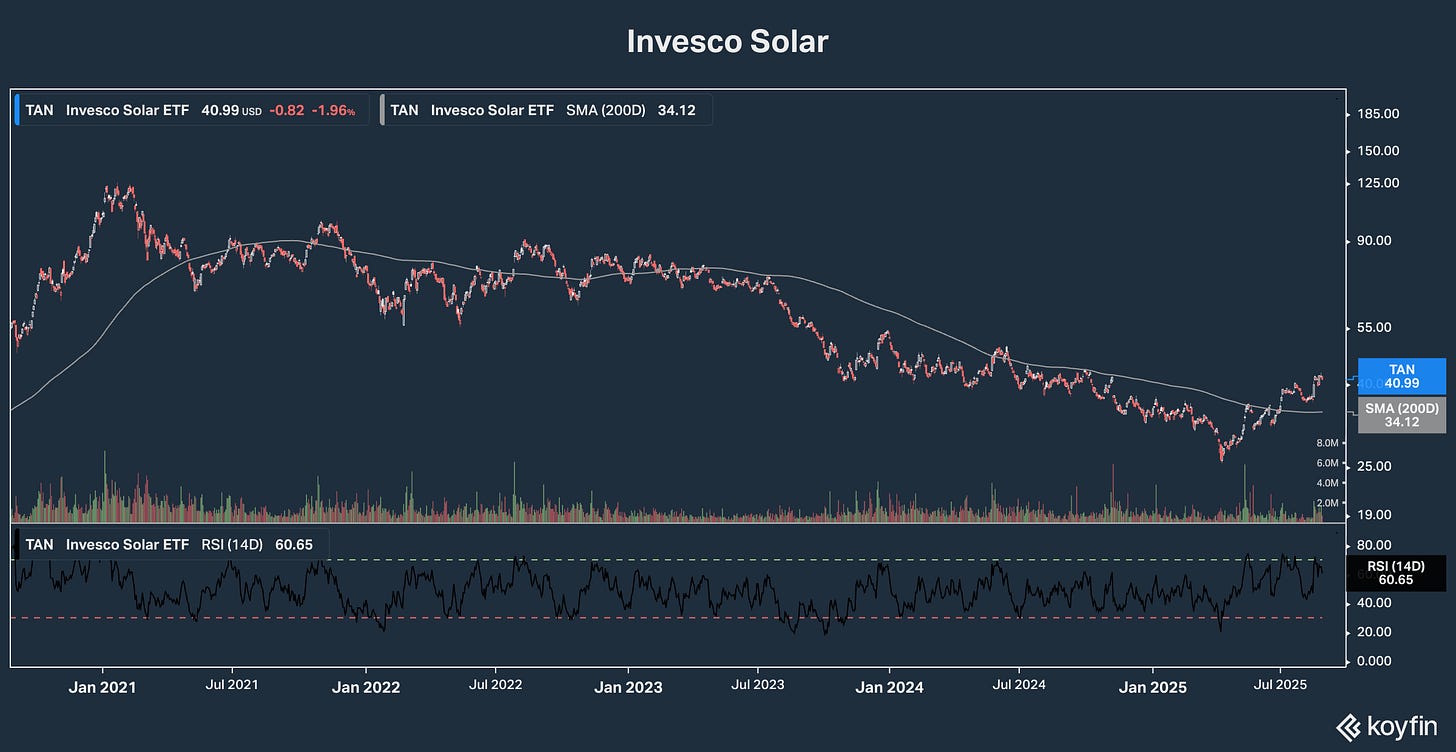

The green energy bubble of the early Biden Administration was an historic opportunity for harvesting gains. From April 2020 to February 2021, the Invesco Solar ETF (TAN) nearly quintupled. But over the next four years, it plunged by nearly two-thirds, severely punishing those who hung on for bigger gains.

Market history never really repeats. But it does often rhyme. In the early Trump 2 administration, energy sector hype is centered on nuclear power. And like the companies in the Invesco Solar ETF, the stocks benefitting are trading 100% on promise rather than actual business performance.

Most have no hope of actually earning money for years even in a best case. And no US utility or power producer is going to place an order for a new reactor—SMR (small modular reactor) or full size—until management can go to investors and regulators with a design and say credibly (1) What it will cost and (2) How long it will take to build.

Instead, any hope of an American nuclear renaissance is going to depend on the continuing flow of hundreds of billions of taxpayer dollars with no return for the foreseeable future. And that makes the now high flying nuclear stocks extremely vulnerable to giving up recent windfall gains.

That even goes for nuclear companies that are making money like Constellation Energy (NYSE: CEG). And it goes double for earnings-free fare like Oklo (NSDQ: OKLO), despite its deep political connections.

By any measure, Brookfield Renewable Corp (TSX: BEP-U/BEPC, NYSE: BEP/BEPC) has been a success story the last four years, raising dividends nearly 25%. But the stock still sells for roughly a third less than it did when the Green Bubble burst. And most of the earnings-less renewable energy winners then no longer exist.

Maybe it won't be the same for today's hyped up nuclear power companies. But anyone sitting on big gains and not doing at least a little harvesting will have only themselves to blame if the past is any way prologue.