The Stocks That Can Take a Punch

4 forecasts for a politically volatile 2026

Editor’s note: I hope everyone is having a very happy holiday season so far. Here’s my last Sunday post for 2025.

And here’s to a prosperous 2026 for all of us!

-Roger

The Big 7 Tech stocks were already historically expensive and overweighted in when 2025 began. Nonetheless, they led the S&P 500 to new heights, and by extension most investors’ portfolios.

The Federal Reserve cut its benchmark Fed Funds rates three times, bettering the forecast of two it issued in December 2024. Yet, long-term interest rates that set borrowing costs for business and consumers have stayed higher for longer.

Combined with the longest-ever US government shutdown and supply chain disruption, investment contracted across multiple sectors. And that added to signs of weakening employment.

Income investors got a boost as utilities and other power companies were suddenly “discovered” as the “picks and shovels” of the artificial intelligence gold rush. The AI theme also began to benefit natural gas producers, as did increased activity to build LNG export infrastructure on the US Gulf Coast.

And renewable energy stocks surprised many investors by massively outperforming oil and gas shares: The Invesco Solar ETF (TAN) has gained more than 50% year to date, versus barely 3% for the SPDR Energy ETF (XLE) and -3% for the Alerian MLP Index.

Real estate investment trusts had a mostly forgettable year. Expansion slowed and several sectors showed weakness in rents and occupancy. And Wall Street forecasts of more weakness ahead for 2026, triggering a late year selloff (and a major buying opportunity) in many names.

Dividends Roundtable Forecast #1 is increased investor interest in dividend investing next year. The Fed’s downward push on short-term interest rates is triggering a corresponding decline in money market yields as well as for other cash alternatives. And with the S&P 500 and other big capitalization averages looking more vulnerable than ever to a real correction, it’s likely we’ll see more buying of stocks that can take a punch.

In my view, the iShares Select Dividend Index ETF (DVY) would have topped the S&P 500 in 2025—rather than lagging it by almost 7 percentage points—but for two factors. The ETF is hamstrung by the fact it can only hold meaningful amounts of very large capitalization stocks. And the index managers are constantly shuffling what’s inside.

Not every stock in the Dividends Premium portfolio is higher on the year. But with just 3 trading days left in 2025, on average they’re up about 34%. And that figure has been steadily rising the past few weeks.

Much of that gain was produced by stocks that had lagged in 2024. Dividends Roundtable Forecast #2 is many of this year’s portfolio laggards will be leaders in 2026. And any stocks I add next year will also be currently out-of-favor high quality companies.

Dividends Roundtable Forecast #3 is long-term interest rates will at least start to follow short-term rates lower in 2026. That would not just increase the relative appeal of companies paying safe, generous and rising dividends. It will also accelerate earnings and dividend growth by allowing many to finance their growth more cheaply.

That’s another good reason to bet on dividend paying stocks next year. But it’s also far from a sure thing in an environment of elevated inflation expectations.

The limited amount of government economic data released since the shutdown ended indicated inflation is moderating. But that hasn’t done much to quell investor expectations for higher inflation. And Exhibit A is the price of gold, which for the first time ever is over $4,500 an ounce.

I continue to believe the Trump Administration would jettison any policy that increases inflation pressure enough to spook the stock market. But inflation is already a major concern on Main Street. That much is clear from the landslide victories won by Democrats in voting this past November—especially in Georgia’s two state-wide elections for Public Service Commission where affordability was a major issue.

Gold’s continuing surge is a clear sign inflation worries have spread to investment markets. And while there hasn’t been much if any inflation-related selling pressure on stocks yet, if could pick up steam if, for example, the president names a new Fed chairman who lacks Wall Street’s confidence.

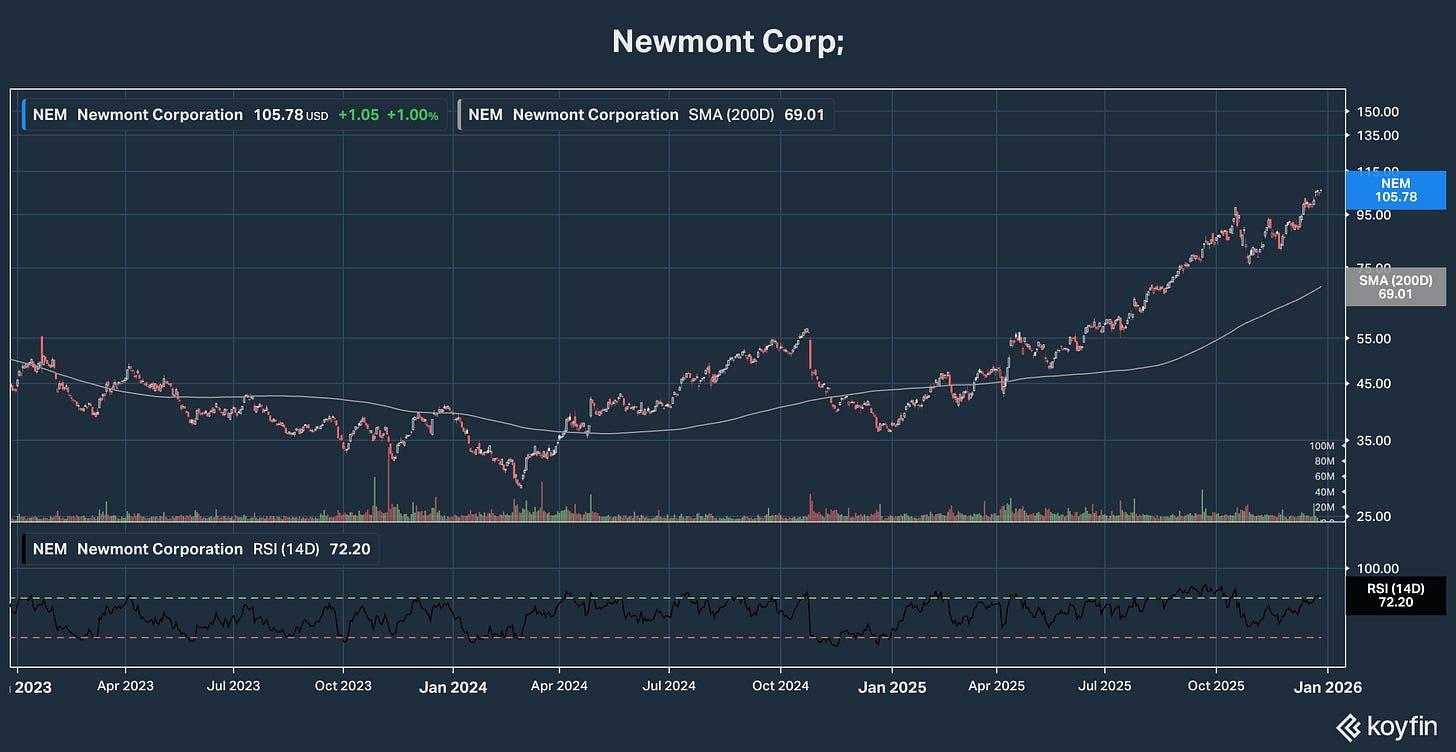

I don’t think that will happen. But the Dividends Premium portfolio is prepared. First, we own several stocks that are big time inflation beneficiaries, for example gold miner Newmont Corp (NYSE: NEM). And the rest are dominant companies in their industries. That means they have pricing power to push on added costs to customers, including import taxes/tariffs.

Dividends Roundtable Forecast #4 is more companies will take hits from aggressive Trump Administration policies.

If anything, 2025 proved once again that investing strategies based on politics generally end in disaster—mainly because government policies frequently have a wildly different impact on investment returns than their proponents intend.

The Trump Administration hasn’t been shy telling the private sector how it ought to do business. And few if any industries have seen more aggressive politics-based intervention than energy.

The order to suspend work at five nearly complete offshore wind projects—three days before Christmas—is only the latest example. The Administration couched the move as a reasonable timeout to review national security concerns. But their statements make clear this is just a new tactic in the president’s “War on Wind Power,” which their lawyers believe will be more difficult to challenge in court.

The order directly affects Dividends Premium stock Dominion Energy (NYSE: D), which needs the 2.6-gigawatt capacity Coastal Virginia Offshore Wind (CVOW) facility to meet soaring demand from AI-enabled data centers. Yet the stock closed Friday basically where it was before the stop work announcement.

How? Because as I pointed out in my post last week, Dominion is a strong company that can take a punch. It’s also much less exposed to CVOW risks than it appears at first glance. Its share of already incurred costs is now absorbed into utility rate base, with private capital partner Stonepeak bearing the other 50%. The company has its own construction vessel ready to go when work resumes. And a pending US Supreme Court ruling could knock $240 million off the now $10.8 billion projected total cost.

That’s the merit of owning strong companies. But the Administration’s War on Wind sounds a clear warning for investors to be prepared for political risk in 2026. The Trump Administration didn’t invent big government. But as aggressive as any federal authority in a while. Stick to companies that won’t fall apart if they’re targeted.