Natural Gas: Powering Up on AI and Still Cheap

Gas’ leverage to AI growth is an insight from Q3 results for those who won’t play the earnings expectations game.

First, I’d like to again thank our rapidly growing Dividends Community for giving us a chance to serve your investment needs. I hope you’ve found “Dividends Premium” and “Dividends Premium REITs” helpful and look forward to rolling out new features in the coming weeks. Thanks especially to our Founders Circle members (still have a few memberships left).

To find out more about Dividends Premium, please check out the upgrade options highlighted in this email, as well as in the Substack app. Thanks for reading!—RC

Q3 earnings reporting season is in full swing. And as is always the case, analysts and the many investors who follow them are mono focusing on “expectations.”

Stocks of companies that do better than the consensus expects are typically rewarded with sizeable gains. Big pharma Dividends Premium stock AbbVie Inc (NYSE: ABBV) was a prime example last week, breaking above $200 a share last week for the first time ever.

Conversely, when companies “miss” a particular number their stocks frequently take a hit, sometimes even when results are obviously strong. Shares of Dividends Premium REITs recommendation Prologis Inc (NYSE: PLD), for example, have dropped by nearly -10% since the warehouse and industrial property landlord reported 10% higher Q3 core funds from operations (FFO).

Prologis also raised its guidance range for full-year FFO per share. And its CEO declared “the supply picture is improving” with “long-term demand drivers strong. Nonetheless, the consensus was Prologis “missed” expectations. In contrast, Abbvie “beat,” despite managing only 1.7% earnings growth.

Don’t get me wrong. I like both of these companies as long-term investments, though for different reasons as Dividends Premium subscribers can explore. But the larger point is the met/miss/beat expectations game is generally meaningless for anyone with a time horizon of more than a couple days—other than it sometimes provides us a very narrow window in which to buy low and sell high.

The analysts at least have an excuse for playing. Those who build a record of forecasting the right numbers will attract more money to the mega investment firms who pay their salaries and bonuses. And while their bosses are increasingly looking for ways to automate and algorithm what they do, the rewards still trickle down.

But for investors like us, playing the earnings expectation game can be severely damaging to our wealth—convincing us to sell when prices are low as well as chase stocks likely to run out of gas sooner than later. And worst of all, it distracts us from the valuable clues about the direction of a company that are always embedded in results.

The earnings releases and guidance updates of natural gas midstream companies provide a great example this time around. Since April, there’s been a powerful rally in stocks of several pipeline companies, including Kinder Morgan Inc (NYSE: KMI) and Williams Companies (NYSE: WMB).

Both stocks are up well over 50 percent year-to-date including dividends paid. And multiple research houses boosted their price targets for Kinder, following the company’s release of Q3 results on October 16.

On their face, Kinder’s numbers weren’t particularly impressive, as distributable cash flow and earnings were flat with EBITDA up just 2%. Management actually cut 2024 guidance for EBITDA growth by half, citing weakness at the CO2 division from lower commodity prices.

But analysts nonetheless rewarded the company for what management called its “opportunity set.” That’s natural gas transportation projects to provide “well north” of 5 billion cubic feet per day of incremental natural gas for generating electricity the next few years, part of a “current backlog” of $5.1 billion of ongoing projects to lift future earnings and cash flow.

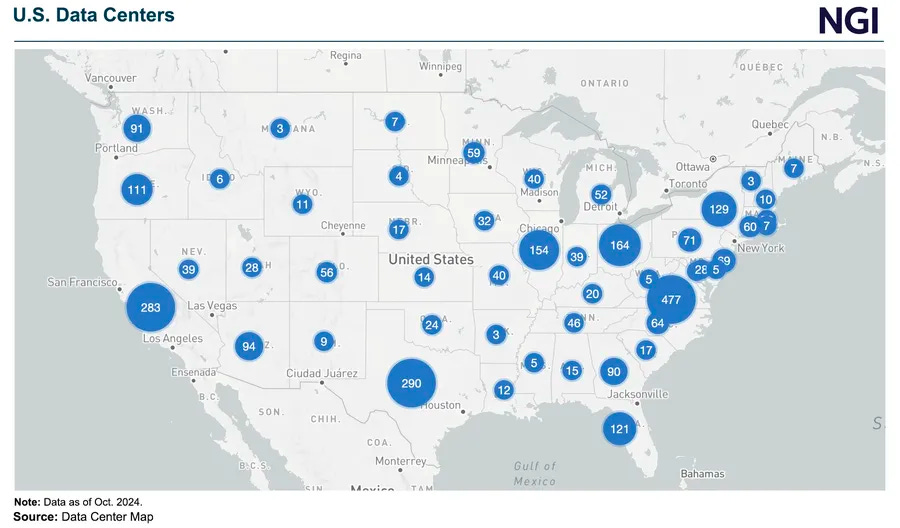

A big chunk of that anticipated demand is expected to serve artificial intelligence enhanced data centers, including for backing up renewable energy facilities. Natural gas’ AI connection was also the subject of TC Energy’s (TSX: TRP, NYSE: TRP) analyst call following the spinoff of its liquids pipeline operations earlier this month as South Bow Corp (TSX: SOBO, NYSE: SOBO).

TC’s Columbia Pipeline system serves the northern Virginia corridor, which is home to the vast majority of US data centers. And management hinted that it will sign multiple new long-term contracts to supply gas to these facilities by early next year.

Altagas Ltd (TSX: ALA, OTC: ATGFF) management also forecast a surge in AI-related business during its Q3 earnings call last week. The company’s Washington Gas unit is the primary gas distribution utility for Loudon County, Virginia, meaning its system is also at the heart of the data center boom.

Stocks of Altagas and TC Energy have gained since this summer. And along with feeding LNG—liquefied natural gas—exports, AI/data center demand figures to support new, long-term contracted projects that will drive future earnings and dividend growth at both companies.

What’s really interesting is the large number of other companies on the natural gas value chain that investors have all but ignored, despite basically operating the same businesses. That includes midstream and pipeline companies that are organized as master limited partnerships or “MLPs.”

MLPs still have a bad name with some income investors, who remember the downturn of the previous decade and are reluctant to file Form K-1s at tax time. And as a result, best in class MLPs pay growing dividends as high as 8% that are also tax advantaged.

Sooner or later, greed will overcome fear and MLPs will catch up to the gains of C-Corp pipelines. But natural gas producers should produce even bigger gains.

Softer natural gas prices this year ensure companies’ Q3 earnings will be less than stellar. That’s the reality current stock prices amply reflect now. But the lesson from midstream companies’ results is they’re preparing for a big surge in demand—as they must, since major pipelines take years to site, permit, fund and build.

Sooner or later, that means fat profits for producers with big stock market gains. And that’s not an insight you’ll get playing Wall Street’s earnings expectations game.