Utilities in the Eye of the Hurricane

How well companies respond to Hurricane Helene devastation will have a major impact on their customers and investors alike.

Depending on the meteorologists you follow, Hurricane Season 2024 probably has another month to run. Tropical Storm Joyce and Hurricane Issac aren’t yet deemed a threat to land but are still churning in the central Atlantic. And two other storms identified by forecasters could develop next week.

Hurricane Helene, however, has clearly been in a class by itself.

Late Thursday, Helene came ashore as a Category 4 storm, thrashing Florida’s Big Bend area with 140 mile/hour winds. And as is always the case, the worst effects have been from flooding, now gauged the worst in at least a century for many areas.

By early Saturday, the storm’s effects had extended as far north as Indiana. At least 52 people have been killed, multiple dams stressed and roads shut down, including critical east-west freight artery I-40. Commercial forecaster AccuWeather Inc estimates eventual Helene losses between $95 and $110 billion. And with a federal emergency declaration in effect for six southeastern US states, damages could wind up even higher.

Whenever a devastating storm hits, responders’ first concern is always safety. Very soon after that, it’s restoring electricity service for vital services like running hospitals, traffic lights and other key infrastructure. But for electric utilities, the clock starts ticking almost immediately to get the lights back on for businesses and consumers. And the longer it takes, the more likely companies will face devastating backlash from the public that regulators and politicians simply can’t ignore.

On July 14 in the aftermath of Texas’ Hurricane Beryl, I posted “Storm Battered Utilities Need a Break,” with the tag line “and despite some angry words, regulators are likely to give them one.”

At the time, Houston utility Centerpoint Energy (NYSE: CNP) was coming under heavy scrutiny for allegedly poor preparation and response to Beryl. At the storm’s peak, 2.3 million people were in the dark on Texas’ Gulf Coast, despite the storm coming ashore as less than a Category 1. And state politicians were all too happy to feed into that popular anger during an election year, threatening investigations, fines and lawsuits.

I think it’s highly unlikely post-Beryl outrage will last long enough to seriously threaten Centerpoint’s health. Texas regulators are likely to accept the utility’s already launched $5 billion hardening plan against future storms. And the company has taken the highly unusual step of not seeking any return on the investment, making its plan far more palatable to regulators.

Still, Centerpoint is a cautionary tale for the utilities affected by Helene. By rights, Helene’s massive devastation should buy the companies some time before public anger starts brewing. But the longer large numbers of people are off the grid, the more stories we’ll see popping up in the media charging utilities were not well prepared. And the risk will grow that anger will boil over into demands for governments to take punitive action.

Entergy Corp’s (NYSE: ETR) response to Hurricane Francine earlier this month is a more hopeful example. The utility’s response to Hurricane Ida a couple years ago was widely attacked for alleged poor preparation and response. But this time, the company restored power to almost all the 500,000 affected customers in a few days. And system infrastructure proved considerably more resilient as well.

That didn’t wholly mollify affected residents, whose angry views some in the press were eager to amplify. But by any measure, Entergy did a far better job of communicating with customers than it did following Ida. And combined with the company’s improved response on the ground, management has largely made its Francine response a positive, rather than a threat to its financial health as Ida became.

That appears to be the case for NextEra Energy (NYSE: NEE). The company’s core southeast Florida service territory was spared the worst of Helene. But the utility was able to restore service within 24 hours to 93% of its roughly 700,000 affected customers.

That follows several years of strong storm response. And NextEra enjoys regulators’ support for aggressive grid hardening, including “smart grid technology” management credited with avoiding another 180,000 Helene-related outages. That investment in turn feeds into rate base, lifting earnings even as storm preparation and response improves every year.

That’s the kind of virtuous cycle that benefits customers and investors alike. But achieving it depends on utilities demonstrating the public is getting something for their money—i.e. greater system resiliency and faster response to storms. And support is at risk every time there’s a major storm.

The two major utilities most on the spot now are Duke Energy (NYSE: DUK) and Southern Company (NYSE: SO). Some 1.7 million Duke customers in the Carolinas lost power at the storm’s peak, along with nearly 700,000 in Florida, 140,000 in Ohio and 20,000 in Indiana.

Duke has said it’s on track to restore power to “approximately” 95% of its Florida customers by the end of the weekend. Restoring service territory in the Midwest is progressing, as it is for other affected utilities such as AES Corp (NYSE: AES).

That leaves the Carolinas as Duke’s major challenge. Helene knocked out power to more than 1.7 million people, mostly in western North Carolina and upstate South Carolina. Flooding has further complicated restoration, with the Catawba-Wateree River Basin considered high risk this weekend. And management’s current guidance for getting the lights back on is still “several days.”

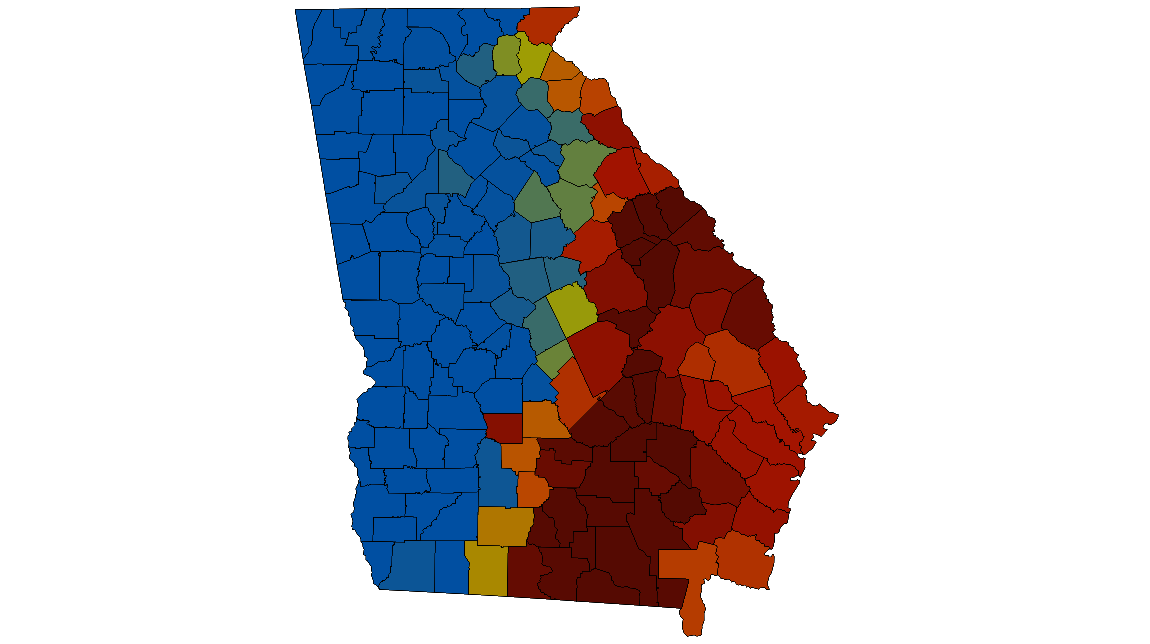

As of Saturday morning, Southern’s Georgia Power utility stated it had restored service to roughly half its nearly one million affected customers. And though still assessing damage, management has issued estimated restoration times in multiple areas.

Of the two, Duke arguably faces the greater geographic challenge, But Southern likely has the most on the line. Georgia customers recently absorbed the last of the rate increases to pay for the two new nuclear reactors at the Vogtle site.

My view of both utilities’ Helene restoration efforts is so far so good. But there’s still much work ahead and the clock is ticking. Investors will do well to pay attention to events on the ground.