Pushing Against the Wind

In an “all of the above” world, investors should remain skeptical of energy politics.

When former President Trump visited the New Jersey oceanfront last month, he promised to “make sure” US offshore wind development “ends on day one”—pledging to “write it out in an executive order.”

Trump is the presumptive Republican candidate for president in an exceptionally tight and contentious election year. So it’s no great surprise his words would carry weight on Wall Street.

At least one prominent analyst is calling Trump’s threat to target the wind sector a “credible threat.” I’m skeptical.

First, as was the case in 2016 and 2020, the candidate is proving there’s not much he won’t say on the campaign trail. But despite at times fiery rhetoric, his first administration took a generally hands off approach to energy development, including wind.

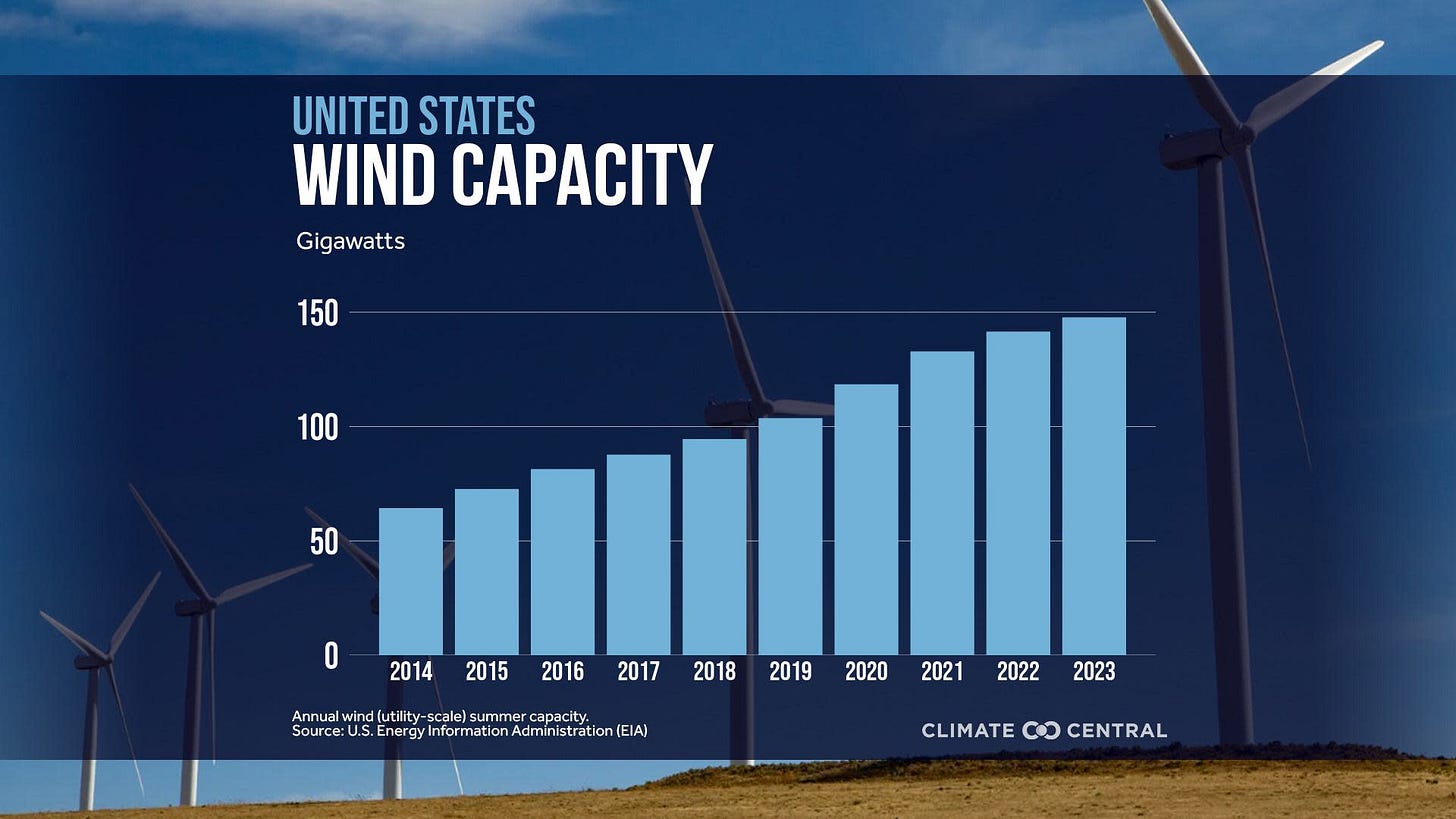

The one exception was at the Bureau of Ocean Energy Management, which did at one point delay permitting for the now operating Vineyard 1 Offshore Wind Facility. But the reality is wind generation increased by 48.5 percent during the first Trump Administration. And the biggest yearly increase was in 2020, despite the disruption of the pandemic year.

Also using figures from the US Department of Energy, the last year of the Trump Administration set records for new offshore wind projects. The pipeline for new capacity increased by 24 percent to 35 plus gigawatts, with New York alone reaching 9.8 GW.

Wind use has continued to grow since Trump left office. And at 12 percent of total US generating capacity in 2023, it’s clearly a critical piece of America’s energy supply as artificial intelligence-enabled data centers are elevating demand in real time. Last year, 25 states generated at least 10 percent of their electricity from some combination of wind and solar—the top 3 all ruby Red politically with no renewable energy mandate in place: Iowa, South Dakota and Kansas.

It’s also worth noting that all of that wind power growth during the Trump Administration occurred well before the unprecedented tax credits of the 2022 Inflation Reduction Act. In fact, the fate of wind and solar tax credits was frequently in doubt from 2017-2020.

Developers couldn’t count on favorable treatment in the tax code. So they had make the economics work on the possibility they wouldn’t be there. That caused a lot of back and forth decision making. But at the end of the day, the projects kept on coming, with full support of regulators and customers.

No one source of electricity is perfect for every situation. Anyone who follows wind power companies has seen the volatility in output from always changing weather conditions. That has a real impact on earnings. And for grid operators, having other sources of energy at their disposal is absolutely essential—with a combination of battery storage and especially flexible natural gas facilities the current preference.

But wind power has proven its economics in multiple geographies. And there’s no more compelling proof than the record number of corporate contracts developers have signed this year. The largest to date is Microsoft’s (NSDQ: MSFT) purchase of 10.5 gigawatts of renewable energy from Brookfield Renewable (NYSE: BEP) announced in early May.

Could a president derail wind power in the US, especially the offshore wind variety?

As President Biden has shown, presidents do have enormous power in some areas of energy policy. For example, the president has imposed a now several months-old “pause” on permitting new LNG export facilities. New oil and gas drilling on federal lands has stalled. And while no energy sector mergers have as yet been seriously challenged, a merger skeptic now runs the Federal Trade Commission’s anti-trust policy.

Presumably, a second Trump Administration would remove restrictions on the fossil fuel industry. And if campaign rhetoric should become reality, a victorious Trump could indeed “pause” permitting for new offshore wind facilities. But that’s about all the low hanging fruit.

Fully permitted projects, for example, are likely untouchable. Even attempting to halt construction of Dominion Energy’s (NYSE: D) Coastal Virginia Offshore Wind facility would be the litigation equivalent of sticking one’s head into a hornet’s nest. In fact, by the time the case did wind its way through the courts, CVOW would have been in operation several years and too critical to shut down.

The Biden Administration has faced a similar reality with Energy Transfer LP’s (NYSE: ET) Dakota Access Pipeline and Enbridge Inc’s (NYSE: ENB) Line 5 in the Upper Midwest. As much as its supporters want to shut them, they’re just too vital.

There’s also the matter of Congress. Even with majorities in both houses, the Biden Administration had to make compromises to pass the IRA, including a deal to complete the long-stalled and controversial Mountain Valley Pipeline.

Cancelling wind power tax credits would require repealing or re-opening the IRA. That effort would face similar hurdles even if Republicans managed to win control of both houses of Congress. And recent statements by several prominent Congressional Republicans indicate support for such a drastic move is hardly universal even in the party.

The biggest hurdle to stopping wind power is the real decisions on electricity policy are made at the state level. The first Trump Administration loudly proclaimed it would “end the war on coal.” But the policies put in place by state regulators, politicians and local utilities to phase out coal continued to roll along.

States have always resisted federal attempts to usurp control over energy policy. They’re doing so now with the new Environmental Protection Agency rules to zero out power plant CO2 emissions in 15 years. And they’ll do the same—also in the courts—with any new policy that forces expensive scrapping of operating power plants or projects in development.

It’s hard not to pay attention to energy politics. And depending on how this year plays out, investors can expect wind power stocks to be volatile. But this is an “all of the above” world of rising demand. All energy sources will count. And that means—more often than not—buying the dips will pay off richly.