The China-Sphere is Open for Business

Forget tariffs and trade wars. Opportunity still abounds in Asia.

Editor’s note: My jetlag-delayed post highlights investment-related thoughts from my past two weeks in the China-sphere. Hope you find them useful. Thanks for reading!—RC

With nearly 40% of combined global GDP, US/China is the world’s indispensable relationship. That remains true despite nearly a decade of attempts to “de-couple” by geo-politicians in both countries, which have created stubbornly high inflation in the US and depressed growth in China.

In the first year of the Trump Administration’s return to power, historically high tariffs, counter-tariffs, trade barriers, embargoes and mutual threats have affected nearly 100% of bilateral trade. Yet even the most casual traveler to the China-sphere will have a hard time not noticing American presence.

That now includes the US casino industry’s biggest profit center: The former Portuguese colony of Macau in southeastern China, now a special administrative region” of the country.

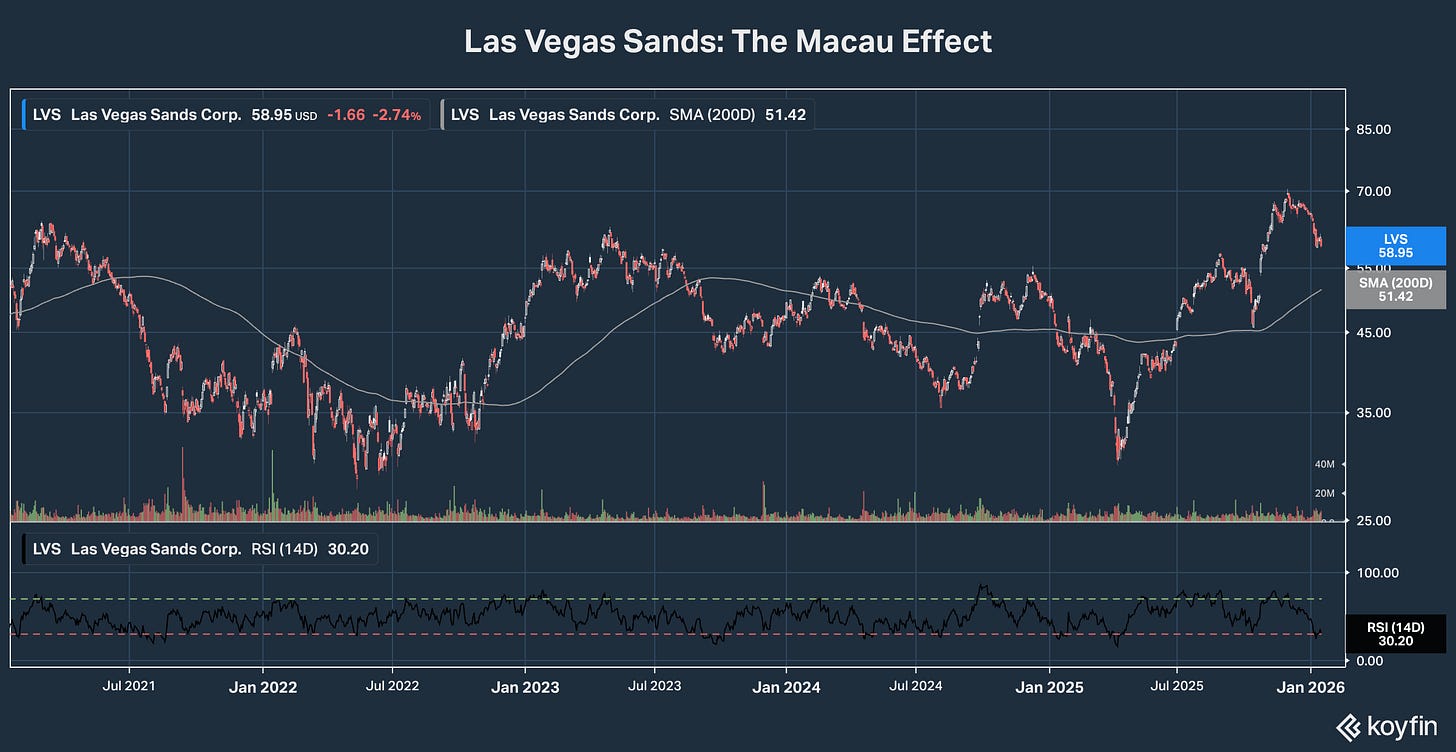

Las Vegas Sands Corp (NYSE: LVS), for example, has five highly profitable properties in Macao, which contributed 58% of its overall revenue in the first nine months of 2025. That figure was over 50% for Wynn (NYSE: WYNN) and more than 20% for MGM Resorts (NYSE: MGM).

Credit rater Fitch reports US gaming companies contribute “around 80%” of Macau’s tax revenues. That’s no doubt a major reason government relations appear constructive for the sector, which continues to execute major plans for “non-gaming” expansion. Facilities last year, for example, hosted NBA basketball games after a six-year league absence from China.

According to igaming.org, Macau casino revenue hit a post-pandemic high in 2025. And anecdotally at least, the big players look set up for an even better year in 2026. That’s even as US operations particularly in Las Vegas deal with worries about expanding competition and a softer economy.

Unfortunately, neither Las Vegas Sands nor Wynn currently pay much in the way of a regular dividend. But Wynn paid four times its current rate as recently as March 2020, while Sands’ payout was 3.2 times higher. And thanks to in large part to growth of Macau operations, those dividends are on the rise again—Sands has raised its quarterly dividend 20% for calendar year 2026.

VICI Properties Inc (NYSE: VICI) is a real estate investment trust with indirect exposure to Macau operators. It yields north of 6%. I track it in Dividends Premium REITs. Look for the January issue later this week.

The first thing I noticed setting foot into Macau casinos is just how much newer and shinier they were than their rivals in Las Vegas. And the same thing is true about basic infrastructure throughout the China-sphere.

If you’ve visited the region recently, I’m not telling you anything new. But as an American there for the first time, I found the contrast with the condition of infrastructure in most of the US and Europe particularly striking, even shocking.

Lines moved rapidly and planes left on time in busy yet comfortable airports. Train and bus systems like Taipei’s were inexpensive, extremely accessible and stuck to schedules. So did the high-speed “turbojet” ferry linking Macau to Hong Kong. And though sometimes congested, keeping roads, tunnels and bridges safe and in good repair is clearly a priority.

Bottom line: Infrastructure spending has been and continues to be top priority in the China-sphere. It provides support to the economy when growth slows. And it boosts basic efficiency and productivity by getting people from one place to another reliably.

China is the world’s largest electric vehicle market. And for the first time, national champion BYD (OTC: BYDIY) outsold Tesla Inc (NSDQ: TSLA) on global markets in Q4 2025, an advantage that may widen with Canada dropping tariffs.

China has massive incentives to promote EVs over ICEs—internal combustion engines. That includes health costs from smog affecting increasingly vertical cities with constrained horizontal space like Hong Kong as well as national security concerns from being the world’s leading oil importer.

Nonetheless, ICEs aren’t going away any time soon, still accounting for nearly half of new vehicle sales and the vast majority of cars on the road. And that means China is going to remain a mainstay of global oil demand for a long time to come.

The country’s EV makers like BYD, however, will continue to innovate and boost global sales and earnings. And advances in battery technology continue to reduce costs and improve efficiency, including prototypes with demonstrated driving ranges of up to 400 miles and charging times of 5minutes or less.

The China-sphere’s efforts to promote “circular” economics get considerably less attention. But they’re potentially a far bigger market in a country with an urbanization rate of over 80% according to the United Nations and nearly 70% as tracked by the Chinese authorities.

Dense populations have to get control of their waste. The idea behind circular economics is to reduce, re-use and recycle what would otherwise wind up in landfill. And the result of 20 plus years putting that into practice in the China-sphere—including Taiwan—is such things as smaller and more efficient packaging and greater division of materials when thrown away to boost recycling efficiency.

As an American visiting Taipei, I was struck by the lack of trash receptacles in public places. And staying at an air B&B, we separated our waste into multiple categories and set it out for collection at designated times.

One notable upside of this added effort is there are far fewer places to attract vermin than in US cities. But the additional time and effort needed to effectively keep track of waste is also arguably a powerful incentive to minimize it in the first place.

Chemicals are a sector where circular economics are just beginning to be a major profit center. That’s both for creating more waste-efficient products and for cutting feedstock costs. And at the center of global development is LyondellBasell Industries (NYSE: LYB).

The benefit to earnings of company investment in circular economics—including opening a second major chemicals recycling facility in Germany—is currently masked by general weakness in the sector. That’s likely to be the case in Q4 results released earlier this month. And the dividend is at some risk. But as the cycle inevitably shifts positive, the company will have a pole position in the fastest growing part of this business.