When the Fed Acts...Expect the Unexpected

The biggest risks and rewards for stocks always come from the direction most people aren't looking.

Thank you for reading Dividends with Roger Conrad! If you like what you're seeing, please consider receiving it on a regular basis by clicking on the link in this email.

This week, all eyes in the investment markets will be on the Federal Reserve, which is expected to resume cutting its benchmark interest rate. Here's my take on how the central bank's actions will affect income investors.—RC

This week, America's central bank will make another key decision on monetary policy. That's whether to resume last year's cuts in the Fed Funds rate, and to what extent.

For most of the spring and summer, the Trump Administration has been ramping up the pressure on the Fed to cut. That's now included an unprecedented attempt to fire a Fed governor, on top of repeated threats to force Powell out before the end of his term next year.

But so far, the Fed has stood its ground, refusing to cut until there's more evidence about the impact on inflation from tariff-induced supply chain disruption. And its official guidance has remained unchanged from December 2024: Two quarter point Fed Funds cuts for all of 2025.

Has anything changed?

My friend Elliott Gue last week posted a very comprehensive piece on the subject in his Substack "Smart Bonds."

I encourage everyone to check it out. But the long and short of what’s changed is labor market weakness. Despite an official unemployment rate that still near generation lows, other measures of joblessness like payrolls have been weakening over the summer.

That’s no surprise to anyone who's been looking for a good job lately. But the data has been enough to change some minds on the Federal Open Market Committee—which determines interest rate policy—that it's time to try to nudge Americans' borrowing costs lower again.

Before I go any further, it's time for a little myth busting.

The Federal Reserve does not on its own determine borrowing costs. It has a great deal of influence over interest rates. But at the end of the day, what you pay for a loan—or what a giant corporation pays to issue a bond—depends on market forces. And probably the most important of those is lenders' expectation of future inflation.

Over the past 30 years or so, when the Fed has cut the Fed Funds rate, other interest rates have followed it lower. Borrowing has gotten cheaper. And all else equal, economic activity that depends on debt has picked up steam. That's meant more jobs available. And both the stock and bond markets have more often than not responded positively.

I think that's likely to happen next week, when the Fed cuts Fed Funds for the first time this year. As Elliott points out in his post, various gauges of investor expectations are assigning a roughly 90% probability for a 25 basis point cut in Fed Funds this week, with the remaining probability for a 50 basis point cut.

I frankly would not be that surprised with either action.

But there is a another factor in play now that really hasn't been since the 1980s. That's inflation.

The Fed often says it has a "dual mandate." One is to support the economy and employment. The other is to control inflation. Both are currently challenging.

Producer price inflation for August was lower than expected. But consumer prices continued to accelerate last month. The Fed's often stated preferred measure of inflation has now jumped over 3%, further away than ever from its long-term target of 2%. And there are some pretty clear signs that tariffs are pushing up prices, both directly as companies try to recover costs and by disrupting long-established global supply chains.

My stock market focus the past 40 years or so has been mostly bottom up. Mainly, I look first and foremost at what individual companies are doing to inform me on the emerging big picture trends.

I have basically three major coverage universes:

Utilities and essential services companies globally

Energy companies up and down the value chain also globally

Real estate investment trusts, mainly US but also globally

Calendar first half 2025 results and updated guidance for the rest of the year and beyond have been in for a few weeks. I've now had time to go over pretty much everything I've needed to. And Dividends Premium readers will receive the full databank of REITs this coming week.

Unfortunately, there's plenty of evidence in all three sectors that inflation has picked up steam this year.

That hasn't really had a lot of impact on earnings and dividend growth for utilities and other providers of essential services like communications. And the reason is pricing power.

I don't blame anyone for being skeptical of what amounts to pretty unsophisticated discussion of artificial intelligence in social media, as well as popular investment media. But AI-enabled data centers' insatiable demand for electricity, communications and water is very real. And it's increasing rapidly in real time.

In a recent podcast—Jason Burack's excellent “Wall Street For Main Street”—I gave the example of Mid-South electric utility Entergy Corp (NYSE: ETR) for what's become literally runaway demand growth for power.

That company's service territory is parts of Louisiana, Mississippi, Arkansas and Texas. It hasn't been known historically as an economic powerhouse. But Entergy is seeing annualized growth of electricity demand from industry including data centers of 12-13%—and it expects at least that much the rest of the decade based on connection orders already received.

Entergy is hardly alone in seeing that kind of demand explosion. And it's far from the leading provider of electricity to data centers, a position held by Virginia's Dominion Energy (NYSE: D).

Simply, electric utilities can push through whatever costs they need to meet demand from data centers. And the facilities' Big Tech owners have no choice but to pay up, which they can easily do as the richest companies in the history of the world.

Inflation is therefore not a big problem for utilities and essential services companies. And they're still increasing investment plans for the next five years.

Not so for energy companies. Oil, gas, solar and other energy producers generally benefit from higher selling prices when inflation is on the rise. But their costs also increase, from key materials like steel to labor. And the most important takeaway from oil and gas producers' Q2 earnings is they're far more interested in investment that brings down cost of production than in boosting output for its own sake.

Real estate values also usually rise with inflation. But growth in most property sectors has ground to a halt in recent years. And the main reason is development budgets at most REITs have been dropping, as management sets a higher and higher bar for returns in an uncertain environment.

What's causing this conservatism?

Higher for longer interest rates have raised the bar in many industries for new investment. And all else equal, the Federal Reserve cutting interest rates should go a long way toward unfreezing activity.

But if the central bank does cut now as so many expect, it will be doing so at a time when inflation is actually rising. So what if the actions the Fed takes now actually increase investors' expectations of inflation? Could companies' borrowing costs go higher, particularly on the longer end of the curve where they can lock in the expense?

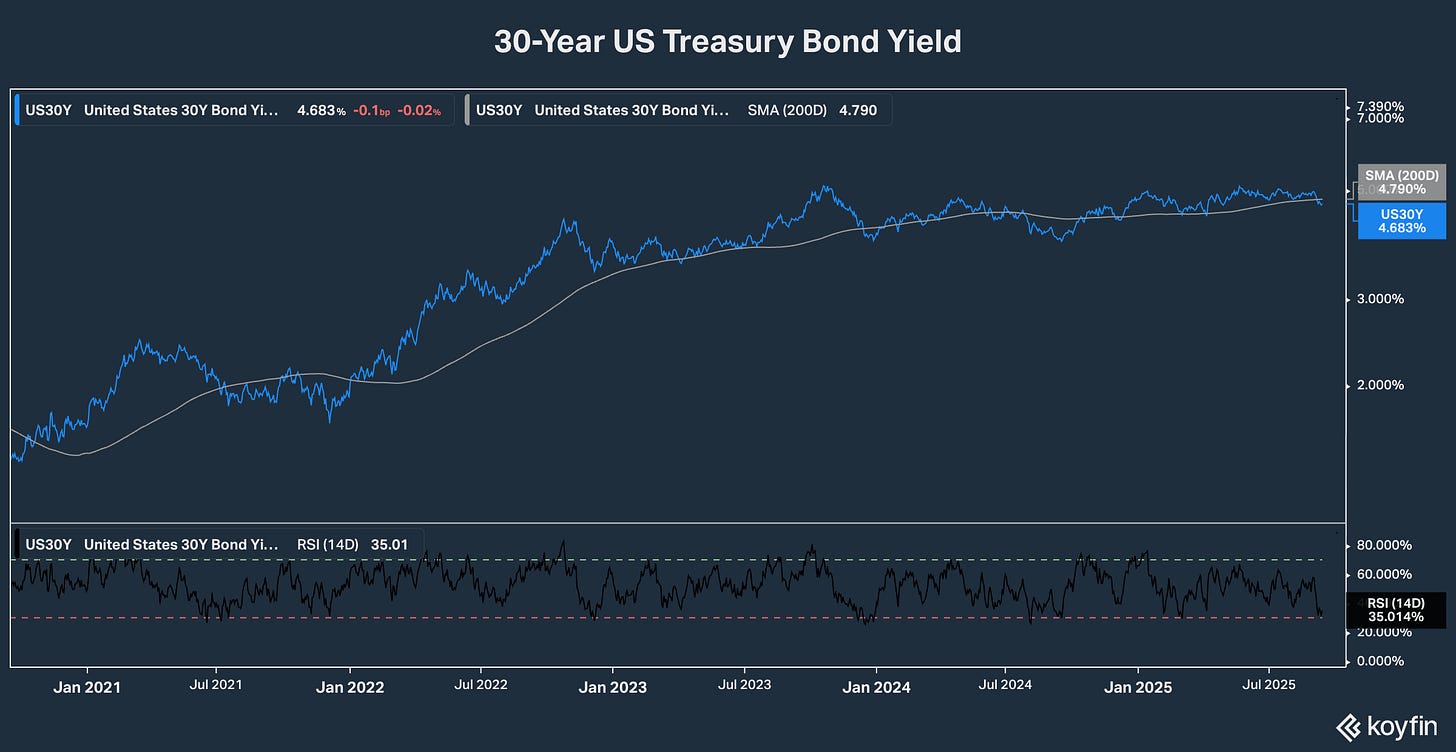

This graph shows the yield on 30-year US government Treasury bonds for the past five years. This is the rate companies' longest-term bonds are priced against by investors.

The key takeaway here is that long-term interest rates spiked up in 2022 and have remained relatively elevated ever since. That increase reflects Fed actions. But more importantly, it tracks investor expectations for inflation, which have remained elevated in part because of uncertainty about tariffs and supply chain disruption.

The key question now is whether Fed actions to cut interest rates now will actually increase those inflation expectations—and push longer-term interest rates higher rather than lower?

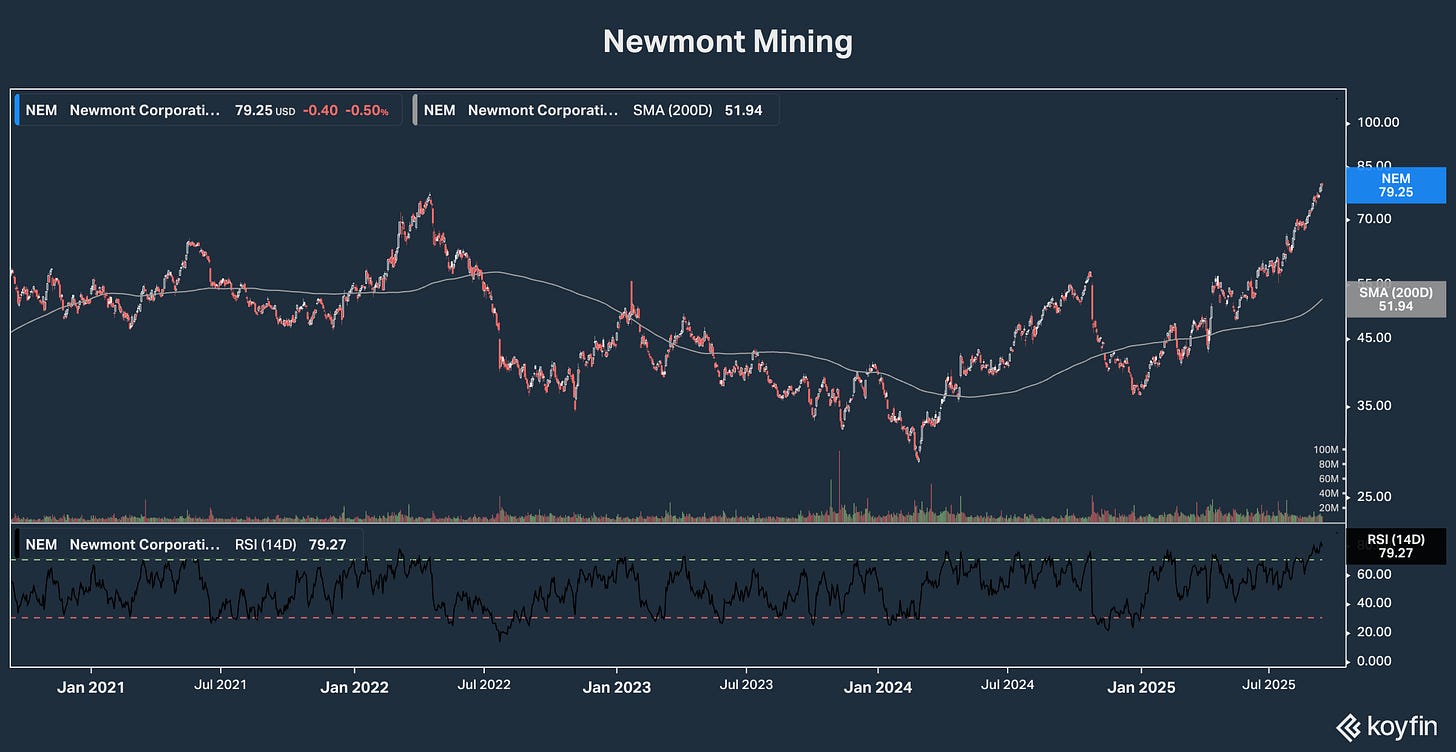

It's hard to argue tariffs and supply chain disruption haven't elevated investor expectations on inflation. Check out my second graph, a five year price history of tbe world's leading gold producer Newmont Mining (NYSE: NEM).

Newmont's earnings and share price closely track gold prices, which in turn follow inflation expectations. The company's shares rallied hard In 2022 as measures of inflation began to spike higher. As the Fed started raising rates and cooling off expectations of runaway inflation, they fell sharply. But since the beginning of 2025, they've been off to the races—basically in tandem with concerns about the impact of tariffs on inflation.

Will Fed rate cuts keep the party going for gold stocks like Newmont? Given that expectations are already so high for rate cuts now and later this year, I suspect a lot of good news for gold is priced in already. We may even see some profit taking—which is why I've advised Dividends Premium readers not to chase the stock at its current price.

Longer-term, I think Newmont shares will hit $100 or more. To the extent the Fed's current actions stir up inflation worries, that could happen sooner rather than later. It's extremely doubtful we've seen the full impact of supply chain disruption on prices. And arguably, higher for longer interest rates have already built in future supply shortages in multiple areas—by encouraging companies to hold in investment the past few years.

So what should investors do now?

First, take a good look at your portfolio and get rid of any companies that couldn't survive a shock in the financial markets. Capital may get cheaper as the result of Fed actions. But in my canvass of REITs, utilities and energy companies, I found a number already struggling with stagnant to falling revenue and rising debt. They may not survive another blow.

Second, harvest some gains in your stocks that have surged the most—and are very likely now overweighted in your portfolio. A big blow to them needn't be a major hit to your wealth, if you take some money off the table now.

Third, deploy the selling proceeds into a good money market fund like Vanguard Federal Money Market (VMFXX), where you can get at the money when you need it and get paid 4% plus in the meantime.

That's how you'll survive and thrive when the market inevitably pitches us a curve, when almost everyone is expecting a fastball.