NVIDIA, AES and the Burden of Investor Expectations

If investors’ hopes are too high or too low for a stock, it will usually underperform.

Since the beginning of 2023, NVIDIA Corp (NSDQ: NVDA) stock has gained more than 700%. Along the way, the maker of graphic processors essential for artificial intelligence applications has risen from relative obscurity to the second largest weighting in the S&P 500. And at nearly 7 percent of the index, its daily share performance now has a major impact on Americans’ wealth.

Business growth is behind NVIDIA’s rise. And it showed up once again in earnings for the three months ended July 28, released by management last week.

Driven by continued robust spending from technology giants like Amazon.com (NSDQ: AMZN), the company reported a 122% jump in revenue from a year ago. Profit margins reached a phenomenal 75.1% of sales, and earnings increased 152%.

Results handily beat published projections of Wall Street analysts. And the CFO proclaimed “the enterprise AI wave has started,” asserting “we are working with most of the Fortune 100 companies on AI initiatives across industries and geographies.”

Message: The best is yet to come, and Wall Street is clearly sold. Bloomberg Intelligence reports 65 research houses it tracks rate NVIDIA stock a buy, versus just 8 holds and zero sells.

Nonetheless, the evening that NVIDIA earnings were announced, its stock plunged in aftermarket trading. And losses extended the next trading day, leaving the stock well below its June 20 all-time high of $140 and change. That’s at the same time the Nasdaq 100—of which the stock comprises roughly 8%--moved higher in anticipation of a Federal Reserve rate cut.

Meanwhile, another clear beneficiary of the unfolding artificial intelligence revolution—power producer AES Corp (NYSE: AES)—is down more than -35% since the beginning of 2023.

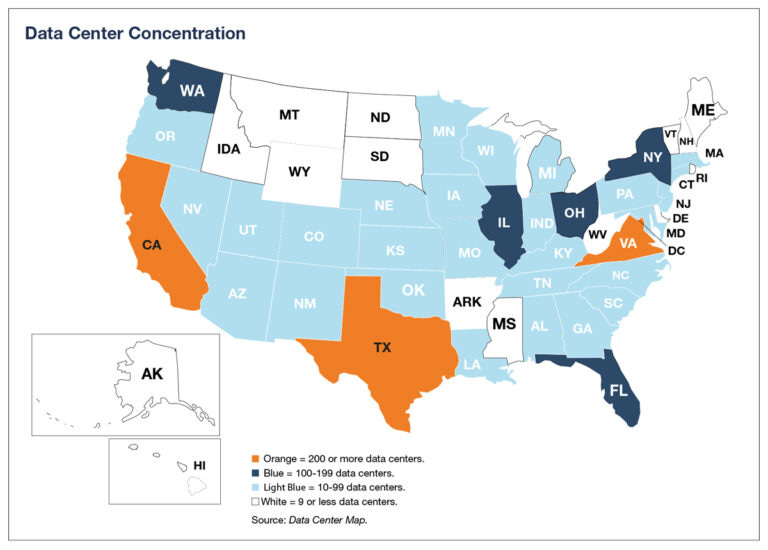

Like NVIDIA, AES reported strong Q2 numbers. And management raised guidance for full-year 2024 results, citing “record sales to data center hyperscalers” as the key driver.

The company signed sales contracts for 2.2 gigawatts of electricity generation “directly with data center customers.” Management reported 1.2 GW of new data center load at its regulated US utilities and “advanced negotiations for up to another 3 GW over the next 12 months.” And the company is on track to bring 3.6 GW into service by the end of the year, of a now 12.6 GW development pipeline.

AES expects expanding data center demand for electricity to power annual earnings growth of 7-9% percent through 2027, as well as yearly EBITDA (cash flow) increases of 5-7% and commensurate dividend growth. And while raw growth isn’t in the same ballpark as NVIDIA’s, it’s recurring and therefore far more reliable.

AES stock, however, sells for just 8.6 times expected next 12 months’ earnings. That compares to more than 25 times for the S&P 500 and 17 times for the Dow Jones Utility Average. And its yield of 4% is more than three times the S&P 500.

The upshot: Investors aren’t giving much if any value to AES’ AI growth prospects. In fact, the stock is actually underwater since the company announced earnings in early August.

So what gives? Simply, NVIDIA shares are languishing under the burden of extremely high investor expectations, which have become increasingly difficult to meet as the stock’s price has risen.

Conversely, AES is facing the burden of very low expectations. Every achievement is doubted to the point of being disregarded.

NVIDIA shares will cost you 55 times trailing 12 months earnings and 35 times projected results for the next 12 months. And routinely producing operating numbers that don’t disappoint depends on a lot of things going right, to say the least.

That’s a fact investors tend to ignore when they’re piling into a rising stock. So even what appears to be extremely good news can actually trigger a wave of selling.

Bloomberg Intelligence, for example, reported NVIDIA’s Q2 earnings per share and revenue beat consensus estimates by 6.3% and 4.7%, respectively. But this week’s sellers focused instead on a “disappointing” forecast that competition would push margins “lower than 75.”

Given how fast NVIDIA’s sales are growing, even profit margins above 50% would be objectively superior. But they’d almost certainly be a severe disappointment for investors, who appear to increasingly expect something exceeding perfection.

That’s a tough environment for NVIDIA stock to produce meaningful gains. It’s entirely possible AI will live up to current hype and the company will own the next breakthrough in processor technology. But anything short of that will probably hit the stock hard. And that means investment losses for most Americans, given how big a part of major indexes and related ETFs the company is.

It’s a bit easier to imagine AES shares making big gains from their current low price—and as only the 451st largest component of the S&P 500. Just a return to the 5-year high of nearly $30 reached in late 2022 would mean a gain north of 70%, not including dividends. And Wall Street firms are bullish, with 10 buy recommendations versus 3 holds and no sells as tracked by Bloomberg Intelligence.

I’m actually pretty confident AES will reach at least the low 30s in the next couple years. The Federal Reserve’s pivot to lower interest rates promises to boost investment appeal of dividend stocks and utilities, while cutting the cost of funding growth.

Whatever the outcome, Election 2024 will eliminate misplaced concern that repeal of the Inflation Reduction Act will crush the business, as AES’ primary growth driver isn’t tax cuts but accelerating data center demand. And risk from operations overseas is also falling, as global central banks support growth and regulation in key countries like Chile continues to improve.

Nonetheless, it may be a while before these favorable developments translate into meaningful price gains. When a stock has lagged the broad market as long as AES has, most investors tend to write it off as a chronic perpetual underperformer.

The burden of low expectations can be as just as heavy as the burden of high expectations.