NVIDIA or Eversource?

Here's why I'll take the utility any day of the week.

Last week was an up and down one for stocks. But a pair of blue chips in two of the hottest sectors took a harder hit than most.

One was NVIDIA (NSDQ: NVDA) leading developer of GPUs and related technology needed to power artificial intelligence. It’s also the most valuable company in the world, with a once unfathomably large market capitalization of $4.35 trillion.

The other was the leading utility in New England, Eversource (NYSE: ES). It’s a somewhat smaller company at a market value of $24.2 billion. But it’s arguably far more important to one of America’s principal cities—providing heat and light to the Boston metro area.

Last week, Connecticut’s Public Utility Regulatory Authority (PURA) rejected Eversource’s proposed sale of its Aquarion Water unit. Earlier in the month, management had said it expected to close by the end of the year, providing an additional $1.6 billion in proceeds to cut debt.

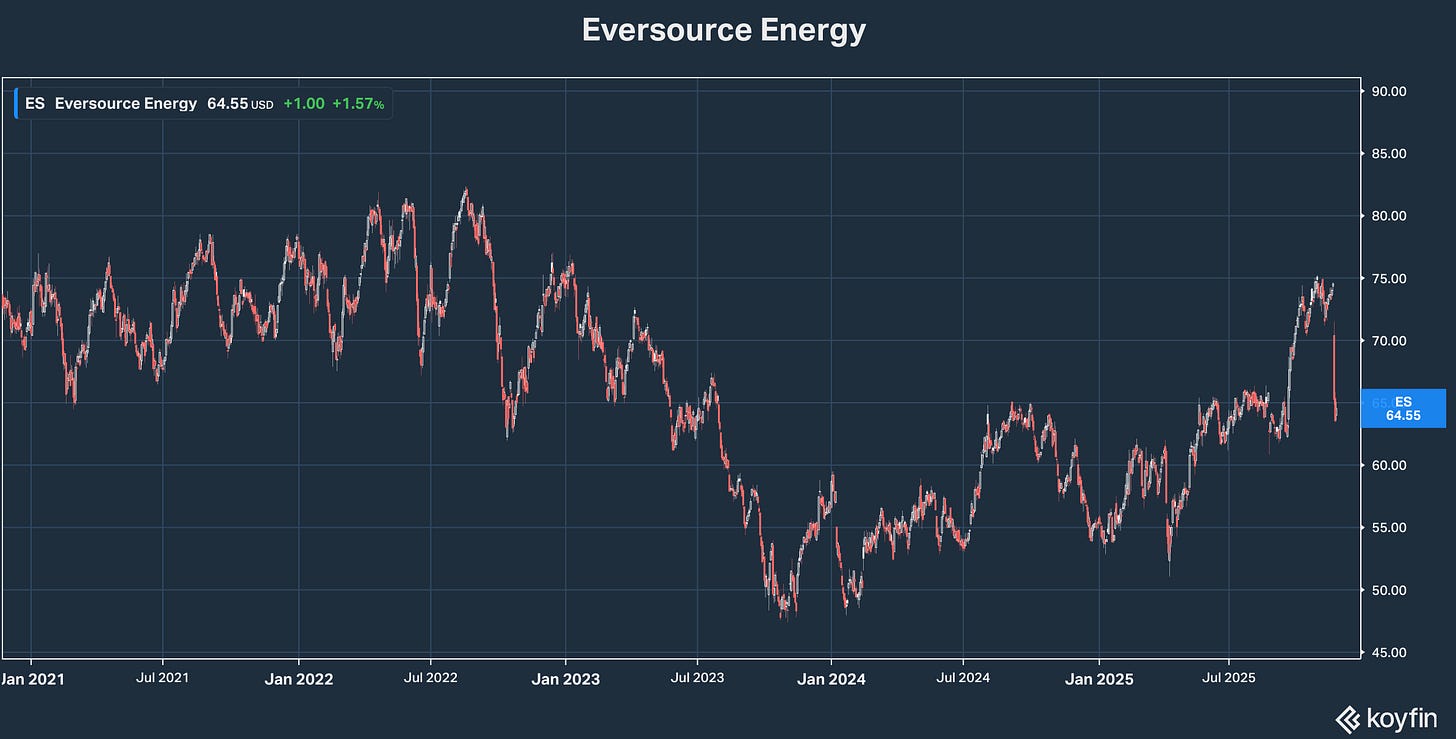

The surprising news the sale would not go through triggered a one-day selloff in the stock of close to -10%. Then came the inevitable day after CYA activity from analysts, as investment banks fell all over themselves to cut their 12-month price targets.

As I’ve said here before, Wall Street analysts’ 12-month price targets for stocks get my vote for “most useless stock market indicator.” And my view is they’ve proven it yet again in the aftermath of the Eversource news.

All but forgotten in the rush to get out the door was the fact Eversource was fresh off raising its 2025 earnings guidance—as well as affirming plans to invest $24.2 billion in its system through 2029 to meet 8 percent rate base growth.

NVIDIA’s selloff also followed strong earnings news. But the stock couldn’t escape the old cliché of buy in rumor, sell on news. And as a result, its price is now more than -15% below the all-time high of $212 and change reached less than a month ago.

If you analyzed utility earnings and guidance for Q3 as I have, it’s hard to give much credence to the increasingly popular media narrative that the AI boom is near collapse.

Big Tech and other data center owners are signing record contracts for energy. And order backlog is increasing, not shrinking. Dominion Energy (NYSE: D)—the power company serving data centers’ northern Virginia hub—now counts 47 gigawatts of prospective capacity in backlog. That’s up from the 40 GW it highlighted with Q2 results this summer.

But NVIDIA’s stock price has a bigger problem: Inevitably, investors bid stocks of the fastest growing companies well beyond their ability to deliver on expectations. And the largest weighted stock in the S&P 500 at almost 8%, this company arguably passed that point some months back.

Being priced for perfection is ultimately an impossible hurdle for a stock to overcome. Management can literally drop all the good news on investors that anyone could hope for. And NVIDIA arguably did that last week, with $57 billion of revenue up 62% over the past year. Gross margin as 73.6%. And CEO Jensen Huang declared that company’s “cloud GPUs are sold out.

But when a stock’s price is 44 times trailing 12-months earnings and 37 times book value, investors are clearly expecting more. All NVIDIA could do was to disappoint.

Eversource’s stock is in the polar opposite situation: Expectations are rock bottom following regulators’ rejection of the Aquarion sale. But so as long as the underlying utility business remains solid and growing, the company will eventually beat expectations and the stock will bounce back.

So what’s “the market” looking for to start betting on a recovery? Basically, the analysts slashing price targets last week are concerned Eversource will be forced to issue $1.6 billion in new stock, to keep credit ratings where they are. And that in turn will lower earnings per share.

It’s a simple formula—and there’s good reason to expect it might be simply wrong.

But let’s start with dividend safety. Earnings are what pay dividends. And a $1.6 billion stock issue at Eversource’s current price would dilute or cut earnings by about 7%, all else equal.

The company’s 2025 guidance range raised earlier this month—and reaffirmed following the Aquarion news—is $4.72 to $4.80 per share, with a mid-point of $4.76. So just taking that number and subtracting 7%, we get to a new range with a mid-point of $4.43. That’s still enough to cover the dividend with a payout ratio of just 67.9%. And it’s more than enough cushion for a sizeable dividend increase this coming January.

Also following the Aquarion news, Eversource reaffirmed its guidance for compound annual earnings per share growth of 5 to 7 percent through 2029. That’s fueled by a planned $24.2 billion investment in its electricity and natural gas grid to meet anticipated 8 percent annual rate base growth. And management threw cold water on speculation of a massive new equity raise by citing a pre-emptive debt and equity issue earlier this year.

Analysts also cited the tough Connecticut regulatory environment as a reason for bearishness on Eversource. And it’s true the utility won’t ramp up investment in the state unless regulators are supportive. That starts with an amicable response to the application for “$60 to $70 million” in higher water rates it intends for file for Aquarion early next year.

But the company also has a truly massive opportunity in its other states to reach target 5 to 7 percent annual earnings and dividend growth. And until Connecticut becomes less dysfunctional, that’s where management will understandably focus.

Bottom line: The company has lost a round here, but it’s hardly out of the game.

The Aquarion operation, for example, is consistently profitable. And Eversource will for now keep those earnings, which it had expected to replace over time with a combination of reduced interest expense and growth of its New England electric and natural gas transmission and distribution rate base.

It’s also still possible another buyer will emerge for Aquarion. HTO America (NSDQ: HTO), for example is the owner of Connecticut Water. And Connecticut regulators’ primary stated objection to the Aquarion sale was the buyer was not an investor-owned water utility.

At the current price, I see at least three potentially powerful upside catalysts for the stock.

First, an offer emerges for Aquarion at a price comparable to the $1.6 billion in expected proceeds from the now failed deal. Second, Connecticut regulators take constructive action on other matters, such as the upcoming Aquarion rate case.

And third, the Revolution Wind offshore project starts generating electricity next year as expected. Construction is now proceeding at warp speed following the courts’ rejection of the wind phobic Trump Administration’s “stop work” order. And once it’s sending power to the New England grid, Eversource will finally be able to close the book on the sale of its 50% interest to Blackrock/Global Infrastructure Partners.

At this point, all three potential catalysts are still a work in progress. But starting with good news at Revolution Wind, we should see Eversource shares back trading in the 70s. And in the meantime—in stark contrast to NVIDIA—it’s pretty much priced for a worst case and then some. Easy to beat.