The Truth About Tariffs

For investors, the question isn’t whether tariffs are good or bad, but who benefits.

Thanks for reading Dividends with Roger Conrad! If you’ve been enjoying my column on a regular basis, I encourage you to find out more about my Dividends Premium service.

Last week, I posted my latest model income portfolio. And later this week, I’ll be releasing the February Dividends Premium REITs. I also host a members-only investor forum 24-7 on Discord called Dividends Roundtable. There’s subscription information in this email as well as in the Substack application. Hope you’re enjoying your Presidents’ Day Weekend!—RC

Over the past week, a number of friends have asked me if trade tariffs have ever worked. And as an investment advisor the past 40 years—as well as a continuing student of history and economics—it’s been important to me to have solid answers.

Unfortunately, what I’ve wound up saying reminds me of the old joke of the one-armed economist—forced to give a definitive answer because they’re unable to say “on the other hand.” But the reality is my friends are asking the wrong question.

It’s not that tariffs are “good” or “bad.” Rather, it’s all about whom they help and hurt.

President Trump and whoever else is running US government economic policy are obviously feeling pretty free about announcing new tariffs. They’re one of the things the president can do without consulting Congress, which in recent years has basically abdicated power to the executive branch on trade matters.

The president can’t unilaterally enact new trade agreements without Congressional approval. And by the US Constitution Congress, not the executive branch, must approve any change in taxes.

But in recent years presidents have claimed extensive authority over US trade policy under national security legislation. In his first term, Trump took it far further than any chief executive previously, particularly against China—then America’s largest trading partner. And the Biden Administration doubled down on trade barriers, slapping on new tariffs of their own.

Now we have Trump 2.0. And it seems likely we can count on more tariff announcements in the coming weeks on imports from America’s largest trading partners.

Let’s be clear about two things regarding tariffs: First, they’re taxes paid to governments. Second, they’re always paid by some combination of consumers and businesses in the countries that impose them.

If businesses have pricing power, consumers will pay the lion’s share, meaning they’ll have less money to buy something else. If businesses can’t pass on the costs, they’ll have to eat them, which means they’ll have less money to invest, employ workers, reward investors and so on.

I would argue the US/China trade relationship since the early 1980s is the single biggest wealth-creator in human history. Hundreds of millions were lifted from poverty in China. Americans enjoyed unprecedented access to low cost products, as inflation remained tame for decades. And the two countries reached a combined 40 percent of rapidly growing global GDP.

Conversely, the tariffs wars of the 1920 and 30s prolonged the Great Depression and likely made World War II inevitable. And while fledgling US industry was arguably shielded by tariffs of the early 1900s, that was also a time of crushing poverty for farmers and factory workers.

Trade creates wealth. And tariffs and other barriers that restrict commerce are—in the aggregate—wealth destroyers.

That’s not just Economics 101. It’s basic common sense. If I can buy something cheaper, I have more money to spend or invest elsewhere. I’m wealthier. And with more funds to deploy, I can boost other businesses’ sales, which means they can invest and hire. It’s a virtuous cycle.

For example, buying tariff-free Chinese solar panels at one-third the current US price means a power company could install three times as much capacity for the same price. More likely, management would use the savings to diversify its power stack with natural gas and possibly even nuclear plants. But now they pay more, which means less money to invest in new supply of electricity—and therefore higher prices.

On the other hand—sorry, there I go again—manufacturing is re-shoring to the US as never before. Some of that’s motivated by making supply chains more secure, following the shocks to the system from the 2020 pandemic. And it’s encouraged by tax credits and direct federal subsidy, namely the Inflation Reduction Act and Chips Act passed during the Biden Administration to encourage US sourcing.

But it’s also crystal clear that tariff avoidance has become a major driver of re-shoring. And management teams across multiple industries used their Q4 earnings calls to highlight US-based, “tariff proof” supply chains.

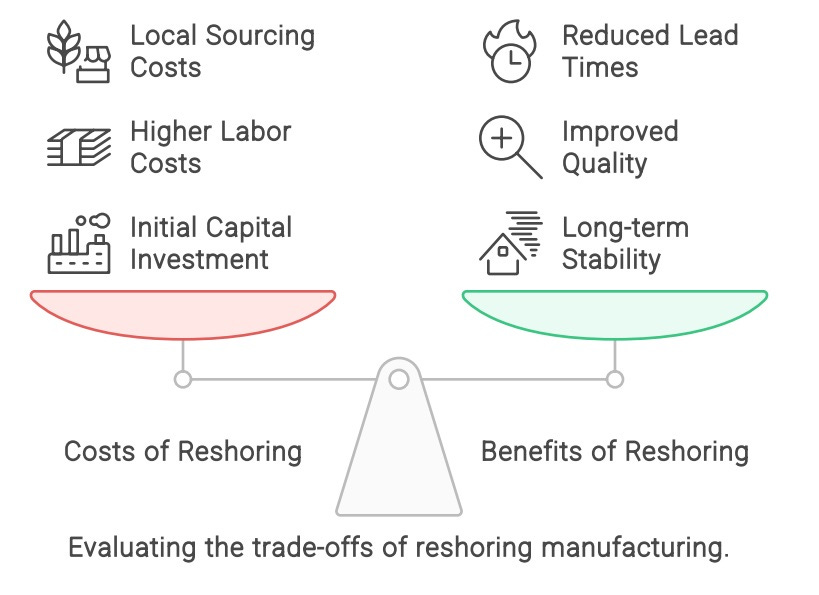

Local sourcing is not cheaper than the global supply chains it replaces. Wages and ongoing costs are higher than in former countries of production. And heavy automation means not as many factory jobs are created as some might think. Then there’s the needed investment to build factories at a time of still high inflation and interest rates, with government subsidy and tax credits only offsetting so much.

Nonetheless, there are clear re-shoring winners. And at the top of the list are US utilities, electricity generators and the entire natural gas value chain.

Quite a few companies haven’t yet reported Q4 results and updated guidance. That’s because end-year financial filings require more disclosure than ever—ultimately good for us investors though we do have to wait longer.

But we’ve already seen plenty to conclude energy companies are ramping up investment to meet the hottest demand growth since the 1960s—with reshoring a huge driver. And well-placed companies will enjoy rising earnings, dividends and stock prices—even as tariffs bite other businesses and American consumers in general.

It’s key for investors to seek other businesses that stand to benefit from a period of higher tariffs. Altria Group (NYSE: MO) comes to mind with its iconic Marlboro brand and growing smokeless product sales likely to face less competition. And taxes on imported solar panels will continue to enrich First Solar (NSDQ: FSLR) behind the tariff walls.

We’ll also want to keep an eye on retaliatory tariffs other countries impose on US companies. China’s 15 percent tax on US exports of LNG and coal, for example, are advantage Canada. The LNG Canada facility is gearing up for first exports later this year, and with a far shorter supply route to Asia than the US Gulf.