Rates Drop, Bet on Banks

Selected financial stocks offer big yields and capital gains as interest rate spreads remain wide.

Money market rates are dropping. That’s bad news for savers.

The recent SEC 7-day yield for the Vanguard Federal Money Market Fund (VMFXX) is down to 3.9%. That’s still well above the sub-1% of just a few years ago. But it’s about 60 basis points less than what this same fund paid earlier this year. And every time the Federal Reserve pushes the Fed Funds rate lower, the Vanguard fund will pay that much less.

So will every other cash alternative in America, from savings accounts to CDs. And that means lower returns for every investor who’s been getting defensive as this Big Tech top-heavy stock market levitates higher.

At the same time, the cost of long-term borrowing has remained elevated. That’s also bad news for consumers and businesses.

Even Uncle Sam isn’t getting much of a break. The Fed Funds rate peaked nearly two years ago. But the yield on 30-year Treasury bonds is still close to 5%, versus around 4% at the beginning of 2024 and basically where it began this year.

The national average for mortgage rates—depending on your source—is still more than twice what it was five years ago at well over 6%. Even investment grade corporations are refinancing lower cost maturing debt by issuing bonds at much higher interest rates, just to lock in a price.

Before I go on any further, let’s get one thing straight. You’ll never build real wealth over time by keeping more than a modest sum in money market funds, CDs and other cash alternatives. You’ve got to own stocks—or bonds, provided you’re willing to treat them like stocks and not “set and forget” investments. And for that purpose, I recommend checking out my long-time friend and colleague Elliott Gue’s “Smart Bonds,” also on Substack.

Cash alternatives like the Vanguard Federal Money Market Fund can be a useful place to park funds at a time of heightened uncertainty, with the objective of investing the cash in stocks when the time is right. And I would argue now is a pretty good time for that.

There’s no magic number Big Tech’s S&P 500 weighting can’t exceed. But every previous time in market history when just seven companies were high priced enough to be 38%. of index ETFs, stocks have eventually gone down in a big way. And while the leaders were the biggest losers, they at least initially dragged everything else down with them.

How useful is US government economic data from September for making a judgment on the state of employment and inflation now—some three months later? Not very. But it’s all Wall Street has to go on, as recently shut and arguably now chronically understaffed federal government agencies struggle to get up to date.

My best guess for when they do catch up is educated primarily by recently released Q3 corporate earnings and guidance updates. Based on what I saw, inflation has not accelerated. But it’s still well above the Fed’s 2% target, with somewhat higher unemployment. That reflects the negative impact on investment highlighted by management teams from tariff-related supply chain disruption, cost pressures and higher for longer borrowing costs.

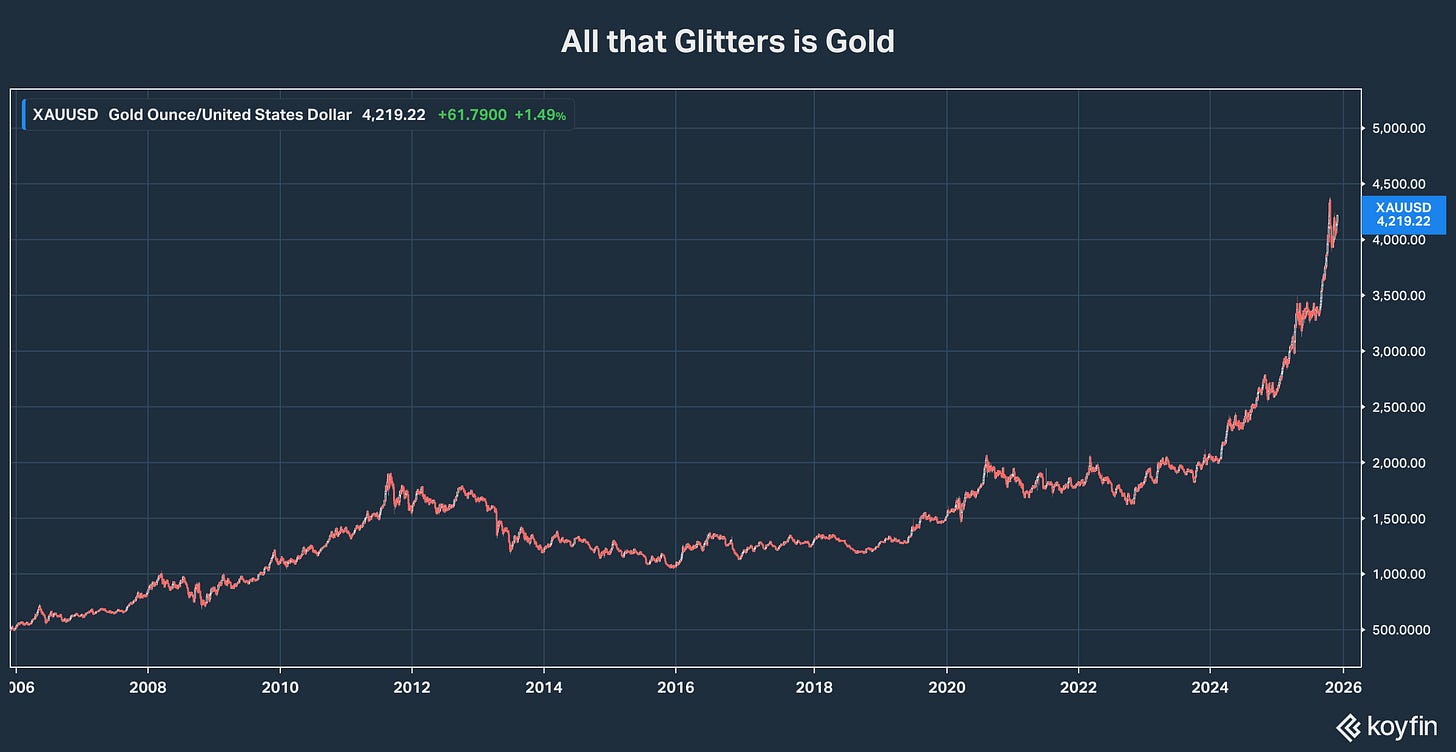

A potential further increase in these still elevated rates on everything from newly issued bonds to credit card rates is my greatest worry for the stock market. Inflation expectations are already high—Exhibit A being gold prices still over $4,200 an ounce and once again pushing toward $5,000. And if the Fed is perceived to be too aggressively cutting short-term rates to please politicians, inflation worries will rise even more. That will push up borrowing costs further and eventually smother stocks.

Throw in some legitimate concerns about what level of the AI boom is sustainable and you’ve got a lot of good reasons to keep some funds in cash this holiday season.

In fact, my Dividends Premium model portfolio has about 20% in the Vanguard Federal Money Market Fund. That could go higher in the next month at least temporarily, depending on if I decide to make any tax selling moves.

But here’s an alternative for your fresh money: Take a look at some financial stocks.

Cutting Fed Funds is pushing down the cost at which banks access funds, from sector inter-lending and the Fed’s “discount window” to what they pay customers on bank deposits, CDs and other instruments. Meantime, the rates at which banks lend for mortgages, credit lines and the like are still elevated.

That means higher lending spreads and higher profits for banks. And the banking industry is also seeing its investment pay off in politicians over the past few election cycles.

The Trump Administration and banks’ Congressional allies are rapidly rolling back regulations enacted following the 2007-09 Financial Crisis and Great Recession. That potentially means greater flexibility to invest and lend with reduced compliance costs, which will also expand earnings.

Maybe you’re thinking stripping away regulation will inevitably lead to the banking industry taking greater risks in pursuit of bigger gains. And that has in fact been the formula for every crisis in the investment markets that’s also delivered a body blow to the economy.

I certainly wouldn’t argue with that. Over the 40 years or so I’ve been in this business, the running “joke”—dark humor for sure—has been that financial institutions engineer a crisis for themselves every decade or so. Remember “disintermediation” that wiped out the S&Ls in the 1980s? The emerging markets debt crisis that eventually bankrupted Russia in the 90s? The sub-prime lending crisis that crashed US housing, a market that had previously been resilient in crisis after crisis?

Those were all the direct result of actions taken by the banking industry. It’s a classic fear and greed cycle. It begins with banks chagrined and the federal government determined to prevent the kind of conditions that could lead to another crisis. But inevitably, the memories of the crisis (fear) fade as the industry starts to lust after “opportunities” those regulations prohibit (greed). Politicians fall into line. Industry eventually goes too far and the cycle begins again, though after considerable pain has been felt economy wide.

There’s no doubt in my mind the banking sector will eventually create another crisis. And what its politician allies are doing now to strip out any guardrails from what they do will almost certainly make it worse. But until that happens, financial companies are going to see a lot of money.

There’s not a lot of yield in Citigroup Inc (NYSE: C) and its ilk right now. JPMorgan Chase (NYSE: JPM) now pays less than 2% after a 33% return so far in 2025. And as readers of Dividends Premium REITs will attest, I’m generally wary of most of the classic mortgage REITs. The yields are tempting. But they also have historically thin distribution coverage. And they would be extremely vulnerable to both a possible spike in long-term interest rates and a weakening of credit.

But there are also real values in financial sector niches, with the bonus of being considerably less exposed as businesses to an inevitable crisis in the big banks. For example, Dividends Premium has realized solid gains in community banks, which have the added attraction of being takeover targets.

HA Sustainable Infrastructure Capital (NYSE: HASI) is another special situation in the financial sector finally getting some positive investor attention. The company makes debt and equity investments in projects that help customers improve energy efficiency and cut costs. It’s coming off the best Q3 in its history as well as a guidance boost, adding investment and expanding the spread between its returns and its cost of capital.

The stock is up by nearly one-third this year and is squeezing still elevated short interest. Bears foolishly bet Trump Administration policies would crush the company’s business model. And they’re doing precisely the opposite.