Wind and Solar: Massive Demand, Very Cheap Stocks

Predictions of renewable energy’s demise are as full of holes as anti-oil and gas forecasts have been.

Thanks for reading Dividends with Roger Conrad!

Please check out the paid version of this service, including Dividends Premium, Dividends Premium REITs and access to my Investment Roundtable on Discord. For more on how to subscribe, see the offer in this email and on the Substack app.--RC

“Never argue with anyone who buys ink by the barrel.” That aphorism basically means don’t pick a fight with a bigger media outlet because they can out shout you—effectively denying you an audience.

I may never have as many followers as some who comment on energy issues. But at the risk of being shouted down, I’m going to keep calling out the increasingly common (and wrongheaded) view that recent political shifts are the end for wind and solar.

Let’s first be clear that oil and natural gas faced a similar erroneous narrative following the previous presidential election cycle. That CO2 emissions are changing the environment is no longer in question. But as the politics heated up, so did the perfect become the enemy of the good in policy.

Even massive success stories in CO2 reduction—like America’s cost cutting shift to natural gas from coal power generation—came to be viewed negatively. And it took an act of Congress to complete the last major gas pipeline in the eastern US—the Mountain Valley Pipeline.

All or nothing policies have had negative consequences. New Englanders, for example, are reportedly relying on oil for more than 20 percent of electricity needs this winter as well as hefty amounts of pricey LNG—liquefied natural gas. And the region is paying the price with record utility bills, even as cheap Appalachian natural gas and Canadian hydropower are less than half a day’s drive away.

At the root of the bear case for renewable energy is that the Trump Administration will enact even more extreme policies in the opposite direction. That is, they’ll throw every available roadblock in the way of renewable energy development.

Certainly, nothing the Administration has announced so far would discourage that view. Suspending permitting on federal lands of any new wind development mirrors the Biden Administration’s now removed ban on oil and gas drilling. And that pretty much rules out any new offshore wind projects that aren’t fully permitted, since all offshore wind is essentially on federal “land.”

The Administration backed away from its earlier suspension of dispersing already allocated federal spending. But the White House clearly favors rolling back wind and solar tax credits if it can find support in Congress.

Sounds pretty cut and dry, doesn’t it—especially combined with the well trod arguments in the blogosphere and the Wall Street Journal about renewable energy’s shortcomings in general, from intermittency to the occasional breakdown of a wind facility blade and the cost of raw materials for batteries.

Small wonder then that many investors are now avoiding renewable energy stocks with long-term track records—just as many sold their oil and gas stocks when the Biden Administration promised aggressive action against that sector.

It’s very hard to ignore politics, and especially now in the energy sector. It’s unfortunately become a new front in a culture war that can only discourage investment, reduce supply and raise prices. But shut out the rhetoric and there’s a massive opportunity now to buy stocks of well-run energy companies.

What makes me so sure? Events on the ground, mainly what industry is actually doing.

In my post a week ago, I highlighted the record deployment, investment in and orders for new renewable energy generation at NextEra Energy (NYSE: NEE), the largest US developer of wind, solar and battery storage. The company affirmed its long-term earnings guidance, fueled by renewable energy deployment at both its regulated Florida utility and unregulated unit. And it detailed insulation of operations from prospective Trump Administration policies, including wind permitting, tariffs and the future of tax credits.

This past Friday another major, Brookfield Renewable Partners (NYSE: BEP/BEPC), released its Q4 results and guidance. The headline number was a 21 percent boost in funds from operations, the company’s primary measure of earnings. But even more impressive was the roughly 7 gigawatts of new renewable energy capacity the company brought into service worldwide, a seven-fold increase of what it did just three years ago.

Brookfield is every bit as bullish on the future as NextEra. In CEO Connor Teskey’s words during the earnings call: “The low cost renewable technologies that we have built out business on are the cheapest form of electricity production and we are seeing greater demand than ever before.”

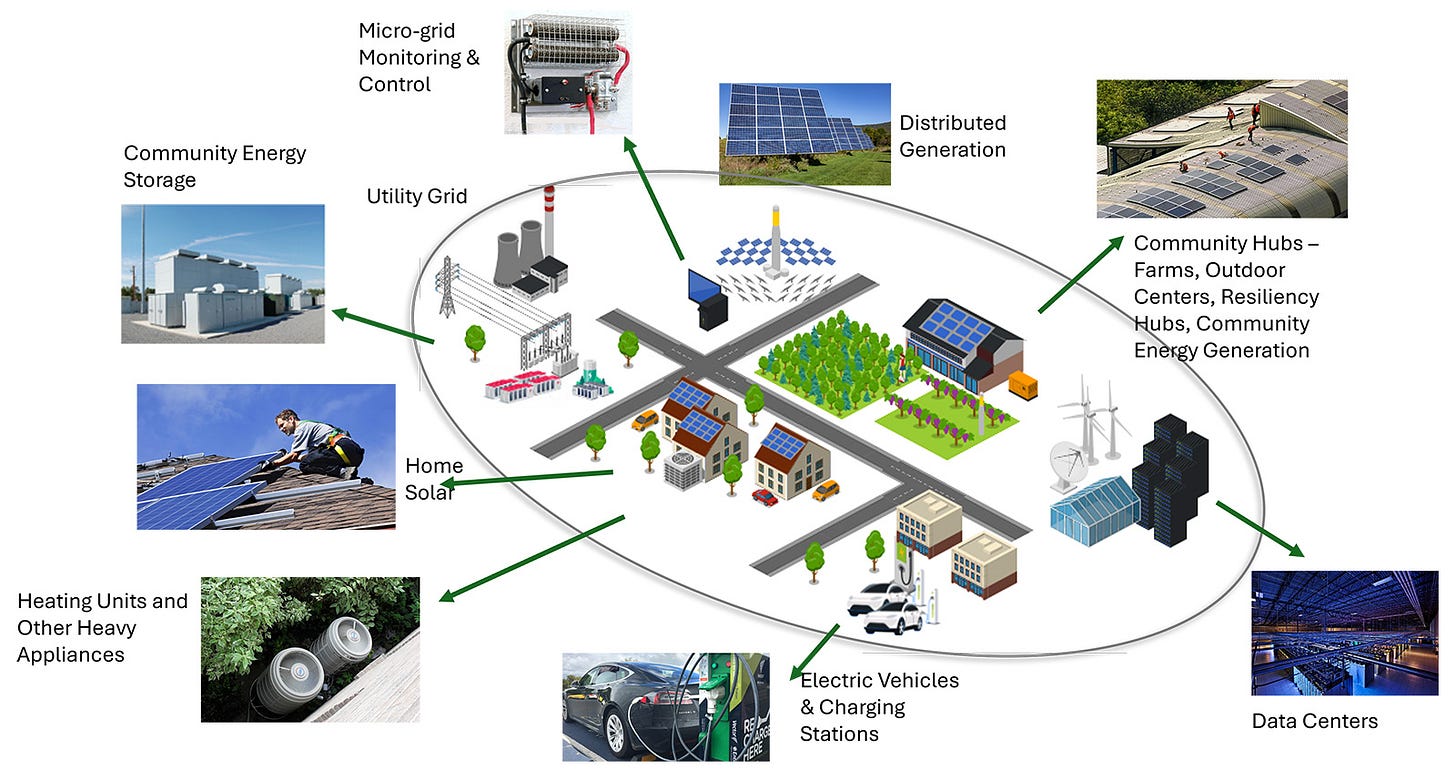

Teskey went on to say that the company’s 200 GW development pipeline is “heavily contracted in the top data center markets of America” and it is “not reliant on government subsidy.” That includes a 35 GW energy storage project pipeline and 3.3 GW of operating assets, following its successful acquisition of global developer Neoen.

Brookfield has no offshore wind projects. Nor are any of its onshore US projects on federal lands. US wind in general is only a minor piece of its portfolio. And it has a well developed global supply chain, including US production to avoid cost increases from tariffs.

But Teskey also made a far more important point I haven’t seen any of the renewable energy bears address. Mainly, developers are currently able to routinely pass their cost increases into PPA contract rates, and have been for some time.

Higher contract prices have more than offset rising interest rates since the Fed started tightening in early 2022. And management is comfortable it will be able to do the same if Trump’s tariffs raise component prices, or if tax credits are rolled back.

There are some obvious exceptions. Multiple offshore wind projects planned in the Northeast the past few years, for example, have been effectively shelved.

Developers who had bid low for projects attempted to renegotiate contracts, to pass on the impact of rising borrowing costs. Customers balked. Negotiations dragged on. And while some agreements were reached, many more were put on hold until it was too late to get them fully permitted before the Biden administration left town.

Brookfield’s focus, however, is onshore wind, storage, utility and distributed solar projects, which can typically be planned, sited, permitted, procured for, funded and built in 12 to 18 months. Costs can be locked in, unlike multi-year projects like offshore wind and nuclear or even large scale natural gas generation, which carries fuel costs after it’s built.

Brookfield can promise fixed costs and deliver the electricity to match demand in real time. That’s what its almost exclusively corporate customers demand. And they’re willing to absorb cost increases to get it.

True, if Microsoft pays more for its energy contracts, it will pass that cost on to its customers. But so far as Brookfield is concerned, stripping away tax credits and jacking up tariffs won’t negatively impact growth, so long as demand remains robust as it is.

Several other major renewable energy companies will report Q4 earnings and update guidance the next few weeks. And it’s possible some won’t be as positive. But based on what two of the largest players have had to say, the boom is alive and well. Their stocks are looking pretty cheap relative to those prospects. Time for patient investors to buy.

I’m glad I subscribe to your newesletter, I’ve owned BEP for years. I live off the coast of Cape Cod, MA on Nantucket Island. Vineyard Wind got approvals for a massive wind farm off our coast. Ugly is too good a word. This past summer a blade feel off one of the windmills and pieces are still washing up on our shores. 60/66 blades have to be replaced. Defective GE Verona blades. Three other wind farms were approved but are now defunct because investors pulled out. Wind farms are truly visual pollution. This liberal enclave once endorsed these plans now they’re adamantly opposed.