What’s Really Happening in Energy

There’s a difference between analysis and advocacy that often tries to pass for it.

Thanks for reading Dividends with Roger Conrad. If you’re interested in finding out more about my investment approach, please check out my Dividends Premium service. There’s information in this email as well as in the Substack application. Happy Valentine’s Day!—RC

Believe it or not, you can get good information on almost any forum these days. In fact, social media used wisely beats mainstream media, including the Wall Street Journal for investing and the Washington Post for politics.

But learning something useful on X, for example, does require a simple skill. That’s the ability to distinguish advocacy from analysis.

Analysis’ prime objective is to educate by exploring all the discoverable, relevant facts. It’s tedious work. And it may take you where you don’t want to go, revealing “inconvenient truths” that challenge long-held beliefs and biases.

Advocates have more fun. They get to pick and choose the facts that best bolster their arguments. And if they’re good, it can be very hard to detect the sales pitch.

But with so much “information” around, it’s never been more important to separate real analysis from well-crafted advocacy. That’s especially true when seeking information to make investment decisions.

Energy investing is now squarely in the cross hairs of the culture wars.

I’ve been writing about, advising on and investing in energy stocks since the mid-1980s. And over that time, there have been two what I would call mega-trends.

First, industry has achieved quantum leaps forward achieving its prime directive: Providing abundant, affordable, safe and clean energy.

The typical US nuclear reactor in the 1980s, for example, ran 60 to 65 percent of the time. That’s now close to 95 percent—the same plants generate half again more energy at a lower cost, even as they’ve aged.

The Great American Shale Revolution enabled the massive swap from coal to natural gas power over the past couple decades. That’s cut carbon emissions and customer rates. It’s all but eliminated acid rain, particulate matter in the air and mercury in the water. And the cost of solar panels, wind turbines and battery storage continues to plunge, slashing fuel costs and improving grid resilience.

Southern California’s massive wildfires this winter are a sobering reminder of increasing challenges from severe weather. So were last fall’s hurricanes and winter freezes in other parts of the US. And Edison International (NYSE: EIX) faces a liability challenge, if its equipment is found at fault for igniting the devastating Eaton Fire.

Nonetheless, utility grids are also arguably more resilient than ever, employing new hardware like covered conductor wire and artificial intelligence-enhanced data science. And while more investment is clearly needed, winter storm performance by Centerpoint Energy (NYSE: CNP) and Entergy Corp (NYSE: ETR) this year is a clear and welcome contrast to both utilities’ stumbles of the recent past.

Ironically, the other mega-trend for the utilities and energy industry is more people outside the industry have apparently come to the conclusion they can do a better job than the companies.

Utilities have always been best off when they’re out of the public eye. That’s why the prime objective every storm season is inherently defensive: Minimizing the extent and duration of power outages. Utilities unable to do that are usually going to face penalties.

But today’s level of “involvement” advocacy goes well beyond storm watching—and it’s across the political spectrum. The climate left tries to put up roadblocks to using natural gas. The right has countered with a narrative solar, wind and energy storage raise customer rates and undermine grid reliability.

Advocates all: Listen to them, you’ll have basically no idea of what companies are doing and why.

That’s not a good foundation for making investment decisions. So let me suggest an alternative information source that’s actually absolutely free: Industry earnings reports and guidance calls.

Maybe you don’t want to subscribe to a paid information source used by investment professionals—if you do I recommend giving Koyfin a try. But you can view companies’ press releases, powerpoint presentations for analysts and transcripts of guidance calls directly on their websites.

If you don’t want to pour over hundreds of companies’ results as I do, focus on what the leaders have to say. That’s major utilities like Entergy, power producers like Brookfield Renewable (NYSE: BEP) and super major oil companies like ExxonMobil (NYSE: XOM).

Yes, a big part of every CEO’s job is to sell their company’s prospects to investors. And even determined questioners may not get all questions answered during earnings calls.

But even the most salesy CEO has to deal in hard numbers. Electric utilities, for example, have to spell out what they’re spending to investors and the state regulators who must approve it.

That’s why these reports are the definitive source of information. Everything else you read—including reports from the US Energy Information Administration—is derivative of them, period.

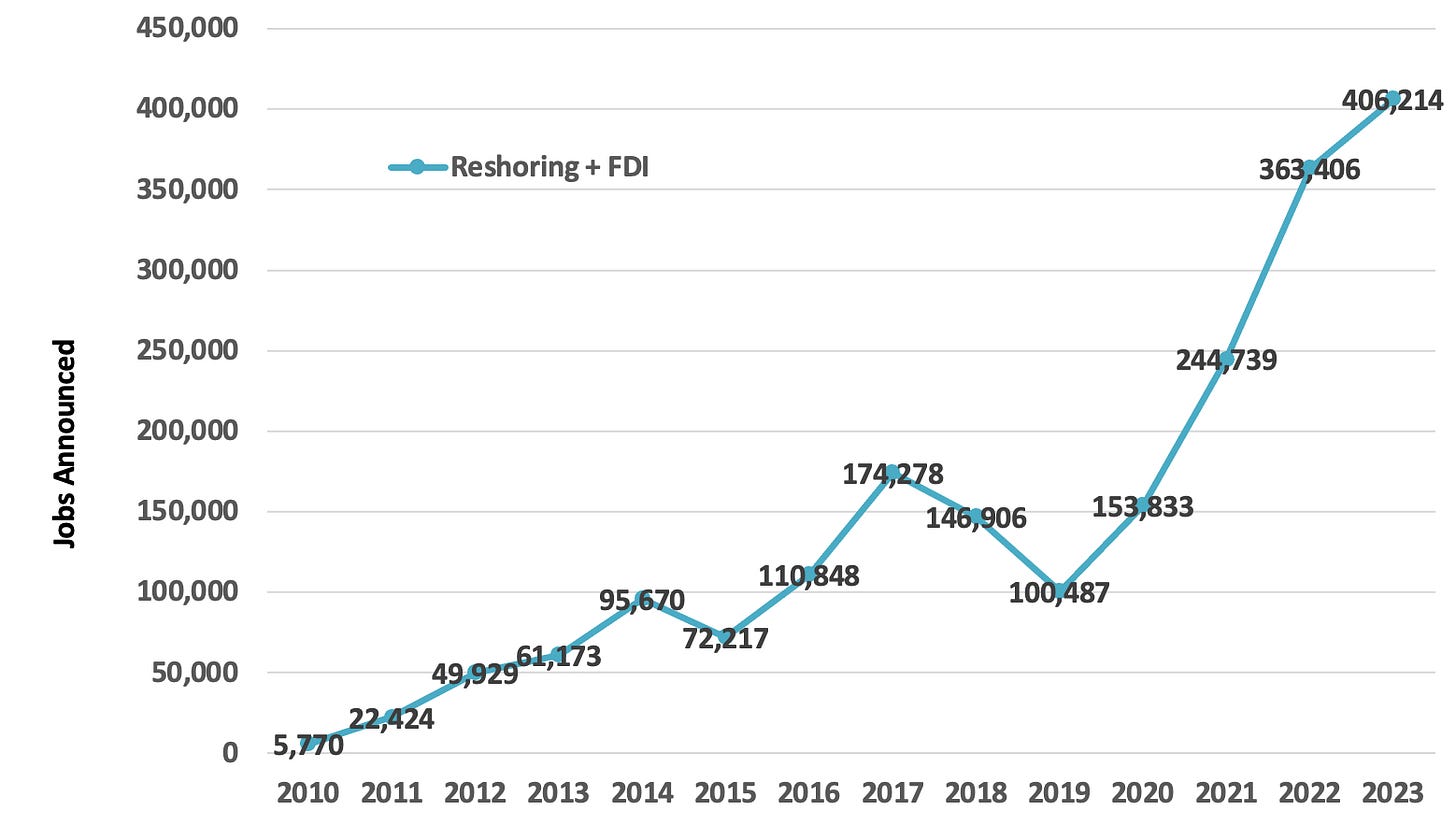

So what is going on in energy now? First, demand for electricity is rising in real time. Data centers and artificial intelligence are definitely an emerging factor. But there’s also ongoing re-shoring of manufacturing to get inside US tariff walls, as the graph below impressively shows.

Electric vehicles aren’t replacing ICE vehicles any time soon. But electrification of transportation and industry are increasing demand for power. So is population growth and increased electrification of American homes. And returning work to the office promises to push up power demand there as well.

I have a general skepticism of big number demand forecasts. But when the CEO of Brookfield tells investors his company is routinely passing rising costs to a major customer like Microsoft, there’s no better sign than it’s a seller’s market for power.

Entergy operates exclusively in red states with no renewable energy mandates. So when that company combines solar with natural gas to meet demand, you can bet it’s the low cost option. And when NextEra Energy’s CEO tells us that it would cost three times as much to build a new natural gas power plant in Florida as a few years ago, it’s a pretty good sign renewable energy has a huge advantage in that state.

Company plans can and do change. But seeing what they’re doing is the ultimate reality check in a world of advocacy run amok. And there’s a real opportunity in energy for investors willing to take a look.

Nice differential between advocacy and analysis -- a needed reminder in today's information "overload". Your work is fact-based, with the advantage of having watched the companies covered for years. Combined, it's gives readers an appreciated perspective. Thank you.