Renewable Energy is Dead, But Not Really

Energy storage investment will boom while wind and solar become more expensive.

Thank you for reading Dividends with Roger Conrad! I hope everyone is having a great summer.

Politics still dominates the investment headlines. But Q2 earnings reports and guidance updates due out the next few weeks are worth infinitely more of our attention.

That’s my focus now in the paid version of this service, Dividends Premium. And I’ll be posting the July edition of Dividends Premium REITs this coming week, with advice and analysis for more than 80 real estate investment trusts.

Members are cordially invited to check out my Dividends Roundtable investment discussion forum, which I host 24-7 on Discord. Use the link attached to this email or in the Substack application to find out more about Dividends Premium.

Here’s to building your wealth no matter the weather!—RC

“You can’t always get what you want. But if you try sometime, you might find, you get what you need.”—Mick Jagger and Keith Richards, “Let It Bleed”, 1969.

Developers and fans of wind and solar power certainly didn’t get what they wanted from Republicans’ now passed federal budget bill.

But I would argue leading sector deployers like NextEra Energy (NYSE: NEE)—America’s largest producer of wind, solar and energy storage—basically got what they needed. In fact, the ongoing investment boom in renewable energy is actually likely to accelerate the next few years.

Don’t believe me? Let’s have a look at what made it into law and what didn’t.

The headliner is the accelerated phase out of tax credits for wind and solar generation, roof top solar, electric vehicles and home efficiency improvements that were enacted by the so-called 2022 Inflation Reduction Act.

Under the new law, US consumers and businesses will have to acquire EVs by September 30 to claim a tax credit. You have until June 2026 to put EV charging into your home, or to buy a house with efficiency features. Commercial buildings have until July 2026 to begin energy saving projects.

That compares to previous deadlines at the end of 2032. And it’s reasonable to assume the rapid loss of tax credits will depress sales of EVs, charging infrastructure and rooftop solar arrays—all of which may cause Tesla Inc (NSDQ: TSLA) CEO Elon Musk to further regret backing Republicans in the 2024 election.

But let’s look at what really happened to the economics of utility scale wind and solar projects. We’re going to find out a lot more about NextEra’s future plans in 10 days, when management reports Q2 numbers and updates guidance. Here’s what we already know.

The biggest change in the law is new wind and solar projects must “begin construction” by July 2026. If that deadline is missed, projects must go into service by the end of 2027.

That’s a sharp reduction from the IRA’s end-2032 deadline. And the president has asked the Treasury Department to take a hard line on the definition of what constitutes “beginning construction.”

But in reality, Congress set the standard fairly loose. And once a project qualifies as being under construction, developers will have four years to get it into service to qualify for the full tax credit. Even projects Treasury chooses to contest and is able to win in court have extremely favorable odds of qualifying for tax credits. That’s because wind and solar projects typically take just 12 to 18 months to go from planning stage to commercial service.

NextEra and the rest of the industry can thank Senator Lisa Murkowski’s (R-AK) willingness to play the moderating role former Senator Joe Manchin (D-WVA) did on the other side during passage of the IRA. She also ensured renewable energy tax credit transferability, which enables developers to sell their tax credits to third parties to fund more projects. And she deep-sixed a provision that would have taxed currently operating renewable energy generation built with imported parts.

Bottom line: Current utility-scale wind and solar construction pipelines should surprisingly be effectively “safe harbored” from the rapid phase out of tax credits. That also includes the five remaining US offshore wind facilities currently in advanced development, such as Dominion Energy’s (NYSE: D) Coastal Virginia Offshore Wind.

The new federal budget actually extends tax credits for geothermal, hydro, nuclear and energy storage projects that begin construction by 2036, an additional four years longer than the IRA deadline of 2032.

Even that won’t ensure new nuclear, until/unless would be developers can realistically pin down construction times and costs. Hydro expansion will be limited to upgrading currently operating facilities—the age of flooding vast new areas by building new dams is long past. And utility scale geothermal to date has been confined to areas of elevated geological activity, though there may be promise in smaller scale distributed energy.

Energy storage investment, in stark contrast, is ready to boom. Not only are deployers’ tax credits extended. But advanced manufacturing of both “critical minerals” and battery/solar components are now advantaged until 2034, versus 2033 in the IRA. Only wind manufacturing saw an accelerated phase out to zero in 2028.

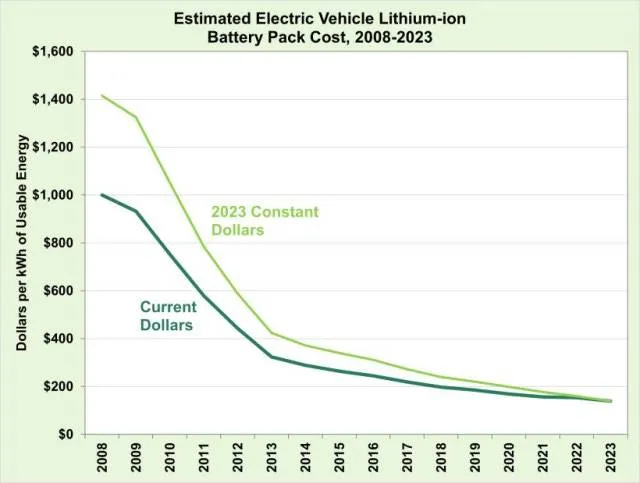

Battery costs have plunged in recent years, in large part because of a massive ramp up of Chinese production capacity. Bloomberg New Energy Finance reports global lithium-ion battery pack prices dropped 20% in 2024 to an all-time low of $115 per kilowatt hour. That’s less than one-tenth the average price in 2010. And projections are the cost will drop to $99 per KWH this year, and even lower in 2026.

Batteries have already proven their worth stabilizing power grids in Texas and California this summer at periods of peak demand and during storms. And companies like NextEra can essentially keep their solar facilities feeding the grid for at several additional hours a day when the sun goes down, by collocating battery storage on site.

Thanks to ever-advancing battery technology, Chinese electric vehicle manufacturer BYD (HK: 002594, OTC: BYDDY) has developed an electric vehicle with a range of up to 400 miles, with a charging time of less than 5 minutes.

BYD EVs are unlikely to be available to US buyers anytime soon, thanks to the president’s America versus the world trade war. But by the time they are, they’ll be cheaper and more efficient than ever.

In the meantime, cheaper batteries combined with big tax credits means the US power grid will benefit in resiliency as the storage deployment boom picks up where the current solar boom eventually leaves off. That means for companies like NextEra, investment-led growth has a clear path to continue in coming years. And as they expand their share of rapidly growing US electricity demand, their shareholders will build real wealth.