REITs: Deep Value Shopping

Your November Dividends Premium REITs.

Editor’s Note: Welcome to your November Dividends Premium REITs. Thanks for reading!

This issue includes my analysis of Q3 earnings and guidance updates for the full 84 real estate investment trust coverage universe. You’ll find it in the “Commentary” column of “The REIT Rater” table.

All the REITs I track have now reported. And my top takeaway is property sector resilience in the face of difficult and in some cases worsening headwinds.

In all, 38 REITs—or almost half the companies I follow—raised their guidance for 2025 following Q3 results. That includes two-thirds of the recommendations on my “First Rate REITs” list. In contrast, just 8 of the 84 reduced guidance, most on very minor adjustments.

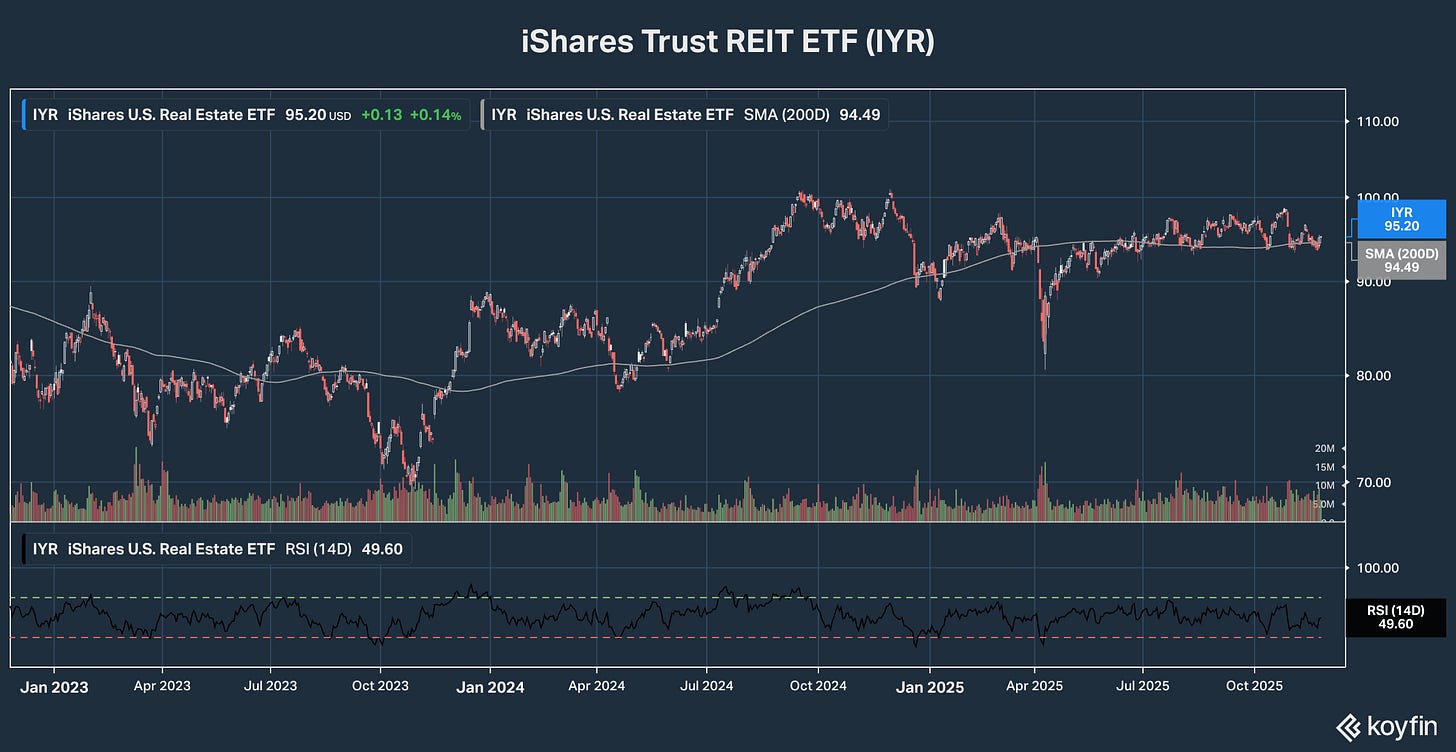

REITs’ very solid business operating performance continues to be largely ignored by investors. And the sector remains a substantial underperformer in a stock market still driven by the seven largest technology stocks. The SPDR REIT ETF (XLRE) has returned 3.05 percent year to date, lagging the S&P 500 by 12 percentage points and the iShares Dividend ETF (DVY) by 6 points.

Strong business performances eventually produce stock market gains. But for now, while most investors are still oblivious to REIT values, we have an opportunity to lock in big yields and future capital gains in the best in class. Top of the shopping list are my best fresh money buys for this month, which both raised guidance on Q3 resilient results.

Got a question about a particular REIT, a property sector or my general outlook? Then please join my Dividend Roundtable forum, which I host 24-7 on the Discord application.

Have a very Happy Thanksgiving everyone!--RC

REITs: A Time to Buy Value in an Unloved Sector

It wasn’t the greatest of months for REITs as stocks. The SPDR REIT ETF is up barely 3 percent year to date. And it would be well underwater, absent an extreme overweight in Welltower Inc (NYSE: WELL) at 11.16 percent.

With a little over a month left in the year, more than half of the REIT Rater coverage universe has a negative total return. That number jumps to nearly two-thirds not including dividends. And fully one-third of the 84 companies are down by a double-digit percentage with dividends.

That’s a noteworthy underperformance for the property sector in a year where the S&P 500 is in the black better than 15 percent. And the disparity could well get worse before the year is out, especially if the Big 7 Tech stocks that are now nearly 38 percent of S&P ETFs manage a rally. REITs by contrast are collectively less than 1 percent of those market-moving ETFs, with even Welltower Inc weighing in at just 0.24 percent.

There’s no doubt in my mind that REITs’ underperformance this year continues to spur selling, further widening the performance gap in a vicious cycle. FOMO—fear of missing out—is a powerful motivator for investors to make moves. And it’s all too easy to equate a paper loss or even a weak relative performance with some fatal flaw at the underlying company that’s yet to show up.

After all, doesn’t “the market” know everything? And if a stock we own is getting creamed, isn’t it more likely we’re wrong than the great mass of investors driving down the price?

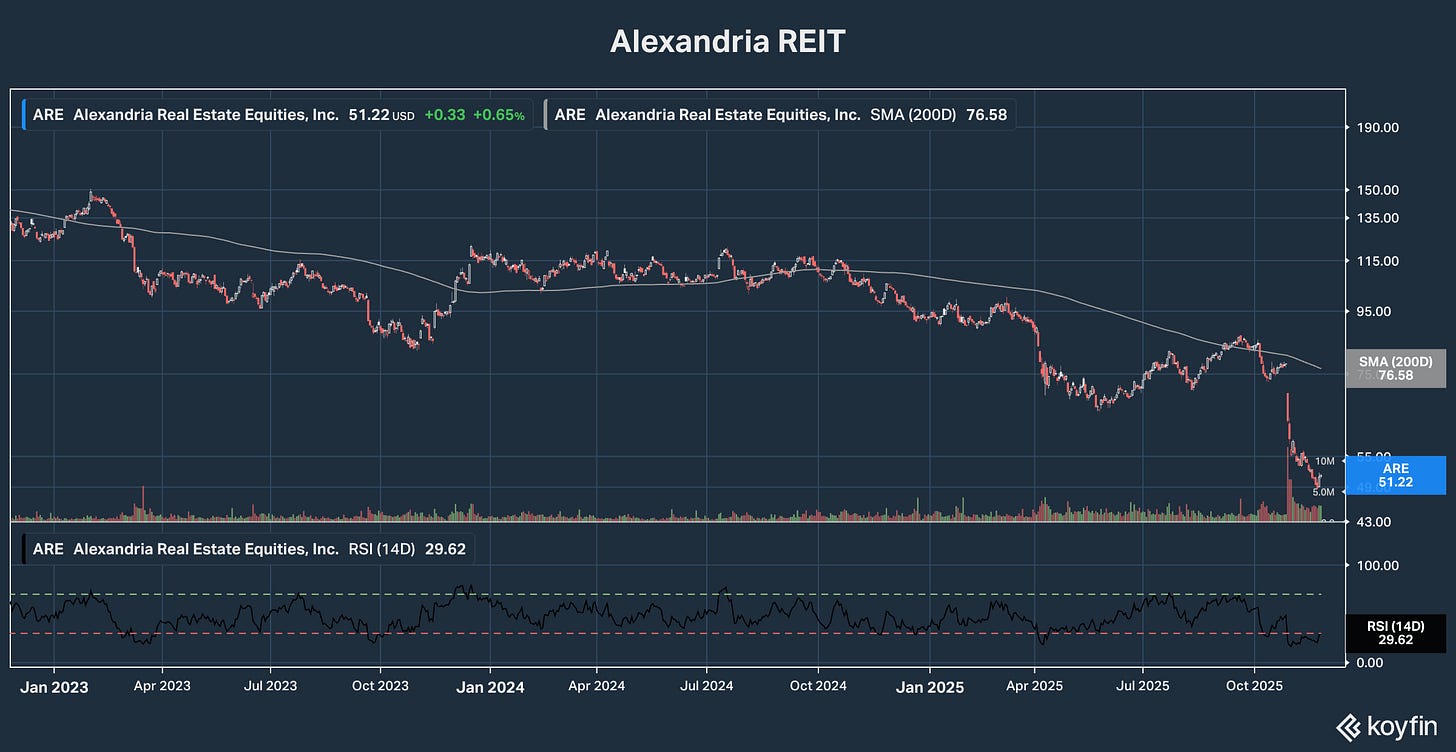

That’s a question I always ask when a stock I own underperforms—and especially if it gets sold aggressively as Alexandria REIT (NYSE: ARE) has been since I posted the October issue.

We always want to know why a stock we own is getting punished severely. In fact, I’ve found that I’m usually better off backing away if I can’t get my head around why a stock is dropping, possibly even selling until the reasons for the drop become clear.

Why REITs Keep Lagging

So why are REITs continuing to underperform this year? For one thing, none of the three long-term drivers of future upside that I’ve consistently highlighted this year have really shown up yet. That’s:

· Growing scarcity of multiple property types relative to long-term demand.

· Re-balancing of the S&P 500 from historically over-weighted Big Tech to under-owned sectors like REITs.

· Moderation of borrowing costs that will spur growth and increase the relative attraction of dividend paying stocks.

We saw evidence of emerging long-term property scarcity in first half 2025 for multiple sectors, ranging from industrial properties to self-storage and residential property. And there’s a lot more to see in the Q3 results and guidance updates I highlight in this issue.

That includes the least new supply of apartments hitting key markets since the pandemic. And prospective new supply in 2026 and beyond is shaping up to be lower still.

Investors, however, paid far more attention to declining rents on new leases as a potential harbinger of worse ahead for residential REITs’ NOI and FFO growth in the first half of 2026. And they punished REITs like Mid-America Apartment Communities (NYSE: MAA), which otherwise reported improving results. Those included record low turnover, stable mid-90s percentage occupancy and a return to positive blended rent growth.

Retail REITs also generally trade lower now than they did a month ago. The primary reason: Concern about the health of the US economy with the impact of supply chain disruption, import taxes and the recently ended federal government shutdown still largely unknown.

Ironically, much of the uncertainty is directly because of the shutdown, which interrupted the daily flow of information the stock market thrives on. And until the BLS catches up, that will continue to sow doubt among investors, including whether future rate cuts from the Federal Reserve are appropriate.

At this point, there appears to be a consensus expectation that the Fed will cut its Fed Funds rate by another quarter point at its December meeting. That would be in line with what the central bank forecast a year ago. What’s less certain is whether such a move will make a difference to reducing real world borrowing costs, as lenders factor in what the impact on inflation could be from Fed action.

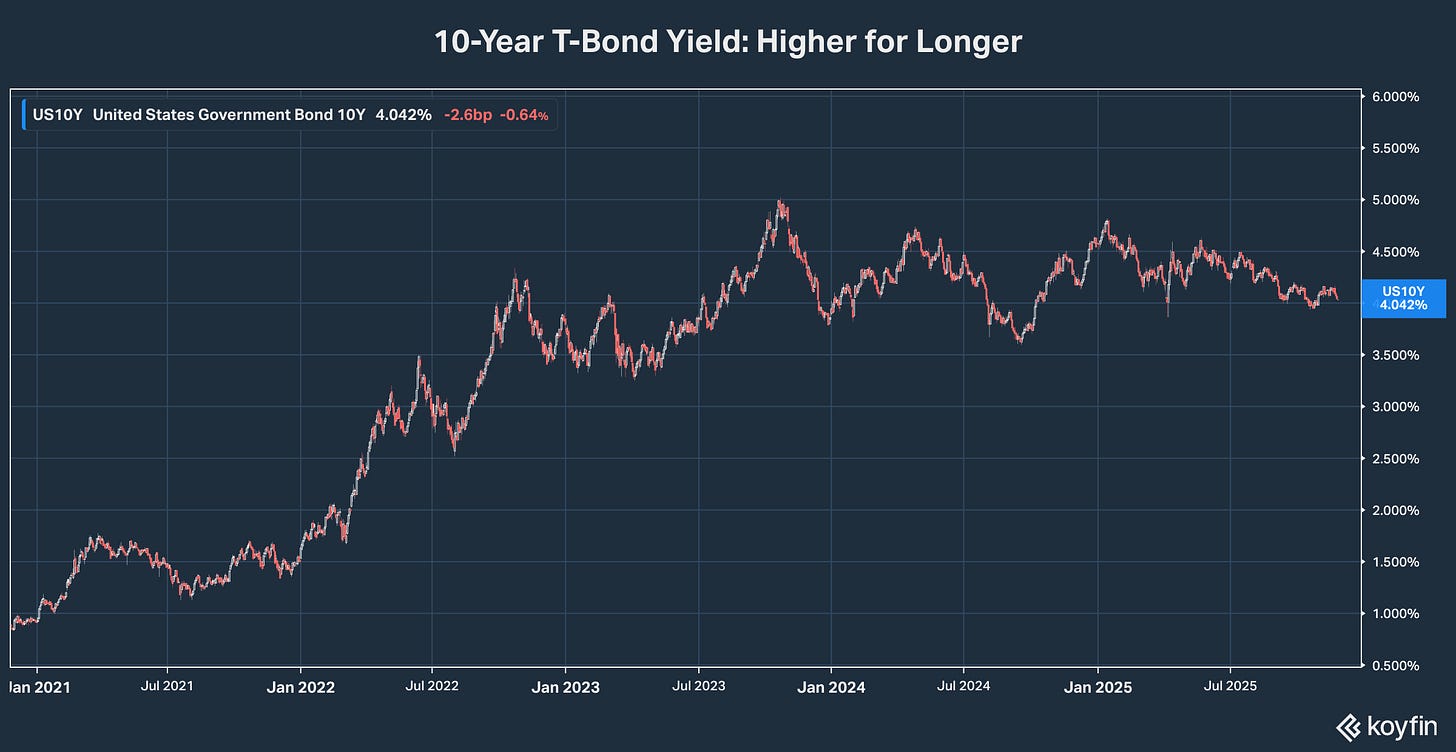

With the price of gold well over $4,000 an ounce, it’s fair to say inflation expectations are still running hot. That’s also reflected in the fact the 10-year US Treasury note yield is still stubbornly over 4 percent—and the fact that companies are still focused on finding other ways to fund projects other than issuing more debt.

To the extent we have seen debt issuance in the REIT-verse over the past month, it seems to have been motivated by a desire to lock in cost, even if it’s at a higher rate than management would have preferred. And more than a few companies have stated their interest in accessing private capital, rather than public funding.

On December 3, Alexandria REIT has promised to issue detailed guidance for its operating and capital plan. And during the earnings call, management touched what’s historically been a third rail for its investors—specifically indicating a meaningful dividend cut is now under consideration. The stated reason is so the REIT can complete its development program and cut debt.

Investors did punish the stock severely on that news, sending the price from the high 80s to low 50s currently. That may deter other REITs from following a similar course. But it’s clear from these actions that borrowing costs have not dropped, even for investment grade companies like Alexandria REIT. And in fact, management teams are wary they may go higher, should inflation expectations keep rising.

The combination of a weakening economy, still potent inflation and higher for longer borrowing costs would present a formidable headwind for REITs. And worries about such a scenario emerging are at the heart of the bear case for the sector, which has triggered the selling.

Why I Still Like REITs

My view is still that once we see the back data, it will become fairly clear that inflation isn’t running away and the economy isn’t crashing. And that will be a solid underpinning for REITs to recover the ground they recently lost.

But even if the outcome is worse, I’m comfortable holding and continuing to build positions in the best in class of the sector.

First, the longer borrowing costs remain elevated with rents under pressure, the less investment there will be in new development. And that means future scarcity will be all the more severe.

Second, actual Q3 operating and financial numbers for best in class REITs were quite solid. And despite some of the post-earnings call commentary and the wave of Wall Street price target cuts for multiple companies, management guidance was quite strong as well.

The proof as always is in the numbers. Of the 84 REITs in the coverage universe, 38 or nearly half raised their 2025 guidance. More than half of those did so for the second or third time this year.

Guidance increases don’t necessarily equate to big boosts in earnings or FFO. But when a company raises projections in October or November, it’s clear management was able at the beginning of year to assess what the key risks and opportunities would be. And it’s equally clear that the company was able to execute its strategy effectively.

Yes, there are companies that consistently low ball their guidance to create the illusion of improving health. But even those management teams must understand their core business just to set those assumptions. And meeting targets still requires execution, especially given the fact circumstances can and do change radically in a typical year.

2025 has had its share of twists and turns for property markets. Companies that didn’t lock in costs of labor and materials like steel have seen construction costs soar to new heights. Those counting on a benign Federal Reserve to aggressively ease credit and bring down borrowing costs have been caught out to some extent.

Alexandria REIT’s biotech tenants have had to absorb disruption in funding as the Trump Administration has attempted to put its mark on research. And then the government shutdown scrambled things even further. That’s had a direct impact on rents, occupancy and especially how fast new development can be filled. And management is likely to adopt an aggressive strategy next month to deal with these challenges.

The fact management hasn’t had to alter 2025 FFO guidance by more than a few cents despite these challenges is a testament to knowing its business. And that’s at least equally the case with the 14 First Rate REITs that raised their guidance for the year.

It’s also true that if Alexandria does cut its dividend next month, it won’t be because revenue and FFO have deteriorated to the point where a lower payout is necessary. Even at the lower end of guidance, the payout ratio is under 60 percent and is likely to stay there next year as well—should the current rate be continued. I

The cut is a matter of capital strategy and therefore is by choice. And that appears to be the case throughout the REIT coverage universe, as payout ratios and the FFO behind them have remained steady as well.

Bottom line: This is not the REIT sector of 2019, heavily leveraged, overbuilt and therefore vulnerable to a downturn no one truly expected in 2020. Instead, it’s a sector that’s five years into historic de-leveraging that’s increasingly conservative with new development. And investors selling the sector are fully expecting a cyclical downturn—and therefore ignoring the clear signs of an emerging secular uptrend.

Prices may go lower by the end of the year. But patient investors will use the dips and opportunities to add the best in class REITs to their portfolios. Read the rest of this issue for the best buys.