"Liberation Day" Cancelled

What Tariffs Plan B Means for Dividends

Last week, the US Supreme Court ruled presidents can’t use the 1977 International Emergency Powers Act to impose tariffs on imports by fiat—at least not without approval from Congress.

Now the administration is on to Plan B: A new 15 percent tariff on imports from all countries, claiming authority under Section 122 of trade legislation passed in 1974. The new tax expires in 150 days. But it gives the president’s team time to target new levies on individual industries and companies for “national security” and “fair trade” concerns.

Theoretically, the Administration could also ask Congress to pass its now scrapped “Liberation Day” tariffs into law. That seems highly unlikely, with recent polls showing roughly two thirds of Americans opposed to President Trump’s tariff policies.

The Supreme Court, however, issued no real guidance for what comes next, including refunds of the tariffs it struck down. So, the executive branch will likely keep acting unilaterally, even if its actions will be struck down later.

In the interest of full disclosure, I believe the Trump/Biden trade tariffs of the past nine years are bad policy. They destabilize supply chains, increase inefficiency, raise prices and discourage investment. And at the end of the day, they hurt the industries they’re supposed to help.

But the big question is if we investors can expect anything different from the Plan B era of tariffs?

The Commerce Department reports US economic growth slowed to an anemic 1.4 percent in Q4, while the Federal Reserve’s preferred gauge of inflation rose to 3 percent in December. All else equal, refunding the $134 billion collected in Liberation Day tariffs would give the economy a boost. But with Plan B tariffs already in effect, inflation relief is unlikely. Private sector investment will remain cautious. And the federal budget deficit at best will remain close to 6 percent of GDP, considered a “crisis level” in the past.

The market reaction to Plan B tariffs has so far been benign. That’s a stark contrast to the aftermath of the Liberation Day tariffs last April, when the S&P 500 cratered nearly 20%.

Investors remember the stock market’s relatively fast recovery last year. Even businesses that appeared hard hit initially like Stanley Black & Decker (NYSE: SWK) learned to adapt. And most of the big tariffs announced were later modified lower.

Trade tariffs, however, are still having a very real impact on multiple industries. For example, there are still 50% tariffs in effect for imports of steel and copper, essential materials for construction and all things electric. We import nearly half our copper and 25% of steel. And domestic producers have raised prices to take advantage of the import tax.

Higher raw material costs may be slowing the once rapid pace of reshoring of manufacturing to the US. Electric utility American Electric Power (NYSE: AEP), for example, reported a -1.5% decline in Q4 industrial sales across its Midwest and Southwest US territory. Exelon Corp’s (NYSE: EXC) large commercial and industrial plunged -5.4% throughout its Midwest and Middle Atlantic operating region.

Even in the Southeast, Southern Company’s (NYSE: SO) Q4 industrial growth barely registered at 0.7%. And Entergy Corp (NYSE: ETR), which serves the energy sector on the US Gulf Coast, saw Q4 industrial sales growth slow to just 1.8%, a sharp deceleration from the full-year average of 6.7%.

From the utilities’ perspective, slowing industrial demand may actually be a blessing, as companies invest heavily to meet surging demand from data centers. Last week, for example, Southern Company raised its annual projections for electricity sales growth by 2 percentage points to 10% through 2030.

The catalyst: The utility’s “large load” pipeline of expected demand rose to 75 gigawatts for its Georgia, Alabama and Mississippi territory. In response, management increased five-year capital spending to $81 billion. And it raised annual earnings growth guidance to 8%, from a previous 5-7% yearly rate.

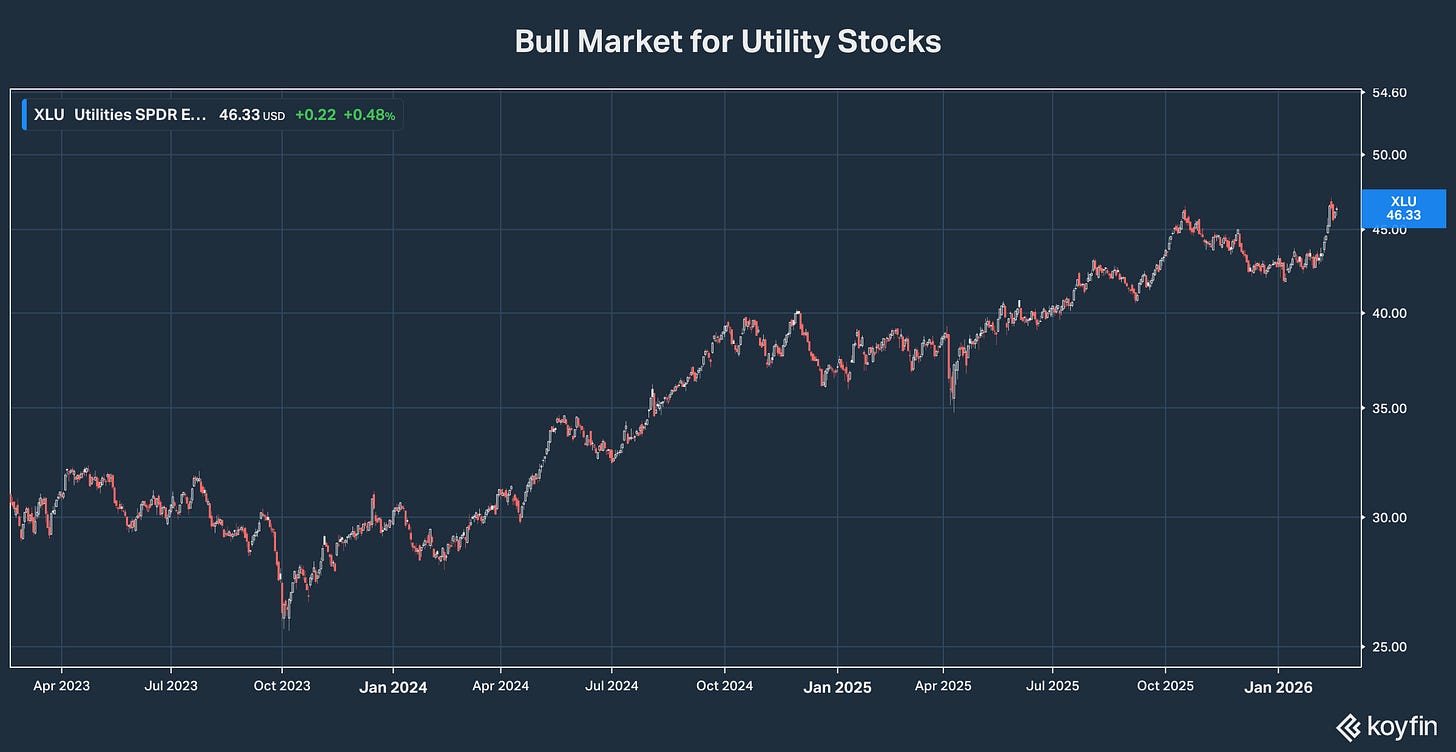

For utilities, capital investment plus regulatory approval equals earnings and dividend growth—and robust returns for income investors. In fact, the biggest challenge for the best in class stocks has become finding good entry points.

Utilities have felt tariffs’ impact. Monday morning, Dominion Energy (NYSE: D) will report Q4 results and update guidance, including progress at its Coastal Virginia Offshore Wind (CVOW) facility. And I’ll be very interested in the prospect for relief on the $400 million in Liberation Day tariffs for a critical component.

But for the most part, utilities pass on tariff related costs such as higher steel prices directly to customers, without earnings impact. That’s thanks to having investments in regulated rate base. But even unregulated power producers like Clearway Energy (NYSE: CWEN) can pass on costs because electricity demand is so robust.

That’s called pricing power. Electric companies have it. And it’s one of two key strengths needed for companies to weather this still highly uncertain global trade environment.

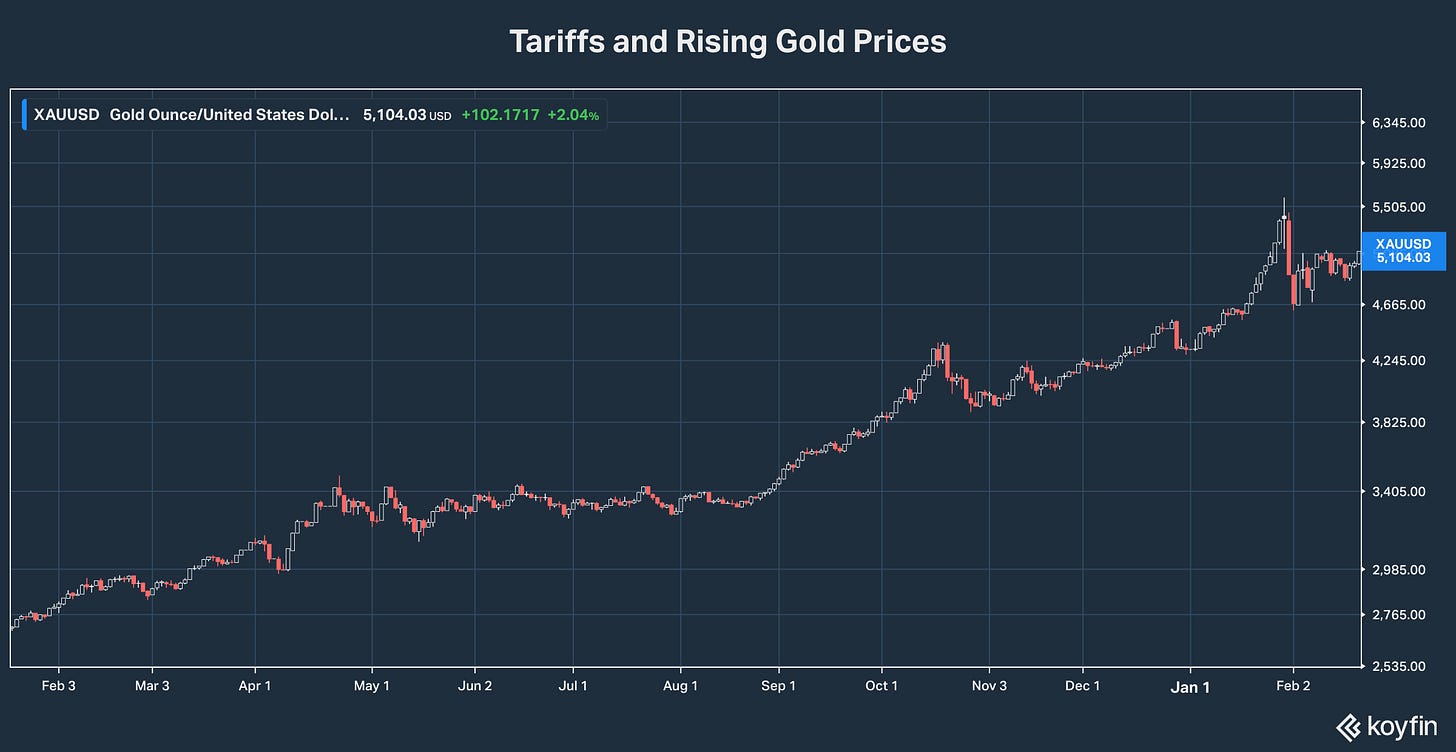

The other is balance sheet strength. Soon-to-be-outgoing Fed Chairman Jerome Powell blames tariffs as a major reason inflation stopped falling last year, and remains above the central bank’s 2% long-term target. Call that what you will. But inflation expectations are still clearly elevated with gold back over $5,100 an ounce again. And corporate America’s borrowing costs remain higher for longer.

The Wall Street consensus is uncertainty on the rules of trade will inhibit CAPEX this year, excepting Big Tech’s AI spending boom. The earnings and guidance research I highlighted for Dividends Premium REITs readers last week indicates interest rate concerns are stunting property companies’ investment plans for 2026.

Both worries would arguably be washed away if the Trump Administration abandoned tariffs as a policy. But until either they or a future government does, we need to stick with companies that have strong enough balance sheets to handle higher for longer interest rates, and can pass on tariff related costs.

In a April 2025 Dividends Roundtable post, I highlighted pricing power and strong balance sheets as essential for companies to shake off Liberation Day tariffs. Nothing’s changed with Plan B. But the good news is success means to just keep doing what we’re doing.