Most REITs are down. Now what?

Your Dividends Premium REITs for December 2025

Editor’s Note: Welcome to your December Dividends Premium REITs. Thanks for reading and Happy Holidays!

There are roughly two weeks left in calendar year 2025. But it’s not too early to draw some conclusions from REIT performance—The most important being that investor returns were frequently disconnected from business results.

That’s not unusual in the stock market. Favorite stocks frequently ride buying momentum to prices far above any measure of tangible value. And unloved companies can languish for years in Wall Street’s doghouse. But eventually growing businesses are rewarded. And stocks that soar too high eventually get too close to the sun, suffering the fate of Icarus.

The Federal Reserve cut the Fed Funds rate three times by a quarter point, one more than the central bank forecast in December 2024. But borrowing costs barely budged for most REITs, resulting in another year of mostly tepid investment activity—with a few exceptions like Realty Income (NYSE: O) and W.P. Carey (NYSE: WPC) that raised spending targets throughout the year.

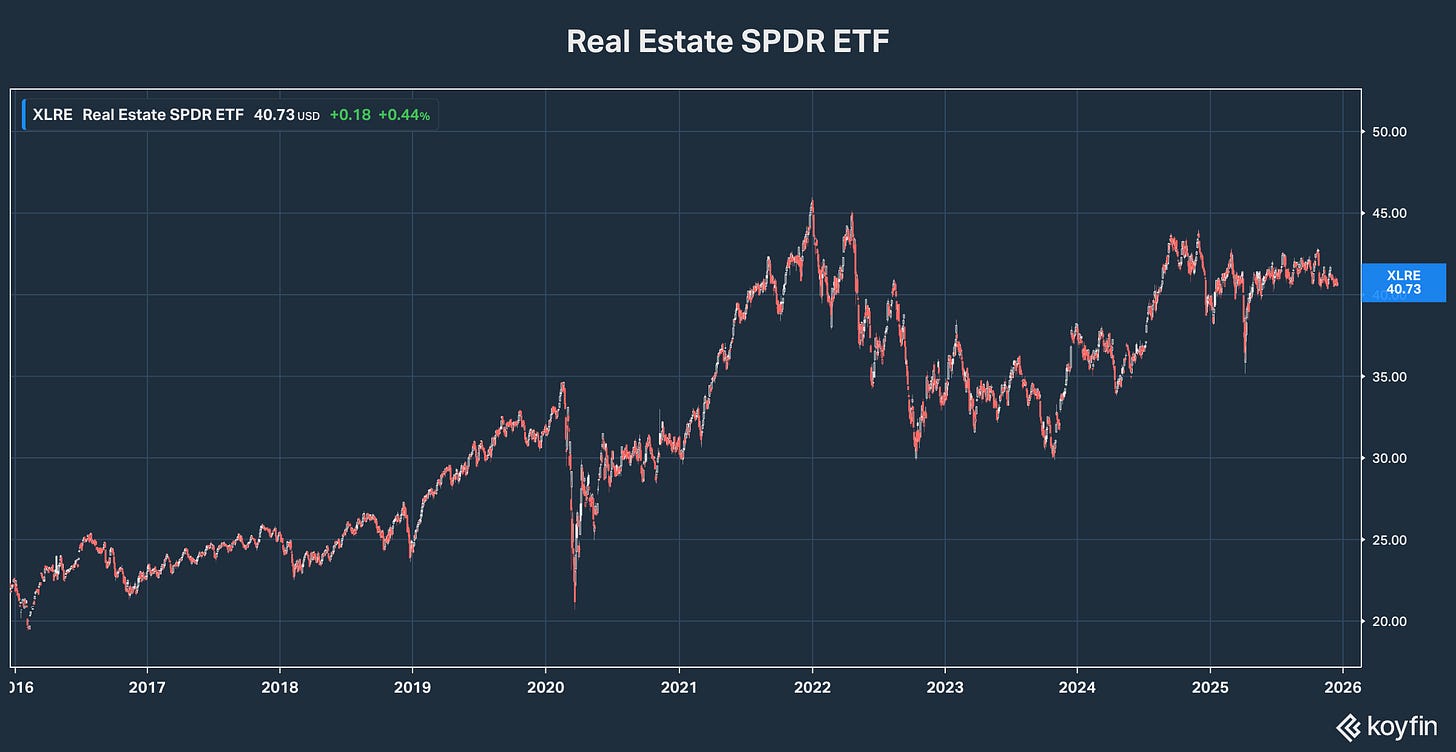

My First Rate REIT list is dead even year to date. REITs’ greatest investment appeal by far for the next few years is they’ll be easy ways to bet on emerging shortages across multiple property types. But companies that keep putting up good numbers should start getting traction in 2026. Add in the highest yields in decades, the likelihood longer-term borrowing costs will drop and an inevitable rotation from Big Tech and investors have some pretty good reasons to stick with and build positions in this unloved sector—this year’s subpar returns notwithstanding.

Got a question about a particular REIT, a property sector or my general outlook? Then please join my Dividends Roundtable discussion, which I host 24-7 on the Discord application. It’s open to all Dividends Premium members.

Happy Holidays everyone and here’s to a profitable New Year--RC

REITs: 2025’s Business Strength = Share Gains in 2026

Barring a truly historic rally the next two weeks, 2025 will go down as a subpar year for real estate investment trusts. And my First Rate REIT list is flat even year to date, as are major REIT ETFs.

As my REIT Rater table’s “Comments” column highlights, there were some exceptional performances. These were, however, mainly companies that were clawing back big losses from the previous couple years.

For example, the year’s biggest winner in the coverage universe will almost certainly be Sotherly Hotels (NSDQ: SOHO). The REIT, which has not paid a dividend this decade, caught a rescue takeover offer from a private capital consortium of $2.25 per share in cash. That’s 134 percent higher than the price it began the year, but less than half where shares traded three years ago.

The greatly consolidated seniors housing sector has been hot, as a smaller number of players absorbs rising occupancy rates and rents while cutting costs. We’ve had a nice gain with First Rate REIT Ventas Inc (NYSE: VTR), since adding it in June this year. And industrial REITs like Prologis Inc (NYSE: PLD) have pulled in buyers with consistently improving results.

But by and large, the consensus view heading into 2026 seems to be that conditions are about to get a good deal worse across multiple sectors. And that’s weighed on REIT returns in 2025.

Sentiment is worst around the still adjusting office market, understandable given this year’s dividend cuts and bankruptcies. But this fall, it extended to apartments and self-storage, sectors that traditionally have been resilient in economic downturns. And while artificial intelligence remains a hot Wall Street theme, once very hot data center REITs have fallen on hard times. The biggest Equinix (NSDQ: EQIX) has a year-to-date loss of nearly -20 percent.

Always with the Negative Waves

The bearish argument for REITs in 2026 basically rests on three pillars:

· Currently elevated supply in multiple property types as development started when the cost of construction and financing were lower is still hitting the market.

· A forecast for softer employment, economic growth and in migration particularly to the SunBelt that will depress supply absorption rates, which were considerably higher than expected in 2025.

· Long-term borrowing costs including mortgages remain elevated, depressing investment and forcing companies to fund efforts with cash flow (taking away from dividends) or by issuing stock, which many analysts consider worse for dilution.

Let’s take them one at a time.

First, the long-anticipated “supply glut” by the industry did notably affect rents for new apartment leases this year. There’s been an impact on both occupancy and new rents for self storage. And office property owners are still seeing consistently lower rents on properties where leases expire.

That includes markets where there’s been a significant “back to the office” push like New York City. SL Green Realty (NYSE: SLG), for example, reported -2.7 percent “mark to market” on signed Manhattan office leases in Q3 versus the year ago quarter.

Unlike during the pandemic year, however, residential REITs’ occupancy has been steady. And rents on renewing leases have continued to rise as turnover rates have stayed historically low. So even SunBelt focused Mid-America Apartment Communities (NYSE: MAA) saw positive year-over-year “effective blended lease rate growth” of 0.3 percent, a 50-basis point swing in the right direction.

That wasn’t enough to offset rising expenses. Net operating income (NOI) from properties the REIT had held for more than a year dropped -1.8 percent, pushing Q3 FFO lower by -2.3 percent. So investors and analysts alike seemed to pretty much ignore everything management had to say about “record lease-ups,” starts over the past four quarters being “roughly half the historical norm” and record low moveouts due to rising affordability challenges for buying a home.

But evidence does continue to build that new development needed later in the decade is falling off a cliff. As a result, it won’t be there when it’s needed to meet demand. And the longer current conditions exist to discourage development—a near-term glut of supply combined with elevated construction and finance costs—the greater the ultimate shortage will be.

The key for apartment REITs like Mid-America, self-storage companies like Extra Space (NYSE: EXR) and office landlords like BXP Inc (NYSE: BXP) is to maintain their current conservative development and self-fund as best they can—so they can avoid having to access capital markets until they inevitably become more accommodating. If they can do that, their stocks are headed for some monster gains the next few years.

Is there risk to dividends in the meantime? Yes. At this point, every REIT on the First Rate List has strong dividend coverage and a solid balance sheet. And if management so chooses, they’ll be able to comfortably raise dividends in 2026.