REITs: 2026 Comeback will Continue

Your January 2026 Dividends Premium REITs

Editor’s Note: Thank you for reading Dividends Premium REITs for January.

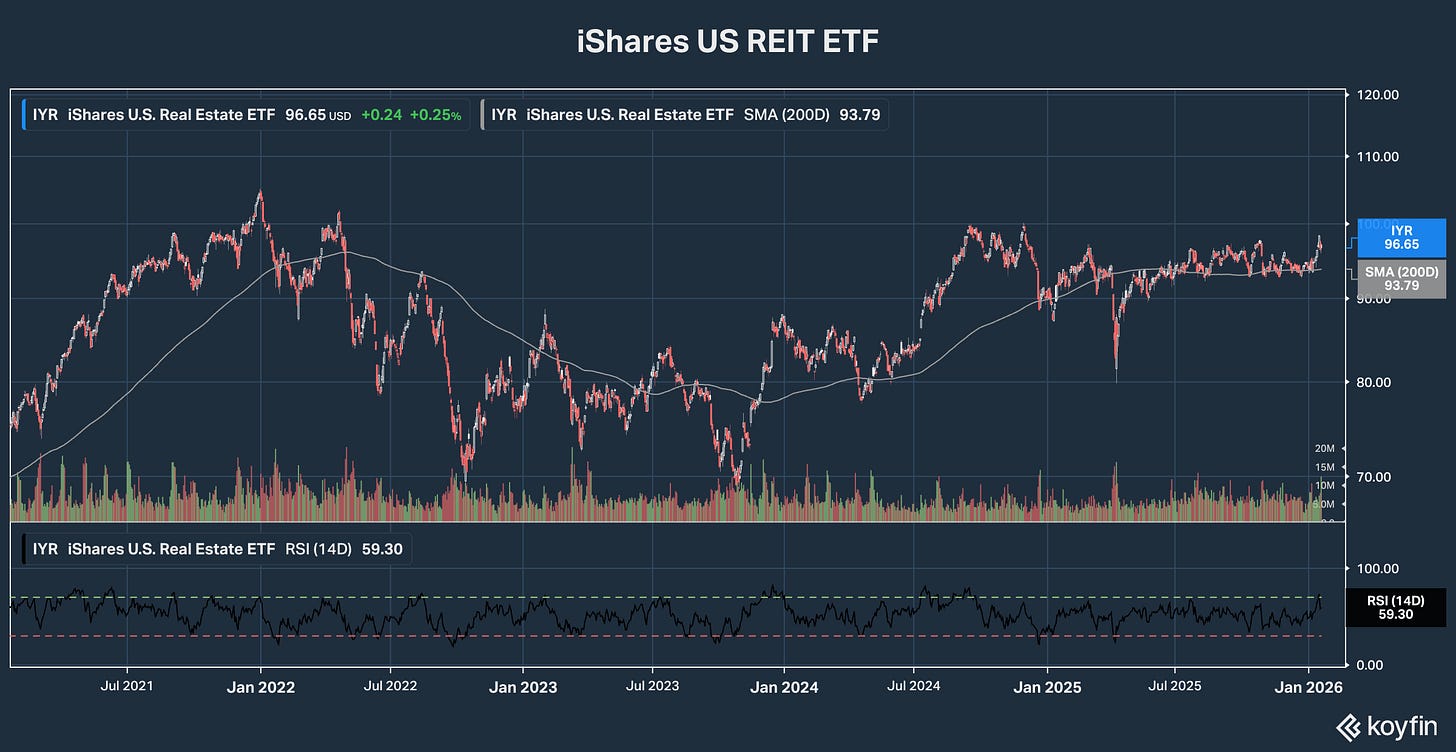

We’re three weeks into calendar year 2026. And so far, despite broad investment market turbulence, REITs are off to a great start.

Some of these gains are a rollback of late 2025 selling. That’s usual for January and is the basis for various “Dogs of the Dow” strategies.

Will REITs’ good start to 2026 continue? Yes, for several reasons. Many best-in-class companies are still quite cheap. Dividend and value stocks are increasingly outperforming as money shifts from bloated Big Tech stocks. And the development slowdown of the past few years is locking in future supply shortages across multiple property types.

A real stock market correction would likely trigger selling of REITs as well. Already elevated borrowing costs are rising again, putting more dividends at risk. And there’s a near-term glut of supply especially in office, residential and self-storage, even as employment has softened and inflation remains stubbornly high.

So, my basic strategy is the same. We still want to buy top quality REITs at low prices, such as this month’s top fresh money buys. But we need to be patient as well as prepared for prices to go lower, if the overall stock market takes a dive.

Got a question? Join the discussion at my Dividends Roundtable forum, which I host 24-7 on the Discord application. To your wealth!--RC

REITs’ 2026 Rally: How to Play It

Will politics end the bull market in stocks?

That question came up more than once last year, starting with the shock of “Liberation Day” tariffs in April. And it has once again, as investor worries percolate about a possible US/European Union trade war and a future Federal Reserve chair who answers to politicians.

Inflation worries are already accelerating. Gold prices are steaming towards $5,000 an ounce. The Japanese bond market broke some key support this week. And the 10-year Treasury bond yield is at its higher level since August, even as the Fed Funds rate is at its lowest level since 2022. Companies that issued debt the past few months are looking prescient, though offerings have refinanced maturing debt at higher rates.

Politics has up-ended markets in the past. President Kennedy’s war with Big Steel in the early 1960s, President Nixon’s resignation in 1974 and Iraq’s short-lived conquest of Kuwait in the early 1990s are instances where there was significant damage. And not many stocks avoided selling.

But without exception, politics-triggered selloffs were eventually followed by furious rallies when the initial concerns faded. More recently, the spring 2025 selloff following the tariffs announcement was erased by mid-June, with the S&P 500 closing out the year near record levels.

As domestic businesses, REITs feel the impact of tariffs and related supply chain disruption this year only indirectly. But the sector also took a hard hit on the tariff news. So it’s likely a future politics-based market selloff would affect them as well.

Nonetheless, I’d view any politics triggered drop as a buying opportunity for the best-in-class companies I recommend here. And the risk of lower prices near-term is not a reason to run for the hills.

Stick to Our Strategy

The best thing we can do to protect ourselves from today’s headwinds while locking in high yields and future growth is to follow this four-part REIT investment strategy:

· Sell any REIT where the underlying businesses is weakening.

· Do not chase REITs above my highest recommended entry points. And take new positions in increments of three, rather than all at once—even if stocks are at Dream Buy prices.

· Take profits in big winners when they trade above profit taking prices in the REIT Rater table included with this issue.

· Never load up on any one REIT. Always balance and diversify positions.

We’ll have our next best opportunity to assess REITs’ health as Q4 results are announced and guidance updated in the next few weeks. And I expect to have analysis for most of the REIT Rater coverage in the February issue, or earlier for any companies on the First Rate REIT list that may require action beforehand.

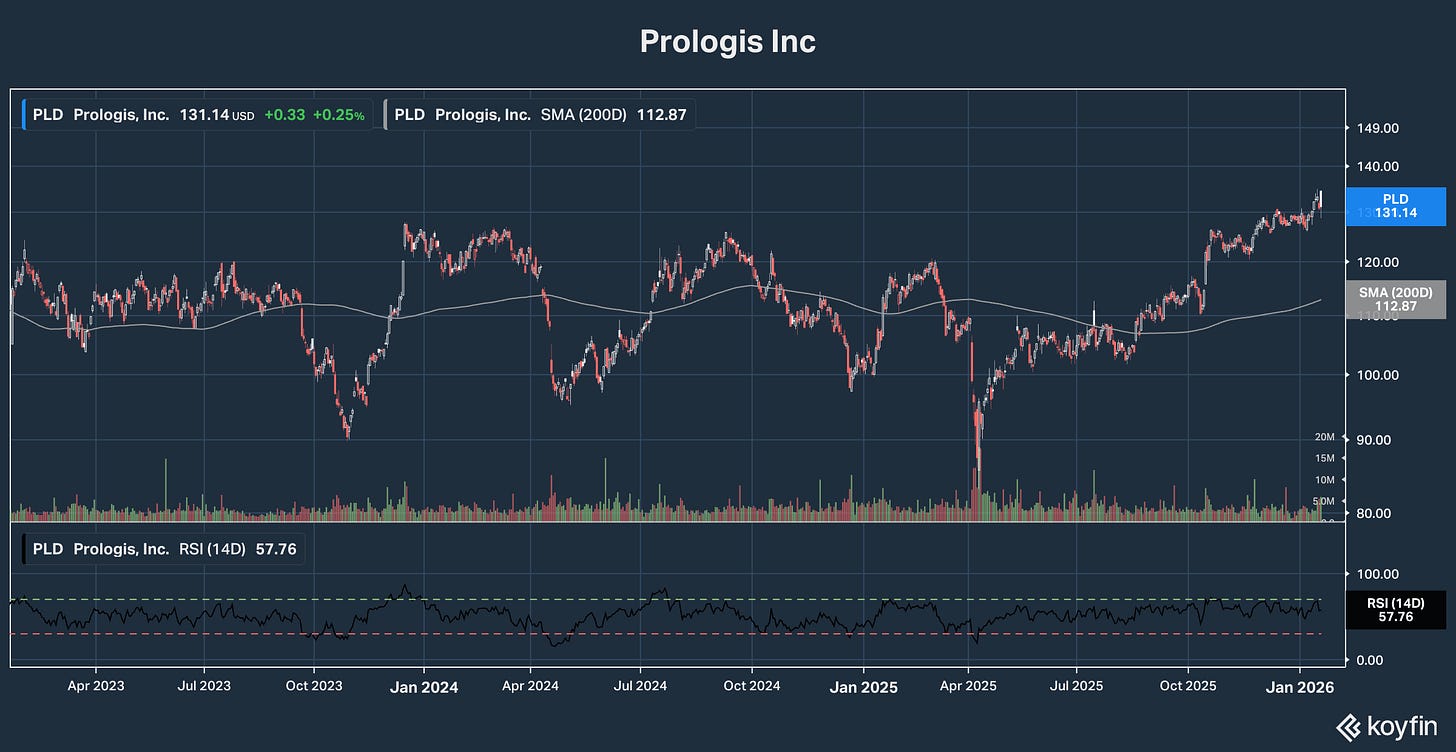

This issue’s “Commentary” column in the table highlights when to expect Q4 results for each REIT. One of this month’s top fresh money buys Prologis Inc (NYSE: PLD) has already reported in.

Prologis was one of the top performing First Rate REITs in 2025, as its industrial and logistics customers began to ramp up activity after a lull. And momentum appears to be carrying over into 2026, with management announcing record leasing activity in Q4 and issuing solid growth guidance for 2026.

Financing remains conservative. The REIT invested $517 million in acquisitions during Q4, along with $539 million “development stabilizations” and $1.019 billion development starts—more than twice the level of Q3. But total $2.075 billion was largely covered by $1.885 billion in asset sales and contributions from venture partners.

Co-investment ventures closed $3 billion of new debt raises at a weighted interest rate of just 3.1 percent with an average maturity of 7.2 years. The average weighted interest rate on total debt is now 3.3 percent with an average term of 8.2 years. That strength is reflected in the credit rating of A2, raised last year by Moody’s.

Management is guiding to “cash same store NOI growth” of 5.75 to 6.75 percent in 2026. Net promote income is expected to be an expense of $50 million. And the REIT is targeting investment of $2.25 to $2.75 billion in development stabilizations, $3 to $4 billion in development starts and $1 to $1.5 billion of acquisitions, mostly funded by a combination of asset sales, partner contributions and “realized” development gains.

Prologis—like Realty Income (NYSE: O), Simon Properties (NYSE: SPG) and WP Carey (NYSE: WPC)—is a multinational property owner. The US accounts for 85 percent of NOI. But the company also has 9 percent from Europe (12 countries), 5 percent from Mexico and Brazil and 1 percent from Asia (China, India, Japan and Singapore).

Global reach reflects the need of its customers, a who’s who of successful multinationals. And the company hedges currency exposure conservatively, so there’s minimal impact on earnings.

Prologis has proven over the past year that its business is resilient against supply chain disruption from erratic US trade policy. I expect a mid-single digit percentage dividend increase to be announced next month. And I’m raising my highest recommended buy price for this blue chip to 135.

The other top fresh money buy this month is