Why Trump Won’t Kill Offshore Wind

Proving economics will weather the political headwinds.

Thanks again to our Dividends Community for giving me the chance to serve your investment needs. I trust everyone by now has had time to check out the November issue of Dividends Premium, including our new portfolio addition.

You can expect to see your next issue of “Dividends Premium REITs in the next couple weeks, along with information about how to use our Dividends Roundtable. And thanks especially to our Founders Circle members (still a few memberships left).

To find out more about Dividends Premium, please check out the upgrade options highlighted in this email, as well as in the Substack app. Thanks for reading!—RC

When technical issues are politicized, investment falls and prices rise.

Germany’s decision to shut down nuclear plants just as Russian natural gas supplies were cut stands out as a particularly dysfunctional case. But there are plenty of examples in America where perhaps well-meaning sentiments have sowed energy chaos.

This winter, for example, New England will import record volumes of expensive LNG—liquefied natural gas—just to keep the lights and heat on. That’s despite cheap Canadian hydropower and Appalachian natural gas just a couple hundred miles away. And it’s the result of years of state policies and lawsuits blocking new natural pipelines and electric transmission lines on environmental grounds.

New England has also shut down almost all of its nuclear power plants in recent years. In fact, only Dominion Energy’s (NYSE: D) Millstone and NextEra Energy’s (NYSE: NEE) Seabrook are major still sources of generation.

The result: New Englanders pay a great deal more for energy than the rest of the country does. So does California, now forced to pay a premium for electricity from natural gas peaker plants operated by companies like Clearway Energy (NYSE: CWEN) and for PG&E Corp (NYSE: PCG) to keep the Diablo Canyon nuclear plant operating—as its massive solar generation fleet must rely on batteries when the sun sets.

It’s fair to say “green” energy politics got these states to this point. And the sentiment behind them are strong as ever: That America needs a 100 percent electrified economy powered by renewable energy to combat climate change, and that aggressive government action the only way to get there.

Ironically, government’s most effective spur to renewable energy development—the Inflation Reduction Act—is not only source agnostic but relies wholly on industry to take action. But the driving force at regulatory agencies in the Biden era, especially the Environment Protection Agency, has been to tighten the noose on the oil and gas business.

EPA and other agencies are reportedly trying to “Trump proof” many of these rules, or at least make them impossible to remove quickly and easily. But it’s a safe bet many rules will be dumped, opening up new opportunities to invest in growing businesses like LNG exports.

What remains to be seen is if the incoming administration will put new restrictions on renewable energy as the Biden administration did fossil fuels. That speculation stems from campaign statements, especially regarding offshore wind power supposedly being both “dangerous” and “expensive.”

The new administration could freeze permitting on federal lands for new wind and solar. And an even more aggressive tariff regime could increase the cost of imported components such as wind blades and solar panels, though the extremely high levels already in place haven’t slowed investment.

Republicans in Congress will theoretically be in position to repeal the IRA, though 18 GOP members of the House are on record this year requesting the speaker not do so. And outright repeal would likely end any hope of the nuclear renaissance favored by both parties, as losing tax credits would make 0dozens of operating nuclear reactors unprofitable to run.

Nonetheless, Wall Street is definitely pricing in tougher times for any stock associated with to renewable energy. The exception is shares of US electric vehicle leader Tesla Inc (NSDQ: TSLA), since CEO Elon Musk will apparently take on a major role in the new administration.

Mr. Musk’s ties to the new president may be an early indication that policy will focus more on encouraging investment in energy, rather than picking favorite sources to the detriment of renewables. But let’s go ahead and assume the worst case of repealed tax credits and restricted permitting. Even then, the Trump administration would not be able to kill offshore wind development in the US.

The reason: After a tumultuous few years with soaring interest rates and inflation jacking up costs and forcing contract cancellations, the US offshore wind industry is at last proving its cost economics. And projects now under development are literally the only way to meaningfully lift electricity supply to the Northeast in the next five years.

Avangrid’s (NYSE: AGR) Vineyard facility has been profitably selling power to the New England grid since spring. But the industry’s real emerging success story is Dominion Energy’s (NYSE: D) Coastal Virginia Offshore Wind.

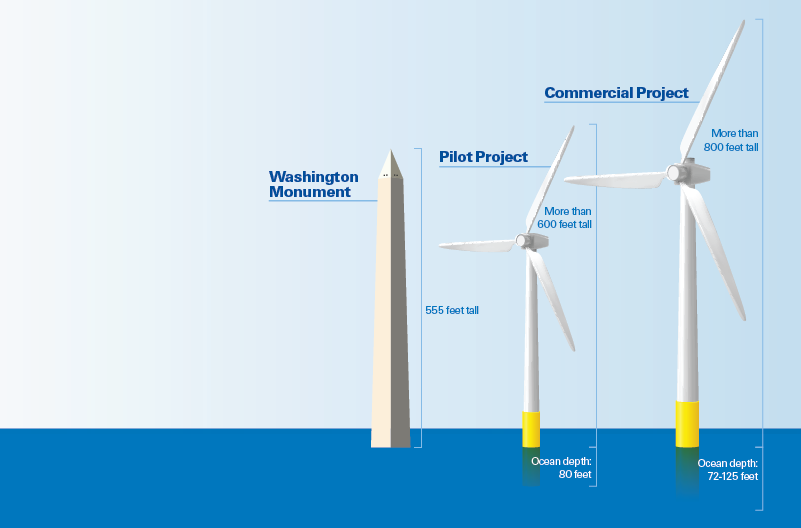

With planned capacity of 2.6 gigawatts, CVOW is more than four times the size of Vineyard. Now 43 percent completed, it’s still on track to “complete construction in late 2026.” And the project is “on-budget,” with 94 percent of costs fixed and the rest heavily reserved.

Best of all, Dominion has cut CVOW’s projected “levelized cost of energy” (LCOE) to just $56 per megawatt hour. That’s down from the previous estimate of $73 per MWH and well below the “prudency” limit of $78 set out in the company’s agreement with Virginia regulators.

There’s still work to be done, starting with taking delivery of the construction ship Charybdis early next year. The company has another season in 2025 for installing monopiles at facility foundations. And with onsite activities curtailed for Right Whale migration, Dominion is focusing on installation of the first offshore substation, export cable lays and onshore transmission construction.

Lack of progress on any of these activities could push LCOE higher. But right now, CVOW’s all-in cost is competitive with the least cost natural gas and solar facilities. And it’s barely one-third the least cost estimate for nuclear plants.

Compelling economics enabled Dominion to close the sale of a 50 percent ownership stake in CVOW to private capital firm Stonepeak last month, well ahead of schedule. And it’s clearly made believers of Virginia regulators, as well as the state’s Republican governor and attorney general.

Dominion also plans to rely heavily on solar, natural gas and nuclear to meet projected regional electricity demand growth. But with data center demand rising from 16 GW in 2023 to “over 21 GW” this year, CVOW and its potential 800 MW expansion are a critical piece of its Integrated Resource Plan.

Unlike the other 12 plus GW of currently permitted US offshore wind projects, Dominion’s CVOW is in regulated rate base. But demonstrating successful offshore economics the next couple years make the company a compelling example to follow for all in this “all of the above” energy world—as well as an increasingly hard target for energy politics to disrupt.