Renewables: Flashing Green

Green stocks are the energy sector's most pleasant surprise of Trump II so far.

Editor’s note: This week’s post is a few hours later than usual, to allow me time to finish up the December issue of Conrad’s Utility Investor. Here I highlight for Dividends Roundtable members one of the high profit opportunities in that sector. Thanks for reading!—RC

Renewable energy stocks were among the top performing sectors during the four years of the first Trump Administration. And so far, they’re tearing up the track of the second as well.

With just a few weeks to go in 2025, the Invesco Solar ETF (TAN) is sitting on a 44% year to date gain. That’s after losing more than -70% during the four years of the Biden Administration. And it’s more than twice the AI hype-fueled gain on the Big Tech-heavy S&P 500, as well as nearly five times the return on the oil and gas-focused Energy SPDR ETF (XLE).

Green energy’s blistering performance this year highlights one very important lesson for investors.

Mainly, as I’ve pointed on numerous occasions since November 2024, politics-based investment strategies generally fail. And the investors who try to bet on election outcomes usually wind up poorer for it.

First there’s the matter of correctly predicting the results. Then we need to correctly forecast which campaign promises will be abandoned so politicians can focus on what’s most important. And finally, even if we get both of those things right, policies have a history of producing different results than what may be intended.

In the case of the Trump II and renewable energy, the nearly unanimous consensus following the election was the new president would come out guns blazing against renewable energy. And the new administration certainly hasn’t disappointed green haters.

Not only did they ram through an accelerated phase out of numerous tax credits in the OB3 or “One Big Beautiful Bill,” and over the opposition of more than a few Republicans. But the Internal Revenue Service has stacked the tax rules against wind and solar projects, effectively phasing out tax credits even sooner than the bill did for many developers. And unprecedented new tariffs restricted the flow and jacked up prices of needed components.

Just as the Biden Administration restricted oil and gas drilling on federal lands and offshore waters, the Trump Administration ruled new renewable projects off limits. And they’ve also gone where Biden would not: Attempting to pull previously granted permits for projects, including the 80% completed Revolution Wind facility off the New England coast.

A federal judge granted a stay of the Interior Department’s “stop work” order at Revolution about a month after it was imposed. Developer Orsted A/S (Denmark: ORSTED, OTC: DNNGY) has since been working on an accelerated timeline to bring the project to full production next year. And the deadline for appealing the judge’s order has now passed, making it unlikely the project will be further challenged.

Nonetheless, the delay triggered more writeoffs for Orsted, as well as its former partner Eversource Energy (NYSE: ES)—as the additional cost cut into the final selling price for its former 50% ownership stake to Blackrock’s Global Infrastructure Partners. And rarely a day goes by without an anti-renewable energy screed on social media—especially X—by some member of the Trump Administration.

But despite all that, green energy stocks are up big this year. Compare that to coal stocks like Alliance Resource Partners that have the Trump Administration’s full-throated support. Alliance cut its dividend more than -14% this summer, one reason the stock is sitting at a -8% capital loss.

In contrast, America’s leading manufacturer of solar panels FirstSolar (NSDQ: FSLR) is up about 50% year to date. So are leading battery storage company Fluence Energy (NSDQ: FLNC) and the C-Corp shares of contract power generator Brookfield Renewable (NYSE: BEPC).

I see one main reason for the outperformance: The green energy universe has come of age this year.

Gone are the growing pains of the last four years, when investment boom abruptly went to bust. That includes the bankruptcy and effective liquidation of SunPower Inc, at one time the US leader in rooftop solar. That earnings-free company liquidated at zero but has been resurected to torture investors, losing -11% year to date and is once again in violation of Nasdaq listing rules.

Rather, the companies leading this year’s charge have real earnings. And investors are slowly but surely waking up to their resilience. They’re profitable and can grow without subsidy.

Contrast that to nuclear power developers like NuScale (NSDQ: SMR) and politically advantaged Oklo Inc (NSDQ: OKLO), which won’t have a commercially available product for years at best, let alone earnings. Those stocks caught a huge buying wave in the first half of the year but have lost nearly half their value since mid-October. And if the flow of subsidy ever lets up, neither will last very long.

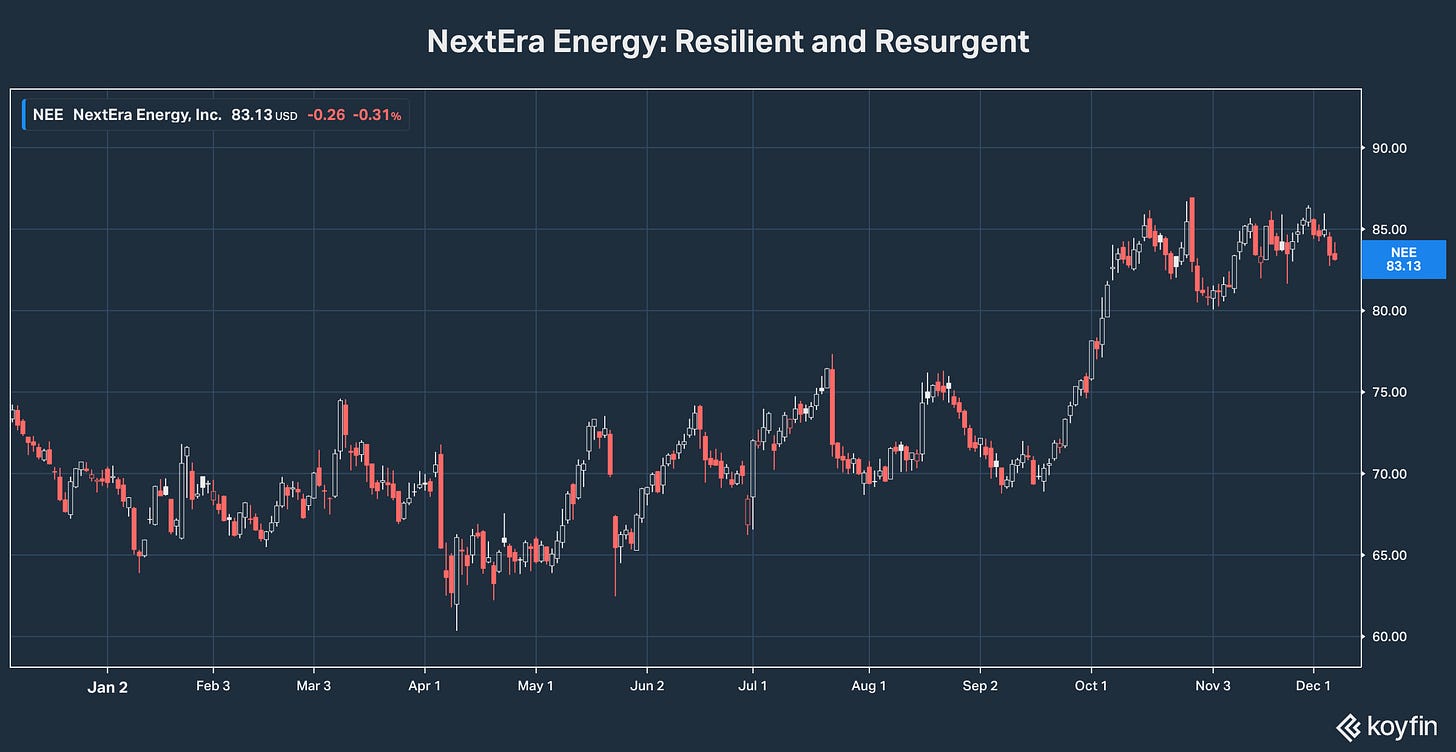

Will green energy stay hot in 2026? The answer almost certainly will depend on what stocks you choose. But Q3 results and guidance showed leading renewable power companies like Brookfield and NextEra Energy (NYSE: NEE) are basically signing on all the business they can handle, particularly from Big Tech firms anxious to lock in power supplies for data centers.

Just proving resilience is already having a positive impact on these companies’ share prices. And I look for more when they release Q4 results, starting with NextEra in late January.

Natural gas is in a bull market. And it’s powering our recommended stocks in Dividends Roundtable sister advisory on Substack, The Energy Bulletin.

Still largely unrecognized is the fact that rising gas prices greatly increase the attraction of wind and solar energy—mainly because there are no fuel costs for either and therefore no direct exposure to volatile commodity prices. That fact certainly hasn’t been lost on Big Tech, which is paying up for nuclear and hydro but also renewable energy.

The cost of renewable energy—still tax advantaged paired storage in particular—is still dropping rapidly globally, even as technology advances. And that’s now happening even inside America’s unprecedented tariff walls, as FirstSolar and others ramp up domestic production.

Finally, results of elections held in 2025 demonstrate once again how US politics can turn on a dime. Democrat landslides in New Jersey and Virginia couldn’t be more bullish for green energy in those states. And the possibility of a pro-green US House of Representatives re-extending wind and solar tax credits a year from now no longer seems far-fetched.

I’d argue the resurgent leaders don’t need the subsidy. In fact, they may not even want them. But any hint of things moving in that direction would undoubtedly be a massive upside catalyst for a group of stocks many investors abandoned this year. And with few still expecting such as turn of events, there’s little risk to betting on companies already on track to grow no matter what Washington does.