What's Behind Rising Rents

I blame the Fed, but its folly is very good news for one investment.

A little over a week ago, Olympic sprinter Noah Lyles collapsed on the track after winning a Bronze medal. That was another grim reminder that Covid-19 is still very much with us. But when Federal Reserve Chairman Jerome Powell blames coronavirus aftershocks for unexpected July “shelter” inflation, his words frankly ring a bit hollow.

First the good news. The government last week reported a year-over-year increase in the Consumer Price Index of 2.9 percent, the first reading of less than 3 percent in several years. And all but one of the Index’ key components is now decidedly in deceleration mode, with further declines strongly indicated.

The exception—housing or “shelter” inflation—however, is noticeably headed higher. That’s at the same time employment data appear to be softening.

The expectation of most economists is still that housing costs will moderate for Americans in the coming months. That’s largely because of new supply coming on the market this year, particularly in the Sunbelt. And they point to data indicating rent growth is moderating, including a year-over-year increase of just 1.6 percent in the RealPage Multifamily Index and a four-quarter change in the New-Tenant Rent Index of -1.1 percent in Q2 from the Cleveland Fed.

Nonetheless, the Fed’s own data show that “primary rents” rose at a 5.1 percent annualized rate through July. The Shelter Index, meanwhile, rose 0.4 percent from the previous month. That was twice the 0.2 percent lift in June. And it means housing is now the single most important reason the central bank’s “core CPI” rate of inflation is still 3.3 percent, well above its long-term target rate of 2 percent.

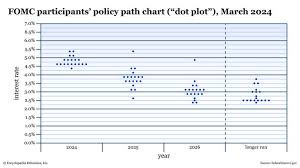

When July inflation data was first released, the big investment media (and the Wall Street analysts that feed it) initially hailed the numbers as giving the Fed “cover” to at last pivot to lower interest rates. But since then, comments from several governors have seemed to indicate that there’s no real sense of urgency. For example, St Louis Fed President Alberto Musalem stated last week that “the risk to both sides of the mandate seem more balanced,” meaning “the time may be nearing when an adjustment to moderately restrictive policy may be appropriate as we approach future meetings.”

That’s hardly a call to arms. And it reinforces my view that this Federal Reserve is responding to basically one data point: The stock market. Mainly, so long as there’s no major market event, they’re not likely to do anything of real consequence. Those banking on a dramatic pivot as so many seem to be are likely to be severely disappointed.

It seems clear that higher shelter inflation has reinforced at least some governors’ caution regarding cutting interest rates. And it means investors can’t afford to take for granted even the quarter point cut in the benchmark Fed Funds rate at the September meeting, the current consensus expectation.

That’s ironic, since the policy of higher for longer interest rates is a major reason why shelter inflation remains so high. Mainly, the sharp spike in borrowing costs since early 2022 has simultaneously discouraged development of new housing supply and home buying.

New renters not buying homes this year have soaked up the supply entering the market much faster than expected. A recession would temporarily mask the trend by pushing up rent delinquencies and vacancies, likely forcing down rents and depressing house prices. But if anything, an economic downturn would further depress new development. And as a result, there would be an even worse supply shortage—and even higher rents—when growth picked up again.

In my May 26 substack post “Think Small to Bet on Big Trends,” I highlighted what I saw as a “building recovery” in unloved residential real estate investment trusts. “REITs” provide investors an opportunity to collect high income from real estate without the hassles of direct ownership.

Last spring, there was a strong investor consensus that a flood of new apartment supply would drive down rents. And as a result, shares of REITs owning residential property –including high quality players like AvalonBay Communities (NYSE: AVB) and Mid-American Apartment Communities (NYSE: MAA)—were deeply depressed.

I posited that most economists, investors and even the Fed were missing the action on the ground from their vantage point of 30,000 feet up. For one thing, the CEO of AvalonBay affirmed during the Q1 earnings call that his REIT was “building occupancy earlier than expected,” and as a result raised 2024 financial guidance. And despite operating mainly in the Sunbelt, Mid-American reported “continued stable occupancy, strong renewable pricing and strong collections.”

I also stated that while “the residential REIT business still faces challenges…the trajectory has clearly turned upward. And that means the bottom for sector stocks was almost certainly last October. Bottom line: It’s time to place your bets if you haven’t yet.”

That turned out to be pretty good advice. Since then, both AvalonBay and Mid-American have reported Q2 results and updated guidance for 2024 confirming the strengthening trends for residential REITs. Urban and coastal property-focused AvalonBay raised its outlook for the second consecutive quarter, as both revenue and net operating income were far more robust than expected. Turnover was lower and occupancy and rent growth higher than anticipated.

That was also the case for Mid-American. The REIT affirmed and narrowed its 2024 guidance for funds from operations. And CEO Eric Bolton affirmed that “strong demand for apartment housing across our markets is steadily absorbing the new supply being delivered,” which is supporting “steady occupancy performance from our portfolio as well as blended lease over lease pricing that has consistently increased since Q4 of last year” that is “continuing into July.”

The good news at AvalonBay hasn’t gone unnoticed by investors. Since late May, the REIT’s shares are up 10.3 percent for a year-to-date total return of 16 percent. Mid-American’s turnaround has been even more dramatic, with a 16 percent gain for a 2024 return of 17.2 percent. That compares to yearly gains of just 6 percent for the S&P 500 REIT Index and roughly matches the showing of the Big Tech-stretched and vulnerable S&P 500.

I think the best by far is yet to come for these REITs, whether the stock market as a whole rotates from over-to-under value, sells off severely or continues to be led by Big Tech this year. Mid-American, for example, should easily take out its late 2021 high of $231 and change, when its dividend was 30 percent lower. I’ll have more on high potential residential REITs this week in the August REIT Sheet.

not much of a dividend for either