When a Dividend is Safe, Or Not

Five steps to secure dividends in an uncertain environment.

Editor’s Note: Thank you for reading Dividends with Roger Conrad!

See the links in this email and on the Substack application to receive these weekly posts on a regular basis, or to check out my Dividends Premium service. Hope everyone is having a great early autumn!—RC

I’ve been a dividends-first investor for 40 years. And contrary to popular misconceptions about those of us who seek a generous payout, I’ve played offense—not defense—for almost all that time.

A company that can pay a regular, sustainable dividend—increasing it reliably over time—is always backed by a substantial, healthy and growing business. Expanding enterprises earn higher stock prices over time. And a generous dividend literally pays us to be patient enough, so we’re around when that happens.

This has certainly been one of those catch up years for my Dividends Premium model portfolio. Long-lagging stocks supported by strong underlying businesses like CVS Inc (NYSE: CVS) have rewarded our patience with some monster gains. And as a result, as of Friday’s close, the average year-to-date return on the 18 open positions is 25.6%.

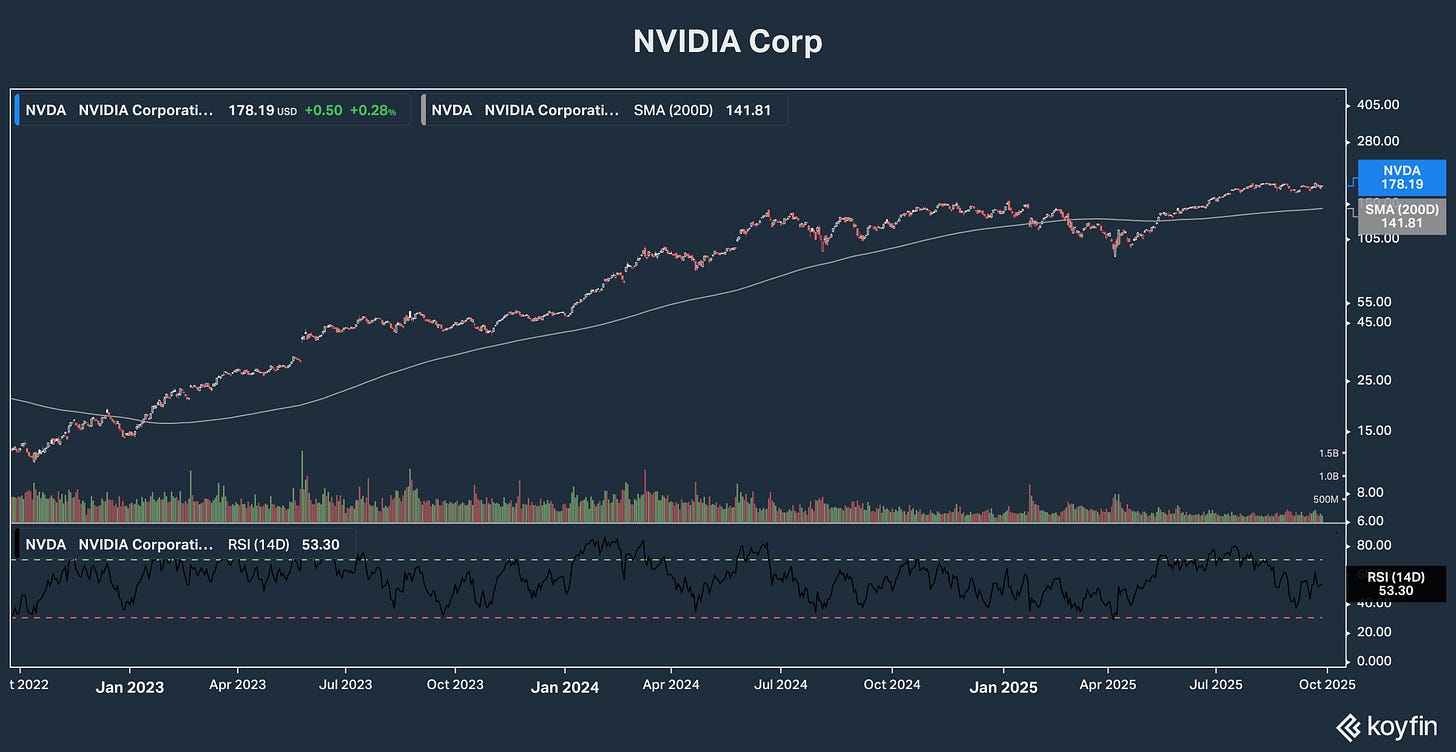

They’re beating the S&P 500 by nearly a 2-to-1 margin. They’re still cheap, with current yields several times and price/earnings ratios less than half the Index. And they’re chronically under-owned: The most heavily weighted Dividends Premium stock in the S&P 500 is just 0.69%, versus 7.7% for NVIDIA (NSDQ: NVDA).

Bottom line: I think our stocks have a lot more upside the next few years. And I intend to stick with all of them to capture those gains, collecting a rising stream of dividends along the way.

Lately, however, I’ve been seeing more investment market developments that have convinced me it’s time to play a little more defense.

One big reason is just how concentrated the US stock market has become. As for Friday’s close, 37.3% of the S&P 500 is in just 8 Big Tech stocks. That’s a record over weight in just a handful of what are now very expensive companies. A share of NVIDIA, for example, will now cost you 50.8 times that company’s annual earnings.

And compared to the late 1990s—the last time the stock market was this narrowly concentrated—there’s more money passively managed—meaning in S&P 500 ETFs—than is actively managed. And when you factor in that a lot of those “actively managed” accounts are just in “a good S&P 500 ETF” as instructed by “prudent man” investing principles, you almost certainly have record overall wealth concentration as well.

Past periods of extreme wealth concentration have generally ended with a great deal of wealth destruction—for those who failed to change strategy. It’s a fair bet many investors are just counting on the S&P 500 to ultimately re-weight in favor of outperforming stocks.

And the index of course will. But that’s only going to happen after today’s overweighted lose a lot of ground to the currently underweighted. And when the Tech Wreck followed the Tech Boom of the 1990s, the result was a “lost decade” for the S&P 500, with the Index actually finishing the ‘00s underwater.

Underweighted and undervalued stocks of high quality dividend paying companies have been outperforming Big Tech this year. But they’ve still lost ground in the weightings race. And those same expensive 8 stocks are a bigger piece of more investors’ portfolios than ever.

Now suppose something under the radar is happening at one of the market leaders that could wind up undermining its extremely high stock price, possibly as soon as the next few quarters.

One of the benefits of joining the Substack community is gaining access to a very wide range of investment opinion. The hallmark of all the best pieces is, whether I wind up agreeing with it or not, it does make me think.

Such a piece appeared in the column “Quoth the Raven” this weekend, titled “What’s That Weird Smell Coming from NVIDIA?” And the key point was the global leader in GPUs for enabling artificial intelligence may be resorting to financial engineering to pump up earnings and keep cash flowing in.

If you’re interested in more detail, I suggest checking out the free version of QTR on Substack. But to me, it jogged memories of companies like Jack Welch’s General Electric using that company’s financial arm to ensure quarterly earnings always beat analyst “expectations” by a certain amount.

I’m a firm believer in AI’s potential. And signed contracts with the world’s richest companies are underwriting pretty explosive future investment in electricity and communications spectrum.

But leading a very real Information Technology revolution the last quarter century didn’t save Big Tech stocks from crashing in the ‘00s, and taking the S&P 500 down with it. And Enron and Worldcom also embarked on a dizzying series of strategic financial moves in the year before they imploded completely, just as QTR points out NVIDIA has been doing the past few months.

So will history repeat itself with another Big Tech-led crash? Frankly, I don’t know. And equally, bailing out of the stock market should never be considered a serious investment option for long-term investors—especially when there are so many still-cheap, high yielding stocks to invest in.

But we dividend focused investors can certainly do a few things to sleep better at night with the S&P 500 looking increasingly vulnerable.

S&P 500 ETF investors should consider lessening exposure to market leaders by picking their own stocks—or at least looking at an ETF less heavily weighted to just 8 stocks like an unweighted S&P 500 ETF.

For those of us who are already picking our own dividend stocks, run the companies you own through a safety check based on five criteria:

Dividend policy sustainability—How well does the best measure of profits cover the current dividend rate and how well has it over time?

Revenue Reliability—Has revenue remained stable in all economic environments? How much has it varied under adverse conditions?

Regulatory/Legal Risk—Are there outstanding issues that could depress profitability enough to affect dividends and balance sheet strength?

Balance Sheet—Is debt expense high enough to force a dividend “reset”?

Operating Efficiency—Is a company controlling costs/improving operations?

The numbers I use to assess these criteria vary across industries for stocks I recommend. And sometimes, I’m most interested in a specific qualitative factor, for example the expiration date of a key patent for a large pharmaceutical company.

But companies ranking highly on at least one of these criteria are likely to stack up well on all of them—and vice versa. And that makes this system actually pretty easy to use, once you spend a little time to become familiar with the stocks you own.

One Dividends Premium stock I’ve fielding questions on recently is chemicals company LyondellBassell (NYSE: LYB). That’s understandable because it’s the only one of the 18 positions significantly underwater this year.

The combination of softer global growth, tariff related uncertainty for supply chains and volatile feedstock pricing convinced management to cut its 2025 guidance last month. And speculation has grown that a dividend cut is imminent.

Our actual risk continuing to hold it in Dividends Premium is limited by the fact it’s just one position of 18. In fact, Lyondell’s share price at a yield of 11% plus arguably already reflects investor expectations of a sizable cut, possibly by the end of the year. That’s despite the lack of pressure on the BBB credit rating, the large level of free cash flow still expected for 2025 and management statements it intends to keep paying at the current rate, which it actually increased this spring.

But what is the actual dividend cut risk for this company? Let’s run down the criteria.

First, this company has regularly increased its dividend every year over the past decade. They have occasionally paid a special dividend reflecting strategic developments as in June 2022. But the “base” rate has been increased reliably, as management has held the payout at a level well covered by free cash flow—which is operating cash flow after all capital spending and debt service.

Lyondell also gets a check for balance sheet strength as I noted above. And management’s “cash improvement plan” has been hugely successful improving efficiency and cutting costs: The end 2025 “run rate” was raised to $600 million this summer from $500 million.

The company’s focus on “greener” chemicals has also kept it ahead in the legal/regulatory game. During the Q2 earnings call, management noted significant dysfunction in the European Union, triggering closure of “more than 20% of European ethylene capacity since the beginning of the decade.” Management notes, however, that the company is increasingly positioned in “cost advantaged” products such as “circular plastics.”

We can count less than ideal regulation as a risk to Lyondell’s dividend. But the biggest danger is simply that the company operates in a cyclical industry that’s currently in a downturn. And as we saw with rival Dow Inc’s (NYSE: DOW) 50% dividend cut this summer, companies operating in cyclical businesses sometimes cut their payouts in tougher times—even when they have an investment grade credit rating like Dow and Lyondell do.

So given that brief analysis, how do I straight up rate the safety of Lyondell’s dividend, in advance of the next dividend declaration, the Q3 earnings release and updated guidance likely in early November?

I don’t claim to read minds from a distance. And much will depend on where management sees guidance. But I think its 60-40 the November payout is the same $1.37 per share declared in August.

Far more important on the decision to keep holding the stock, however, is that Lyondell is a financially strong company with a clear long-term direction in a still essential industry facing cyclical pressures that will eventually reverse to the positive.

That means better conditions will enable the stock to outperform, very likely even more dramatically than it underperformed this year. And again, our Dividends Premium portfolio downside is protected by the fact it’s just one position trading at a very low valuation.