Resolution 2025: Keep Your Politics Off Your Portfolio

Even the most supportive policies don’t guarantee investment returns.

Thanks for reading Dividends with Roger Conrad! For more in depth analysis and top quality investment recommendations, please consider a trial subscription to Dividends Premium. You’ll receive my Actively Managed Income and Growth Portfolio, including the January issue posted last Friday. Later this week, you’ll see Dividends Premium REITs. And all subscribers have 24/7 access to Dividends Roundtable, which I host on the Discord application.

Upgrade options are highlighted in this email and in the Substack application. Hope everyone is having a nice holiday weekend!—RC

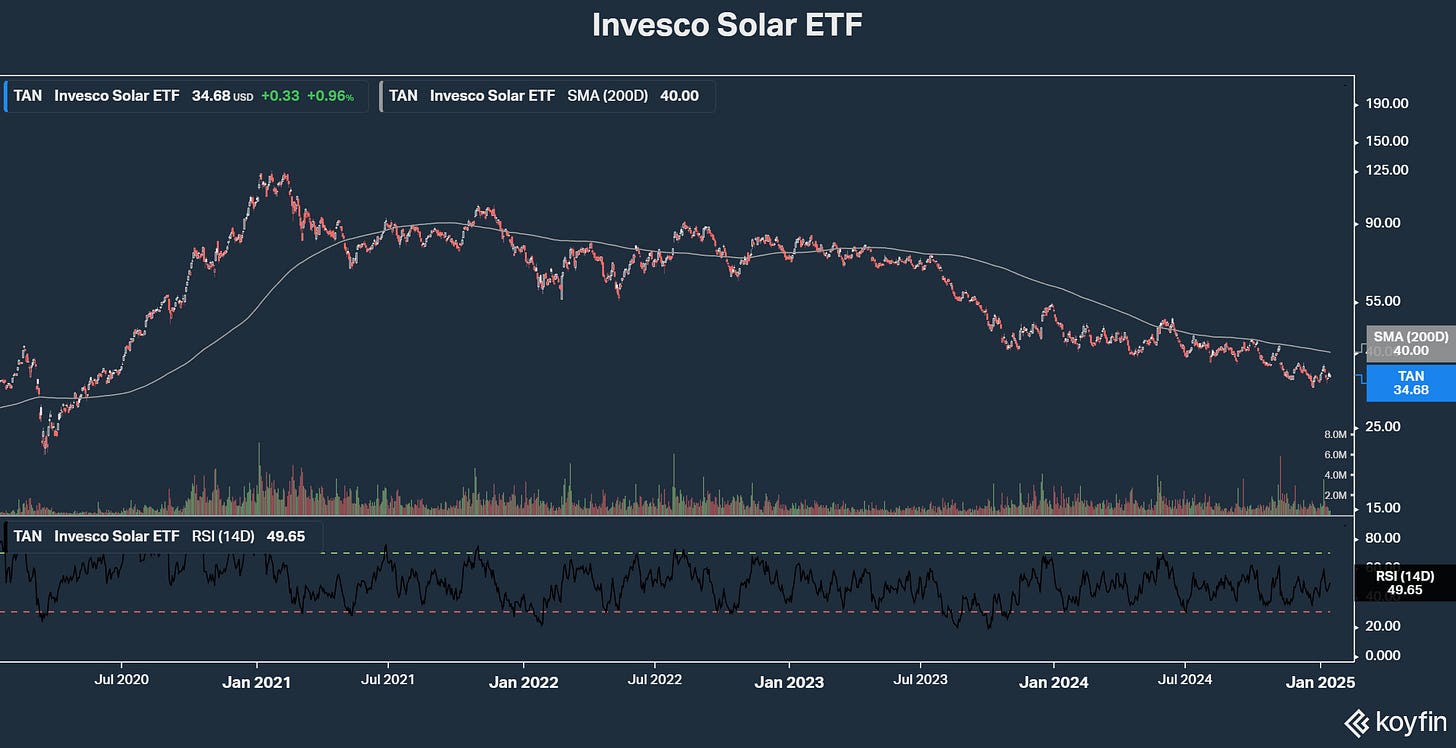

Biden Administration policies could hardly have been more favorable for American renewable energy development. But you could hardly have picked a worse time to buy the Invesco Solar ETF (NYSE: TAN) than Inauguration Day 2021.

That week in January, the ETF peaked at a price of around $125, a roughly six-fold gain from its March 2020 low. But four years later—with Biden about to leave the White House—Invesco Solar sells for less than $35 per share, a decline of more than -70 percent.

And many individual solar stocks have fared far, far worse. Four years ago, for example, SunPower was the leading rooftop installer and service provider in the country. And to many investors, having Joe Biden in the White House meant the sky was the limit for the company’s prospects.

Four years later, however, SunPower no longer exists. Solar panel costs plunged and efficiency advanced by quantum leaps. State and federal tax credits provided unprecedented incentive for homeowners and businesses to install panels.

But despite those advantages, SunPower management never figured out a sustainable business model, where rising sales would translate to greater profitability. And when rising interest rates choked off access to cheap credit in 2022-23, the company found itself snared in accounting irregularities—finally forcing it to liquidate by selling assets to the highest bidder.

If you’re interested in more detail on why SunPower and the rooftop solar business model failed, then I suggest checking out Nate Conrad’s still available “New Energy Future” articles and his nPowered posts, which focus on aspects of artificial intelligence. Both columns are available on Substack.

But suffice to say many other factors besides Biden’s very favorable policies have affected the fortunes of SunPower and other rooftop solar companies. And they ultimately proved far more important for investor returns than politics.

The counter example during the Biden Administration was the oil and gas sector. Government policy introduced unprecedented regulation on the industry, including an effective ban on new permits to drill on federal land. Yet Biden leaves office with US oil and gas production hitting new records. And the sector was the absolute top performer for investors during the last four years as well.

I’ll also mention that renewable energy stocks were the top-performing sector under the first Trump Administration, while oil and gas were among the very worst. But you get the point: Just because a government policy changes doesn’t meant investors should react.

More often that not, there are other factors with far greater impact on returns. And investors who focus on politics run the risk of overlooking them, until its too late.

Now I’ll admit it’s quite difficult right now to ignore politics’ impact on investment. Clearly, politics have been roiling investment markets since November election results were known.

And this is hardly unusual. It was the case in the weeks before Biden took office four years.

Uncertainty about what policies will be adopted and how they’ll affect industry hits a peak. And to say the least, President-elect Trump has been more loquacious than most before entering office about what he might do.

The result has been a mad scramble by investors great and small to get positioned on the “right” side of what’s likely to come. And the vast majority of the politics-based bets they’re making not only won’t pan out. They’ll leave big holes in portfolios that will be hard to recoup later on.

The energy sector is already providing a pretty good example of the dangers of following politics based investing under Trump 2.0.

The narrative following the election was Trump’s “drill baby drill” policies were bearish for energy companies. Mainly, they’d inevitably lead to over production and oversupply of oil and gas, cutting prices. And that in turn would undermine companies’ profitability, sending their stocks crashing.

What the sellers somehow overlooked was the US doesn’t have a national oil company. Decisions to produce or not are up to investor-owned companies, which put shareholders first. And that rules out turning a wrecking ball on earnings, dividends and share prices just because government policy has changed.

Shale producers are pumping oil and gas at record levels because it’s profitable to do so. They may raise output further with the right incentive. Higher prices would be the surest to get action. But companies may also increase output if government cuts taxes and regulation enough to have a meaningful impact on development expense—or permits more LNG exports. And natural gas use to generate electricity is also rising to meet demand from re-shoring industry, electrification of transportation and artificial intelligence-enabled data centers.

What won’t happen is companies producing more if management perceives profitability at risk. They’ll instead devote the free cash flow to stock buybacks and paying higher dividends.

Realization of that is now sinking in with investors. And the result is stocks of the stronger oil and gas companies are coming off their lows, with more gains in store.

But there’s a far bigger “Trump trade” setting up investors for disaster: It’s based on the thesis Trump Administration policies are inevitably going to accelerate inflation, in turn forcing the Federal Reserve to pivot once again from cutting to raising interest rates.

That narrative really gained steam in mid-December when the Federal Reserve surprised investors by forecasting just two quarter-point cuts in the Fed Funds rate for 2024. And economists and Wall Street analysts have been hard at work in recent weeks calculating just how much inflation will be caused by trade tariffs and tax cuts that aren’t matched by real reductions in government spending.

This is the case of a lot of very smart people not seeing the forest for the trees. Mainly, higher inflation is precisely the opposite of what President-elect Trump has promised Americans. And getting the blame for re-igniting inflation—that December PPI and CPI figures show is still decelerating—is probably the surest way to turn him into essentially a lame duck, even before his full cabinet is in place.

You heard it here: The new administration will quickly jettison any policy that’s a risk to reaccelerate inflation, if they haven’t already. And as investors wake up to that reality, the damage to dividend stocks of the past two months will reverse with a vengeance. It’s time to build positions in top quality companies with high yields.