Wall Street’s Words on Utilities are Wrong

But actions say differently and are starting to speak louder.

Bloomberg Intelligence reports 20 utility companies in the S&P 500 have released Q1 earnings. Of those, 14 have beaten Wall Street consensus estimates.

That’s against just 3 that underperformed analysts’ projections. And the only utility to meaningfully miss consensus numbers—Entergy Corp (NYSE: ETR)—affirmed it’s still on track to meet full-year 2024 guidance.

Most of the remaining 10 companies to report will do so this coming week. But already, utilities as a sector have trounced expectations of a majority of the people who influence hundreds of billions of dollars of investment in their stocks.

Does it matter? Normally, I’d say no. Meeting management guidance is absolutely critical to investor returns. But how quarterly numbers compare to so-called Wall Street consensus estimates is a remarkably poor gauge of companies’ quality.

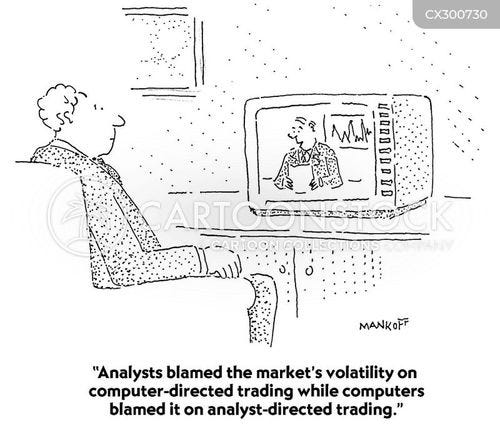

Consensus earnings forecasts are the product of “group think.” That’s to be expected, as most people landing Wall Street jobs these days went to the same schools, took the same classes, had the same professors etc—and thereby learned to think the same way.

That much will be clear to anyone who tunes into companies’ guidance calls and other analyst events: Many if not most questions are essentially the same thing asked a different way.

Throw in the rising use of algorithms and artificial intelligence applications and it’s small wonder there’s little variation in earnings forecasts. And that’s even when there are several dozen research houses covering the same company. Only very rarely will you see an analyst who’s willing to come at things from a different direction.

The tighter the distribution of forecast numbers, the more a “surprise” will cause money to slosh around. But only very rarely is there any follow through to these ups and downs.

That’s because “meeting or beating” the Wall Street consensus is quite literally meaningless to a company’s long-run prospects. And it’s why wiser investors are always on the lookout for over wrought reactions to earnings news. Then they buy the dip or sell the blip, and stock prices settle around where they were before.

But I think this time there are a few reasons for investors to heed utilities’ ongoing “beat.”

First, Q1 results are the latest confirmation that the Wall Street consensus has been dead wrong on utilities and interest rates.

In fact, this is the third consecutive quarter where the Street has anticipated an earnings “Armageddon” for utilities, supposedly to be caused by rising interest rates. And for the third time in a row, it hasn’t happened.

Rather, utilities have stuck to long-term earnings guidance and investment plans. They’ve offset higher debt interest expense with cost cuts elsewhere. And management teams have been indicating in guidance calls that higher for longer borrowing costs are actually helping them gain market share.

On Friday, for example, Brookfield Renewable’s (NYSE: BEP) Vice President of Investments pointed out multiple “renewable power developers and operators were not prepared for a higher interest rate environment.” As a result, they “have seen their business models disrupted” despite “50 percent growth in renewable capacity additions globally.”

Brookfield, in contrast, boosted its Q1 profits by 8 percent, while advancing a target of installing 7 gigawatts of new wind, solar and energy storage capacity in 2024. And the company signed an historic agreement to provide 10.5 GW of new wind, solar and storage to Microsoft (NSDQ: MSFT) through 2030.

Why has Wall Street gotten it so wrong on utilities? One reason is group think that repeatedly underestimates utilities’ ability to access low cost funding. Earlier this year, companies took advantage of a narrowing yield curve to sell long-term bonds at interest rates as low as money market yields. Others have sold non-core assets at good prices without undermining earnings. And tax credits from the Inflation Reduction Act have directly offset borrowing to fund renewable energy and grid infrastructure.

Analysts have also grossly misread the US regulatory environment. The consensus view has been states will focus on “affordability” at time of inflation. So the theory went, officials would balk at rate increases and cut return on equity, rather than raise it to offset the impact of rising interest rates.

That did happen famously late last year in Illinois. But as I noted in my March 10 Substack “When Just Saying No is Bad for Your Health,” utilities in the state have simply shifted their investment to other places offering a better return.

Exelon Corp (NYSE: EXC), for example, effectively shifted investment from Illinois to Maryland. As a result, it’s been able to stick to its investment and earnings growth plan. Illinois, meanwhile, may be getting the message that stiffing the local utility ultimately means less investment and a weaker system.

Exelon has filed a new Illinois grid investment plan two months ahead of schedule with 30% lower investment and customer bill impacts. But regulators last month added $150 million to last year’s rate increase, an apparent olive branch.

Connecticut is another tough environment that may be softening. EverSource Energy (NYSE: ES) has now shifted roughly $500 million of previously projected five-year investment to Massachusetts and New Hampshire. Management stated in the company’s Q1 earnings call that “regulatory policies in Connecticut discourage investment and utility innovation” and that “we cannot move forward to put additional capital resources on the table.”

At the end of the day, however, Connecticut like Illinois has no choice but to treat its local utility fairly, if it wants to attract needed investment to meet aggressive electrification and clean energy targets. And a favorable final decision this spring on an annual rate adjustment mechanism for EverSource may be its first step to repair utility relations.

What will it take for Wall Street to admit it’s been getting utilities all wrong? Don’t count on a formal statement from anyone.

But after lagging the stock market for roughly a year and a half, the S&P 500 Utilities Index and the Dow Jones Utility Average are again moving towards 52-week highs. Wall Street actions may already be speaking louder—and in a different direction—than its words.